Summary

United States: “Transitory” Feels Increasingly Long

- Chair Powell reiterated his view that current inflation pressures would prove temporary in testimony to Congress, but there were few signs of inflation cooling this week. Both consumer and producer price inflation came in notably higher than expectations for June, while plans among small businesses to raise prices rose to a 41-year high.

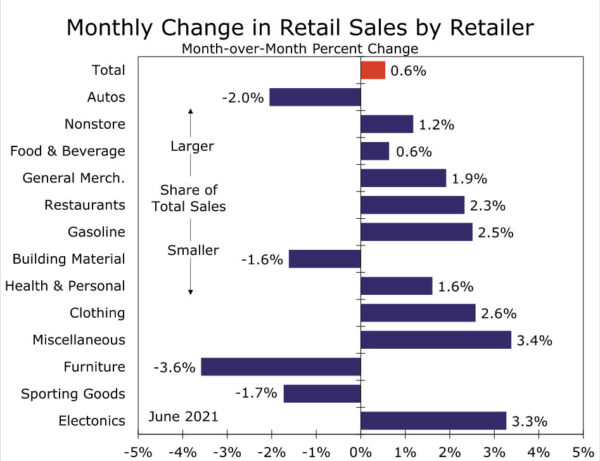

- Retail sales rose 0.6% in June, which was stronger than expected and an indication that stronger spending on services as the economy reopens need not come at the expense of goods.

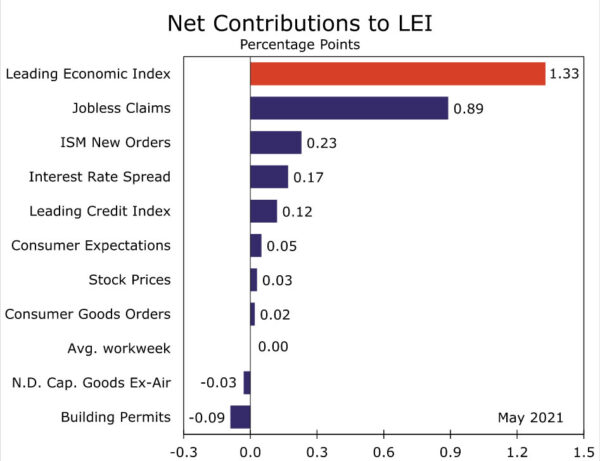

- Next week: Housing Starts (Tuesday), Existing Home Sales (Thursday), Leading Index (Thursday)

International: China Resilient; Monetary Policy Divergences Building

- China reported Q2-2021 GDP data and June activity indicators this week. Our takeaway is that China’s economy, while slowing, is still resilient. In addition, the Reserve Bank of New Zealand announced an end to its asset purchase program, while the Bank of Canada slowed asset purchases and the Bank of England turned more hawkish, all while the Fed remained relatively dovish.

- Next week: European Central Bank (Thursday), South African Reserve Bank (Thursday), U.K. Retail Sales (Friday)

Interest Rate Watch: A Rise to Nine and Hold the Line

- The Fed’s balance sheet recently crossed over $8 trillion; this week’s Interest Rate Watch considers where it is going from here and what it means for financial markets.

Topic of the Week: Extreme Heat and Megadrought Threaten U.S. Agriculture

- The summer has brought severe heat, worsening drought conditions, wildfires and shrinking water supplies to the West, which is disproportionately affecting the region’s agriculture industry.

