Last week, investors appeared to view the banking crisis as well-contained, pushing it into the rearview mirror. Confidence saw a revival, resulting in significant gains for major global stock indexes. In tandem with the lower-than-anticipated inflation figures from the US, market sentiment underwent a notable shift, paving the way for a fresh start in Q4, with a renewed focus on economic data and interest rate projections..

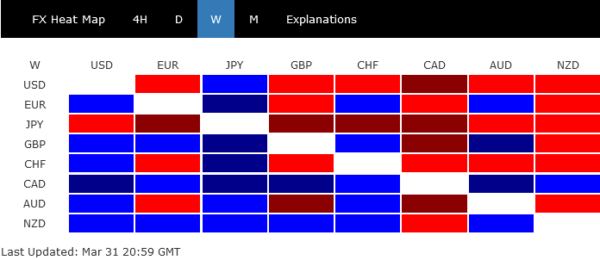

Yen, Dollar, and Swiss Franc, typically seen as safe-haven currencies, emerged as the weakest performers last week. Their late recoveries on Friday likely indicate month-end adjustments rather than a genuine return to risk aversion. On the other hand, Canadian Dollar was the top performer, benefitting from a surge in oil prices, followed by New Zealand Dollar, British Pound, and Australian Dollar. Euro’s performance was mixed but leaned more towards strength.

With no meetings scheduled for Fed or ECB in April at the outset of Q2, the current risk-on trend has room to continue. This ongoing development could further restrain Dollar’s rebound. The main question now is whether commodities will switch positions with their European counterparts. It’s also important to keep an eye on Bitcoin, Gold, and oil prices, as their movements could confirm trends in stocks and currencies.

Optimism prevails with banking crisis in rearview mirror

Last week’s strong finishes in major global stock indexes signaled an overall positive risk sentiment, as investors appeared to view the recent banking crisis as fully contained. Additionally, a lower-than-expected reading in Fed’s preferred inflation gauge confirmed the ongoing disinflation process, suggesting there is less need for the Fed to revert to aggressive rate hikes. Some Fed officials have noted that recent developments could prompt banks to tighten lending standards, which could partially offset the need for additional rate increases.

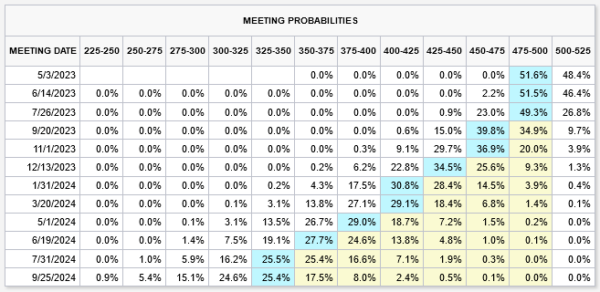

Fed fund futures are pricing in a 50/50 chance of another 25bps hike by Fed in May. But it’s crucial to note the changing market expectations for rate path ahead. Currently, there is over a 55% chance of a cut back to 4.50-4.75% in September and over a 63% chance of interest rates returning to 4.25-4.50% by the end of the year.

NASDAQ ready for upside breakout, S&P 500 following

With improved market sentiment, NASDAQ was an outperformer for both March and Q1, up 6.69% and 16.77% respectively. It’s indeed the best quarter for the tech-heavy index since 2020. S&P 500 was up 3.51% for the month and 7.03% for the quarter. DOW was a lagger, up only 1.89% for the month and only 0.38% in Q1.

Based on current momentum, NASDAQ should take out 12269.55 resumed very soon to resume the whole rally from 10088.82. 38.2% retracement of 16212.22 to 1088.82 at 12427.95 shouldn’t be a big problem for the index. The real test lies in 100% projection of 10207.47 to 12269.55 from 10982.80 at 13044.88. The level is close to 50% retracement at 13157.41. Or to put it simple, around 13k handle. Reaction there would reveal much on whether NASDAQ is reversing whole fall from 16212.22, or it’s just in a corrective rebound. But in any case, near term outlook will now stay bullish as long as 11823.34 support holds.

S&P 500’s break of 4078.89 resistance last week was also a bullish development. Pull back from 4195.44 should have completed at 3808.86. Further rise is expected as long as 55 day EMA (now at 3985.56) holds. Break of 4195.44 resistance will resume whole rebound from 3491.58 to 61.8% retracement of 4818.62 to 3491.58 at 4311.69, which is close to 4325.58 resistance. Sustained break there will pave the way back to 4818.62 high, even as the second leg of the corrective pattern from there.

DAX reversed all banking crisis losses, Nikkei closed higher in range

Performance of German DAX was also impressive as it ended the quarter with 12.25% gain with Friday’s strong rally. The losses from the banking crisis was totally reversed. Immediate focus is now on 15706.37 resistance in the coming days. Decisive break there will resume the rise from 11862.84 to retest 16290.19 record high.

It should also be noted that the strong support from 55 week EMA (now at 14383.54) was a medium term bullish signal too. The rally might not hit real resistance until meeting 61.8% projection of 8255.65 to 16290.19 form 11862.84 at 16828.18 later in the quarter.

