With less than two weeks to go until the US election, markets are on red alert as opinion polls in key battleground states have tightened. In the meantime, there are three central bank meetings and a ton of data to keep things exciting. The ECB could steal the show by opening the door for more stimulus, to negate the risk of a double-dip recession as the virus rampages through Europe. The central banks of Canada and Japan will meet too, third-quarter GDP is out in America, the Brexit saga continues, and most of the tech world reports earnings.

Dollar focused on stimulus, stocks on election

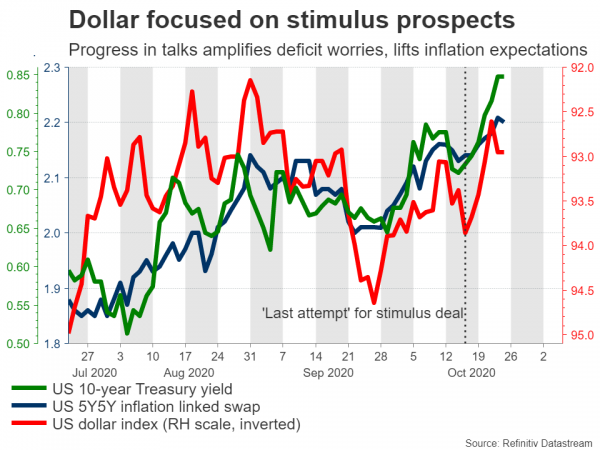

The FX and bond markets were on the same page this week, both pricing in higher chances of a US stimulus deal, but the stock market did not play along. Signs that the negotiations are making progress and that a large relief package could pass right after the election saw investors dump the dollar and Treasuries, on expectations that this will leave a gaping hole in public finances and lift inflation a little.

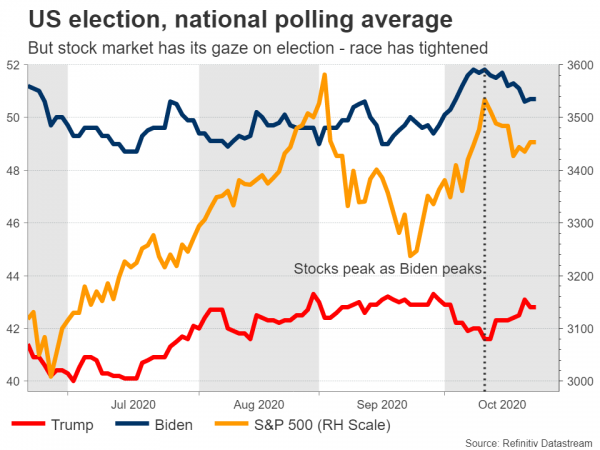

Yet, the enthusiasm wasn’t enough to boost the stock market, which seems petrified by election polls. Biden is still leading Trump by a comfortable margin, but the gap is narrowing, especially in key battleground states like Florida and Pennsylvania. This raises the risk of a contested election that ends up disputed in the courts, and more importantly, makes a divided Congress more likely. That could drastically reduce the odds of any future aid packages passing next year, if anything goes wrong.

Essentially, the dollar is focused on the near term and is signaling that a stimulus deal will come, but Wall Street is anxious about the longer-term risk of continued political deadlock. Indeed, the correlation between stocks and election polls has strengthened, with the peak in the S&P 500 this month coming right as Biden peaked in polling.

Correlation doesn’t imply causation, but this is too striking to ignore. Investors have not forgotten the shock of 2016, so the tiniest hint that Trump could make a comeback is taken very seriously this time.

In this light, the most crucial variable over the next few days may be incoming opinion polls, as investors tend to attach greater weight to surveys conducted just before Election Day. The joker of course is how the stimulus talks play out.

ECB likely to pave way for more easing

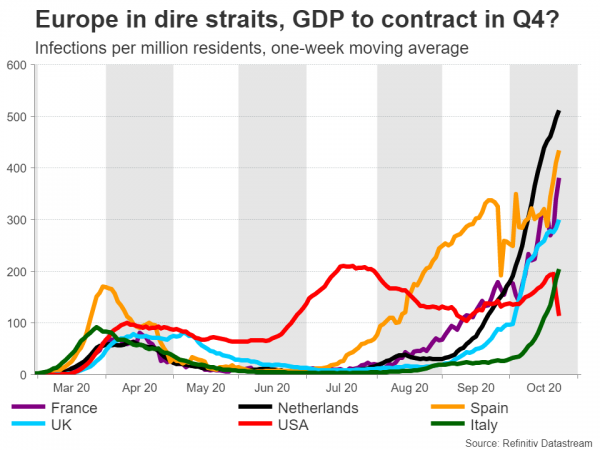

In Europe, the second wave of coronavirus is running rampant, forcing most governments to implement partial lockdowns or outright curfews. Many businesses are therefore operating at reduced capacity and consumers have turned defensive, with Google data confirming a sharp drop in mobility across the region.

