Dollar is trying to recover again as markets are heading for weekly close. But the greenback is overwhelmed by the rebound in Yen. There was some concerns over US government shut down. But with the spending bill passed in the House already, vote in the Senate should be just procedural. Sterling is also paring some gains after weaker than expected retail sales. Meanwhile, in spite of solid data from Canada, the Loonie is also trading mildly softer. From Canada, manufacturing sales rose 3.4% mom in November, international securities transactions dropped to CAD 19.56b.

German SPD to vote on coalition on Sunday

In Germany, 600 Social Democrats (SPD) delegates will vote on Sunday on the proposal to start formal coalition talks with Chancellor Angela Merkel’s CDU/CSU this Sunday. The vote will be the junction in German politics as either heading back to stability of grand coalition, or to another election. On the table is a 28-page policy framework, the production of the marathon preliminary talks between CDU/CSU and SPD.

Released from Europe, German PPI rose 0.2% mom, 2.3% yoy in December. Swiss PPI rose 0.2% mom, 1.8% yoy in December. Eurozone current account surplus widened to EUR 32.b in November. UK retail sales dropped sharply by -1.5% mom in December, below expectation of -0.9% mom.

Japan government upgraded economic assessment

The Japan Cabinet Office raised the economic assessment in the monthly economic report released today. The document noted that "Japan’s economy is gradually recovering". Consumer spending is also seen as "recovering" too. Japan Economy Minister Toshimitsu Motegi said that "the difference between previous recoveries and the current recovery is that right now both the corporate sector and the household sector are steadily improving." Economists noted that global economic recovery will continue to help the export led Japanese economy. At the same time, there is little sign of a drag from domestic factors.

New Zealand manufacturing PMI tumbled sharply

New Zealand business NZ manufacturing PMI dropped sharply to 51.2 in December, down from 57.7. While it still stayed above 50 which signals expansions, the slowdown is notable. Looking in to the details, all five of the sub-indices declined with the biggest fall seen in new orders, from 57.3 to 50.2. BNZ noted that "anecdotal evidence, across the economy, suggests there was a post-election hiccup in activity as businesses put off major spending."

EUR/USD Mid-Day Outlook

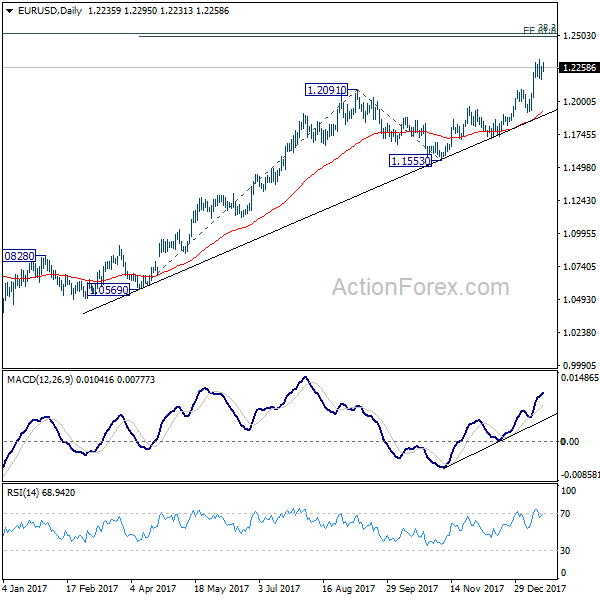

Daily Pivots: (S1) 1.2181; (P) 1.2222 (R1) 1.2281; More….

EUR/USD continues to be bounded in consolidative trading below 1.2322 and intraday bias remains neutral. More consolidations could be seen. But as long as 1.2088 resistance turned support holds, further rally is expected. Break of 1.2322 will resume medium term rise to 1.2494/2516 key resistance zone next. At this point, we’d expect strong resistance from there to limit upside and bring reversal. On the downside, break of 1.2088 will argue that EUR/USD has topped earlier than expected. In that case, intraday bias will be turned to the downside for 1.1915 support first.

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of another rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 38.2% retracement of 1.6039 to 1.0339 at 1.3862.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing PMI Dec | 51.2 | 57.7 | ||

| 07:00 | EUR | German PPI M/M Dec | 0.20% | 0.20% | 0.10% | |

| 07:00 | EUR | German PPI Y/Y Dec | 2.30% | 2.30% | 2.50% | |

| 08:15 | CHF | Producer & Import Prices M/M Dec | 0.20% | 0.40% | 0.60% | |

| 08:15 | CHF | Producer & Import Prices Y/Y Dec | 1.80% | 2.10% | 1.80% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | 32.5B | 31.3B | 30.8B | 30.3B |

| 09:30 | GBP | Retail SalesM/M Dec | -1.50% | -0.90% | 1.10% | |

| 13:30 | CAD | Manufacturing Sales M/M Nov | 3.40% | 2.00% | -0.40% | -0.60% |

| 13:30 | CAD | International Securities Transactions (CAD) Nov | 19.56B | 15.76B | 20.81B | 20.77B |

| 15:00 | USD | U. of Mich. Sentiment (JAN P) | 97 | 95.9 |