U.S. Review

“Transitory” Feels Increasingly Long

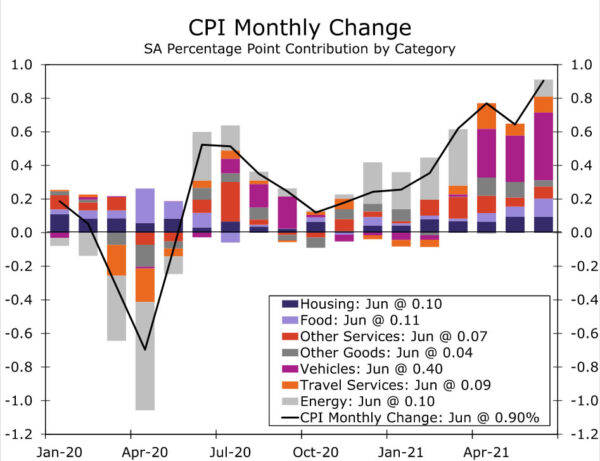

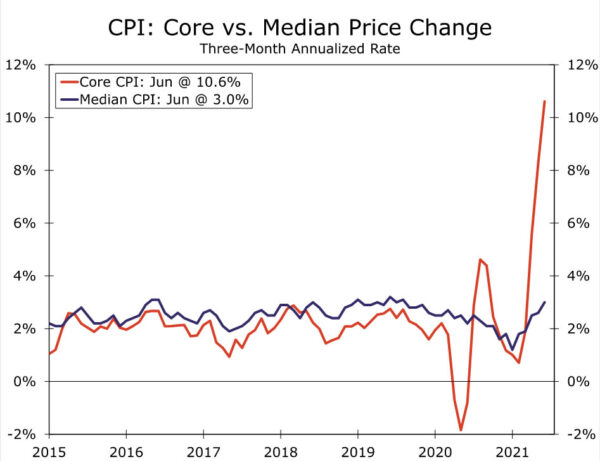

Inflation data this week came in as hot as July’s scorching temperatures. Across a host of price gauges, inflation pressures have continued to build and businesses continue to pass on costs. The biggest head-turner was a 0.9% jump in CPI inflation, with an equally large jump in what is usually the less volatile “core” index. Again, huge gains in a few small categories at the center of the economy’s reopening and supply chain issues drove the increase, including the rapid rebound in airfare and hotel prices and another monster gain in used car prices. June’s increase pushed the core CPI up 4.5% over the past year, the largest yearly increase in roughly 30 years. Looking at the median CPI change shows inflation is not nearly as extreme as the traditional core suggests, but is nonetheless picking up and running at a pace above the Fed’s 2% target. Notably, food and housing costs are picking up, spending that is more difficult to put off than travel or a car purchase.

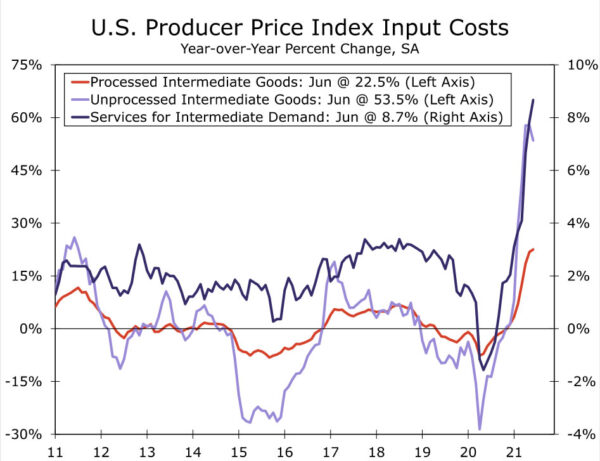

The CPI was not alone in signaling inflation is far from quieting down. The share of small businesses planning to raise prices over the next three months rose to a 41-year high of 44%. Ongoing cost pressures as well as indications that businesses are taking advantage of booming demand to increase margins was evident in the producer price index (PPI). The PPI for final demand rose 1.0% in June and is now up 7.3% over the past year. Trade services, which measures margins rather than prices, jumped 2.1% in June and is up 5.8% from a year ago in a sign that rising costs need not come at the expense of greater profits.

The ongoing strength in inflation did not seem to faze Fed Chair Jay Powell’s view that the run-up in inflation is only temporary. In his testimony to Congress this week, he continued to emphasize that price pressure should ease as current bottlenecks unwind.

However, there are few signs of costs and supply constraints easing just yet. The PPI showed input costs continued to rise in June for raw and processed goods, as well as services, such as shipping. Industrial production in June fell short of expectations, largely due to a 6.6% drop in motor vehicle production as the industry continues to grapple with supply issues. In a glimmer of hope that the worst of the bottlenecks may be over, an average of the New York and Philadelphia Fed’s manufacturing surveys’ supplier delivery times indices showed wait times did not lengthen quite as quickly in July, while shipments growth quickened.

Retail sales for June showed consumers are not put off at this point by higher prices. Sales rose 0.6%, beating expectations for a modest decline. Consumers are pivoting away from home-related spending toward more social and experience spending. For example, furniture and building materials fell again last month, while restaurants, apparel, and personal care all jumped. Overall, the June retail sales report was indicative that with households emerging from the pandemic in a solid financial position, strengthening services spending need not come at the expense of goods.

U.S. Outlook

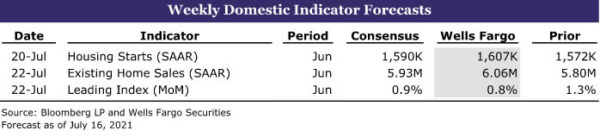

Housing Starts • Tuesday

Housing starts rose to a 1.572 million-unit pace in May. Year-to-date starts are up around 25% relative to 2019, but since the year began, weather issues and rising material and labor costs have kept builders from meeting robust demand. The decline in lumber prices from May’s record high should give builders a sigh of relief. Lumber is now nearly a third of its peak price, which should renew interest in construction projects, but other key inputs, like steel and copper, are still expensive and hard to source. In the Federal Reserve’s July Beige Book, many districts cited high material and labor costs as hindering growth. These factors also weighed on home builder confidence, and the NAHB Housing Market Index fell in June.

