Summary

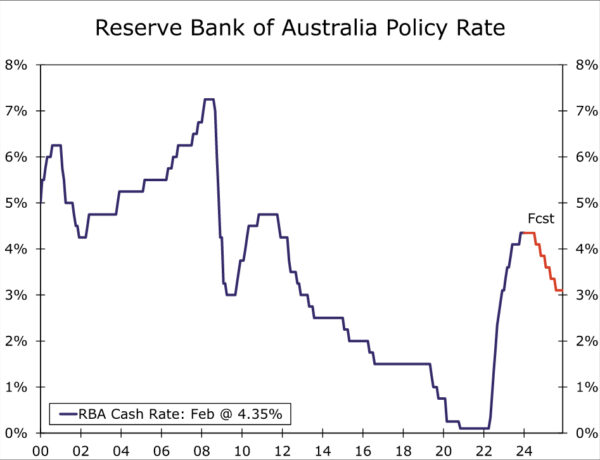

- The Reserve Bank of Australia (RBA) held its policy rate steady at 4.35% this week as expected, and its accompanying announcement was more hawkish than expected. The RBA did not rule out a further increase in interest rates, saying inflation—especially services inflation—is still high.

- We do not expect a further RBA rate increase, but with the central bank forecasting above-target inflation for an extended period, we believe rate cuts are some way off. We anticipate an initial 25 bps rate cut at the August meeting, while also acknowledging the balance of risks as tilted toward a later move.

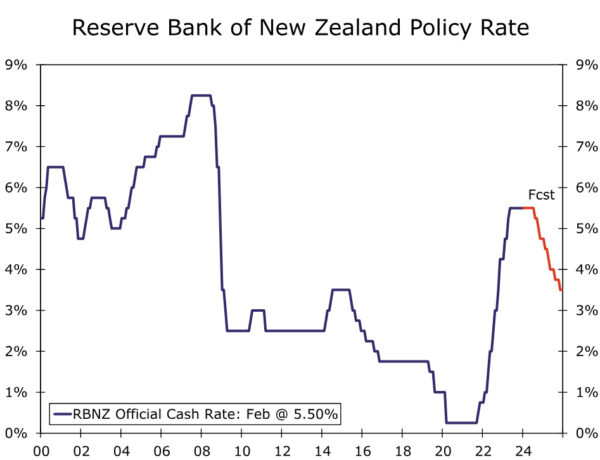

- In New Zealand, improving sentiment surveys suggest the economy is moving toward recovery after a challenging 2023, while domestically oriented inflation pressures remain elevated. That backdrop is contributing to a continued hawkish stance from the Reserve Bank of New Zealand, which has not ruled out further rate hikes and said there is a way to go before inflation returns to target. We now see RBNZ rate cuts occurring later than previously envisaged, and forecast an initial 25 bps reduction at the August announcement.

- Against a backdrop of a U.S economic slowdown and Fed easing, a more gradual pace of rate cuts from the RBA and RBNZ could offer some support to the Australian and NZ dollars against the greenback over time.

Hawkish Hold From the Reserve Bank of Australia

The Reserve Bank of Australia (RBA) held its policy interest rate at 4.35% at this week’s meeting, as widely expected. While acknowledging slower growth and improving inflation trends, the RBA is nonetheless clearly wary of reducing interest rates prematurely. This is reflected in several elements of its announcement:

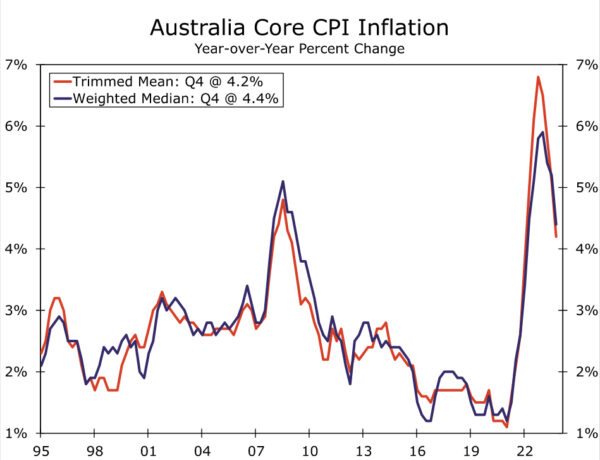

- Inflation remains high at 4.1 per cent. Goods inflation has slowed, but services inflation has declined at a more gradual pace, consistent with continuing excess demand and strong domestic cost pressures.

