Yen selloff returned to focus in Asian trading today as investors positioned ahead of Japan’s snap election this weekend. continues to enjoy solid public support. Although recent polls show a modest dip in approval, her standing remains strong enough to anchor expectations of electoral success.

More importantly for markets, her ruling Liberal Democratic Party appears on track to comfortably exceed the 233-seat threshold needed for a single-party majority in the House of Representatives. A new survey by Asahi Shimbun, conducted between January 31 and February 1, suggests that with coalition partner Nippon Ishin, the ruling bloc could secure more than 300 of the 465 seats at stake in a landslide outcome.

Voting on February 8 will determine the next lower house, but markets are already pricing in the implications of a decisive LDP victory rather than waiting for confirmation. A commanding victory would strengthen Takaichi’s hand in pursuing fiscal stimulus. Investors fear that expanded spending plans would worsen Japan’s already heavy debt load, pressuring government bonds and undermining Yen.

In the US, attention briefly shifted away from shutdown risk after President Donald Trump signed a spending deal into law on Tuesday, ending a partial government shutdown. The legislation ensures full-year federal funding through September, with the exception of the Department of Homeland Security, which receives only a two-week extension as lawmakers debate immigration enforcement measures. The deal passed the Senate with broad bipartisan backing and scraped through the House by a narrow margin, removing a near-term tail risk for markets.

Elsewhere, oil prices rebounded as geopolitical risks intensified. Markets reacted after the US military said it had shot down an Iranian drone that approached the Abraham Lincoln in the Arabian Sea. The incident has raised concerns that efforts to de-escalate US–Iran tensions could falter. Oil markets are rapidly repricing geopolitical risk as the perceived probability of direct US action increases.

For the week so far, Yen sits firmly at the bottom of the FX performance table, followed by Swiss Franc and Euro. Aussie remains the strongest performer, trailed by Kiwi and Sterling. Dollar and Loonie trade in the middle of the pack.

In Asia, at the time of writing, Nikkei is down -0.92%. Hong Kong HSI is down -0.21%. China Shanghai SSE is up 0.12%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is down -0.009 at 2.251. Overnight, DOW fell -0.34%. S&P 500 fell -0.84%. NASDAQ fell -1.43%. 10-year yield fell -0.001 to 4.274.

New Zealand jobs grow 0.5% in Q4, unemployment ticks to decade-high

New Zealand’s labor market delivered mixed signals in Q4. Employment rose 0.5% qoq, beating expectations for a 0.3% gain, pointing to continued job creation. Employment rate edged up to 66.7% from 66.6%, reinforcing the view that labor demand remains resilient.

At the same time, unemployment rate climbed to 5.4% from 5.3%, above expectations and the highest since the September 2015 quarter. The rise was accompanied by an increase in the labor force participation rate to 70.5% from 70.3%, suggesting that more people are entering or re-entering the job market, which is adding to slack even as hiring continues.

Wage pressures remained contained. The labor cost index rose 2.0% yoy, with private sector wages up 2.0% and public sector wages up 2.2%. The combination of steady employment growth, rising participation, and moderate wage inflation points to a labor market that is still cooling gradually.

