U.S. Review

More Evidence of Economic Recovery

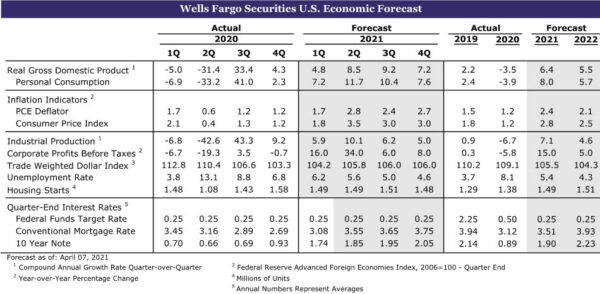

- Data released this week continue to show that the economic recovery is gaining momentum. The much anticipated consumer boom has arrived, helped by an influx of stimulus in March, and industrial production rebounded from its partly weather-induced February decline. But supply chain constraints are standing in the way of a more robust rebound in the manufacturing sector and are adding to inflationary pressures. The pickup in consumer prices for March suggests inflation is already heating up.

Global Review

Asian Economies Hit by COVID

- COVID cases in India have skyrocketed, forcing local governments to impose restrictions on major cities across the country. New restrictions introduce downside risks to our India GDP forecasts and will likely result in downward revisions to our 2021 growth forecast in the coming weeks.

- China reported Q1 GDP this week, with data revealing the Chinese economy was affected by an outbreak of COVID early in the year. Restrictions on mobility around Beijing placed pressure on PMIs and other indicators over the first few months of the year, which eventually filtered down to the real economy. These lockdowns resulted in Q1 growth rising over 18% on a year-over-year basis; however, data is heavily skewed by base effects. Quarter-over-quarter data reveal a much sharper slowdown than markets expected.

Interest Rate Watch

Will the ECB Make Any Policy Changes Next Week?

- The Governing Council of the European Central Bank holds its next policy meeting on April 22, and one could make a convincing case that it will ease its monetary policy stance further.

Topic of the Week

The Share of First-Time Homebuyers Improved in 2020

- Multiple rounds of fiscal stimulus have supported household income, which, alongside historically-low mortgage rates, is helping offset higher home prices for first-time buyers.

U.S. Review

More Evidence of Economic Recovery

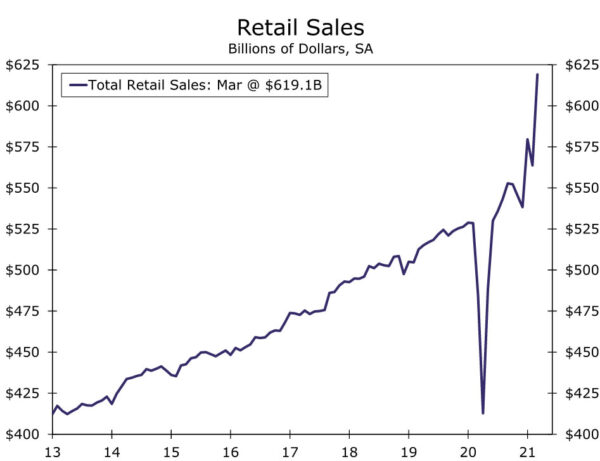

Data released this week continue to show that the economic recovery has gained momentum in March. The much anticipated consumer boom has arrived. An influx of cash from the latest round of stimulus and warmer weather after harsh arctic temperatures across the country in February led to a blockbuster month for retailers in March. Total retail sales surged 9.8% during the month, a gain exceeded only by the surge tied to the reopening of the economy in May of last year after the lockdowns. The gain pushed the total level of sales a stunning 17% higher than it was before the pandemic. Without exception, every store type posted better sales in March, and the level of sales reported at every type of retailer except food services (restaurants) is now between 2% and a staggering 44% ahead of where they were prior to the pandemic.

