It was a week marked by a series of significant headlines that captured the attention of global investors.

- Bitcoin led the charge and surged sharply, touching 35k mark, a noteworthy move for the cryptocurrency giant.

- At the same time, US 10-year yield demonstrated ambition as it flirted with 5% level, but lacked the momentum to seal the deal decisively.

- Major US stock indexes sent alarm bells ringing. Falling into what analysts label as “correction territory.”

- Gold, acting as the traditional safe haven, rode on the back of global uncertainty, breaking past the significant 2000 handle.

- Japanese Yen drew attention as well, as it momentarily dipped below 150 level but managed to recover, all without BoJ stepping in.

- On economic events, ECB’s move this week was highly anticipated by many. After a streak of ten rate hikes, the bank decided to hit the pause button. Meanwhile, the robust US Q3 GDP growth surpassed market expectations.

- In the background, geopolitical conflicts in the Middle East cast a lingering shadow, adding an element of unpredictability to the already complex financial equation.

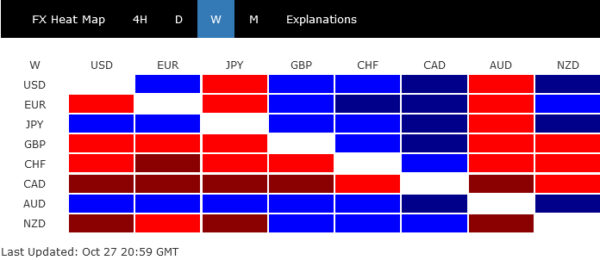

On the currency front, Dollar, despite its general strength, only secured the third spot, hindered by 10-year yield’s hesitance to break past the 5% mark decisively. Despite momentarily crossing 150 level, Yen reverted to close as second strongest. Australian Dollar made notable strides, outpacing both Dollar and Yen. This uptick is bolstered by robust CPI data, which has solidified expectations of an imminent interest rate hike by RBA in the coming month.

Conversely, Canadian Dollar did not fare as well, emerging as the week’s weakest performer. BoC’s decision to hold rates was a significant factor, coupled with growing consensus that the current rate cycle might have hit its peak. Swiss Franc continued to shed its recent gains, while Sterling and Euro were mixed.

Stocks dive, 10-year yield flirts with 5%, Dollar index holds Firm

The financial markets exhibited a notable downturn last week, with sentiment taking a hit from ongoing geopolitical strife in the Middle East and concerns over an impending economic slowdown. Despite a strong showing in the US Q3 GDP, apprehensions loom large as Fed’s “high for longer” monetary policy is expected to decelerate economic growth. Market observers are now left grappling with the questions surrounding the depth and speed of the anticipated deceleration.

Major US indices registered declines, with DOW, S&P 500, and NASDAQ dropping by -2.1%, -2.5%, and -2.6% respectively. Significantly, both S&P 500 and NASDAQ have plummeted over 10% since their July highs. US 10-year yield flirted with 5% but ultimately fell short. While there’s still a tilt towards higher yield, diminishing momentum might cap the rise around 5.1% mark. Concurrently, Dollar Index maintains its bullish stance, eyeing a breakout above 107.34. However, should Treasury yields lose steam, Dollar Index might require additional support from risk-off sentiment to surpass a hurdle at 108.9 Fibonacci resistance.

S&P 500’s decline from 4607.07 extended through 38.2% retracement of 3491.58 to 4607.07 at 4180.95. Break of near term falling channel support argues that it’s probably in downside acceleration. Near term outlook will stay bearish as long as 4259.84 resistance holds. Next near term target is 61.8% retracement at 3917.70.

More importantly, the fall from 4607.07 could be viewed as the third leg of the pattern from 4818.62 (2022 high. The strong break of 55 W EMA (now at 4231.74) is a medium term bearish sign too. This decline could eventually extend through 3491.58 support to 100% projection of 4818.62 to 3491.58 from 4607.07 at 3280.03 before completion.

