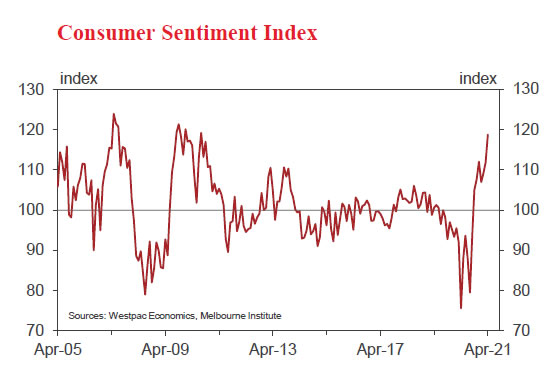

Australia Westpac consumer sentiment rose 6.2% to 118.8 in April, up from 111.8. it’s the highest level since August 2010, “when the Australia’s post-GFC rebound and mining boom were in full swing”. The survey continues to signal that “consumer will be the key driver of above-trend growth in 2021”.

Westpac expects RBA to maintain currency policy settings on May 4. Markets will focus on the new economic projections to be released with the SoMP on May 7. Overall, the forecasts would be consistent with the policy guidance that, “it will still be some time – 2024 at the earliest – before the Bank expects to achieve its full employment and inflation targets.”

RBNZ stands pat, outlook remains highly uncertain

RBNZ left stimulatory monetary policy unchanged as widely expected, with OCR at 0.25% and Large Scale Asset Purchase and Funding for Lending program unchanged. It maintained that to meet the requirements of sustainable 2% inflation and maximum employment will “necessitate considerable time and patience”. The committee is also “prepared to lower the OCR if required”.

The medium-term growth outlook was “similar” to the scenario presented in the February statement. Outlook remains “highly uncertain, determined in large part by both health-related restrictions, and business and consumer confidence.” The would be some temporary factors for near-term price pressures, including global supply chain disruptions and higher oil prices. But medium-term inflation and employment will “likely remain below its remit targets in the absence of prolonged monetary stimulus.”

Full statement here.