Retail sales were certainly boosted by the latest round of direct checks, which were more than double the amount households received from the previous round of checks in January. This presents the natural question of how sustainable this consumer recovery is. By our estimates, nearly 80% of the latest round of checks were sent to households by the end of March, but payments did not start going out till the second half of the month. This suggests that if sales are not due for payback in April, we may see some payback in May. Although some households are set to get another influx of cash from the temporary expansion of the Child Tax Credit sometime in the second half of the year, overall stimulus is fading. That said, consumers are still sitting on a pile of accumulated savings. Excess savings combined with the expected reopening of the service economy this summer, supports our forecast for a consumer spending boom this year that will rival any in living memory for most Americans.

Warmer weather in March also helped spur a rebound in industrial production from February’s partly weather-induced decline, but manufacturing still faces its challenges. Supply chain constraints are standing in the way of a more robust rebound in the sector. This is most evident in the auto manufacturing industry where production has been pummeled by the global semiconductor shortage. But constraints extend throughout the manufacturing sector as producers struggle to get the inputs they need.

We expect current supply challenges to persist over the next few months, but to eventually ease. Staffing challenges appear to be easing up with manufacturers having hired the most workers since September in March (+53K). The latest Beige Book from the Federal Reserve also noted absenteeism due to COVID was down. Separately the Department of Labor reported, just 576K workers filed an initial claim for unemployment benefits last week, nearly 200K fewer than a week prior. Although claims remain elevated, this marked the lowest level of workers claiming benefits since March of last year and is consistent with other indications that the recovery in the labor market is progressing. Nevertheless, supply chain disruptions of physical inputs remain widespread, which will limit the pace of production, and could constrain sales, adding to inflation pressures in the near term.

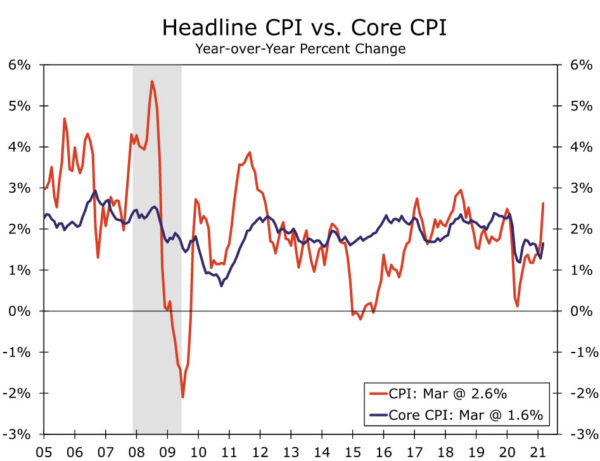

There are already signs inflation is heating up. With the struggle across the supply chain to keep up with the wave of demand, a wide range of businesses are experiencing something they have not seen in more than a decade: pricing power.

The consumer price index (CPI) rose 0.6% in March, which pushed the year-over-year rate to 2.6%, helped by a low base comparison after last year’s shutdowns. Easy base comparisons will continue over the next two months, but inflation is picking up now. Over the past three months, the CPI has increased at an annualized rate of 5.0%. Core prices are also firming. Excluding food and energy, prices rose 0.3%, as a pickup in recreation and travel-related services prices signaled the services economy is beginning to reawaken.

As we have said before, inflation is a process. Whether near-term price hikes keep inflation higher even after the initial itch is scratched for services, like travel, and supply chains adjust will depend on inflation expectations. The Fed has made clear that it wants to see a sustainable pickup in inflation rather than a temporary increase, and that will keep the Fed in wait-and-see mode for months to come as it sees if rising inflation proves persistent.