Single-family and multifamily starts grew solidly in May, rising 4.2% and 2.4%, respectively. But building permits, which lead starts by a couple of months, declined 3% in May, as both single-family (-1.6%) and multifamily permits (-5.8%) fell. Tight inventories should support new single-family construction in June, while a return to the office should bolster demand for multifamily starts as people move into the hard-hit central business districts. We expect housing starts rose slightly in June to a 1.607 million-unit pace as demand held steady and lumber constraints eased.

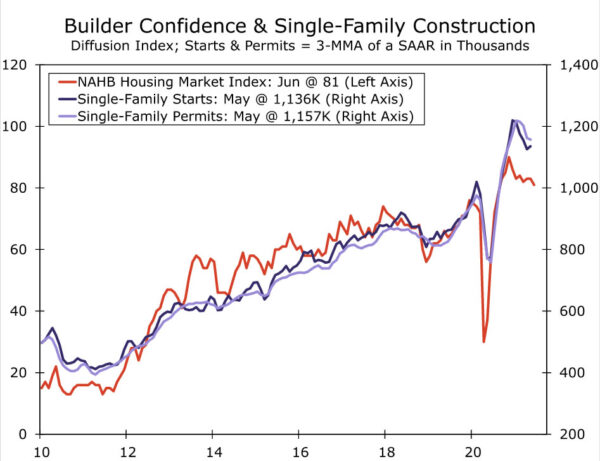

Existing Home Sales • Thursday

Existing home sales fell for the fourth consecutive month in May but are still running strong at a 5.8 million-unit annual rate. The recent cooling has been driven by a lack of affordability in the housing market, with the median price of an existing home sitting at $350K, a 23.6% increase from the prior year. While higher prices should help bring sellers to the market, the current imbalance of supply and demand has made homeownership unattainable for many first-time buyers, who tend to account for around a third of purchases. Even if a home buyer is able to fit the bill for a new place, search costs are also high as homes were only on the market for an average of 17 days before being sold in May. A Richmond Fed contact reported in the Beige Book that, “buyers are increasingly willing to buy homes in poorer or unknown condition,” further highlighting the impact of record-low inventories.

This morning’s University of Michigan consumer sentiment release reported 67% of respondents considered it a bad time to buy a home—for comparison, this share maxed out at 30% in 2006 before the Great Recession. Plans to buy a home have also declined. A bright spot in the data is the slight turnaround of inventories. Months supply of homes has remained flat or slightly increased for five months since its record low last December. We forecast existing home sales ticked up in June to a 6.06 million-unit pace as demand for extra space and low mortgage rates supported sales.

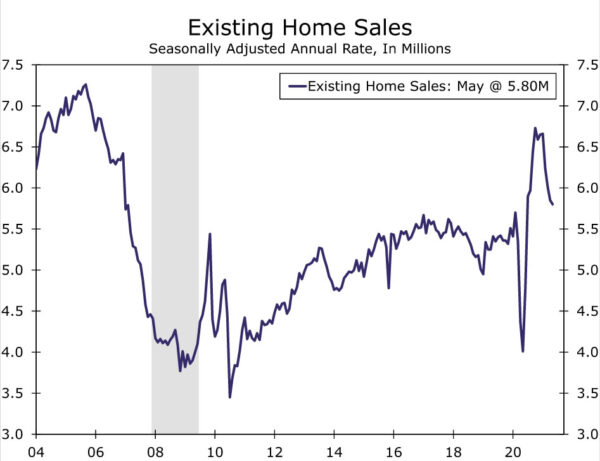

Leading Index • Thursday

The Leading Economic Index (LEI) grew a strong 1.3% in May to a fresh record of 114.5. Recently, the sharp decline in jobless claims has accounted for the lion’s share of the headline’s growth. Lower jobless claims boosted LEI by 0.89 percentage points in May and 0.81 percentage points in April. As claims have continued to fall, June should also see a boost from this category, but the contribution was likely smaller because jobless claims’ monthly decline was less pronounced. Consumer expectations have also lifted the headline as outlooks brighten and should continue that trend in June. Consumer confidence climbed higher in June, hitting its highest point since the pandemic began.

