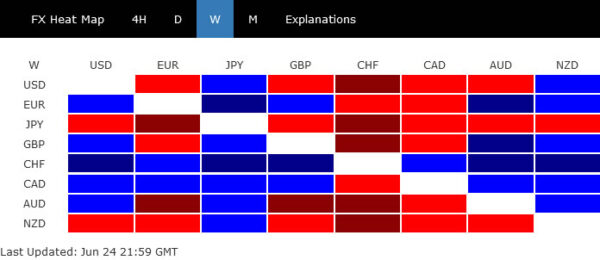

The forex markets were rather mixed last week. Yen ended as the worst performer, but Swiss Franc was the best. Canadian Dollar rose against all but Franc, while Aussie and Kiwi were weak. Euro was mixed together with Sterling wile Dollar was ended lower against all but Yen and Kiwi.

Overall, there were hints of a turnaround in sentiment, as manifested in the late rebound in stocks. Tumbling commodity and energy prices raised hope that inflation is nearing its peak, which is also reflected in pull back in treasury yields. The upcoming developments in the last week of the quarter, and the first of next would reveal more on what next.

S&P 500 bottomed for the near term

After being pressured for most of the week, US stocks staged a strong rebound on Friday. S&P 500 snapped a three-week losing streak and closed the week notably higher. There is also hope that a recession could be avoided in the US with soft landing achieved. Also, a key driving factor was the optimism that the economy could finally be seeing lights out of the inflation tunnel, following the deep decline in commodity prices. Further fall in commodity and energy prices could give sentiments more lifts.

A short term bottom should at least be in place at 3636.87. Considering bullish convergence condition in daily MACD, it’s possible that whole correction from 4818.62 has completed with three waves down, after hitting 161.8% projection of 4868.62 to 4222.62 from 4637.30 at 3672.97. Further rise is now in favor for the near term for 55 day EMA (now at 4061.93). Reaction from there would tell whether it’s just another oversold bounce, or it’s already in near term bullish reversal.

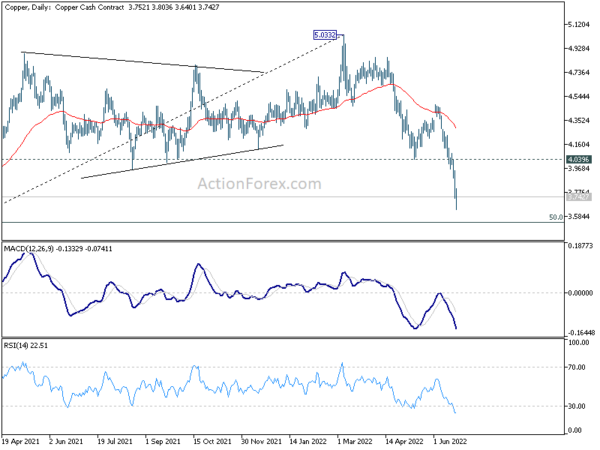

Copper heading back to pre-pandemic level

Copper’s selloff accelerated for another week, and closed at the lowest level in 16 months. 5.0332 high made in March is definitely a medium term top. The fall from there could be attributed to resumption of global supply, as the industry normalized out of the pandemic. On the other hand, there is bearish pressure from deteriorating demand from China.

50% retracement of 2.0400 to 5.0332 at 3.5366 might provide an initial floor. But break of 4.0396 support turned resistance is needed to be the first sign of reversal, or risk will stay on the downside. Copper might to 61.8% retracement at 3.1834 before bottoming. But, anyway, that was still slightly above pre-pandemic range which was below 3. So, it’s not unreasonable.

Natural gas correcting whole up trend since pandemic

Natural gas also extended the steep decline from 9.588 high, made earlier this month. It has been reversing the rally since Russian invasion of Ukraine, as Germany, the Netherlands and Austria are reverting to coal power, rather than turning to gas. Technically, with the break of 6.427 (2021 high), it could now be correcting the whole up trend that started back at 1.527 in 2020, after the start of the pandemic. Near term outlook will stay bearish as long as 6.953 resistance holds. Next target is 55 week EMA (now at 5.353).

10-year yield probably started medium term correction

US 10-year yield gyrated further lower last week as pull back from 3.483 extended. Considering bearish divergence condition in daily MACD. 3.483 could be a medium term top, just ahead of 161.8% projection of 0.398 to 1.765 from 1.343 at 3.554. It’s possibly already in correction to whole five-wave rally from 1.343 already.

Deeper fall is likely to 55 day EMA (now at 2.890) and possibly below. But there is little scope of breaking through 2.709 support, which is close to 38.2% retracement of 1.343 to 3.483 at 2.665.

Risk growing for medium term correction in Dollar index

Dollar index staged in range trading below 105.78 last week. It’s still too early to call for medium term topping 105.78. But risk is growing considering bearish divergence condition in daily MACD. Near term outlook will stay bullish as long as 55 day EMA (now at 102.52) holds. However, sustained break of 55 day EMA will argue that DXY is already correcting the whole rise from 89.52. Deeper fall could then be seen to 38.2% retracement of 89.52 to 105.78 at 99.46, or even further to 55 week EMA (now at 97.77).