U.S. Outlook

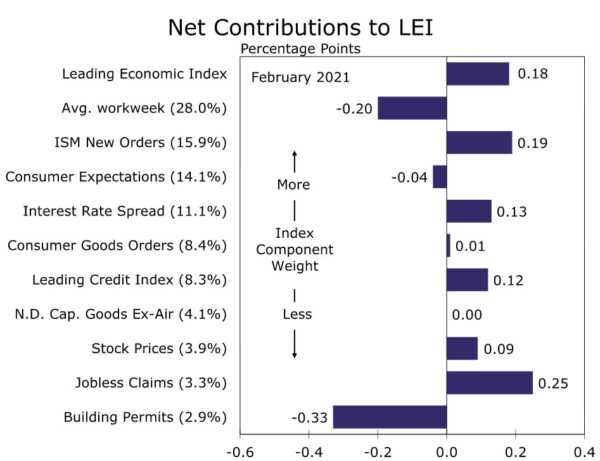

Leading Index • Thursday

The Leading Economic Index (LEI) rose 0.2% during February. The modest gain occurred alongside harsh winter storms that disrupted economic activity throughout much of the central United States. Looking ahead, the LEI should see a more robust gain in March. Retail sales surged almost 10% during the month, which points to a rebound in the consumer expectations component as well as a solid rise in the consumer goods orders. Jobless claims continued to drift lower in March, while a solid rise in average weekly hours worked points to a similar gain in the average workweek component. What’s more, ISM new orders beat expectations and jumped to 68 during the month, the highest since 2004. In short, the March LEI should takeoff alongside the ramp-up in economic activity that appears to already be under way.

- Previous: 0.2%

- Wells Fargo: 1.2%

- Consensus: 0.6% (Month-over-Month)

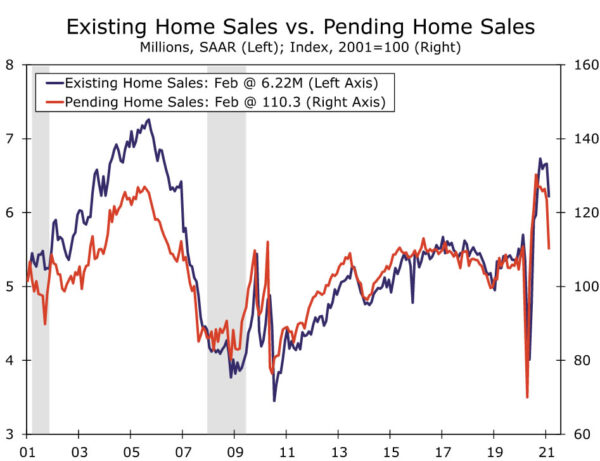

Existing Home Sales • Thursday

Existing home sales fell 6.6% in February. Even with a pullback in sales, existing home sales remain exceptionally strong as mortgage rates remain low and buyers seek more space. February’s 6.22 million-unit pace is 9.1% above its year-ago rate. We expect resales declined again in March. February’s existing home sales reflect contracts signed in December and January. Thus, the negative impact of February’s severe winter weather may be apparent in the March sales figures. More structurally, the number of homes for sale continues to shrink, which is also starting to constrain sales. Pending homes, which lead purchase contracts by one to two months, dropped 10.6% in February. The steep decline suggests existing sales may soften further in coming months. Furthermore, mortgage applications for purchase sunk for most in February, which indicates contract closings likely stepped back in March.

- Previous: 6.22 million

- Wells Fargo: 6.08 million

- Consensus: 6.20 million (SAAR)