Nikkei’s has a strong weekly close, even though it’s still stuck in medium term range trading. Overall performance was indeed not bad. With the all market turbulence, it’s just extending the sideway pattern that started back in late 2021. Indeed, barring a week of climax selloff to 24681.75, the index managed to defend 38.2% retracement of 16358.19 to 30795.77 at 25280.61 well.

Medium term outlook stays neutral in Nikkei for now, with favor on an upside breakout eventually. Break of 29222.77 could prompt further rise to retest 30795.77 high first.

Dollar index gyrated lower, but range trading is the base case

Dollar index gyrated lower last week after failing to break through 103.44 support turned resistance. The question remains on whether price action from 100.82 are developing into a three wave corrective pattern. Hence, even in case of deeper decline in the DXY, attention should be paid on reversal sign is it approaches 100.82 low. On the other hand, break of 103.44 will argue that the third leg of the pattern has started for 38.2% retracement of 114.77 to 100.82 at 106.14. After all, the favored case is for range trading to continue between 100.82 to 106.14 for a while.

Bitcoin, Gold and oil price are worth attention in April

Looking ahead in April, the developments in Bitcoin, Gold and oil prices are worth much attention.

Bitcoin would continued to be seen as a gauge for overall risk sentiment, in particular as a proxy to NASDAQ. Rally from 15452 haled ahead of 100% projection of 15452. to 25242 from 19552 at 29342. Retreat is contained well above 25242 resistance turned support so far, keeping outlook bullish. Firm break of 29342, and probably more importantly the 30k handle, could prompt upside acceleration. That would bring further rise to 38.2% retracement of 68986 to 15452 at 35901 at least. If realized, NASDQ should also march towards 13k handle in tandem.

Gold will be used to gauge intensity if Dollar is back in selloff mode. So far, price actions in Gold price 2009.59 are corrective looking, keeping near term outlook bullish. Break of 2009.59 could extend the rise from 1614.60 to retest 2070.06/2074.84 key resistance zone. Rejection by this resistance zone, if happens, should come with DXY bouncing off 100.82 support. Firm break of 2074.84 in Gold could have DXY breaking through 100.82 low together. Meanwhile, break of 1934.07 support in Gold could also have DXY breaking through 103.44 resistance for a stronger rebound.

WTI crude oil extended the rebound from 64.19 last week on tightening supplies, as well as Fed expectations. With bullish convergence condition in daily MACD, there is reason for 64.19 to be a medium term bottom. But it’s way too early to call for a bullish trend reversal, with upside capped well below 80.82, even though further rise is in favor towards this resistance level for the near term. So, while the support the Canadian Dollar could continue, it might not last long until 80.82 is cleanly taken out. In that case, traditional stocks in DOW could also undergo a revival too.

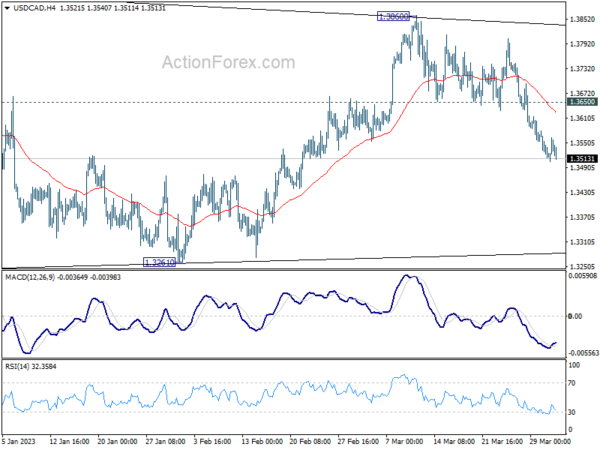

USD/CAD Weekly Outlook

USD/CAD’s decline from 1.3860 last week suggests that corrective pattern from 1.3976 is extending with another falling leg. Initial bias remains on the downside this week for 1.3224/61 support zone. But strong support should be seen around there to bring rebound. Still, break of 1.3650 support turned is needed to indicate completion of the decline first. Or further fall will remain in favor in case of recovery.

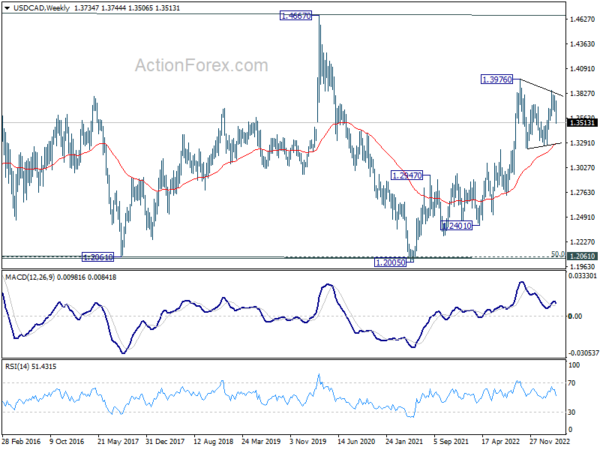

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, sustained break of 55 week EMA (now at 1.3282) is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 month EMA (now at 1.3003) holds.