Markets have been taunted by shifting Fed expectations over the past week and there’s likely to be more anguish for investors in the next few days as crucial payrolls and inflation numbers are coming up. The August jobs report and PCE inflation readings will be closely watched amid signs the US economy is starting to lose steam fast. The Eurozone economy is going through an even rougher patch, putting the spotlight on flash CPI figures. China has been another source of concern and its PMI prints for August will be important too.

NFP report and PCE inflation to raise the stakes

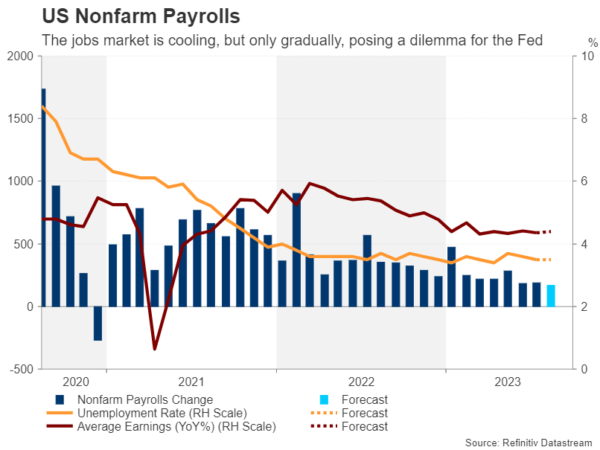

It’s payrolls week in the United States and the August numbers will be eagerly awaited on Friday as, apart from some signs already that jobs growth is slowing, the latest S&P Global PMI survey raised a few alarm bells about hiring conditions. Nonfarm payrolls are projected to have increased by 170k in August, moderating from the 187k jobs added in July.

The unemployment rate is expected to hold steady at 3.5%, while average hourly earnings growth is also forecast to remain unchanged at 4.4% y/y in August.

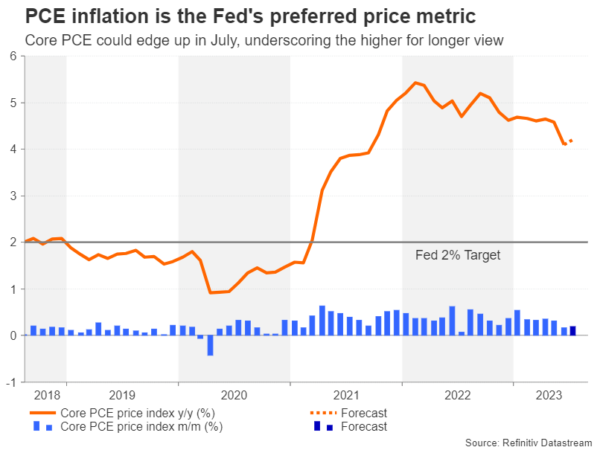

Also attracting a lot of attention is Thursday’s personal income and outlays report, which contains the all-important core PCE price index. With both personal income and personal consumption holding up surprisingly well against the backdrop of rising borrowing costs, another solid reading for August would ease worries about a slowing economy. What has been more of concern, however, is the stickiness of the Fed’s favourite inflation gauge.

Although core PCE did finally take a dive in July to fall to 4.1% y/y, that’s still double the Fed’s target of 2%. Furthermore, core PCE could edge up to 4.2% in July, so those investors hoping for further declines in this particular metric are likely to be disappointed.

Yet, with the economic risks tilted somewhat more towards a recession than a soft landing after the PMI releases, if the above indicators are broadly better than expected, it’s unlikely that rate hike odds would rise very significantly. On the other hand, an overall soft or even poor set of data could lead investors to further up their rate cut bets for next year, punishing the US dollar but probably boosting Wall Street.

Ahead of those big reports, the Conference Board’s consumer confidence index will be watched on Tuesday along with the JOLTS job openings for July. On Wednesday, the second estimate for Q2 GDP growth and ADP employment report will keep the top-tier data flowing. Pending home sales are due on Wednesday too and the Chicago PMI will follow on Thursday.

Wrapping up the US agenda on Friday will be the ISM manufacturing PMI, which will get to have the final say on how markets close for the week. It’s expected to come in at 46.6 for August, a very modest improvement over the prior month.

Will Eurozone inflation keep falling?