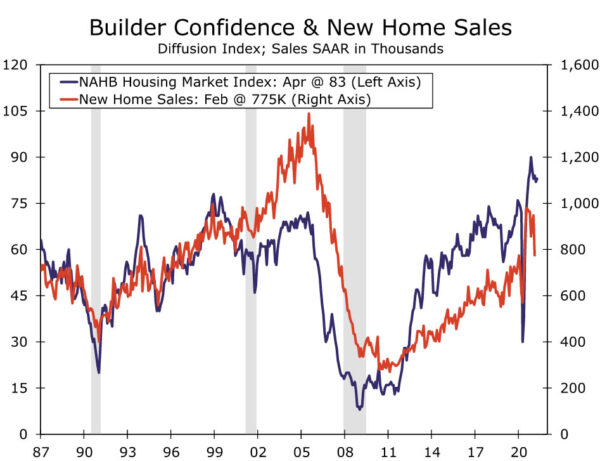

New Home Sales • Friday

New home sales were not sheltered from February’s arctic blast. Sales plummeted 18.2% during the month to a 775,000-unit pace. Other factors, namely supply-chain issues surrounding the availability and prices of lumber and other building materials, also likely played a role in the sharp decline. Even with February’s drop, new homes through the first two months of 2021 remain 16%above the same period last year. What’s more, new home sales appear poised for a quick rebound. Sales closely track the NAHB/Wells Fargo Homebuilder Index, which has bounced around in recent months, but remains near a historically high level. Digging deeper, the prospective buyer traffic component has strengthened over the past few months, which suggests buyers are not yet fazed by the recent increase in mortgage rates or higher home prices. Overall, we expect a robust gain in new home sales during March.

- Previous: 775,000

- Wells Fargo: 893,000

- Consensus: 875,000 (SAAR)

International Review

Indian Economy Under Pressure

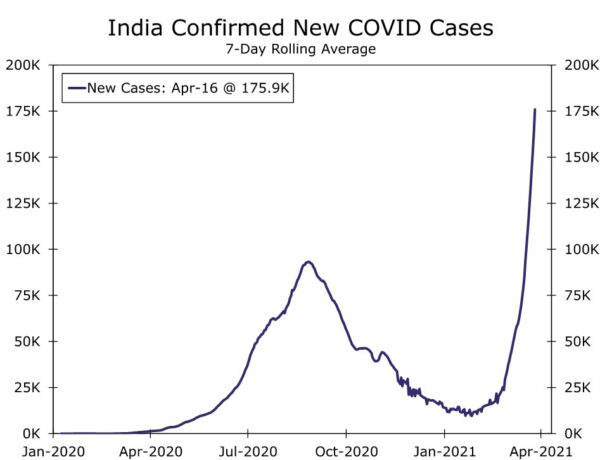

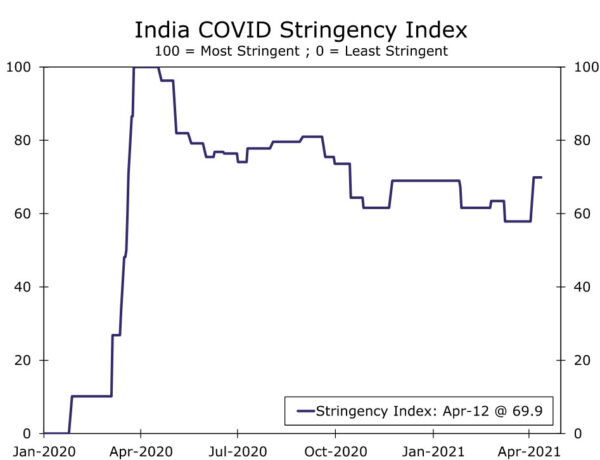

Since September of last year, COVID cases across India had receded quite sharply. On average, confirmed cases fell from a peak of around 100,000 per day down to about 10,000 by early 2021. However, over the last few weeks cases are on the rise again and have the ability to potentially disrupt India’s economic recovery. This week, confirmed cases hit a record high as 176,000 people per day on average caught the virus. As a result, local governments have imposed new restrictions across major states and cities, including Mumbai and New Delhi. In Mumbai, businesses have been ordered to close for at least two weeks and public gatherings have been restricted, and in some cases, outright banned. Local media have also reported an exodus from major cities toward more rural towns and villages, while hospitals nationwide are at capacity.

