It was a very volatile week full of central bank surprises. Fed indicated that there would be as many as three rate hikes next year. BoE surprised by raising the Bank Rate. Even ECB turned out to be less dovish as expected. But in the end, if was the late selloff in the stock markets that finalized that over tone.

We would like to point out that in the background, there were still some worries over the fast spread of Omicron. Risk of return to tougher restrictions, prolonged supply bottlenecks and more persistent high inflation are realistically there. At the same time, major central banks are clearly turning more hawkish on inflation. Hence, the stock markets were indeed rather resilient in this context. Friday’s selloff was probably more because of “quadruple witching”. But we’ll have to see how it goes in January.

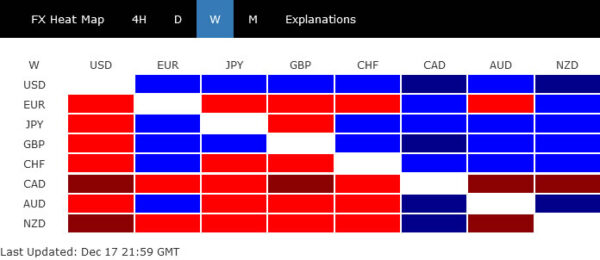

In the currency markets, Dollar ended as the strongest one, followed by Sterling and Yen. Canadian Dollar was the worst performer, followed by Kiwi and then Euro.

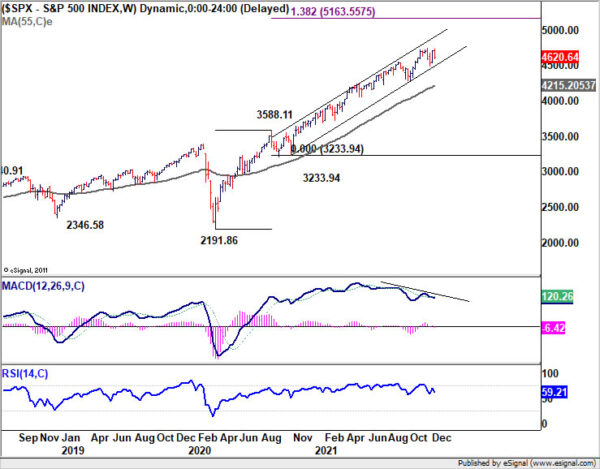

S&P 500 extending the corrective pattern from 4743.83

S&P 500 failed to break through 4743.83 high last week and has indeed closed lower. The development wasn’t a surprise, as we’re envisage that the corrective move from 4743.83 would be unfolded as a three wave pattern. Deeper fall is now mildly in favor for the near term to 4495.12 support.

The main question is whether the SPX is indeed correcting whole up trend from 3233.94. Firm break of 4495.12 would favor this case and bring deeper fall to 38.2% retracement of 3233.94 to 4743.83 at 4167.05 before completing the correction. But keeping 4495.12 intact would maintain the chance of extending the record run before forming a medium term top.

10-year yield’s near term outlook mixed

Outlook is 10-year yield is unchanged that it’s seen as being in the third leg of the corrective pattern from 1.765. Last week’s decline and prior rejection by 55 day EMA are both suggesting more downside for the near term. Yet, at the same time, TNX is also trying to draw support from 55 week EMA (now at 1.381). So, the near term outlook is relatively mixed.

On the upside, break of 1.537 resistance will argue that the fall from 1.693 is finished and bring stronger rebound. But firm break of 55 week EMA could open up deeper fall to 1.128 support. The next move in TNX will be a certain impact on USD/JPY.

Dollar index extending near term consolidation with bullish bias

Dollar index is still bounded in a sideway pattern after a few weeks of volatility. Near term outlook remains bullish with 95.51 support intact. Rise from 89.20 is still in favor to continue to 61.8% retracement of 102.99 to 89.20 at 97.72. However, break of 95.51 will open up the chance for deeper correction to 55 week EMA (now at 93.49) before bottoming.