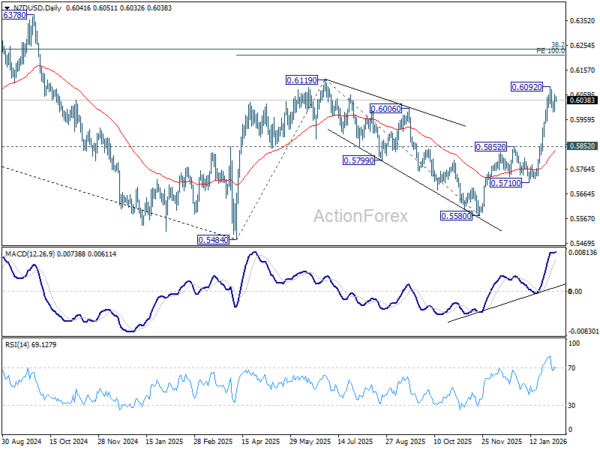

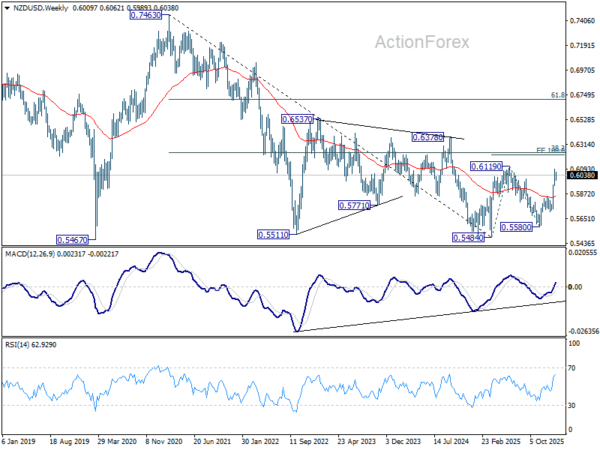

NZD/USD in range awaits upside breakout, as RBNZ outlook holds after job data

NZD/USD is trading steadily in range after New Zealand’s Q4 employment data delivered few surprises for policy expectations. The mixed report offered early hints of stabilization but stopped well short of forcing a rethink at the RBNZ. Interest rate is expected to remain on hold at 2.25% for most of the year.

The next policy move is still expected to be a hike rather than another cut, but timing remains highly uncertain. Whether that comes late in 2026 or slips into early 2027 will depend on how growth, inflation, and labor market slack evolve. For now, it is too early to draw firm conclusions.

Technically, NZD/USD continues to consolidate below the 0.6092 short-term top. While a deeper pullback cannot be ruled out, downside should be contained well above 0.5852 resistance turned support. Current rise from 0.5580 is seen as the third leg of the pattern from 0.5484 (2025 low). Above 0.6092 should send NZD/USD through 0.6119 (2025 high) to 100% projection of 0.5484 to 0.6119 from 0.5580 at 0.6215.

Longer term, the 0.62 resistance area is decisive. Sitting near 38.2% retracement of 0.7463 (2021) to 0.5484 at 0.6240, it will define whether the recovery from 0.5484 evolves into a broader bullish trend reversal or stalls as a corrective rally within a dominant downtrend.

Japan PMI composite finalized at 53.1, broadening growth at start of 2026

Japan’s PMI Services was finalized at 53.7 in January, up from December’s 51.6. PMI Composite rose to 53.1 from 51.1. The data point to a clear acceleration in private-sector activity at the start of 2026, with growth firmly back above expansionary levels.

According to Annabel Fiddes of S&P Global Market Intelligence, business activity rebounded at the fastest pace since May 2023. Services remained the primary growth engine, posting the strongest rise in activity in nearly a year, while manufacturing output also returned to growth for the first time since last June.

The surveys suggest the recovery is becoming more broad-based. Demand improved across both manufacturing and services simultaneously for the first time in more than two-and-a-half years, a notable shift after a prolonged period of uneven momentum. Employment was another bright spot, with firms adding staff across both sectors to expand capacity in response to stronger demand.

Cost pressures eased at the start of the year, with input prices rising at their slowest pace in almost two years. However, companies raised selling prices more aggressively, indicating efforts to rebuild margins.

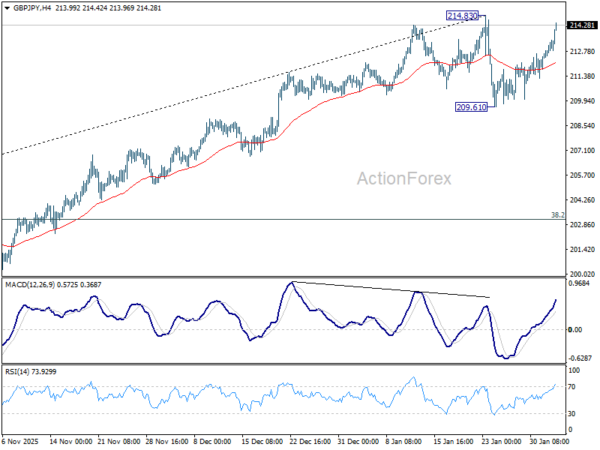

GBP/JPY Daily Outlook

Daily Pivots: (S1) 211.69; (P) 212.29; (R1) 213.28; More…

Immediate focus is back on 214.83 as GBP/JPY’s rebound accelerates higher. Firm break there will resume larger up trend to 220.90 projection level next. Rejection by 214.83 will bring more consolidations first. But in case of another dip, downside should be contained by 55 D EMA (now at 209.70) to bring rally resumption.

In the bigger picture, up trend from 123.94 (2020 low) is in progress. Next target is 61.8% projection of 148.93 (2022 low) to 208.09 (2024 high) from 184.35 at 220.90. On the downside, break of 205.30 resistance turned support is needed to indicate medium term topping. Otherwise, outlook will stay bullish even in case of deep pullback.