If this bearish scenario really happens, it should be accompanied by stronger rebound in stocks and deeper pull back in yields.

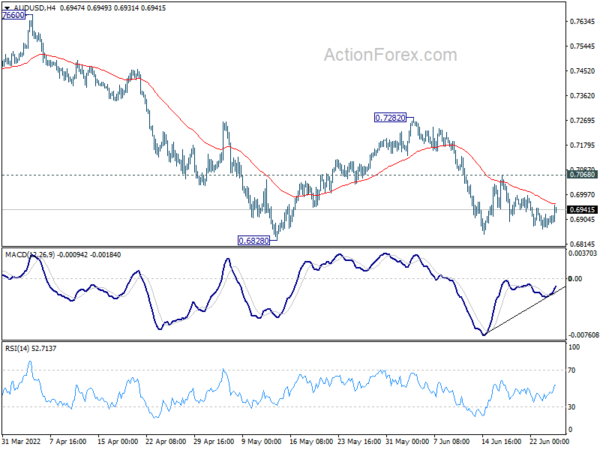

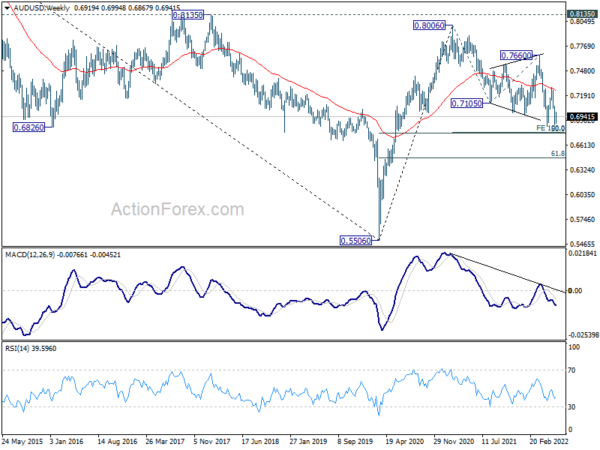

AUD/USD Weekly Outlook

AUD/USD stayed in sideway trading last week. Initial bias remains neutral this week first. downside, firm break of 0.6828 support will resume larger fall from 0.8006. Next target is 0.6756/60 cluster support. On the upside, above 0.7068 minor resistance will bring stronger rebound to 0.7282 resistance first. Firm break there will be a sign of bullish reversal and bring stronger rebound to 0.7666 resistance.

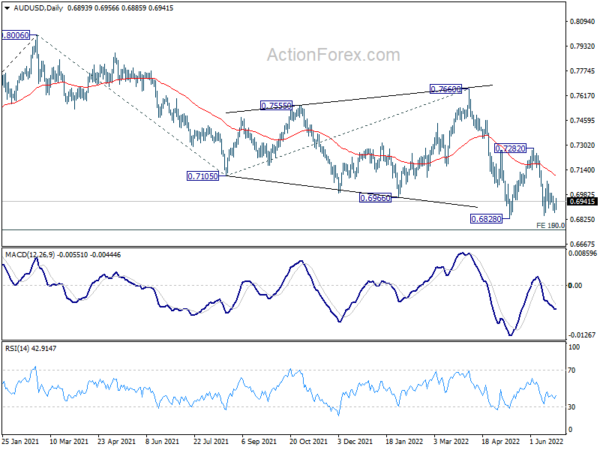

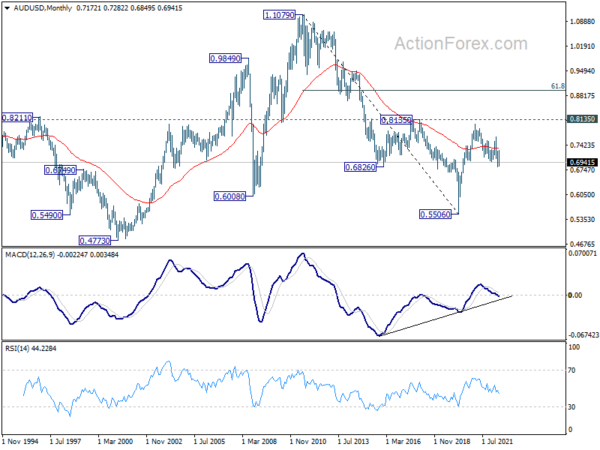

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Deeper fall could still be seen to 50% retracement of 0.5506 to 0.8006 at 0.6756. This coincides with 100% projection of 0.8006 to 0.7105 from 0.7660 at 0.6760. Strong support is expected from 0.6756/60 cluster to contain downside to complete the correction. Meanwhile, firm break of 0.7660 resistance will confirm that such corrective pattern has completed, and larger up trend is ready to resume.

In the longer term picture, focus remains on 0.8135 structural resistance. Decisive break there will argue that rise from 0.5506 is developing into a long term up trend that reverses whole down trend from 1.1079 (2011 high). However, rejection by 0.8135 will keep long term outlook neutral at best.