- Fears of a global slowdown ease substantially after China posts stronger-than-expected GDP data for the first quarter

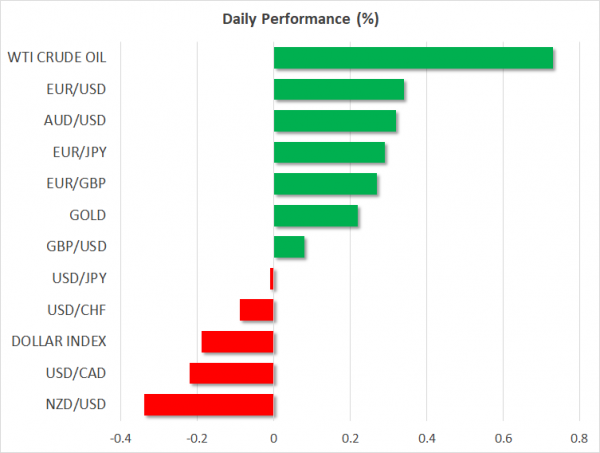

- The data lifts risk-assets with the Australian dollar being the main beneficiary

- But broader gains are limited amid caution about the outlook

China GDP beats expectations, industrial output surges

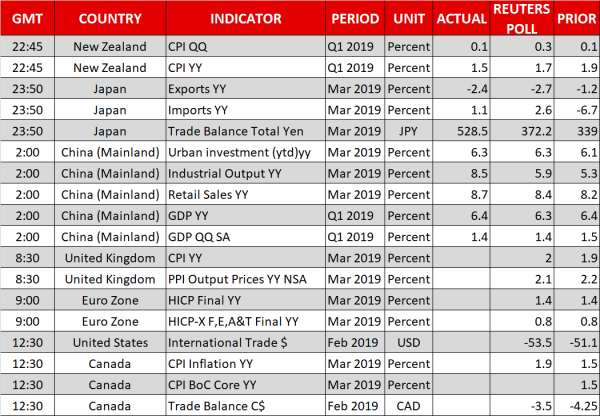

Markets cheered upbeat economic figures out of China on Wednesday, continuing the series of positive numbers out of the country over the past couple of weeks. China’s economy expanded by 6.4% year-on-year in the first three months of the year, defying forecasts of a slowdown to 6.3%. But more encouragingly, March data for industrial output and retail sales beat expectations with a wide margin, pointing to a possible rebound in growth. Industrial output rose at the fastest annual pace in four and a half years, growing by 8.5% in March.

The data lifted the Australian dollar, which hit a 2-month high of $0.7205, while the yen slipped to a 4-month low of 112.16 versus the US dollar. Only yesterday the aussie had fallen sharply from the minutes of the RBA’s April policy meeting, which hinted at rate cuts. An improving economic picture in Australia’s major trading partner could see market expectations of an RBA rate cut diminish, suggesting more upside for the aussie.

The Australian currency will likely remain in focus over the next 24 hours as Australia will publish its employment report for March. The RBA has signalled rate cuts are dependent on a worsening labour market so a strong report would further dash expectations of an easing in policy.

Muted gains for equities

The positive sentiment also supported equities, though shares in Asia pared earlier gains as some investors were cautious about upgrading their views on the global growth outlook just yet. China’s blue-chip CSI 300 index was last trading flat on the day, but Japan’s Nikkei 225 index managed to rise to 4-month highs.

Equity futures for European and US indices were pointing to a mixed start for Wednesday. But the general market mood has been on the up in April and the Chinese data, together with a mostly positive earnings season so far in the US are leading investors to abandon some of their worst-case scenarios for the world economy.

Kiwi slumps on weak inflation readings

The New Zealand dollar bucked the trend on Wednesday, falling sharply against its peers following weaker-than-expected inflation numbers out of New Zealand. The annual rate of CPI increased by 1.5% in the first quarter against expectations of a 1.7% rise. The decline in the inflation rate towards the lower end of the Reserve Bank of New Zealand’s 1-3% target band increases the likelihood of a rate cut by the central bank in the coming months.

The kiwi hit a 3½-month low of $0.6667 before rebounding to around $0.6740 on the back of the Chinese numbers.

Euro and pound edge up ahead of key releases

The euro was also boosted from the China data, recovering back above the $1.13 level, only to hit resistance around $1.1325. The single currency came under pressure yesterday on reports that some ECB policymakers think the bank’s latest economic projections are too optimistic. However, apart from a potential turnaround in China, some recent Eurozone data has also been surprising on the upside. The next major clue on the Eurozone economy will come from the April flash PMIs on Thursday.

The pound was marginally higher at $1.3053, finding support from yesterday’s solid jobs figures. March inflation numbers, due later today, will be viewed next in the UK. However, any gains from more positive data will likely be modest amid doubts about the prospect of a deal between the Conservatives and the Labour party to reach a consensus on the current Brexit impasse.

Canada will also publish its inflation report for March later today. The Canadian dollar is up for a second day against its US counterpart with the help of a rebound in oil prices. But the loonie has been struggling to make significant advances against the greenback as the Bank of Canada has turned more dovish.