This second wave of infections is likely to have consequences for India’s economy going forward, particularly in the short term. Business closures and the migration out of major business hubs will weigh on economic activity in Q2 and possibly persist into Q3. In addition, India’s vaccination campaign has been slow and is struggling to gather momentum despite a large amount of doses pre-ordered earlier in the pandemic. As of now, we forecast India’s economy to expand over 11% this year; however, the new wave of COVID cases and subsequent restrictions introduces downside risks to our GDP forecast. In the coming weeks, it is likely we will revise our growth forecast lower to reflect the high likelihood of a slowdown in economic activity. As far as financial markets, Indian asset prices as well as the rupee have come under pressure over the last few weeks. Should the outlook for India’s economy continue to worsen and confidence deteriorate, we could also make revisions to our forecast for the Indian rupee to reflect an elevated likelihood of a sharper depreciation in the Indian currency.

China Q1 GDP Shows Slowdown

Without question, China has been an economic outperformer during the COVID crisis. Authorities were quick to implement lockdown restrictions and strict testing protocols in an effort to contain the spread of the virus. These measures resulted in China being the only major economy to record positive growth in 2020. For the most part, this strong momentum has carried forward into 2021; however, an early outbreak of COVID cases early in the year weighed on activity and mobility. Over the first few months of the year, we saw PMIs trend lower and other indicators show modest deceleration. This slowdown eventually had an impact on Q1 GDP as data missed expectations. On a year-over-year basis, China’s economy expanded 18.3%, below our forecast of around 19%. While year-over-year data looks quite impressive, low base effects from early 2020 play a large role in one of the strongest growth rates in recent memory. Base effects make the interpretation of the year-over-year data difficult, and in our view, quarter-over-quarter data is more telling in regard to the health of the Chinese economy. On a quarter-over-quarter basis, China’s economy expanded only 0.6%, well below consensus expectations for growth of 1.4%. Quarterly data indeed reveal the COVID outbreak and restrictions placed downward pressure on the economy in the first quarter of this year.

However, we continue to believe China will be an engine for global growth this year. As of now, we forecast China’s economy will grow about 9% this year, well above the government’s stated target of 6%. While the underperformance in Q1 relative to our forecasts likely means our growth forecast will be revised lower in the coming weeks, we do not feel the need to sound any alarms on the prospects for China’s economy. Going forward, we continue to expect the PBoC to tighten policy and defend against potential asset bubbles and deleverage the economy. Tighter policy could create some economic headwinds toward the end of the year, possibly in early 2022, but we continue to believe China’s economy will sustain its outperformance for the time being.

International Outlook

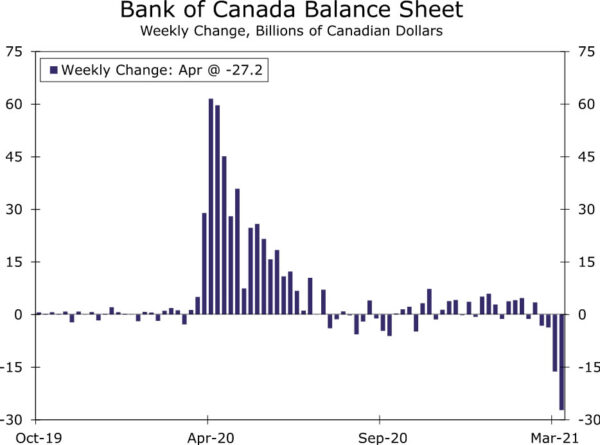

Bank of Canada • Wednesday

As the economic outlook for Canada’s economy brightens, the Bank of Canada (BoC) has begun to offer signals and guidance about potential adjustments to its monetary policy path. Some of these adjustments have already occurred and are clearly evident in the BoC’s actions. For example, the size of the balance sheet has fallen perceptibly over the past few weeks. There have also been some noticeable changes in the composition of the BoC balance sheet. Holdings of Canadian government bonds continue to grow; however, Treasury bill holdings and total outstanding repo transactions are components of the balance sheet that have fallen. In addition, the BoC has discontinued some emergency liquidity programs and started to highlight the possibility of tapering asset purchases even further. To that point, we believe the BoC will announce further tapering of its Canadian government bond purchases at its April 21 meeting, reducing its purchases to at least C$3 billion per week, from the current pace of at least C$4 billion per week. While we do not expect any changes to policy rates next week, we do feel the BoC will look to lift interest rates in the second half of 2022.

