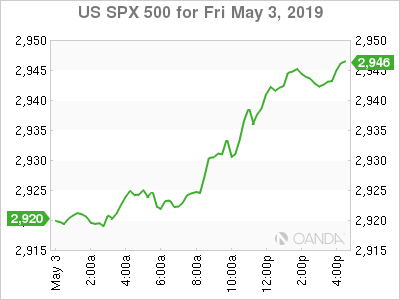

The US dollar reversed earlier gains on a blockbuster headline employment number as market participants focused on the slightly lower than expected wage growth. The nonfarm payroll report showed April employment created 263,000 new jobs, well above all estimates. Wage growth for the prior year slowed to 3.2%, down from the 3.4% high of the current cycle. The US economy remains the most attractive spot for equity traders, but the greenback may be at a critical turning point. The US dollar may take a backseat at the start of the week as the focus shifts to live rate decisions from the RBA and RBNZ.

- Earnings – Softbank, Disney, Toyota, Tyson Foods, and Anheuser-Busch Invev on tap

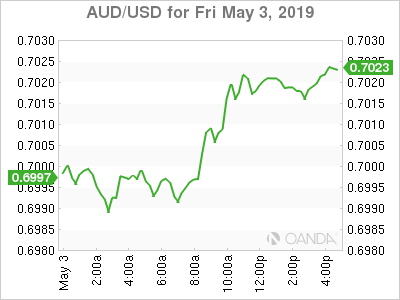

- AUD – RBA to switch to an easing bias

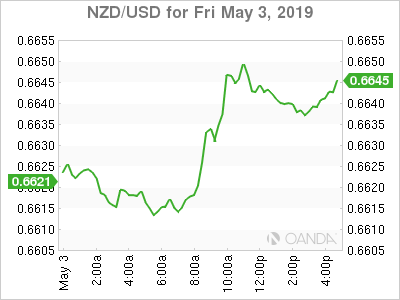

- RBNZ – First cut expected in over two years

- Mexico – Higher inflation to support bank’s tightening bias

- Oil – Demand arguments improve on strong US data

- Gold – Fifth weekly decline in six weeks

Earnings

Roughly 10% of the S&P 500 companies will report earnings in the last full week of earnings results. Technology earnings will come from SoftBank, Wirecard and JD.com. Toyota, Honda, BMW, and Subaru will wrap the automobile results. Big media names, such as Disney, Viacom and News Corp will report as well.

Heading into the final week, Financials and Technology stocks have outperformed this earnings season, delivering 3.3% and 2.5% returns respectively, while Energy, Materials and Real Estate disappointed with negative price returns.

AUD

The Reserve Bank of Australia (RBA) rate decision is a live event that will likely see rates kept steady with a shift to an easing bias. Current implied probabilities are pricing in a 38% chance the RBA will cut interest rates by 25 basis points on Tuesday. Positive signs for both the domestic and global outlook may have the RBA take a patient stance on delivering rate cuts.

The RBA could downgrade their forecasts following softer Australian and Chinese data over the past month. While inflation has softened, economic growth and building approvals saw steep declines, retails sales, consumer confidence and employment change all posted significant rebounds.

RBNZ

The Reserve Bank of New Zealand is expected to cut rates at its May 8th policy meeting as inflation and economic activity have fallen off a cliff in recent months. The labor market is showing signs of weakening and dismal wage growth might warrant two rate cuts this year by the RBNZ.

RBNZ Governor Adrian Orr switched to an easing bias in March, highlighted a mixed picture in April, and since then the data has been soft, probably solidifying a rate cut in the near future for the bank. The last time New Zealand cut rates was back in November 2016.

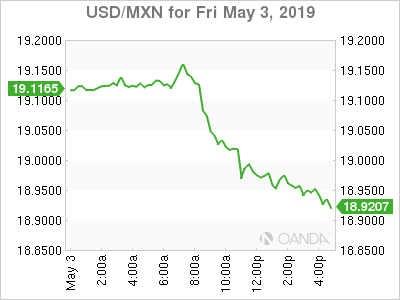

Mexican Peso

Mexican inflation is expected to remain high and Thursday’s reading could support the Mexico Central Bank (Banxico) bias for high interest rates. The central bank is in a tightening cycle that last saw a rate rise in December. While other economic indicators are showing a deceleration in growth and domestic demand, rising inflation will keep the bank on hold. Hotter inflation could help the peso target the lower boundaries of the 2019 range of 18.80 and 19.60.

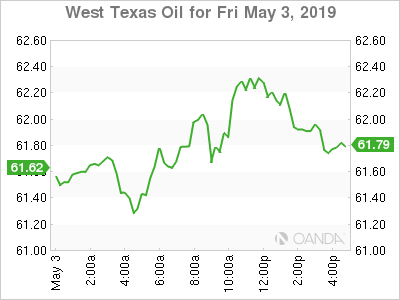

Oil

Oil prices got a boost from an impressive US nonfarm payroll employment report. The better than expected data should alleviate some falling demand concerns, but it will not likely shift the focus away from the supply side risks. West Texas Intermediate posted its second consecutive weekly decline after a string of 7 straight weeks of gains.

The Venezuelan situation remains volatile and will likely see opposition leader Guaido push for further protests and attempts to gain more military support. It appears he is still pretty far away from gaining momentum in ousting Maduro.

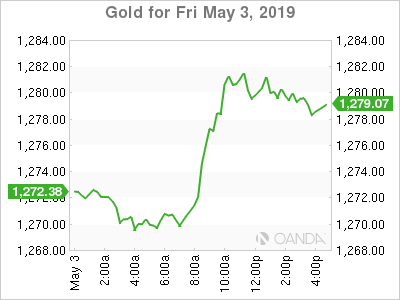

Gold

The precious metal remains vulnerable after delivering a fifth weekly loss in six weeks. The Friday rally was mainly attributed to the softer wage data that suggested that low inflation is transitory. Wages however are still close to cycle highs and we will not likely see this be the key catalyst to support a sustained rebound for gold prices.

Monday, May 6th

- 3:00am ET EUR Spain Unemployment Rate

- 4:30am ET EUR Eurozone Sentix Investor Confidence

- 9:30pm ET AUD Retail Sales and Trade Balance data

Tuesday, May 7th

- 12:30am ET AUD RBA Interest Rate Decision

- 2:00am ET EUR Germany Factory Orders m/m

- 3:30am ET GBP Halifax House Prices m/m

- 10:00pm ET NZD RBNZ Interest Rate Decision

- 11:00pm ET NZD Inflation Expectations

- 11:00PM ET NZD RBNZ Press Conference

Wednesday, May 8th

- CNY Trade Balance

- 2:00am ET EUR Germany Industrial Production m/m

- 2:00am ET NOK Norway Industrial Production data

- 7:00am ET USD MBA Mortgage Applications

- 10:30am ET DOE US Crude Oil Inventories

- 9:30pm ET CNY CPI y/y

Thursday, May 9th

- 8:30am ET USD PPI m/m

- 8:30am ET USD Trade Balance m/m

- 8:30am ET USD Initial Jobless Claims

- 9:00am ET MXN CPI m/m

- 9:30pm ET AUD RBA Monetary Policy Statement

Friday May 10th

- 2:00am ET EUR Germany Trade Balance

- 2:00am ET NOK Norway CPI m/m

- 2:45am ET EUR France production data

- 4:00am ET EUR Italy production data

- 4:30am ET GBP GDP q/q

- 4:30am ET GBP Trade and Production data

- 8:30am ET USD CPI m/m

- 8:30am ET CAD Net Change in Employment