Supply shortages dragged on the index last month. Building permits declined, as high labor and material costs led builders to put off construction. While some constraints have eased, many of these headwinds stuck around in June. Overtime, however, we suspect home building will start to stabilize as input prices come down. The ISM new order index boosted the LEI by 0.23 percentage points in May, but new orders declined slightly, albeit less than expected, in June and are currently at 67. Given the mixed bag of economic data seen over the past month, we suspect LEI grew at a more modest but still strong pace of 0.8% in June.

International Review

China Data Reveals Resiliency

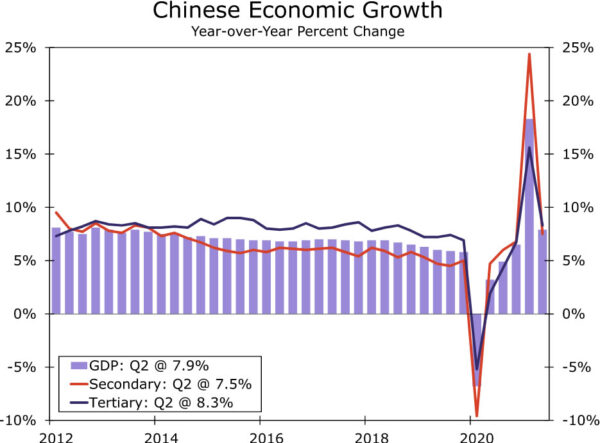

This week, we received a slew of Chinese data, including Q2-2021 GDP as well as June activity indicators. In our view, the key takeaway is, while the Chinese economy is slowing, the economy is also demonstrating some form of resiliency. To that point, on a year-over-year basis, China’s economy grew 7.9%, in line with the consensus forecast of 8.0%, although a sharp deceleration from growth of over 18% in Q1. The fall in headline GDP is mostly due to base effects in Q1; however, in the lead-up to the GDP release, there was some concern among market participants that China’s economy could be in worse shape than expected. Last week, the People’s Bank of China (PBoC) cut its Reserve Requirement Ratio for most local banks, leading markets to believe the Chinese economy may be experiencing a significant slowdown and that the central bank could be starting a monetary easing cycle to offset slower growth. The fact that GDP data were in line with consensus estimates should give markets reprieve the Chinese economy is holding steady and the PBoC is not too worried about the health of the local economy.

As far as activity indicators, the takeaway is similar. Industrial production and retail sales data beat consensus forecasts, which should also demonstrate the Chinese economy’s resilience. To this point, the Chinese labor market has not fully recovered and worries about the pace of consumption were starting to build. Retail sales rose 12.1% year over year against a consensus view of 10.8%, revealing a still resilient consumer. In addition, a strong consumer should take pressure off China’s export sector in the second half of this year. In the coming weeks, we will incorporate Q2 GDP and June activity data into our China GDP forecasts. As of now, we forecast the economy to grow a little over 8% and will likely make modest adjustments to our expectations in our next forecast publication.

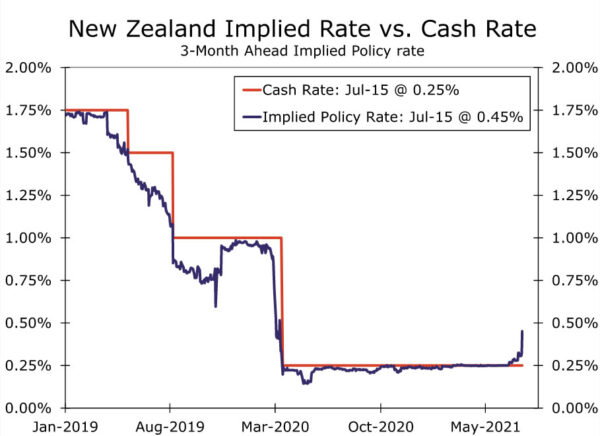

Reserve Bank of New Zealand Ends Asset Purchases

In a surprise announcement at its monetary policy meeting this week, the Reserve Bank of New Zealand (RBNZ) decided to end its asset purchase program. Governor Orr announced this week that the RBNZ would end asset purchases in July amid a strong economic recovery and in an effort to defend against a potentially overheating economy. The New Zealand economy has been outperforming for a while as inflation has moved higher and confidence numbers rise. However, the hawkish shift in monetary policy still came as a surprise and financial markets responded quickly. To that point, the New Zealand dollar rallied in the immediate aftermath of the announcement, while markets are also now priced for interest rate hikes much earlier than previously expected, pricing around 20 bps of monetary tightening over the next three months.

As a result of the RBNZ’s more hawkish turn on monetary policy, we are adjusting our forecast for New Zealand policy rates. Prior to this week’s meeting, we forecast the RBNZ’s tightening cycle to begin in mid-2022; however, we now expect interest rates to move higher at the RBNZ’s August meeting. For now, we expect a 25-bp increase come August, which would take the Official Cash Rate to 0.50%. Future rate hikes will depend on the progress of the economy; however, with inflation running hot at 3.3% year over year and home prices elevated, multiple rate hikes before the end of the year would not be surprising.