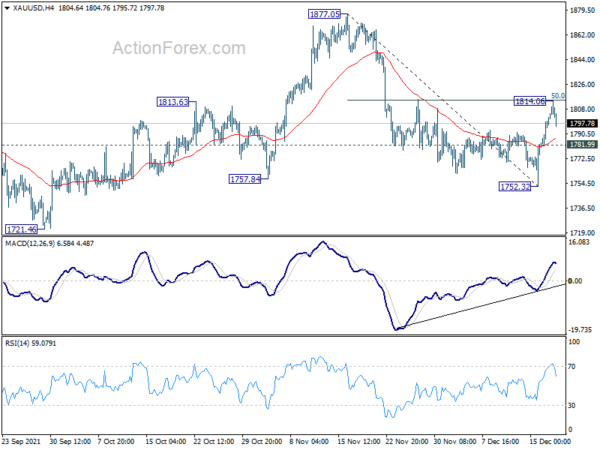

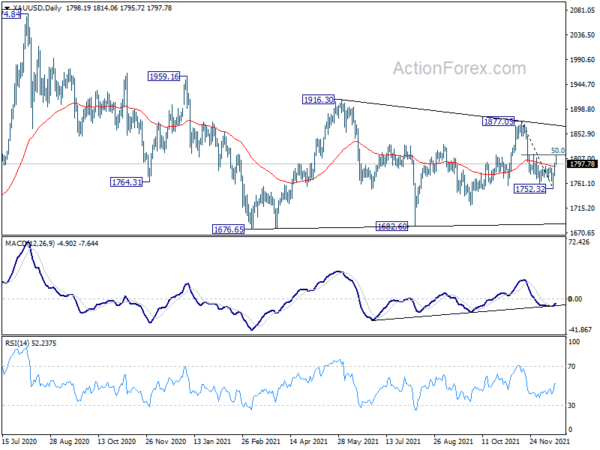

Gold rebounded strongly but couldn’t stay above 1800

Gold staged impressive rebound to as high as 1814.06 last week. But it’s disappointing that it could close above 1800 handle. Further rise is mildly in favor for the near term as long as 1781.99 minor support holds. Break of 1814.06 will target 1877.05 resistance next. However, break of 1781.99 will argue that fall from 1877.05 is still not complete as another leg inside the larger sideway pattern from 1676.65. Deeper fall could be seen through 1752.32 to 1721.46 support and below. We’d continue to use gold to help confirm Dollar’s next move.