- Previous: 0.25%

- Wells Fargo: 0.25%

- Consensus: 0.25%

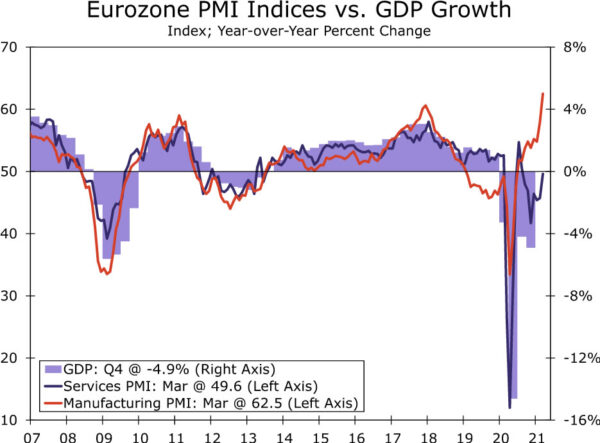

Eurozone PMIs • Friday

Despite renewed lockdowns and an underwhelming vaccine rollout, the Eurozone economy has been somewhat resilient. The manufacturing and services PMIs are perhaps the best evidence to highlight this resilience. In March, the manufacturing PMI reached a historical high, while the services PMI has been slowly rising over the last few months. Next week, April PMI data will be released which should give some additional insight into the underlying health of the Eurozone economy as we head into Q2. Given the renewed surge in COVID cases and restrictions across the major Eurozone economies, it would not be terribly surprising if we saw PMI data soften in April. Other measures of activity and sentiment have started to deteriorate, most notably the April ZEW survey which tracks economic expectations. The ZEW survey suggests a renewed downturn in the Eurozone economy is somewhat likely. However, the PMI indices may provide a clearer picture next week as they track economic growth quite closely in the Eurozone. We expect Q1 GDP to contract; however, the PMI data release next week could give an early indication of how the economy could perform in Q2 as well.

- Previous: Manufacturing 62.5 ; Services 49.6

- Consensus: Manufacturing 62.0 ; Services 49.1

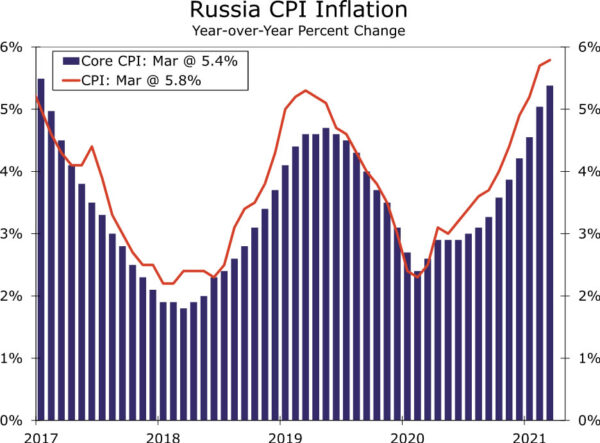

Central Bank of Russia • Friday

With oil prices continuing to push higher and the ruble under pressure amid sanctions risk, CPI inflation in Russia has moved sharply higher. In fact, inflation currently sits at 5.8% year-over-year, well above the Central Bank of Russia’s target for inflation “close to 4%.” As inflation trended higher, the central bank was forced to lift its key policy rate 25 bps at its last meeting, and in our view, additional monetary tightening is very likely next week. In an effort to bring inflation closer to its target, the central bank is likely to raise policy rates at least another 25 bps next week. In addition, the currency remains volatile as the Biden administration considers further sanctions. Tighter monetary policy can also act as a buffer against potential currency weakness in the event harsh sanctions are imposed in the near future. Central banks across the emerging markets have started aggressive monetary tightening campaigns. As the year goes on, we expect the Central Bank of Russia to be on the forefront of emerging market central banks looking to tighten policy, possibly raising rates 100 bps this year.