Aside from the RBNZ, other foreign central banks exhibited a hawkish stance on monetary policy this week as well. To that point, an above-consensus inflation print in the U.K. led Bank of England policymakers to suggest tighter monetary policy could be imminent. In addition, the Bank of Canada tapered asset purchases again as growth and inflation dynamics improved. Within the G10, foreign central banks continue to turn more hawkish, while the Federal Reserve maintains its patient and relatively dovish position on U.S. monetary policy. These divergences in monetary policy could result in interesting moves in financial markets going forward.

With the Fed keeping policy settings on hold and foreign central banks beginning tightening cycles, it is entirely possible the U.S. dollar comes under some pressure. Rate hikes in New Zealand and Norway, along with reduced asset purchases in the U.K. and Canada, could attract capital flows toward these respective currencies and away from the greenback. Going forward, we will continue to track central bank policymaker rhetoric and how policy expectations are evolving to get a sense for the path of the U.S. dollar.

International Outlook

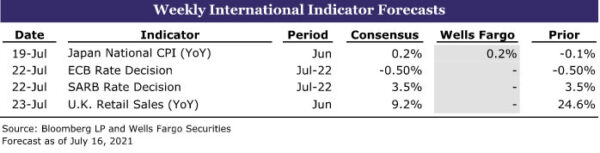

European Central Bank • Thursday

ECB President Christine Lagarde recently suggested the potential for policy change at its monetary policy meeting next week. In our view, a “policy change” does not necessarily mean interest rate adjustments; in fact, the more likely adjustment would come to the ECB’s asset purchase program. It’s possible ECB policymakers look to extend the duration of asset purchases, or possibly the asset purchase envelope itself, in an effort to keep monetary policy accommodative for longer than ECB policymakers originally intended.

Adjustments to asset purchases would be consistent with the ECB’s recent strategy review. The results of the strategy review also appear to be intended to keep policy accommodative for longer as the ECB will now target inflation of 2%, rather than inflation “below, but close, to 2%.” Over the past few months, the Eurozone economy has shown improvement, particularly as vaccinations have stepped up. With monetary policy likely to stay easy for the foreseeable future, mobility and consumer spending rising and fiscal stimulus to be disbursed around the end of the summer, the Eurozone economy is showing signs of life.

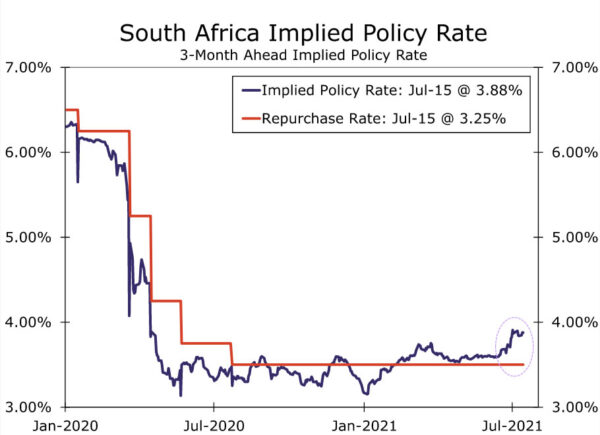

South African Reserve Bank • Thursday

Against a backdrop where interest rates across emerging markets have moved higher, the South African Reserve Bank (SARB) will meet to assess monetary policy next week. The context for the SARB’s next meeting is also complicated as nationwide protests have broken out in response to COVID-related frustrations and new restrictions as well as the imprisonment of former president Jacob Zuma. Another wave of COVID infections and restrictions will likely weigh on activity across the country and delay the local recovery even further, while demonstrations are likely to have an economic impact as well. A sluggish local economy and tighter monetary policy from peer central banks put the SARB in a tough position, especially as inflation moves higher toward the upper end of the inflation target.

In our view, the central bank is likely to keep policy rates on hold next week and will likely keep rates steady through the end of the year. Policymakers have noted that inflation is likely transitory and should recede, while economic disruptions should result in accommodative policy for longer than policymakers initially expected. Our view on rates is out of consensus and against market pricing, as market currently are priced for at least two 25-bp rate hikes over the next three months.

