- Chinese PMIs send conflicting signals. Metal prices and other indicators still support the case for a moderate recovery.

- Trump tweets that US and China will find another place for signing the phase one deal and says it will cover 60% of a total deal.

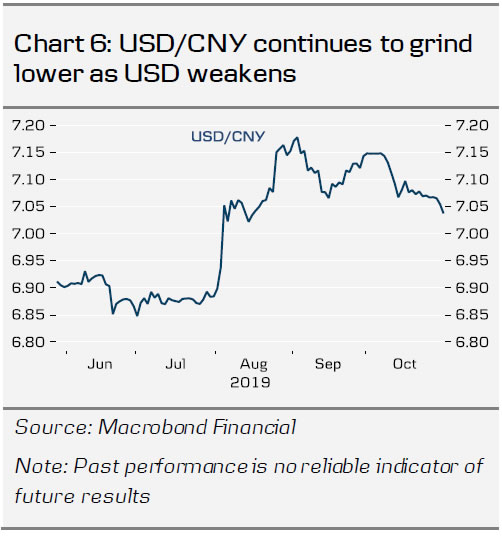

- USD/CNY keeps grinding lower, stocks set to push higher.

- Xi endorses blockchain and gives boost to Chinese tech stocks.

- No major news from the Fourth Plenum, which focused on improving the efficiency of institutions and of governance.

Chinese PMIs diverge, we still see moderate recovery

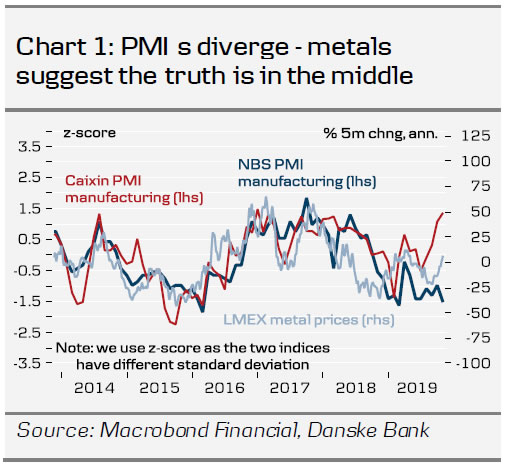

Chinese PMIs for October were all over the place this week. The official PMI manufacturing from NBS disappointed, while the private version from Caixin on Friday moved higher once again and reached the highest level in three years. It led to more confusion than clarity over where the Chinese economy is right now.

