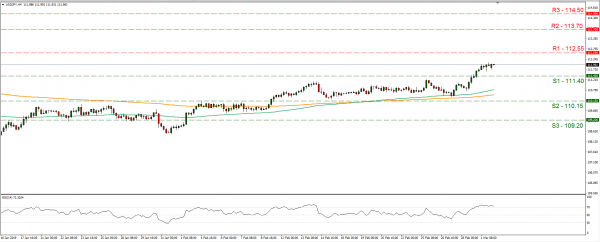

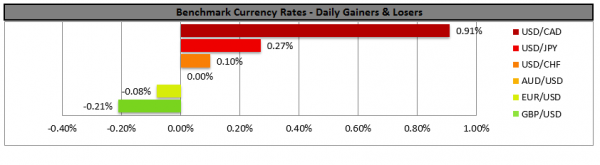

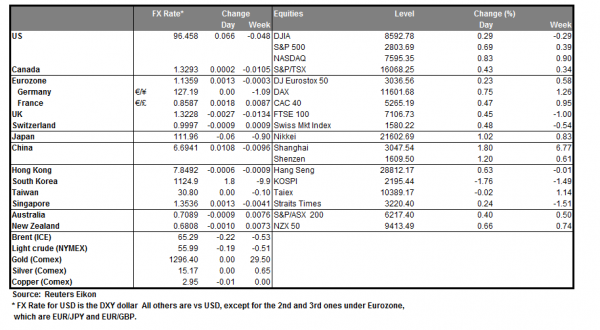

Hopes grew for a possible deal between the US and China, to close their tariff disputes during today’s Asian session. Hopes were fueled by a media report on Sunday, stating that China and the US could reach a formal agreement at a summit around the 27th of March. It should be noted that US government economic adviser Larry Kudlow had stated on Friday that there was much progress in the talks with Chinese representatives. Analysts point out that despite the trade news, pushing the USD lower against a number of Asian currencies, it strengthened against the safe haven JPY. Should there be further positive headlines reeling in, regarding the trade talks we could see the USD’s position as a safe haven being undermined. USD/JPY rose on Friday and during today’s Asian session, yet remaining between the 112.55 (R1) resistance line and the 111.40 (S1) support line. We could see the pair moving in a sideways movement today unless further positive headlines about the US Sino trade negotiations push the pair higher. Should the pair find fresh buying orders along its path, we could see it breaking the 112.55 (R1) resistance line, while if the pair comes under the selling interest of the market, we could see it breaking the 111.40 (S1) support line.

RBA Interest rate decision

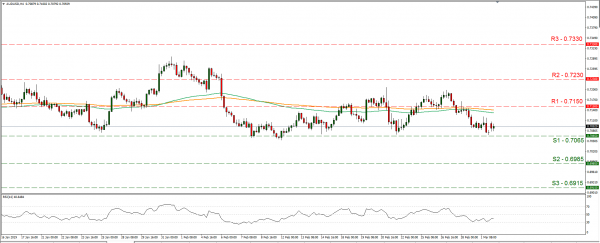

The Aussie could be in for a bumpy week as number of Australian and Chinese data are due out. Starting with RBA’s interest rate decision tomorrow during the Asian session (05:30,GMT+2), the bank is widely expected to remain on hold at +1.50 %.According to AUD OIS, there is a chance of 99% for such a scenario and should the bank do so, we could see the markets attention turning to the accompanying statement. With the CPI rate being below the bank’s target range of 2.00% -3.00% and the GDP rate forecasted to slow down for Q4, there seems to be little room for the bank to maneuver. Should a dovish tone prevail in the accompanying statement, we could see the Aussie weakening. AUD/USD opened with a positive gap during today’s Asian session stabilising and remaining above the 0.7065 (S1) support line. We could see on the one hand the pair being pushed upwards by positive headlines regarding the US-Sino trade relationships, while on the other hand RBA’s interest rate decision along with other financial releases this week could keep the pair under pressure. Should the bears be in control of the pair’s direction, we could see it breaking the 0.7065 (S1) support line and aim for the 0.6985 (S2) support barrier. Should on the other hand the bulls take over, we could see the pair, breaking the 0.7150 (R1) resistance line aiming for higher grounds.

Today’s other economic highlights

During the European session today, we get Turkey’s CPI rate for February, UK’s Construction PMI for February and Eurozone’s PPI rate for January.

As for the rest of the week

On Tuesday, from Australia we get the Current Account balance for Q4, RBA’s Interest Rate Decision, UK’s Services PMI for February, Eurozone’s Retail sales for January, and the US ISM Non-Mfg PMI for February. On Wednesday, we get Australia’s GDP for Q4, form Turkey CBRT’s interest rate decision, the US trade balance for December, form Canada BoC’s interest rate decision and the Ivey PMI for February. On Thursday, we get Australia’s Retail Sales for January and ECB’s Interest rate decision. On Friday, we get Japan’s GDP for Q4, China’s Trade Balance for February, Germany’s Factory orders for January, the US employment report for February, as well as Canada’s employment data for February. On Saturday, from China we get the PPI and CPI rates for February.

USD/JPY

Support: 111.40 (S1), 110.15 (S2), 109.20 (S3)

Resistance: 112.55 (R1), 113.70 (R2), 114.50 (R3)

AUD/USD H4

Support: 0.7065 (S1), 0.6985 (S2), 0.6915 (S3)

Resistance: 0.7150 (R1), 0.7230 (R2), 0.7330 (R3)