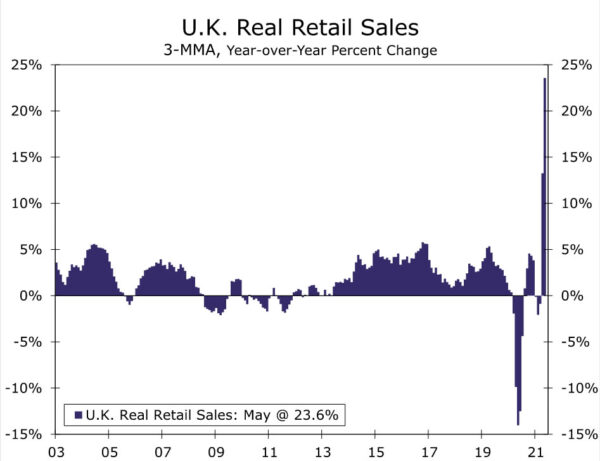

U.K. Retail Sales • Friday

According to British authorities, the U.K. economy is set to reopen, allowing nightclubs and other service venues to become fully operational for the first time in more than a year. Our most recent analysis shows that household savings rates and disposable incomes are elevated, which should support consumption activity and pent-up demand when the U.K. fully reopens. In our view, U.K. consumers are likely to support the economy going forward; however, U.K. virus cases are ticking higher amid the spread of the Delta COVID variant. As confirmed cases push higher, U.K. consumers may be hesitant to resume normal spending patterns and venture back into nightlife and other service-based industries.

Next week’s retail sales data should give some insight into whether consumers are deploying the excess savings they have built up over the course of the pandemic. While we will not have retail sales data reflecting a fully open U.K. economy for a few more months, nevertheless, June data should act as a good precursor for what to expect later in the summer.

Interest Rate Watch

A Rise to Nine then Hold the Line

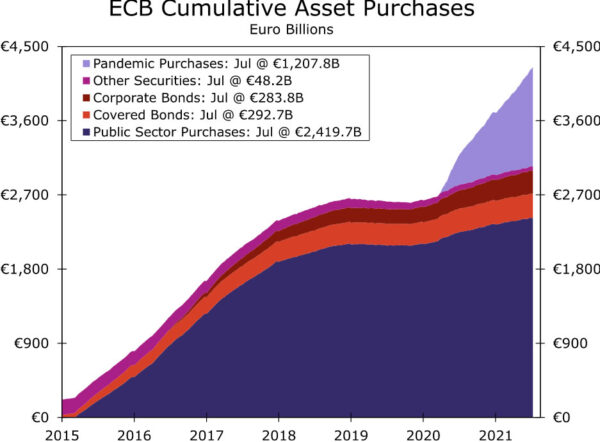

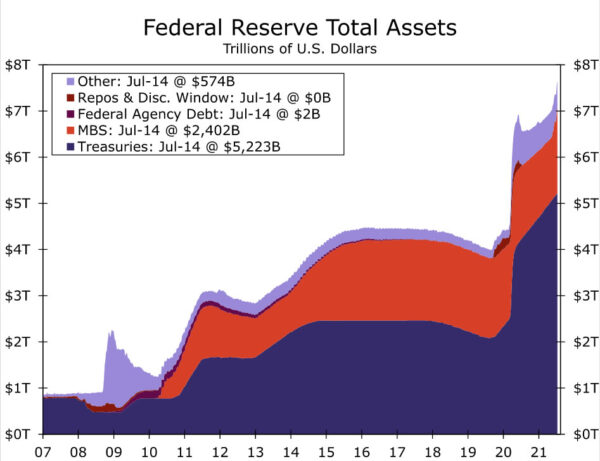

To augment its near-zero rates policy, the Federal Reserve is currently buying $80 billion worth of Treasury securities and $40 billion worth of MBS every month. This means the already historically large balance sheet of the Federal Reserve is growing by $120 billion every month or more than $1.4 trillion this year alone.

The Fed has been slow-walking the messaging around tapering its asset purchase program for months, and while the mantra has been that it will continue its current rate of asset purchases “until substantial further progress has been made toward the Committee’s maximum employment and price stability goals,” details from the latest minutes suggest the moment is drawing nearer, a view that only gains momentum in the wake of this week’s hotter-than-expected CPI inflation report. That said, testimony from the Fed Chair Powell was clearly aimed at dispelling any notion that tapering was imminent.