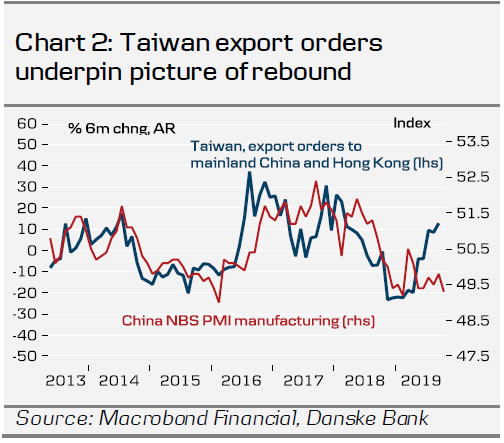

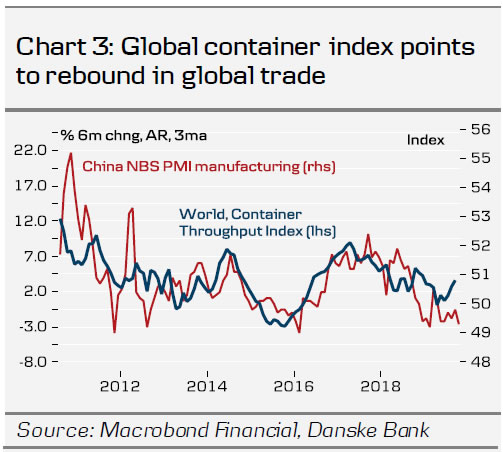

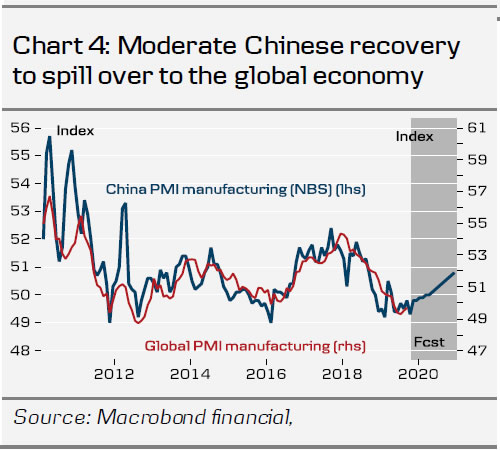

Comment : The divergence between the two indices is the biggest in 10 years and leaves a muddy picture of the state of the Chinese economy. However, we like to look at a broad range of indicators to gauge the state of the economy and here we see a picture of moderate improvement. Charts 2 and 3 shows a couple of examples of this and we could add electricity production and rail freight to indicators that suggest the worst is behind us. We expect to see a gradual recovery in China going into next year on the back of a decent amount of stimulus and the risks from the US-China trade war declining.

Trade talks on track for phase one deal

The US-China trade talks still seem to be on track for a phase one deal despite the surprise cancellation of the APEC summit in Chile in mid-November. The summit was supposed to be where the deal would be signed by US President Donald Trump and Chinese President Xi Jinping. Trump tweeted Thursday that “China and the USA are working on selecting a new site for signing of Phase One of Trade Agreement, about 60% of total deal ” and that a new location would be announced soon. Regarding the timing, the US Commerce Secretary Wilbur Ross said to Fox News that a date to sign a phase one deal would be around “the same timeframe as APEC had been scheduled for “.

A Bloomberg story this week caught a few headlines as it reported that Chinese officials had expressed doubts over the possibility of a big deal after the phase one deal was reached. It would require Trump to remove all extra tariffs on China again, which the officials were sceptical he would be willing to do.

Comment: It seems very likely that the US and China will strike a phase one deal soon. The question then becomes whether China and the US will be able to strike a bigger deal, which we know will be much more difficult. China has its red lines and apparently doubts whether Trump will agree to remove all extra tariffs as part of a deal. We continue to see a 50-50 probability of a big deal being struck in the first half of 2020. Trump seems very keen on such a deal and may have realised by now that China will not change its red lines. However, he needs a strong economy and happy farmers to win the US election and a trade deal could give him just that.

With trade tensions easing and signs of a moderate recovery in China, we see more upside for Chinese stocks in the coming quarters. Over the past week Xi Jinping added a boost to Chinese tech stocks by highlighting blockchain as a core technology, urging more efforts to accelerate the development of the technology.

With clouds lifting a bit from the economy, we also expect the recent decline in USD/CNY to continue over the next year. Our 12-month target is 7.0 (current rate is 7.04), but we increasingly see downside risks to this forecast.

Fourth Plenum emphasises efficiency of institutions

China this week held its fourth plenary session of the Central Committee of the Communist Party of China (CPC), where focus was on the efficiency of governance and the institutions. As usual, few things are revealed during the week and the communiqué at the end of the session on Thursday did not offer any big surprises. Instead it repeated areas already in China’s current plans but emphasised continued work on a more efficient functioning of institutions and governance. Rule of law, socialist democracy, scientific development and reform and innovation were highlighted and “upholding the centralized and unified leadership of the CPC” continued to be stressed.

Comment: The meetings did not provide anything concrete or put new things on the table. There had been some speculation around changes or additions to the top leadership but as is generally the case, the speculation exaggerates what is actually going on. If anything, the meetings leave the impression of a CPC that has laid out the plan for the coming decades and discusses how to make institutions and people more aligned and efficient in the execution of the strategy. The path laid out is one of continued opening-up and reform to improve the functioning of markets alongside a strong state sector in strategic areas and with CPC as the core leadership. Innovation and technology is at the forefront as well as a focus on a more green development path than during the first 40 years on the reform and opening-up path.

Other China news this week:

While trade talks go smoothly according to US officials, tensions run high in all other areas. Trump ‘s secretary of defence Mike Pompeo launched another verbal attack on Chinese leaders this week, saying that Beijing was focused on international domination and needed to be confronted. He added “It is no longer realistic to ignore the fundamental differences between our two systems, and the impact that … the differences in those systems have on American national security.” The speech triggered a sharp response from China.

China strengthens Europe ties with appointment of first special envoy.

5G networks are now a reality in China, with the country ‘s huge telecom companies offering access at USD18 per month.