The European Central Bank will meet on Thursday and while no immediate action is expected, there’s a strong likelihood that policymakers will adopt a more cautious tone, opening the door for new measures in December. The bloc’s core inflation rate hit a record low in September, well before infections skyrocketed, and the latest PMIs suggest the recovery is running on fumes.

And yet, the euro has not reacted much so far to the risk that growth turns negative again in Q4, most likely because US stimulus speculation has been keeping the dollar under even greater pressure. That said, it may be only a matter of time until the euro has a ‘reality check’ moment, the catalyst for which could be the ECB.

It’s a huge week on the data front too. On Friday, we get the first estimate of euro area GDP for Q3 and preliminary inflation data for October. Normally, markets would focus more on the GDP numbers, but this time may be different as the Q3 growth data could already be considered outdated given how rapidly infections have surged lately.

BoC: Steady as she goes

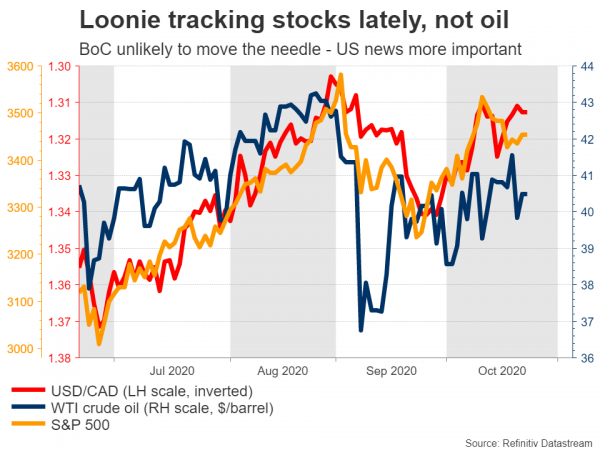

Over in Canada, the local central bank meets on Wednesday. The economy has admittedly improved since the previous meeting, with core inflation accelerating, retail sales picking up, and the unemployment rate falling substantially. Covid infections have risen a little but remain under control.

These suggest the BoC is unlikely to act or even change its tone. Markets agree, as overnight index swaps suggest virtually no chance of a rate cut in the coming year. A neutral message by the BoC could give the loonie a boost, though any reaction is likely to be minor.

Instead, what will truly drive the Canadian currency is how stock markets perform. The loonie has a very high correlation with the S&P 500 lately, and funnily enough, very little correlation to oil prices. Hence, the US election and stimulus talks may be the most crucial elements.

BoJ: Yen to be driven by risk sentiment

In the land of the rising sun, the Bank of Japan will decide early on Thursday and media reports suggest a downgrade of economic forecasts is coming. However, the same reports indicate this will not trigger an immediate policy response, and rightly so, as the BoJ has almost nothing left in its ammunition box.

As for the yen, neither BoJ decisions nor economic data have any impact nowadays. Instead, the safe-haven currency may respond more to how global risk sentiment evolves, and particularly whether infections in Europe continue to soar. If so, euro/yen may be headed lower.

US GDP and a barrage of earnings in sight

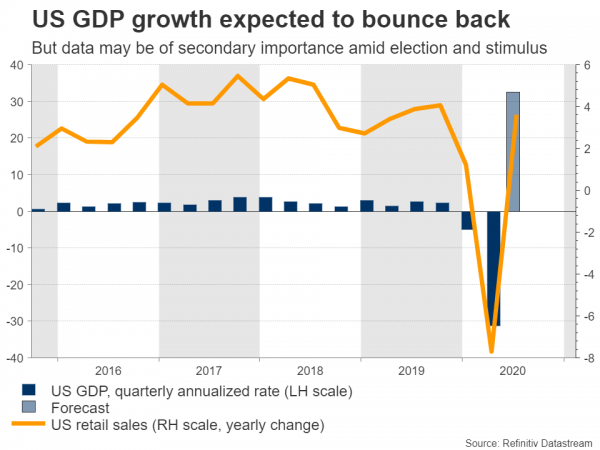

In America, besides the stimulus talks and election polls, there’s also the first estimate of economic growth for Q3 coming up on Thursday. The forecast is for a rebound of 32.5% in annualized terms, which although impressive, still wouldn’t make up for the 31.4% plunge in Q2.

The good news is that the Atlanta Fed GDPNow model projects an even bigger rebound of 35.3%, so the risks may be tilted towards an upside surprise. Durable goods orders for September are also due Tuesday, while personal income and spending, alongside the core PCE price index for September are all out Friday.

The question is whether any of this will truly matter for markets, to which the answer is probably not. Investors have bigger fish to fry, and politics will likely overshadow economics for now.

In equities, the earnings season fires up with the likes of Apple, Amazon, Microsoft, Google, Facebook, and many others releasing their quarterly results. Given how much weight these tech titans have in the S&P 500, their results could matter not just for their own shares but for the broader market as well.

Finally, Australia’s inflation stats for Q3 are out Wednesday and could be vital ahead of the RBA’s November 3 meeting, where expectations for a rate cut are flying high.