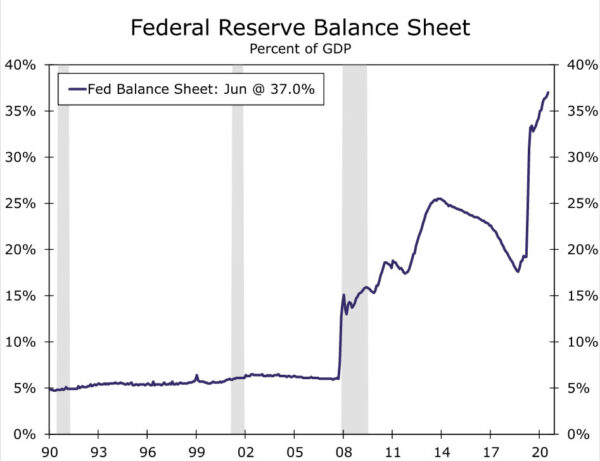

The longer the asset purchases continue, the bigger the Fed’s balance sheet gets. It recently crossed the $8 trillion mark and is likely to continue to rise for some time. Estimates from the New York Fed put the value of the balance sheet at $9 trillion by the end of 2022, which is an order of magnitude larger than it was in 2008 when the entire balance sheet was only about $900 billion. Rather than comparing these enormous dollar figures, it may be more helpful here to think of the balance sheet as a share of GDP. In the prior cycle, the balance sheet swelled from about 6% of GDP in 2008 to just over 25% at its height before tapering finally got under way in 2014. In the current cycle, the balance sheet has gone from a pre-pandemic low of 17.6% to 37% at present. In other words, even before the pandemic-related purchases began, the Fed still held most of the assets it purchased in the aftermath of the 2008 financial crisis.

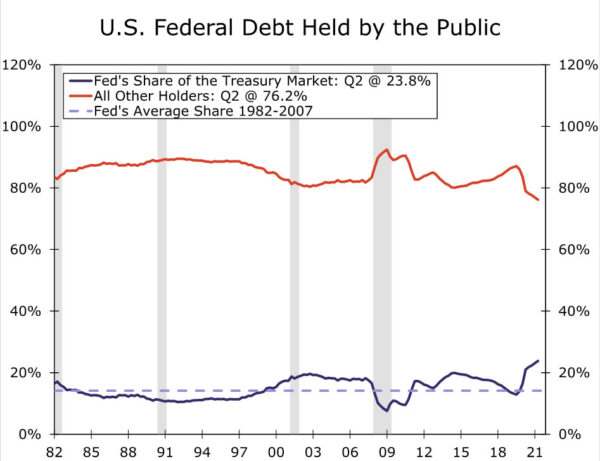

The Fed’s Treasury holdings are large relative to the size of the economy and significant compared to the Treasury market itself. Through the first quarter of this year, the Fed owned $5.4 trillion in Treasury debt or about 24% of the $22.3 trillion in total debt outstanding. That may sound like a lot, but it is not uncommon for the Fed to own a significant share of Treasuries, and the bulk of Treasuries remain privately owned and traded.

The combination of significant monetary and policy stimulus has left the financial system awash in cash in search of a place to go. With rates uncomfortably close the zero lower bound, at its June meeting the Fed made some technical tweaks: It raised the interest it pays on excess reserves (IOER) to 0.15% from 0.10% and the rate on overnight reverse repurchase agreements to 0.05% from 0.00%. In the wake of that decision, the amount of money pouring into the reverse repurchase agreement facility rose to a record $992 billion at month-end in June and still sits at roughly $776 billion as of this writing.

The ultra-accomodative stance taken by the Federal Reserve has resulted in a number of records: The Fed’s balance sheet is as large as it has ever been. This is true in dollars, as a share of GDP and as a share of total debt outstanding. Meanwhile, banks and other institutions have never had more cash tucked away in overnight repos. Like an undriven sports car that sits in the garage, the financial system is awash in excess cash, all while the balance sheet continues to grow to new record highs.

Whether it is this year or next, the eventual Fed tapering will likely result in the balance sheet leveling off around $9 trillion where it will probably stay for a while. We were a couple of years into the previous tightening cycle before the Fed began letting its balance sheet shrink, and until we get alternative guidance, that is a reasonable base case for this time as well. If the first rate hike occurs sometime in 2023, the Fed’s balance sheet is unlikely to shrink in dollar terms until at least 2024. This may be a factor in the growing realization among firms that this excess cash situation will probably be a reality for at least a few more years.

Topic of the Week

Extreme Heat and Megadrought Threaten U.S. Agriculture

The economy is heating up this summer, and so are temperatures. In late June and early July, a “heat dome” brought an unprecedented rise in temperatures to the Pacific Northwest. A heat dome occurs when high-pressure atmospheric conditions produce vast areas of heat that get trapped in a bubble, creating an intense and slow-moving heat wave for areas under the “dome.” Temperatures spiked to above 100 degrees across the region, with temperatures reaching as high as 108 degrees in Seattle and 116 in Portland, which are both new records. The sweltering heat has created several challenges for the Pacific Northwest. The region typically enjoys mild summers, and many residents do not have air conditioning to cope with triple-digit temperatures. As a result, state and local authorities opened cooling centers and lifted any remaining COVID-related capacity restrictions at movie theaters, swimming pools and shopping malls. In order to beat the heat, many residents also flocked to air-conditioned hotels, which caused occupancy levels to rise sharply across the region.