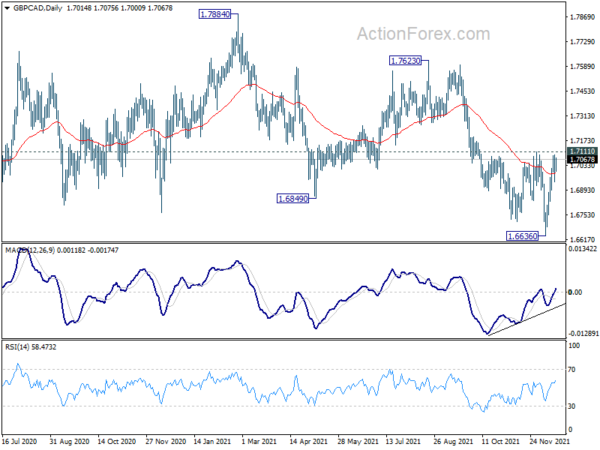

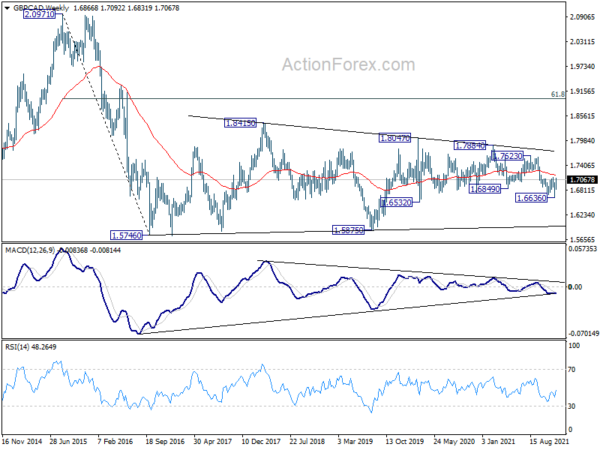

GBP/CAD eyeing 1.7111 resistance as bullish case builds up

GBP/CAD was among the top movers last week as rebounded from 1.6636 extended. The chance of near term bullish reversal is increasing considering bullish convergence condition in daily MACD. But this is not confirmed yet as GBP/CAD would still need to break through 1.7111 resistance decisively to confirm. If happens, such development would also argue that whole decline from 1.7884, as a falling leg inside the long term range pattern, has completed with three waves down to 1.6636. Further rise would be seen towards 1.7623 resistance next. However, rejection by 1.7111 will retain near term bearishness for another fall through 1.6636 at a later stage.

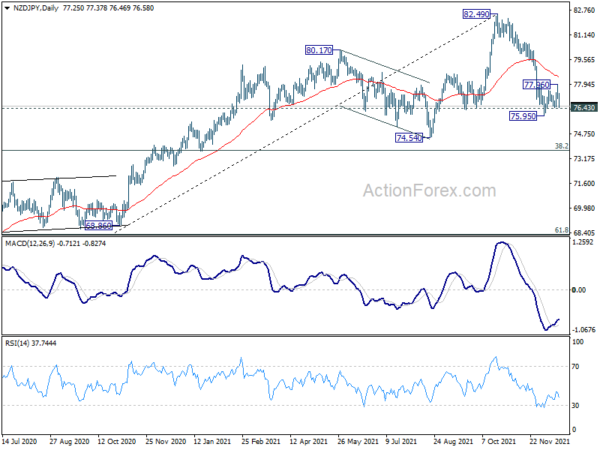

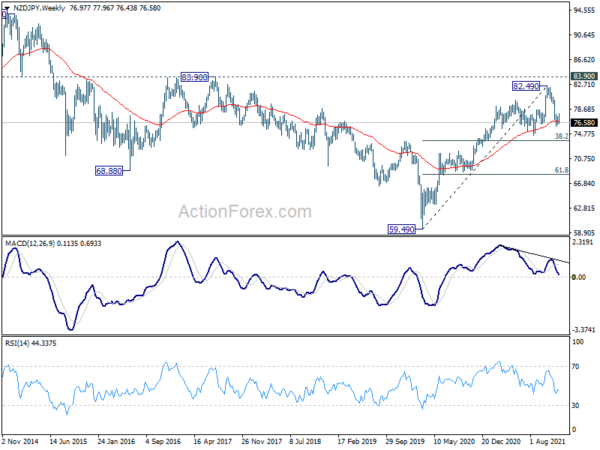

NZD/JPY ready to resume fall from 82.49 after brief recovery

Despite recovering further 77.96 last week, subsequent sharp fall in NZD/JPY suggests that near term outlook is staying bearish. Break of 76.43 minor support will argue that fall from 82.49 is ready to resume through 75.95. Such decline is seen as a correction to whole up trend from 59.49. Break of 75.95 will target 38.2% retracement of 59.49 to 82.49 at 73.70. Though, break above 77.96 will extend the recovery pattern from 75.95 first before staging another decline.

