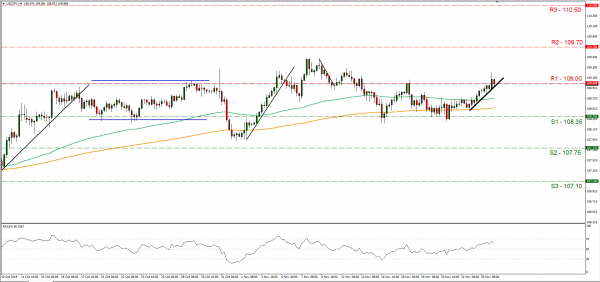

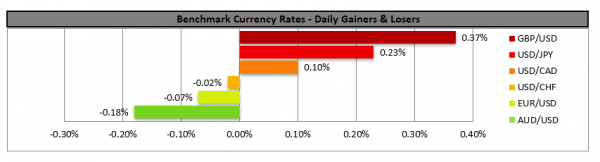

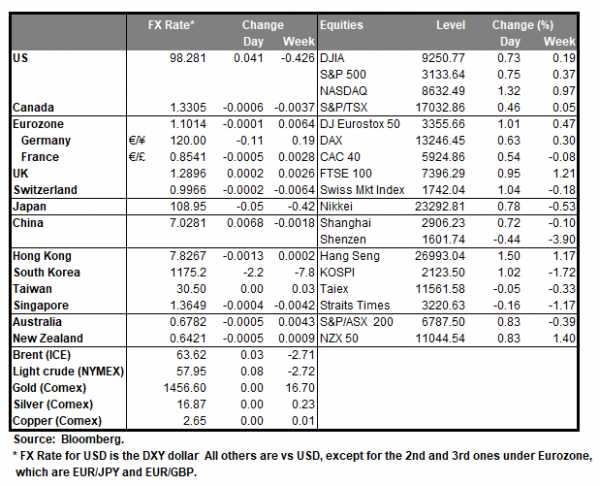

A phone call between top negotiators in Beijing and Washington, helped to lift the USD yesterday against the Yen and other of its counterparts, according to media. Reports state that Chinese Vice Premier Liu He, US Trade representative Robert Lighthitzer and USD Treasury Secretary Mnuchin, discussed various issues regarding a possible ‘phase 1’ deal, and agreed to maintain communication. It should be noted that Chinese state media, yesterday also reported that the two sides were very close to a partial deal. Analysts tend to note the positive signals from both sides and despite agreeing with their notes, we note that no substantial progress was made yet. Also please note the slow market reaction to the news, evident that that more headlines would be required to convince market participants. Should we see further positive headlines about the prospect of a ‘phase 1’ deal, we could see the safe haven Yen retreating further while the USD and commodity currencies gain. USD/JPY rose yesterday and during today’s Asian session for a short period broke the 109.00 (R1) resistance line, before retreating slightly below it. We maintain a bullish outlook for the pair and for it to change we would require a clear breaking of the upward trendline formed since the 22nd of the month. Should the pair find fresh buying orders along its path, we could see it breaking the 109.00 (R1) resistance line and aim for the 109.70 (R2) resistance level. Should the pair come under the selling interest of the market, we could see it breaking the prementioned upward trendline and aim if not break the 108.35 (S1) support line.

…while the Kiwi thwarts the Aussie…

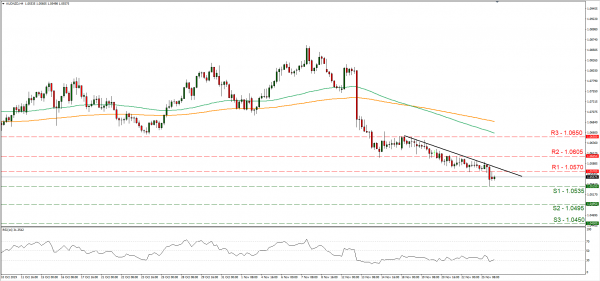

The Kiwi gained some further ground against the Aussie yesterday, as New Zealand’s retail sales growth rate for Q3 outperformed expectations. The rate’s substantial acceleration caused the pair to slip by 35 pips upon release and could be providing a boost to New Zealand’s Reserve Bank. Analysts tend to note that the differentials in the outlooks of the RBA and RBNZ seem to guide the pair, as RBA’s dovish stance seems to weigh on the Aussie. RBA deputy Governor De Belle, warned yesterday that wage growth seems to be trapped in a 2-3% range and unemployment would need to drop further. Arguments about a possible easing of RBA’s policy, either through a possible rate cut or quantitative easing, increased over the past few days. We tend to place special attention on the release of New Zealand’s trade data for October, however the main event could be RBA Governor Lowe’s speech later this morning, as it is to gather attention for Aussie traders. AUD/NZD dropped yesterday and just before today’s Asian session, clearly broke the 1.0570 (R1) support line now turned to resistance, dropping as low as to test the 1.0535 (S1) support level. We maintain a bearish outlook for the pair, as the downward trendline incepted since the 18th of the month remains intact. Should the bears maintain control over the pair we could see it breaking the 1.0535 (S1) support line and aim for the 1.0495 (S2) support level. On the flip side should the bulls dictate the pair’s direction, we could see the pair breaking the 1.0570 (R1) resistance line and aim for the 1.0605 (R2) resistance hurdle which served the pair faithfully on the 21st of the month.

Other economic highlights today and early tomorrow

Today, during the European session, we get from Germany the more forward-looking GfK consumer confidence indicator for December. In the American session we note the release from the US of the advance goods trade balance for October, the consumer confidence for November, the new home sales figure for October and the API weekly crude oil inventories figure. Just before the start of tomorrow’s Asian session, we get New Zealand’s trade data for October. As for speakers please note that ECB’s De Guindos, ECB’s Coeure, RBA’s Philip Lowe, ECB’s Lane, Fed’s Brainard and BoJ’s Makoto speak. Also Kiwi traders could be greatly interested in the release of RBNZ’s financial stability report, followed by a press conference.

Support: 108.35 (S1), 107.75 (S2), 107.10 (S3)

Resistance: 109.00 (R1), 109.70 (R2), 110.50 (R3)

Support: 1.0535 (S1), 1.0495 (S2), 1.0450 (S3)

Resistance: 1.0570 (R1), 1.0605 (R2), 1.0650 (R3)