The UK’s Brexit Secretary David Davis has resigned along with two junior ministers, Steve Baker and Suella Braverman, over PM May’s latest softer Brexit proposals that were agreed at a cabinet meeting over the weekend. He said in a statement that his role requires an “enthusiastic believer” in May’s approach rather than a “reluctant conscript”. GBP reacted to the data during a period of lower liquidity with GBPUSD selling off a little from 1.33139 to 1.32846. The full impact of the move has yet to be priced in with the possibility that PM May now places a more “enthusiastic believer” in the role which could result in a shift in Brexit negotiations going forward. Alternatively this may result in a no-confidence vote and a leadership contest. All in all it is shaping up as an interesting week ahead in UK politics.

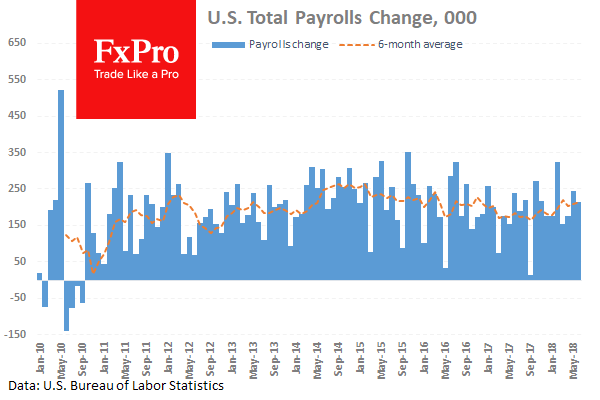

US Non-Farm Payrolls (Jun) came out with a number of 213K against an expected 195K from a prior 223K which was revised higher to 244K. This measures the change in the number of employed people in June which is up from the forecast with a higher revision. The Unemployment Rate (Jun) was 4.0% against an expected 3.8% with a prior of 3.8%. This measures the percentage of the total workforce unemployed and actively seeking employment during June and is shown to be increasing.

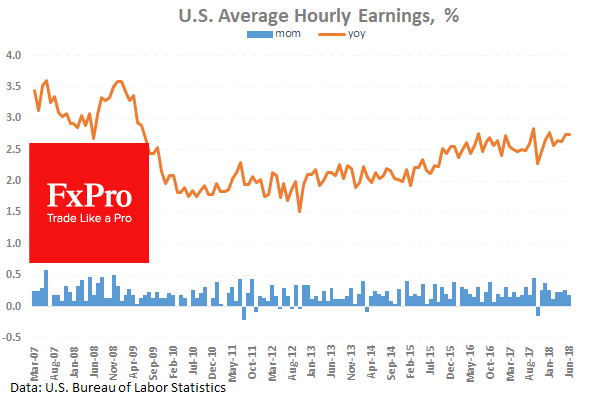

Average Hourly Earnings (Jun) was 0.2% (MoM) and 2.7% (YoY) against an expected 0.3% (MoM) and 2.8% (YoY) from 0.3% (MoM) and 2.7% (YoY) previously. Labour Force Participation Rate (Jun) was 62.9% against an expected 62.7% from a prior reading of 62.7%. This data showed modest improvements and markets reacted positively to the headlines with the US 30 Index moving higher from 24281.90 to 24520.00 and EURUSD up from 1.17164 to 1.17669.