- The RBA remains highly attentive to inflation risks.

- While conditions in the labor market continue to ease gradually, they remain tighter than is consistent with sustained full employment and inflation at target.

- The RBA expects it will be some time yet before inflation is sustainably in the target range of 2%-3%. The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out.

Importantly, therefore, the RBA kept the possibility of a rate increase on the table, even as it lowered both its GDP growth and CPI inflation forecasts. With respect to economic activity, the RBA now forecasts annual average GDP growth of 1.5% for 2024, down from the 1.8% it forecast in November. It also projects a slightly faster rise in the unemployment rate to 4.3% by the end of this year, compared to 4.2% previously. Meanwhile, despite a downside surprise for Australia’s CPI in Q4-2023, inflation is expected to remain above the 2%-3% inflation target range for an extended period. Both headline inflation and trimmed mean inflation are not forecast to return to that target range until the end of 2025, and are not forecast to be at the midpoint of that range until mid-2026.

Keep in mind these forecasts are all predicated on the technical assumption of a policy rate path that is broadly consistent with market implied pricing, which sees the policy rate at 4.3% in mid-2024 and 3.9% by end-2024. Even with that technical assumption, however, the RBA projects inflation remaining above the target range for an extended period. In our view, given that RBA continues to highlight that “returning inflation to target within a reasonable timeframe remains the Board’s highest priority”, at the very least that suggests rate cuts are unlikely to come before the second half of this year. That is, we view the RBA’s announcement and forecasts as consistent with interest rate cuts starting in the second half of this year or later.

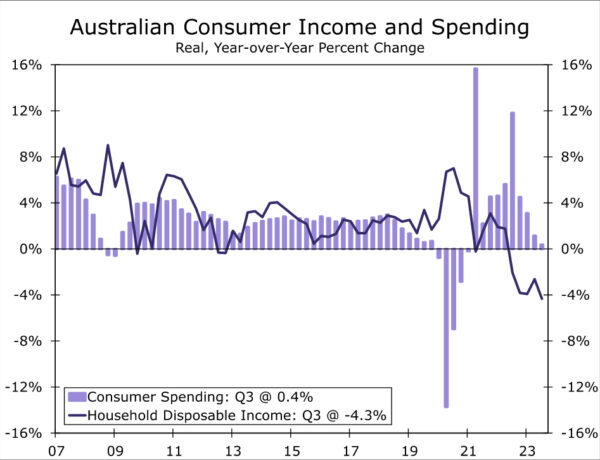

Against this backdrop, we doubt that sluggish economic growth will elicit early easing from Australia’s central bank. The RBA has repeatedly highlighted an uncertain outlook for the consumer, uncertainty that is reflected in recent data. Q4 real retail sales rose a modest 0.3% quarter-over-quarter and, while that was better than expected, it was offset by a downward revision to Q3 sales. In fact, the increase in quarterly sales was the first since Q3-2022, and thus, in our view, represents more stabilization than strength in retail activity. In terms of consumer fundamentals, real household disposable incomes fell 4.3% year-over-year in Q3-2023 and the household saving rate dropped to just 1.1% of disposable income, arguing against a quick rebound in consumer spending. Perhaps on a more encouraging note however, tax cuts scheduled for 1 July have been adjusted to provide greater support to lower income earners, which should at least offer some support for consumer spending, and help to limit the extent of any slowdown in the overall economy.