There have also been a number of other economic consequences. For one, households that do have the ability to cool their homes cranked up the air conditioning during the heat wave, which likely contributed to a 3.3% jump in national electric utility production during June. The blistering heat has also been a test for a region’s infrastructure. High temperatures cause asphalt to expand, and some of the region’s roads have warped or buckled. In Seattle, several metal bridges needed to be doused in cold water to prevent the metal from expanding. The heat disrupted Portland’s power grid and damaged the city’s streetcar and light rail system’s overhead wires, causing service to be suspended.

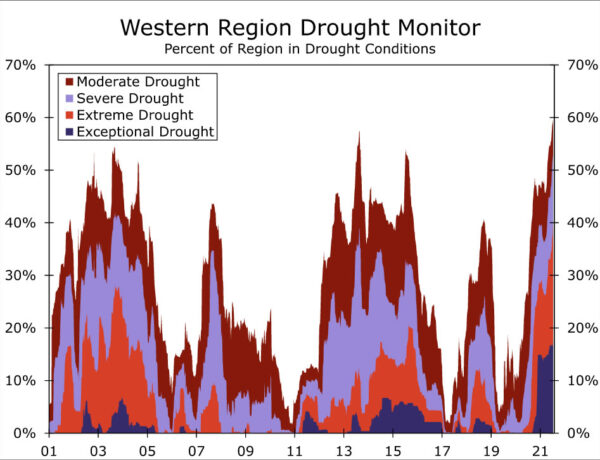

The extreme heat comes on top of a “megadrought” that has been ongoing since 2020 throughout most of the West. As of July 13, over 50% of the Western region was classified as experiencing severe drought conditions, the most since the National Drought Mitigation Center at the University of Nebraska-Lincoln first started keeping records in 2000. Most concerning, drought conditions have escalated to “exceptional” (the most severe classification) in over 33% of California. The ongoing drought and recent heat wave have put the region’s entire water infrastructure under tremendous strain. For instance, more than 1,500 reservoirs in California were 50% lower than normal for this time of year, according the Center for Watershed Sciences at the University of California-Davis. The reduction in water supplies means less water for hydropower as well as residential and commercial uses. California state officials recently asked residents as well as industrial, commercial and agricultural operators to cut back on water usage by 15%.

Adding to the region’s woes, wildfire activity in the West is ramping up alongside the excessive heat and severe drought conditions. During June, large wildfires were burning in Arizona, California, Colorado and Oregon. So far this year, California wildfires have scorched over 142,000 acres in the state, over three times more than during the same time period last year. Similarly, the Telegraph Fire in Arizona has burned more than 180,000 acres and became the sixth-largest wildfire in modern state history.

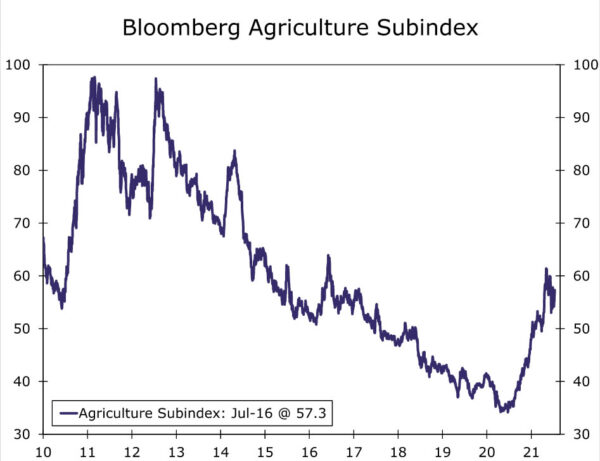

So far, the agriculture industry appears to be feeling the brunt of the impacts from wildfires, worsening drought conditions and shrinking water supplies. Dry conditions have lowered expectations for crop yields this year, notably for barley and durum wheat. Livestock owners have also found feeding their herds has become a challenge, as drought conditions make it difficult for pastures and rangeland to grow. As a result, livestock producers are opting to reduce their herds or send stock to pastures with better conditions. Lower crop and livestock yields alongside rebounding consumer demand has triggered a surge in agriculture prices, which had been trending lower since 2012. Bloomberg’s Agriculture Index, which tracks futures contract prices for a basket of agricultural commodities, currently sits about 40% higher than the level seen at the end of 2019. While there are undoubtedly other factors other than the drought that are contributing to the rise in agriculture prices, the recent upturn is nevertheless yet another example of mounting inflationary pressures still building across the economy.