Following the RBA, the Reserve Bank of New Zealand (RBNZ) will be next to decide on monetary policy this week. As their Australian counterparts, RBNZ policymakers are widely expected to leave interest rates unchanged on Wednesday at 1900 GMT under a fragile global trade environment and downbeat local business sentiment. The kiwi however could start fluctuating prior to the rate statement as the quarterly employment report out of the country and the outcome of the US midterm elections are poised to affect investors’ buying interest for the currency.

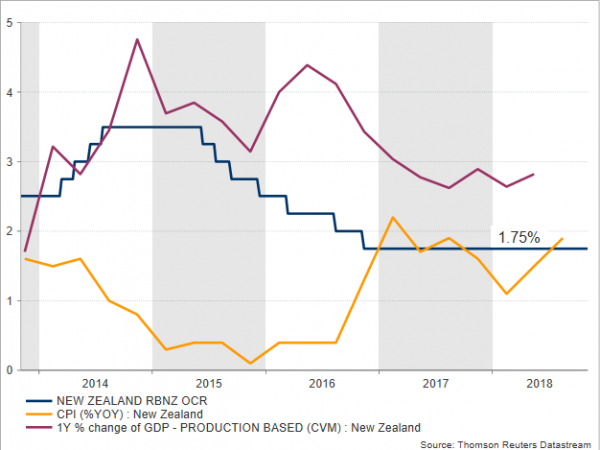

In the three months to September, consumer prices in New Zealand picked up steam for the third consecutive quarter, rising faster than analysts projected. The headline CPI rose by 1.9% year-on-year compared to 1.5% and 1.1% registered in the previous two quarters respectively, while the trimmed-mean measures, which adjust for volatility, ranged between 1.8% and 1.9%. In the wake of the data and given the comfort from a surprisingly stronger GDP growth in Q2, worries about a rate cut started to cool down even if probabilities of such a scenario were never particularly high.

Yet, on Wednesday the Bank is widely anticipated to hold interest rates at the 1.75% record low for the second year, probably explaining that an accommodative policy is still needed to support consumption and business activities. Consumer confidence in the third quarter dropped to the lowest since the end of 2008 according to Westpac Banking corporation, while a business survey by ANZ found that companies were still pessimistic in October albeit less than in the past four months. The above evidence flags that the economy is not ready to pay higher interest rates, especially now when trade barriers between China and the US, the world’s two largest economies, have turned more restrictive, threatening to put breaks on global growth, if they have not already. New Zealand could be caught in the middle of this trade war if tensions fail to ease, something trade stats continue to support so far, with the trade deficit reaching the highest since early 2009 in October.

The progress in inflation however could alter forward guidance into favouring a rate hike instead of backing a rate cut. But before judging, the Bank will take advice from the Q3 employment report due late on Tuesday as unlike most other central banks the New Zealand monetary policy framework targets employment in addition to inflation. Should job growth surprise to the upside or more importantly wages increase at a stronger pace, policymakers might adopt a less dovish tone this time.

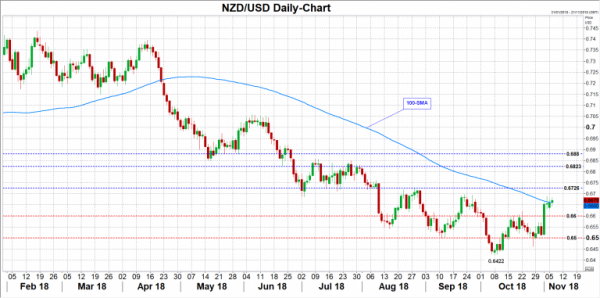

Turning to FX markets, the kiwi could benefit significantly on the back of upbeat employment readings and gain even more if the RBNZ plays down chances for a rate cut. In such a case, kiwi/dollar could rally above the 100-day simple moving average to retest the barrier between the 0.6700 round-level and the August 28 high of 0.6726. Steeper declines may also challenge the 0.6823-0.6858 zone identified by the lows on June 21 and May 23.

On the other hand, disappointing evidence out of the labour market may brush enthusiasm on inflation away, keeping the scenario of a rate cut in the table. In the aftermath kiwi/dollar could give up recent gains, running down to meet the 0.6600 psychological level. Beneath that, the focus will turn to the 0.6500 support, while a deeper decline may also stretch towards the 0.6422 bottom.