10-year yield extended near term consolidation below 5% handle last week but the retreat has been shallow so far. Mild bearish divergence condition in D MACD argues that while further rise is in favor, 61.8% projection of 1.343 to 4.333 from 3.253 at 5.100 should hold on first attempt. But after all, even in case of extended pull back, near term outlook will stay bullish as long as 4.532 support holds.

Dollar index extended the corrective pattern from 107.34 with another dip last week. But it recovered ahead of 55 D EMA (now at 105.28). Outlook will stay bullish as long as 38.2% retracement of 99.57 to 107.34 at 104.37. Break of 107.34 will resume the rise from 99.57 to 61.8% retracement of 114.77 to 99.57 at 108.96. This would now be the important hurdle to overcome.

Gold and Bitcoin soar as global tensions intensify

With the current global backdrop, it’s crucial to cast an eye on the noteworthy developments in Gold and Bitcoin, as both assets have charted a course of strong rally. While Gold has traditionally been embraced as a safe-haven asset, the recent surge suggests that Bitcoin might be joining its ranks, benefiting from a similar flight to safety.

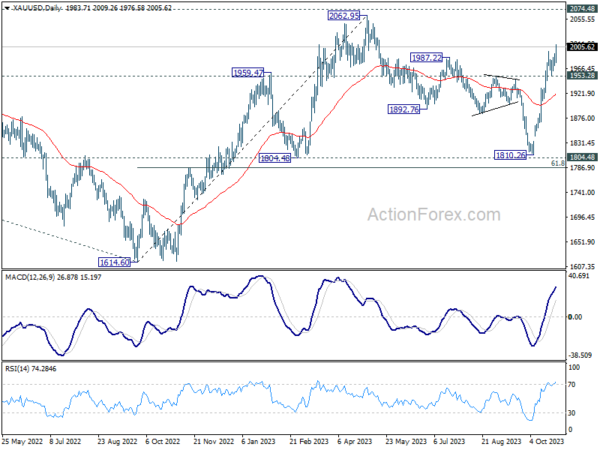

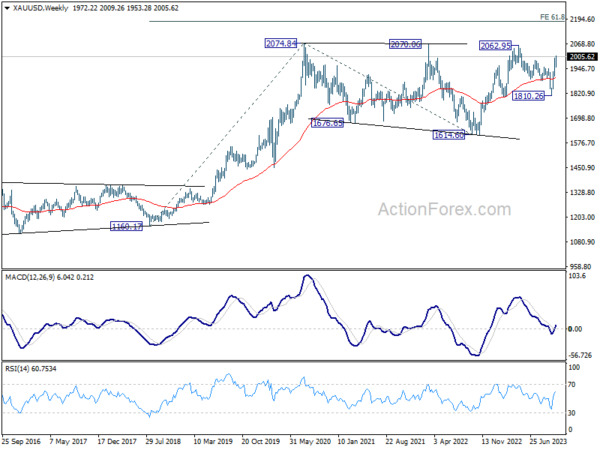

Over the last week, Gold primarily lingered in a phase of consolidation but made a decisive move, breaking 2000 handle as its recent robust rally picked up momentum on Friday. This upward trajectory coincides with the international community’s unsuccessful appeals for a humanitarian truce between Israel and Hamas. Despite the United Nations General Assembly’s efforts, the call for peace has yet to be heeded.

Technically, as long as 1953.28 support holds, Gold’s bullish momentum would continue to 2062.95/2074.48 long term resistance zone. Given the three-wave corrective structure observed from 2062.95 to 1810.26, uptrend from 1614.60 is likely ready to resume through 2062.95. This would also mean that the long-term uptrend would be back in play. Next medium term target will be 61.8% projection of 1160.17 to 2074.84 from 1614.60 at 2179.86.