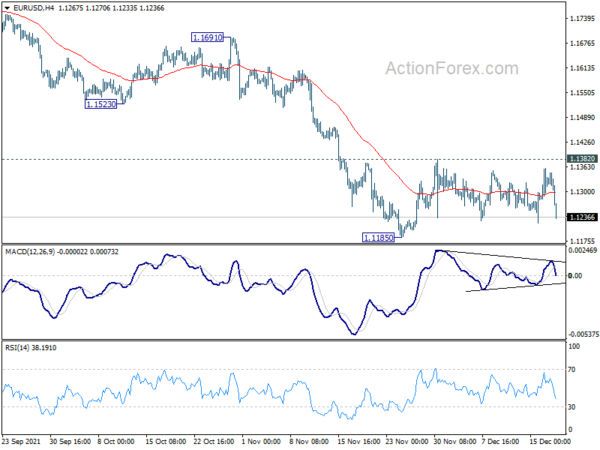

EUR/USD Weekly Outlook

EUR/USD stayed in consolidation between 1.1185/1382 last week and outlook is unchanged. Further decline will remain in favor as long as 1.1382 resistance holds. Break of 1.1185 will resume larger decline from 1.2348. Next target is 161.8% projection of 1.2265 to 1.1663 from 1.1908 at 1.0934. On the upside, firm break of 1.1382 resistance should confirm short term bottoming at 1.1186. Intraday bias will be turned back to the upside for 55 day EMA (now at 1.1432).

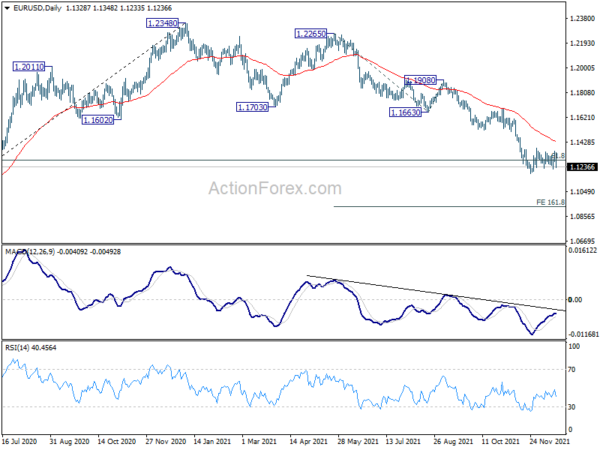

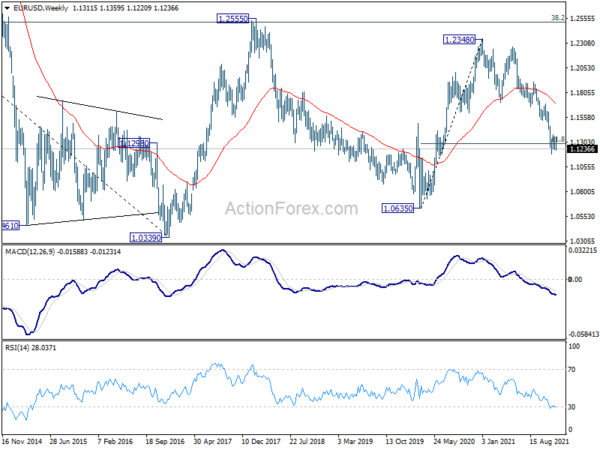

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

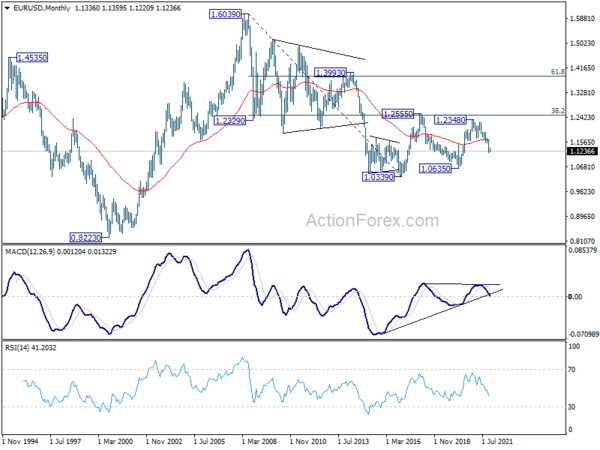

In the long term picture, EUR/USD has possibly failed 1.2555 cluster resistance (38.2% retracement of 1.6039 to 1.0339 at 1.2516) again. Long term outlook will remain neutral as sideway pattern from 1.0339 (2017 low) is extending with another medium term fall. For now, we’d hold back from assessing the chance of downside breakout, and monitor the momentum of the decline from 1.2348 first.