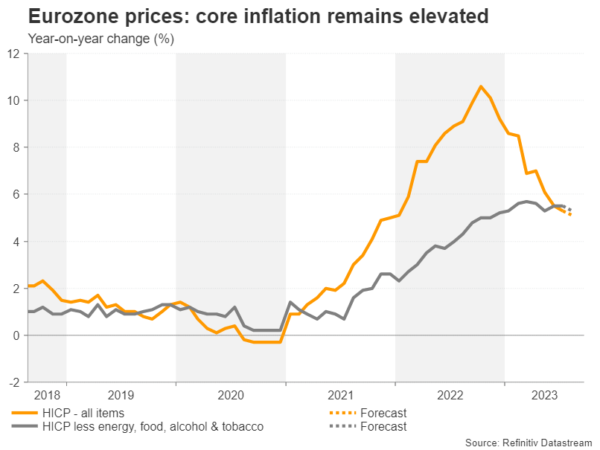

Across the pond, recession fears are heightened even more so, as there appears to be no relief for European businesses lately. Manufacturing activity did improve slightly in August, but services output slumped deeper into contraction territory. With interest rates at a record high since the euro’s inception, energy prices rising again and demand weakening in key export markets such as the US and China, one of the few things Europeans can celebrate about is that inflation is on the way down.

The flash estimates for August are due on Thursday and should show further declines. The headline rate of CPI is expected to dip from 5.3% to 5.1% y/y, while core CPI that strips out food, energy, alcohol and tobacco prices is forecast to ease from 5.5% to 5.3% y/y.

The European Central Bank has repeatedly stressed that getting core CPI down to 2% is its main priority and will likely relay that message in the minutes of the July meeting that will be published on Thursday. However, a less hawkish-than-anticipated tone is possible as the recent deceleration in growth is raising doubts about the need for further rate increases.

The euro could halt its slide and firm somewhat should rate hike bets for September, which at the moment is a coin toss, be ratcheted up from any upside surprises. But even then, the gains would be limited as the risk of a more severe downturn would also rise.

Battered aussie eyes Chinese PMIs and local CPIs

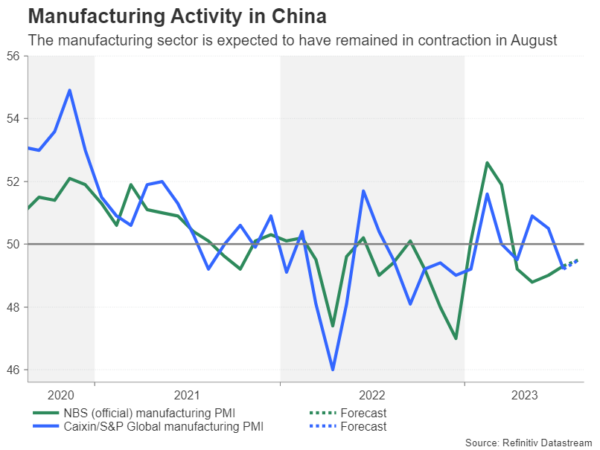

Amid frustration about China’s drip-feed stimulus, announcements on new support measures have become almost a daily occurrence. Yet, for the markets, a one-off bazooka is seen as having a bigger impact. In the absence of one, all investors can do is to look for signs that the incremental policy tweaks are starting to generate some momentum in the economy.

There could be some clues of this on Thursday when China reports its manufacturing and non-manufacturing PMIs for August. The Caixin manufacturing PMI will follow on Friday.

The Australian dollar, which is viewed as a liquid proxy for China-related risks, has taken quite a beating lately following a series of downbeat Chinese data. China’s slowdown is already being felt across the Australian economy as pointed by the recent dismal PMIs.

Next week, the focus will be on domestic barometers, comprising July retail sales (Monday), monthly CPI prints (Wednesday) and Q2 capital expenditure (Thursday).

In recent meetings, the Reserve Bank of Australia had become more concerned about growth than inflation. If the annual CPI rate maintains a downward course in July, the RBA would have little incentive to hike rates again, and unless there is a turnaround in risk sentiment, the aussie looks poised to remain under pressure.

In other data, second quarter GDP growth figures are due out of Canada on Friday, while in Japan, there’s a slew of releases, including preliminary industrial output for July on Thursday and the Ministry of Finance’s estimate of Q2 capital expenditure on Friday. The latter will provide an indication on whether or not the preliminary GDP reading of 6.0% annualized growth is likely to be revised up or down.