Shifting to Bitcoin, some analysts believe its rally transcends the mere anticipation of the Spot BTC ETF’s eventual rollout. They posit that Bitcoin is increasingly being viewed as a “flight to quality” amidst escalating global tensions and conflicts. Furthermore, the indirect impact of warfare on depreciating fiat currencies due to governmental spending cannot be overlooked.

Technically, Bitcoin’s gaze is fixed on the pivotal resistance of 38.2% retracement of 68986 to 15452 at 35901. Sustained break of this threshold would suggest bullish trend reversal, rather than a mere correction, of the overall downtrend from 2021 high of 68986. The next immediate target is 100% projection of 15452 to 31815 from 24896 at 41259. However, should 31815 resistance-turned-support be broken, it could signal a decrease in upward pressure, leading to a phase of consolidations first.

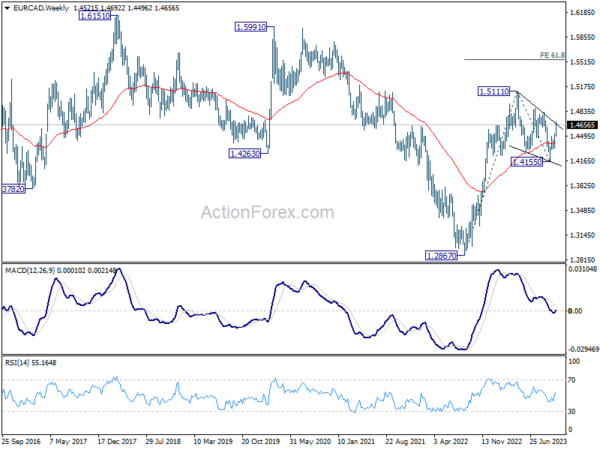

EUR/CAD continues upward march following BoC and ECB holds

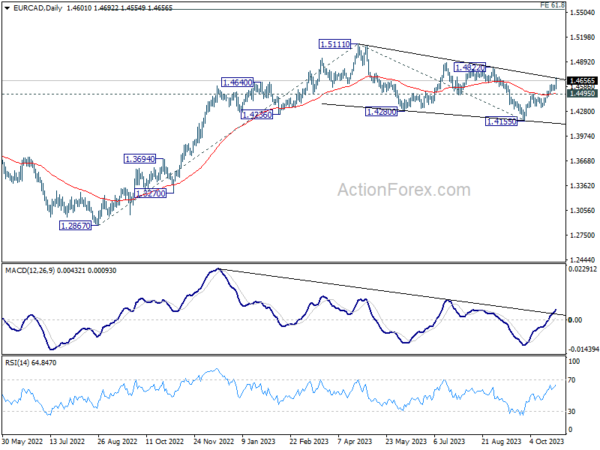

EUR/CAD extended recent rally last week as the financial markets parsed the implications of policy decisions by BoC and ECB.

BoC elected to hold its policy rate steady at 5.00%. Despite maintaining a moderate hawkish bias, a growing consensus among analysts suggests that we might have seen the peak of this rate cycle. Canada’s growth outlook is on a subdued trajectory, a consequence of prior tightening measures still permeating through the economy. Meanwhile, the pace of disinflation was evident, even if its pace might not align with BoC’s idea. Money markets have recalibrated their expectations post the rate decision, now seeing a reduced 40% likelihood of a further rate hike in the coming months, a notable decline from the earlier 60% probability.

On the European front, ECB also opted to keep its main refinancing rate unchanged at 4.50%. President Christine Lagarde emphasized the prevalent economic uncertainties but voiced confidence that sticking to the current rates for an extended period would guide inflation back to the bank’s target. Notably absent was any conversation about hastening the conclusion of PEPP reinvestments.

While the peak for interest rates from both banks might have been attained, forecasts diverge regarding the timing of the first potential rate cut, and the subsequent moves. Some financial experts anticipate the BoC might slash rates as soon as in early Q2 2024, positioning the rate between 3.00% and 3.50% by year’s end. Simultaneously, market sentiments lean towards a rate cut by the ECB later in the same quarter, followed by two subsequent reductions, settling the rate at approximately 3.75% by the close of 2024.