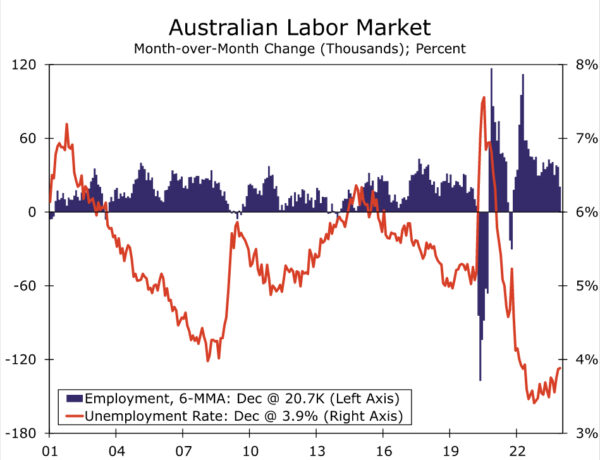

Even amid slow growth, the labor market has remained reasonably resilient so far. Employment has been particularly volatile in recent months, with a large December decline in jobs broadly offsetting a big November increase. Looking through that volatility, the average monthly employment increase slowed during the second half of last year to a still-respectable 20,700 per month. The unemployment rate has also increased to 3.9%, from as low as 3.4% in late 2022. While the labor market has loosened to some extent, we note that a further moderate increase in unemployment and slowing in wage growth (from the current 4.1% year-over-year for the Wage Price Index) would be in line with the RBA’s forecast, and could make the central bank more comfortable that inflation is returning sustainably to the target range.

Accordingly, we think an initial RBA rate cut remains some way off. At this time, we remain comfortable with our outlook for an initial 25 bps rate reduction to 4.10% at the August monetary policy announcement, by which time the labor market will likely have softened further, and wage and price pressures will likely have moderated somewhat. We also expect the pace of rate cuts to be quite gradual even after that initial easing, at just 25 bps per quarter, which means the RBA’s policy rate would not reach a low of 3.10% until the second half of 2025. While we see risks around this policy rate outlook in both directions, those risks are perhaps tilted toward a later rate cut than an earlier rate cut. Persistence in services or wage inflation could easily see an initial rate cut pushed back to Q4 of this year while, although it is not our base case, an especially sharp slowdown in consumer spending or inflation pressures could still prompt the RBA to move earlier than August.

The pace of monetary easing we forecast for the RBA, at least through the end of 2024, is broadly in line with that implied by market pricing. As mentioned, however, the risks are more heavily tilted toward a later move. Moreover, even our base case for an initial RBA rate cut in August sees Australia’s central bank moving noticeably later than the Federal Reserve, where we expect an initial rate cut to occur in May. Overall, a gradual moderation of Australian economic growth and inflation that leads to only a gradual pace of monetary easing from the Reserve Bank of Australia should be supportive of the Australian dollar versus the greenback over time.

High Inflation and Recovering Economy Keeping New Zealand Central Bank Hawkish

In New Zealand, the economy appears to be moving toward recovery after what was a challenging year through much of 2023. The impact of elevated inflation and the Reserve Bank of New Zealand’s (RBNZ) aggressive monetary tightening contributed to GDP reporting sequential declines in three out of four quarters through Q3-2023, according to the latest available figures. Election-related uncertainty may have also provided a temporary restraint to growth late last year. Q3-2023 saw New Zealand’s GDP fall 0.3% quarter-over-quarter and 0.6% year-over-year: economic underperformance that occurred even as immigration, and population growth, surged.

Some key economic headwinds facing New Zealand are now starting to abate; inflation has peaked, and we also believe the RBNZ has come to the end of its rate hike cycle. We think that should gradually allow for the economy to transition to a recovery phase, even if these key fundamentals have not turned to significant tailwinds just yet. That appears to be reflected in some available economic indicators for Q4 of last year. Most importantly, the Quarterly Survey of Business Opinion saw businesses become much less downbeat, as just a net 2% of businesses were pessimistic in Q4, compared to the net 52% of businesses who were pessimistic in Q3. Moreover, a net 6% of respondents reported an increase in their own trading activity in Q4, compared to net 17% who reported a decrease in Q3. This latter point is significant as, historically, it is firms’ assessment of their own trading activity that has tended to be more closely correlated with overall GDP growth.