- Previous: 4.50%

- Consensus: 4.75%

Interest Rate Watch

Will the ECB Make Any Policy Changes Next Week?

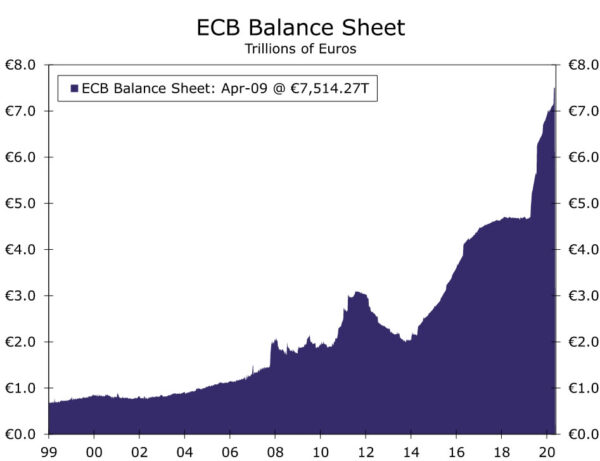

The Governing Council of the European Central Bank holds its next policy meeting on April 22, and one could make a convincing case that it will ease its monetary policy stance further. For starters, the level of real GDP in the Eurozone in Q4-2020 (latest available data) remained nearly 5% below its pre-pandemic peak, and we estimate that output fell another 1% or so (not annualized) in the first quarter. The unemployment rate in February was 8.3%, a full percentage point above its pre-pandemic low and only modestly below the 8.7% rate that was registered in August. The year-over-year rate of CPI inflation in March was only 1.3%, well below the ECB’s target of “below, but close to, 2%.” The rollout of COVID vaccines has gone agonizingly slowly in the euro area, and the French economy is in a state of lockdown again.

That said, we do not look for the Governing Council to make any major changes to its policy stance at its upcoming meeting. Although the economy undoubtedly contracted in the first quarter, the outlook is not quite so bleak. The manufacturing PMI rose in March to its highest level since the series began in 1997. The service sector PMI is lagging its manufacturing counterpart, but the former has trended up since its low in November and currently sits just below the demarcation line that separates expansion from contraction. Although real GDP in the Eurozone likely will not grow at the same breakneck pace that we expect the U.S. economy to expand, most forecasters, the ECB included, look for growth to be positive in coming quarters.

The deposit rate, which is the rate the ECB pays commercial banks on the deposits they hold at the central bank, is currently -0.50%, where it has been maintained since September 2019. (That is, commercial banks currently pay the central bank 50 bps per annum on the deposits that they hold at the ECB.) The balance sheet of the ECB has grown considerably over the past year (see chart), but there is room for further balance sheet growth under the Pandemic Emergency Purchase Programme (PEPP) through which the ECB buys government bonds and other eligible securities from the private sector. Specifically, the ECB has nearly €900 billion remaining it its €1.850 trillion PEPP “envelope.”

Although we do not look for the Governing Council to ease policy further in the foreseeable future, we also do not look for it to begin removing monetary accommodation anytime soon. Therefore, short-term interest rates in the euro area likely will remain at rock-bottom lows for quite some time. Long-term interest rates may drift higher as market participants become convinced that a lasting recovery in the Eurozone is taking hold. But we expect that long-term rates in the euro area will generally remain low in a historic context over the next few quarters.