That could partly explain the recent rally in EUR/CAD, which continued last week. From a technical perspective, EUR/CAD’s corrective fall from 1.5111 should have completed with three waves down to 1.4155. Further rise is expected as long as 1.4495 support holds, to 1.4822 resistance next.

Decisive break of 1.4822 will bolster the chance of up trend resumption through 1.5111 high. In this bullish case, next target will be 61.8% projection of 1.2867 to 1.5111 from 1.4155 at 1.5542.

Yen mounts comeback as bears left wanting

Yen underwent an initial decline, slipping below 150 psychological level against Dollar, but managed to stage a recovery on Friday without any evident backing from Japan’s intervention.

The resurgence in Tokyo inflation strengthened expectation that BoJ would raise its core inflation forecast for fiscal 2024 into 2% range. Additionally, ongoing conjectures suggest BoJ might be on the cusp of adjusting policies, potentially paving the path towards exiting negative interest rates in 2024.

However, it’s essential to remember that even the most optimistic BoJ board members foresee “January to March of next year” as the earliest window for tangible evidence of sustained wage growth and inflation. Furthermore, the current JGB yield curve doesn’t display significant distortions that would necessitate another adjustment in yield curve control. Consequently, the upcoming BoJ meeting might be premature for any substantial policy adjustments.

The late-week recovery of Yen could likely stem from the disappointment among Yen bears, who observed no follow-through in the markets after USD/JPY breached 150.15 mark. From a technical standpoint, USD/JPY is just in near term consolidations. While deeper retreat cannot be ruled out, outlook will stay bullish as long as 147.28 support holds, for another attempt on 151.93 high.

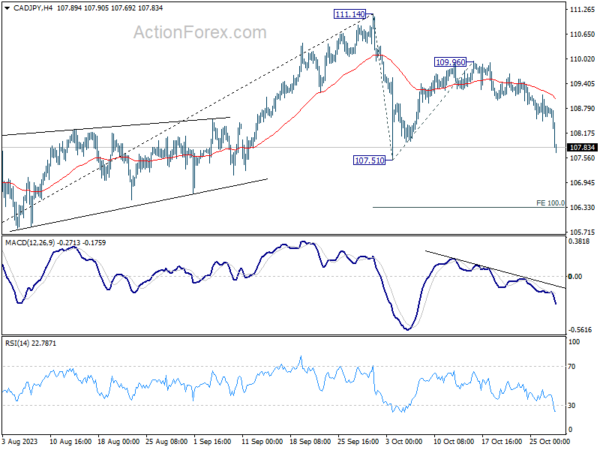

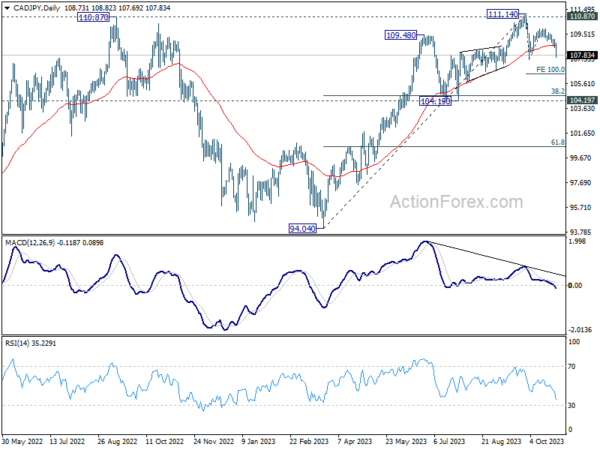

However, Yen’s rally was far more pronounced against Canadian Dollar. CAD/JPY’s steep fall on Friday indicates that fall from 111.14 is ready to resume. Firm break of 107.51 support will target 100% projection of 111.14 to 107.51 from 109.96 at 106.63, or even further to 104.19 support which is close to 38.2% retracement of 94.04 to 111.14 at 104.60.

