It was a rough ride in the financial markets last week. Stocks were initially pressured in concerns over US-China trade negotiations. US President Donald Trump threw the idea that waiting until after 2020 election before closing the phase one deal. Sentiments were additionally weighed down by a string of weaker than expected economic data. Nevertheless, investors cheered Friday’s better than expected job data while Dollar rebounded notably. Still, the greenback ended as the worst performing. Canadian Dollar was the second weakest, as poor job data outweighed hawkish BoC. On the other hand, New Zealand Dollar was the strongest, followed by Sterling.

High volatility will very likely continue this week considering the high profile events featured. Firstly, the “natural deadline” of December 15 for US-China trade negotiation approaches. We’ll quickly know if there is a deal, or at least progress, to avert the new tariffs on USD 156B of Chinese imports. Secondly, Sterling is currently pricing in a Conservative majority after December 12 elections. With that, Prime Minister Boris Johnson’s Brexit deal should be approved quickly to pave the way for orderly Brexit on January 31 finally. Thirdly, three central banks will meet, Fed, SNB and ECB. Fed fund futures are pricing in near 100% chance for Fed to stand pat. Yet, the traders would be eager to know if policy makers are projecting Fed to stay on hold throughout next year. It will also be Christine Lagarde’s first ECB meeting as President.

Dollar index still staying in up trend despite looking vulnerable

Dollar index dropped to as low as 97.35 last week but recovered ahead of 97.10 near term support. Outlook is starting to look vulnerable again but there is no clear bearishness yet. DXY is still holding above rising 55 week EMA. Up trend from 88.26 (2018 low) is in favor to extend. Above 98.39 resistance will reaffirm this bullish case and bring retest of 99.66 high first. However, sustained break of 97.10 support will have the 55 week EMA firmly taken out. That in turn suggests that 99.66 is already a medium term top. Deeper decline would likely be seen to 38.2% retracement of 88.26 to 99.66 at 95.30 at least.

10 year yield defended 1.67 support, more upside in favor

10 year yield dipped to as low as 1.6963 last week but rebounded ahead of 1.670 near term support, then closed at 1.842. With 1.670 support intact, corrective recovery from 1.429 is still in favor to extend higher. Break of 1.971 resistance cannot be ruled out. But for now, we’d still expect upside to be limited by 38.2% retracement of 3.248 to 1.429 at 2.123, which is close to 55 week EMA at 2.128. Meanwhile, break of 1.670 will bring retest of 1.429 low. Overall, TNX is seen as in medium term sideway trading between 1.429 and 2.123, which should extend for a while.

DOW’s up trend intact after strong support from near term cluster

DOW dipped to as low as 27325.13 last week but quickly rebounded. Strong support was seen from cluster of 55 day EMA as well as 38.2% retracement of 25743.46 to 28174.97 at 27246.13. Near term bullishness is maintained and larger up trend should resume sooner or later. Break of 28174.97 will target next long term projection level, that is, 61.8% projection of 15450.56 to 26951.81 from 21712.53 at 28820.30. That’s where the real medium term test lies.

USD/CNH as a gauge in expectation on US-China trade deal

USD/CNH (off-shore Yuan) is seen as the better gauge in market expectations on US-China trade deal. The pair has been staying in the corrective decline from 7.1964 since late August, with no clear sign of downside acceleration. That was accompanied by the constant flip-flopping in the progress of negotiations. Ideally, if a deal could be reached to avert December 15 tariffs, we should seen USD/CNH dive through 6.952 low as Yuan strengthens. On the other hand, a break through 7.087 resistance to retest 7.1964 high is likely if negotiations break down again.

It might be time for breakout in FTSE after elections

FTSE is also an interesting one to watch this week. It’s be bounded in range above 7000 handle since August and the time for a breakout could finally come after this week’s election. Note that FTSE has been in a loose inverse relation with Sterling ever since the Brexit referendum. So, in case of a clear Conservative win, a strong rally in both the Pound and FTSE would be a strong sign of return in investor confidence. 7446 is the resistance level to watch and break will pave the way to retest 7727.49 high.