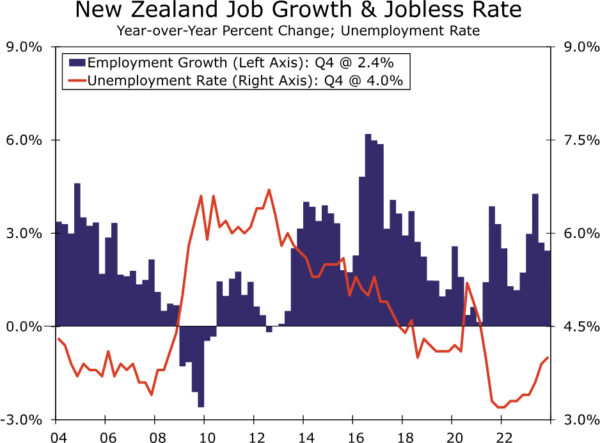

The improvement in sentiment in Q4 suggests that a gradual economic recovery may be upon us, a message that is also reflected in labor market data for the fourth quarter. Q4 employment rose 0.4% quarter-over-quarter, rebounding following a small decline in Q3, while employment was also up 2.4% year-over-year. The unemployment rate did edge higher to 4.0%, though in part, that stems from surging population growth. In fact, if anything, rising unemployment may help to place some restraint on wage pressures. The fourth quarter also saw the Labor Cost Index for the private sector rise to 1.0% quarter-over-quarter and ease to 3.9% year-over-year. Overall, we believe the New Zealand economy can enjoy a moderate recovery this year. We forecast GDP growth of 1.2% for 2024, which would be up from an estimated 0.8% growth in 2023.

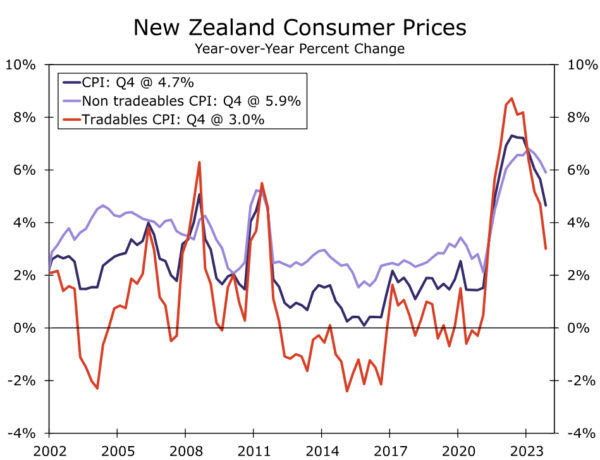

On the inflation front, consumer prices have started to recede, although domestically oriented inflation pressures remain persistent. Q4 CPI inflation slowed to 4.7% year-over-year, matching the consensus forecast. However, although tradeables inflation surprised to the downside and slowed to 3.0%, non-tradeables inflation surprised to the upside, with only a moderate slowing to 5.9%. Both headline inflation and, more particularly, domestically-oriented inflation, remain well above the central bank’s 2% inflation target. As a result, the RBNZ has maintained a relatively hawkish monetary policy stance. At its most recent announcement in November, the RBNZ said that despite some decline, inflation remains too high, and policymakers maintain a wariness of inflationary pressures. In fact, the central bank said if inflationary pressures were stronger than expected, the policy rate would likely need to increase further. In more recent comments, RBNZ Chief Economist Conway offered additional hawkish comments. Conway said non-tradeables inflation was higher than expected and a long way from 2%, and that the central bank still has a way to go to get inflation back to target. Given the backdrop of improving sentiment, domestic inflationary pressures and a hawkish central bank, we now see RBNZ policy rate cuts occurring later than previously envisaged. We expect an initial 25 bps rate cut to 5.25% at the August announcement. Beyond that, we see a relatively steady pace of easing, with our forecast for a cumulative 75 bps of rate cuts in 2024, and a further cumulative 125 bps of rate cuts in 2025, which would see the RBNZ’s policy rate reach 3.50% by the end of next year. Against a backdrop of a U.S economic slowdown and Fed easing, we believe a moderate rebound in NZ economic growth and gradual RBNZ monetary easing should see the New Zealand dollar enjoy moderate gains against the U.S. dollar over time.