The Australian dollar declined against major peers as the market reacted to the latest Australian jobs numbers. According to the Bureau of Statistics, the country’s unemployment rate rose from 6.8% to 6.9% in September while the participation rate remained unchanged at 64.8%. Further, the country lost more than 29,000 jobs during the month after it added more than 111k in the previous month. The high unemployment rate and job losses were attributed to extreme lockdown measures taken in Victoria. The currency also reacted to a statement by Governor Philip Lowe, who said that the bank was ready for more easing and QE.

The euro was little changed as the market reacted to rising Covid-19 cases in the region. Some of the most affected countries are Spain, Belgium, and France. In a statement yesterday, Emmanuel Macron said that France would impose a strict 9 pm to 6 am curfew in Paris and other eight big cities as he tried to slow the spread. Other European countries are said to be considering similar measures. Worse, analysts warn that the number of cases will continue rising as the winter season arrives. Later today, the euro will react to the Italian industrial sales numbers.

The US dollar was little changed ahead of key economic data. Later today, we will receive last week’s jobless claims data. Analysts expect that the number of people who signed for unemployment benefits for the first time fell to 840k to 825k. They expect the data to show that those still taking jobless claims to fall from 10.9 million to 10.7 million. We will also receive the manufacturing index from New York and Philadelphia. Other important numbers from the US will be the export and import price index and crude oil inventories.

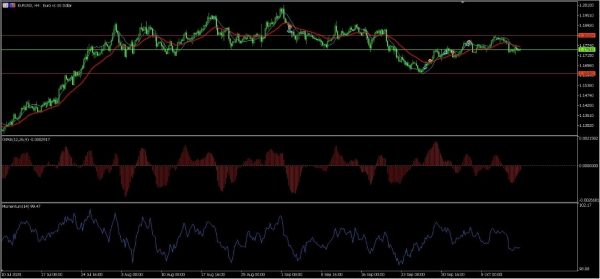

EUR/USD

The EUR/USD price is trading at an important level of 1.1750. On the four-hour chart, the price is consolidating along the short and medium-term moving averages. The moving average of oscillator remains below the neutral line while the momentum indicator has continued to fall. The pair is also forming what seems like a bearish flag pattern. Therefore, although the pair will likely remain in the current range, there is a possibility that it will break out lower eventually.

GBP/USD

The GBP/USD bounced back after it emerged that the UK and EU will continue talking even after today’s unofficial deadline. The pair formed a hammer pattern with the lower side being at 1.2860 and then rose to a high of 1.3015. On the four-hour chart, the price moved back above the ascending trendline shown in pink. It also moved back above the 25-day moving average while the average directional index is at 31. The pair is likely to continue rising as bulls aim for the next level at 1.3050.

AUD/USD

The four-hour chart shows that the AUD/USD price fell to a low of 0.7125, which is the lowest it has been since October 8. As it fell, it moved below the rising trendline. It also moved below the 15-day and 25-day moving averages while the RSI has started moving lower. It is between the 50% and 38.2% Fibonacci retracement level. Therefore, the price is likely to continue falling as bears attempt to move below 0.7100.