January’s employment report for Australia is likely to attract investor’s attention on Thursday at 0030 GMT as the Australian dollar has been losing some ground over the past week. Stronger figures in employment may provide some relief to the currency.

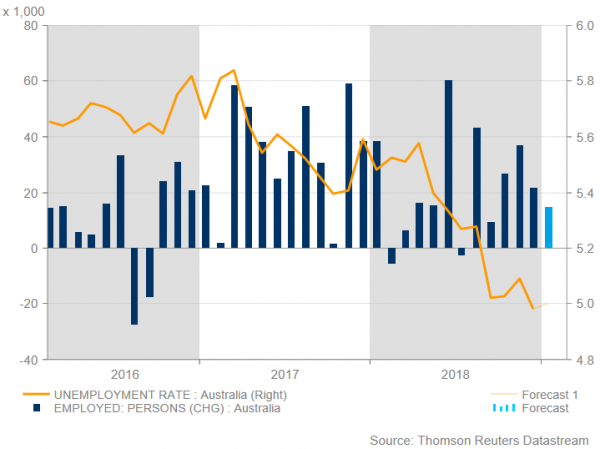

The unemployment rate is predicted to have stayed at 5.0% in January, while the net change in employment is expected to show that the economy added 15,200 jobs, less than December’s 21,600. However, the participation rate is expected to remain steady at 65.6%, while there could be some gains ahead for the aussie if wage growth and employment numbers show further tightening in the labour market.

Early on Tuesday, the Reserve Bank of Australia released the minutes of its latest policy meeting, that kept interest rates unchanged and the statement had a somewhat dovish flavor compared to the preceding one. Policymakers noted that the growth in real GDP of 0.3% in the third quarter and 2.8% over the year had been below expectations as it was expected to be above 3%, reinforced by accommodative monetary policy. Slowing growth in China and ongoing trade tensions had led to lower growth in global trade and forced the RBA to lower its GDP growth forecast for 2019 to 2.75% from 3.25% in its latest Monetary Policy Statement.

Board members were more upbeat, though, about the labour market, citing employment that continues to grow faster than the working-age population in the December quarter, as the unemployment declined to 5%, which was the lowest rate since 2011 and lower than had been expected a year earlier. Moreover, inflation had remained low with the headline rate falling to 1.8% y/y and the underlying rate being 0.5% m/m in the latest quarter. Headline inflation had been lower than forecast because of cheaper fuel prices as a result of falling oil prices. Underlying inflation was expected to increase to 2% until the end of 2019 and to reach 2.25% by the end of 2020.

However, despite the recent downside rally in the Australian dollar, having a look at the outlook for the US economy, the US Federal Reserve had emphasized that it would be patient in making any future adjustments to the funds rate, and that the next monetary policy decisions would be guided by the incoming data because interest rates were closer to estimates of neutral.

So, from the technical point of view, aussie/dollar moved slightly lower, dropping below the 50- and 200-simple moving averages (SMAs) in the daily timeframe, indicating selling interest. Upbeat numbers on employment are likely to propel the price higher towards the 38.2% Fibonacci retracement level of the downleg from the 31-month high of 0.8135 to the decade low of 0.6746, near 0.7278. More bullish pressure would drive the pair towards the 0.7340 – 0.7390 resistance zone.

However, the price could be at risk of a bearish retracement if the employment report disappoints. Price action is likely to challenge again the 23.6% Fibonacci region of 0.7075 and slightly below the 0.7050 support level. A significant leg below these levels could send prices until the 10-year low of 0.6746.

Overall, aussie/dollar is losing momentum in the near term and continues to endorse the long-term bearish structure.