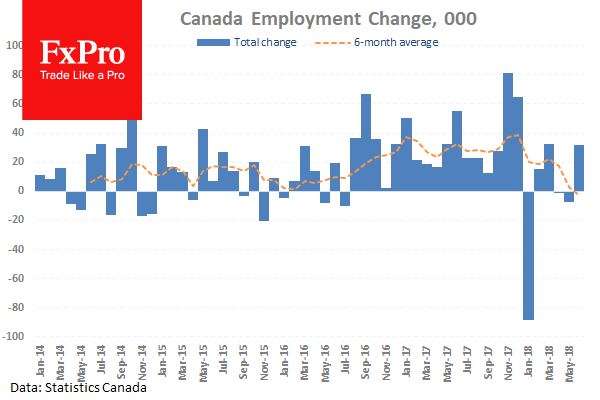

Canadian Unemployment Rate (Jun) was 6.0% against an expected 5.8% from a previous 5.8%. Participation Rate (Jun) was 65.5% against an expected 65.3% from 65.3% prior. Net Change in Employment (Jun) was 31.8K against an expected 24.0K from a prior -7.5K. Unemployment had fallen to the lowest levels in ten years and was settled around 5.8% but has risen 0.2% with this data. The Net Change in Employment data is showing a strong rebound, coming back into positive territory from under zero. Overall the report was positive as it showed more Canadians are working.

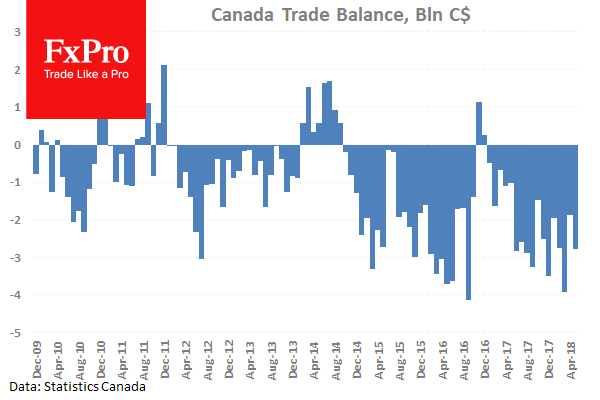

Canadian International Merchandise Trade (May) was $-2.77B against an expected $-2.05B from $-1.90B previously which was revised up to $-1.86B. This fell to miss the expected forecast. EURCAD moved down to 1.53334 but rebounded higher to 1.54409 after the data was released.

Canadian Ivey Purchasing Managers Index s.a. (Jun) was 63.1 against an expected 63.2 from a previous 62.5. Ivey Purchasing Managers Index (Jun) was 65.1 down from 69.5 previously. The data dropped from the April reading which was the highest since 2011 at 71.5 and slipped under expectations. This data is showing robust growth, despite the fall as it is now at recent levels, continuing one of the longest positive runs with over 20 months above 50.0. USDCAD moved up from 1.31050 to 1.31177 after this data release.

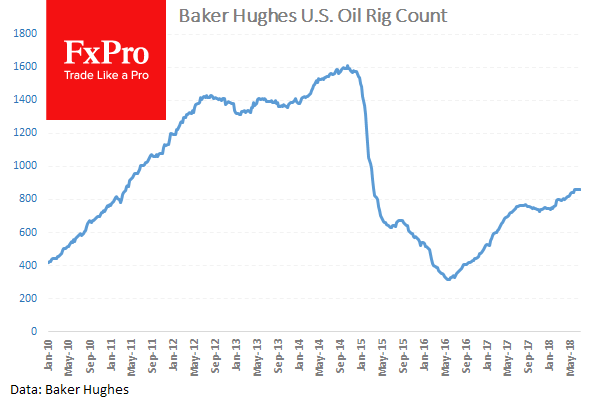

Baker Hughes US Oil Rig Counts was released with a headline number of 863 up from last week’s 858 from 859 previously. Oil prices fell last week after a build in inventories following 3 weeks of bigger than expected draws. WTI Oil can become volatile around this data release and will be in traders’ minds when trading resumes on Monday. WTI finished higher on Friday to close at $72.39.

EURUSD is up 0.21% overnight, trading around 1.17662.

USDJPY is up 0.02% in the early session, trading at around 110.742

GBPUSD is up 0.13% this morning trading around 1.33022

Gold is up 0.40% in early morning trading at around $1,259.66

WTI is up 0.17% this morning, trading around $72.54