Live Comments

RBA’s Hunter: Job market tightness consistent with inflation pressure

RBA Assistant Governor Sarah Hunter signalled that Australia’s labour market remains tight despite signs of moderation elsewhere in the economy. In a speech today, she said the RBA’s full employment and NAIRU frameworks indicate that conditions have stabilized and remain “a bit tight,” consistent with "some inflationary pressure in the economy."

She described the relationship between labour tightness and inflation as “like the entwined double helix,” arguing that persistent capacity constraints continue to underpin price pressures. Recent data support that view, with unemployment unexpectedly falling to a seven-month low of 4.1% in December, raising the possibility that the labor market may be tightening again.

Hunter noted that the slowdown over the past few years has occurred primarily through fewer vacancies, reduced job switching, and slower hiring rather than a material rise in unemployment.

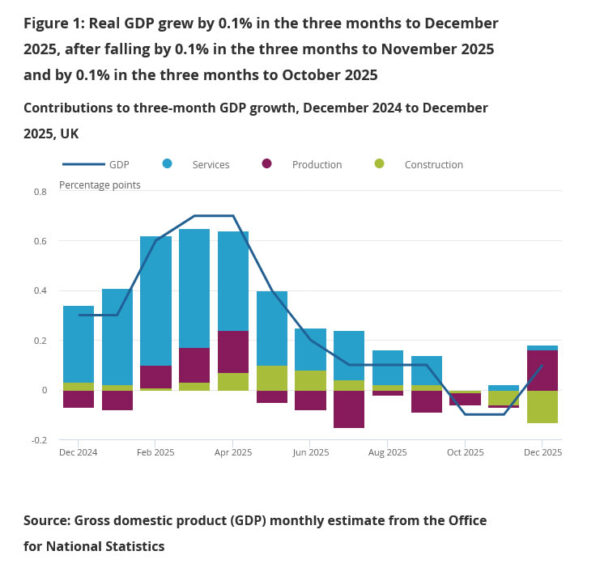

UK GDP misses at 0.1% mom growth, production and construction drag

UK GDP rose just 0.1% mom in December, undershooting expectations for a 0.2% gain and pointing to a subdued end to 2025. While services output expanded by 0.3% on the month, weakness in production, which fell -0.9%, and construction, down -0.5%, capped overall growth.

For the fourth quarter as a whole, GDP grew 0.1% quarter-on-quarter compared with Q3. Production output provided the largest positive contribution, rising 1.2%, while services showed no growth and construction contracted sharply by -2.1%.

On a broader basis, GDP expanded 1.0% in the three months to December 2025 compared with a year earlier, with services and production both up 1.0%. Annual GDP growth for 2025 came in at 1.3%, driven primarily by 1.4% growth in services, while production posted its first annual increase since 2021 at 0.2%. Construction grew 1.8%.

Japan PPI eases to 2.3%, but import costs accelerate

Japan’s producer price index slowed slightly to 2.3% year-on-year in January from 2.4%, matching expectations and suggesting pipeline price pressures are stabilizing. The moderation came despite sharp divergences across components.

Fuel prices dropped -12.9% yoy, providing a significant drag on overall wholesale inflation. In contrast, nonferrous metal prices surged 33%, while agricultural goods rose 22.4%. Food and beverage prices also remained elevated, increasing 4.7% from a year earlier, highlighting persistent cost pressures in parts of the supply chain.

Meanwhile, Yen-based import prices climbed 0.5% yoy, up from a 0.2% gain in December. Despite a recent rebound in the currency, Yen’s broader weakness over recent months has raised the cost of imported energy and raw materials.