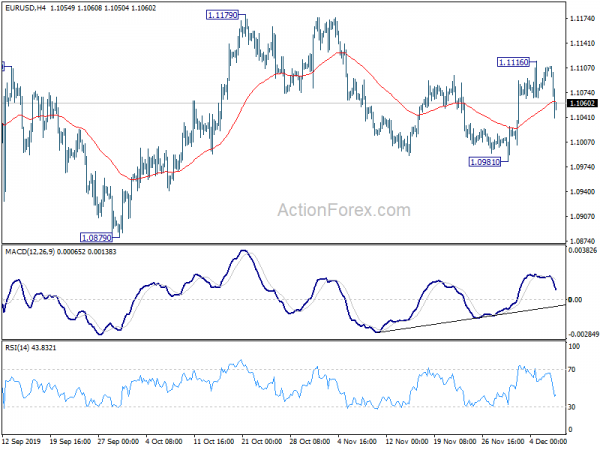

EUR/USD Weekly Outlook

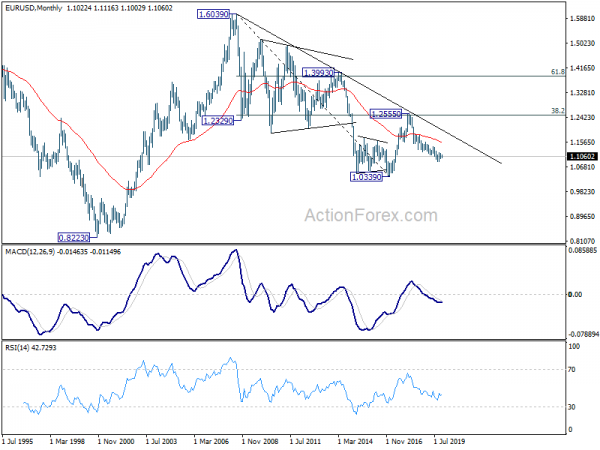

EUR/USD rebounded strong to 1.1116 last week but quickly reversed from there. Near term outlook is mixed for now and initial bias stays neutral this week first. On the downside, break of 1.0981 will resume the decline from 1.1179 for retesting 1.0879 low. On the upside, above 1.1116 will bring a test on 1.1179 resistance.

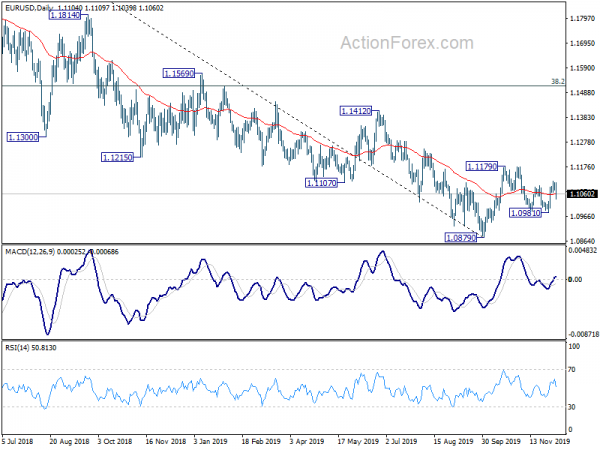

In the bigger picture, rebound from 1.0879 is seen as a corrective move first. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

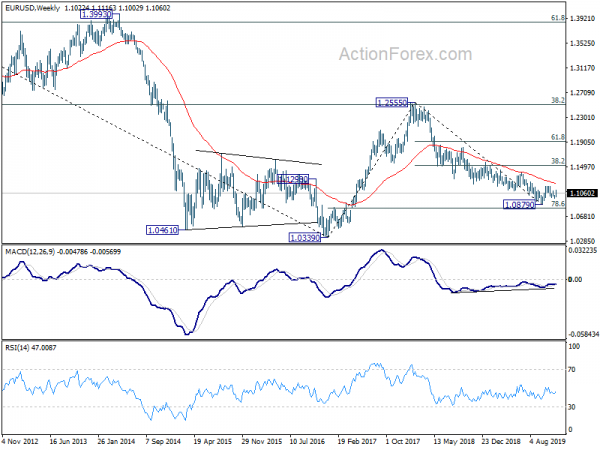

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1566) holds.