Topic of the Week

The Share of First-Time Homebuyers Improved in 2020

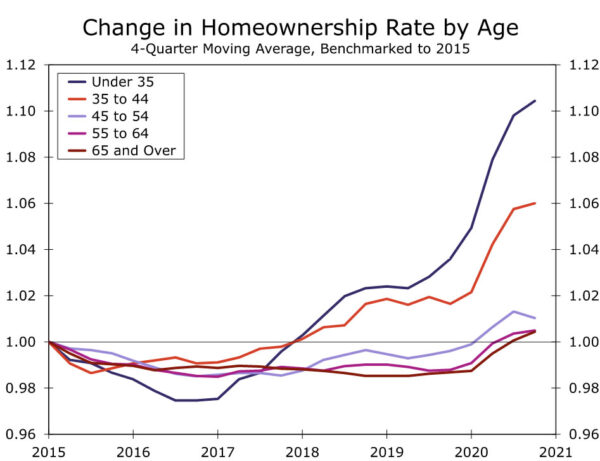

Home sales soared in 2020. Low mortgage rates and the pandemic-induced need for more space bolstered demand at a time when inventories were exceptionally lean. Home prices, as measured by S&P CoreLogic’s National Home Price Index, have sharply increased as a result and were up 11.2% year-over-year in January. Despite the sharp rise in home prices and elevated unemployment, the homeownership rate among younger adults rose faster than other age cohorts last year.

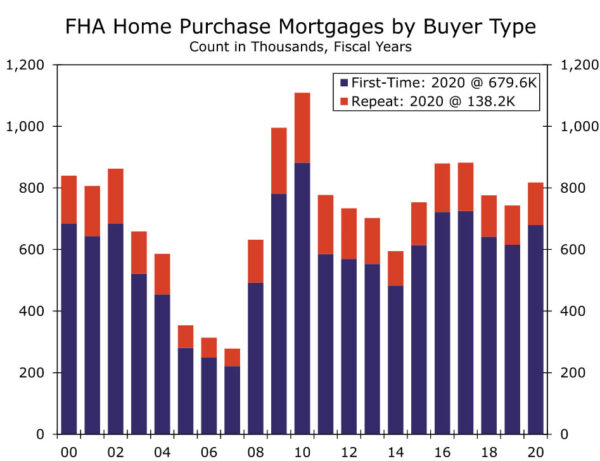

While homeownership among adults under 35 is still relatively low, the rate has gained significant momentum in recent years. Higher debt-to-income ratios among young adults, typically due to student loan balances and the lingering adverse effects of the Great Recession, has pressured the share of first-time homebuyers over the past decade. However, a growing number of Millennials are now reaching a point in their lives where they are marrying, having children and buying homes, which explains the recent upward trend.

These strong demographic tailwinds likely contributed to last year’s boom in home sales, even in the face of a wallowing labor market. Research from Liberty Street Economics and the U.S. Department of Housing and Urban Development (HUD) show the share of first-time homebuyers increased in 2020. Multiple rounds of fiscal stimulus have supported household income, which, alongside historically-low mortgage rates, is helping offset higher home prices. In fact, according to S&P Global, the average monthly mortgage payment slightly declined in 2020.

In addition to record-low mortgage rates, automatic forbearance on federal student loans could have helped first-time buyers as well. Saving for a down payment on a house can be difficult while servicing large debt obligations. So, the suspension of student loan payments for the greater part of last year likely freed up cash to put toward a home.

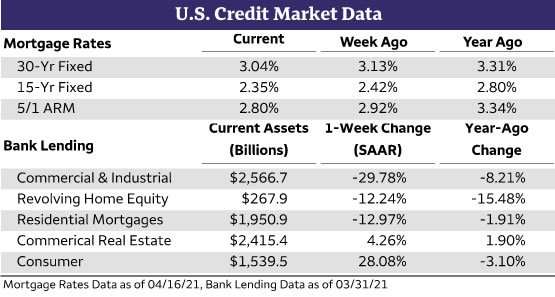

Mortgage rates have risen from last year’s lows, and are currently hovering around 3.1%. Even with higher rates, consumer optimism toward the housing market has brightened. The latest sentiment data from the Conference Board and show a rise in home-buying intentions in March. The Fannie Mae Home Purchase Sentiment Index also rose solidly during the month, climbing 5.2 points to 81.7. That noted, higher mortgage rates and continued lack of inventory will likely lead to a more moderate pace of housing market activity this year, especially for first-time homebuyers where affordability concerns are most acute.