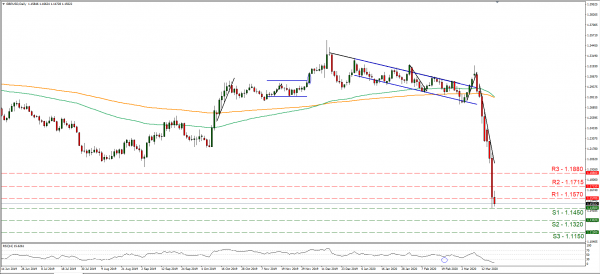

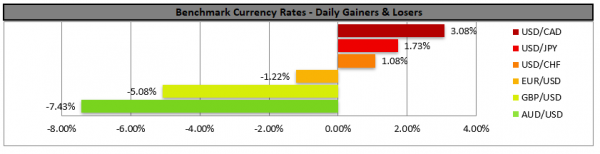

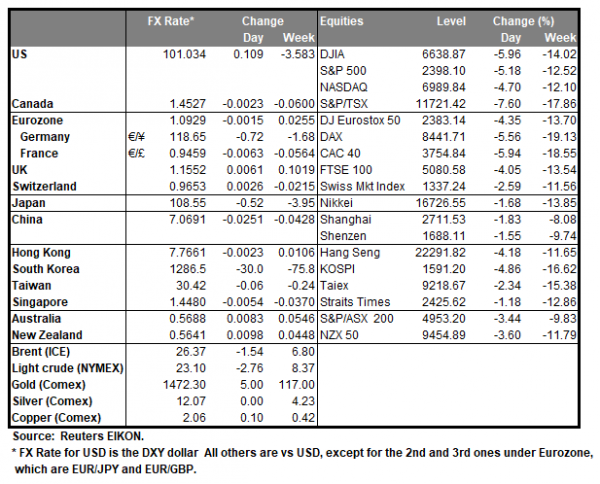

The pound crashed to a record 35 year low against the USD, practically equalling levels reached at the night of the Brexit referendum, according to media as the selloff caused by the coronavirus outbreak intensified, fuelled by insecurity. Also, the drop was fuelled by a soaring USD, which has further gained ground against its major counterparts as positions were liquidated by funds and investors in order to keep their money in dollars, in face of the high uncertainty according to analysts. It should be noted that the UK joined other countries in closing down schools, colleges and nurseries from Friday on, according to the BBC. The UK government seems to be changing course from containment to delaying the disease by closing down schools, limiting large gatherings, encouraging home working along with other measures. At the same time London braces for a possible lockdown, a scenario which UK PM Johnson did not deny in a relevant question but answered that all scenarios are under consideration. Confirmed cases of coronavirus infections in the UK have jumped to a number of 2626, a rise of almost 35% since Tuesday, while the number of deaths reached 104 and undetected cases may be much more with estimations ranging between 35k and 50k, also according to the BBC. We maintain a bearish outlook, as mentioned on Tuesday’s report for the pound, as fundamentals still indicate a wide uncertainty in the UK. GBP USD was in a freefall yesterday breaking all support levels and moving to mark a 35 year low. We maintain a bearish outlook for the pair albeit some correction could be in the cards for the pair and it should be mentioned that the RSI indicator in the daily chart is clearly below the reading of 30 and despite confirming the strength of the bears, at the same time could imply an overcrowded short position for the pair. Should the bears maintain control over the pair, we could see cable breaking the 1.1450 (S1) support line and aim for the 1.1320 (S2) support level if not lower. Should the bulls take over, we could see the pair breaking the 1.1570 (R1) resistance line and aim for the 1.1715 (R2) resistance line.

AUD also crashes to multi year lows

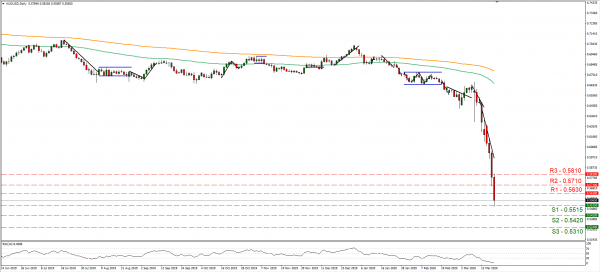

The Aussie tumbled to multi year lows against the USD, yesterday and during the Asian session today. At the same time the strengthening of the USD intensified the situation and magnified the drop of the pair. RBA continued to pump cash into the banking system of Australia by injecting a record 12.7 billion AUD today, aiming to ease the liquidity constraints in a stressed bond market. It should be noted that the bank proceeded with an emergency cut of its interest rate by 25 basis points, lowering them to 0.25%, from prior 0.50%, reaching historic lows, while the market seems to expect further cuts to come. Analysts tend to note that the bond market is dysfunctional, and that typical bond market moves in a risk off environment seem to be absent. It is characteristic that even the solid employment data with the unemployment rate dropping and the employment change figure outperforming market expectations failed support the battered Aussie. AUD/USD also crashed yesterday, breaking all support levels. We maintain a bearish outlook for the pair albeit a reversal could be possible as the RSI indicator of the daily chart could also imply a possibly overcrowded short position for the pair. Should the pair remain under the selling interest of the market we could see it breaking the 0.5515 (S1) support line and aim for the 0.5420 (S2) support level. Should the pair’s long positions be favored by the market we could see it breaking the 0.5630 (R1) resistance line and aim for the 0.5710 (R2) resistance level.

Other economic highlights today and early tomorrow

Today during the European session, we get SNB’s interest rate decision, while in the American session we get the US initial jobless claims figure as well as the Philly Fed business index for March.

Support: 1.1450 (S1), 1.1320 (S2), 1.1150 (S3)

Resistance: 1.1570 (R1), 1.1715 (R2), 1.1880 (R3)

Support: 0.5515 (S1), 0.5420 (S2), 0.5310 (S3)

Resistance: 0.5630 (R1), 0.5710 (R2), 0.5810 (R3)