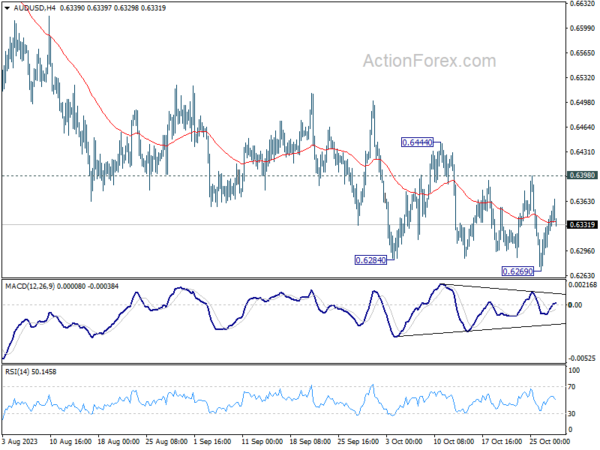

AUD/USD Weekly Report

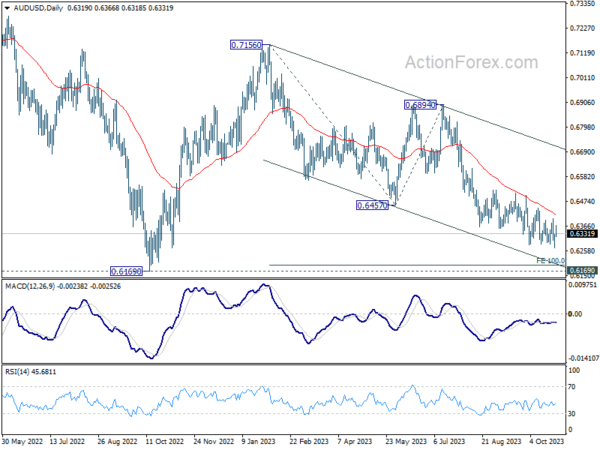

AUD/USD edged lower to 0.6269 last week but quickly recovered. Initial bias remains neutral this week first. Outlook will stay bearish as long as 0.6398 resistance holds. Break of 0.6269 will resume larger fall from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 medium term support.

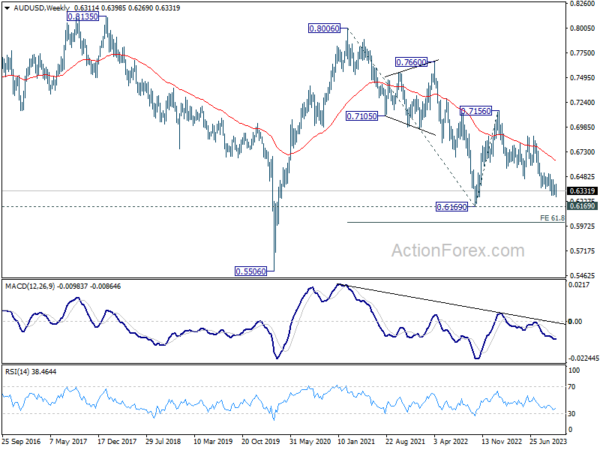

In the bigger picture, down trend from 0.8006 (2021 high) is possibly still in progress. Decisive break of 0.6169 will target 61.8% projection of 0.8006 to 0.6169 to 0.7156 at 0.6021. This will now remain the favored case as long as 0.6894, in case of strong rebound.

In the long term picture, while fall from 0.8006 might extend lower, the structure argues that it’s merely a correction to rise from 0.5506 (2020 low). In case of downside extension, strong support should emerge above 0.5506 to bring reversal. But still, momentum of the next move will be monitored to adjust the assessment.