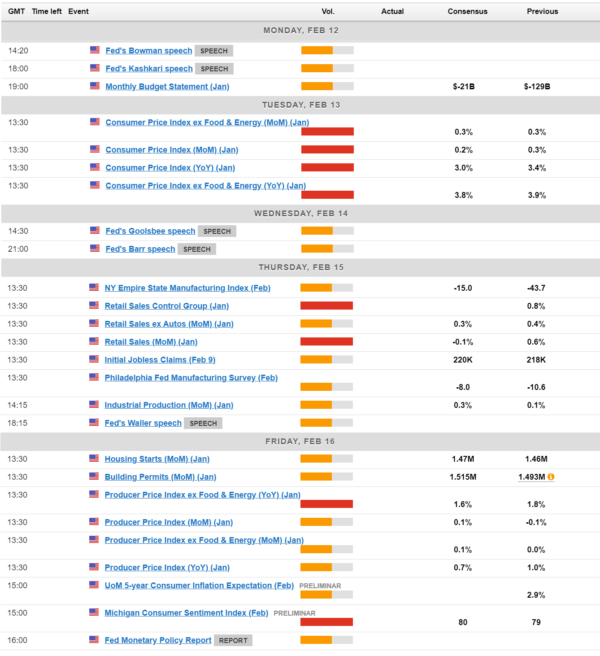

- US inflation and retail sales among the highlights

- Tier three Canada data only after employment update

Could a March rate cut still be on the table?

US economic data since the turn of the year has been far from ideal considering traders had priced in up to 175 basis points of rate cuts at one stage.

Expectations have since been pared back with markets only pricing in 125 but some think that may even be too optimistic, particularly following the January jobs report.

The US inflation revisions on Friday helped to settle the nerves but now it’s over to the scattering of January data we get next week. CPI inflation is once again front and center as we look for further signs that near-term inflationary pressures have significantly abated which could improve the chances of a March cut.

But there are plenty of other releases too that traders will be watching closely for. Retail sales, jobless claims, and consumer sentiment to name a few. Inflation may be the most important but the combination helps to build a fuller picture for the central bank. And it is determined to only cut when its convinced inflation will fall sustainably back to target.

A quiet week for Canada after the unemployment release

January saw unemployment fall in Canada for the first time in more than a year which would be good news in normal times.

Unfortunately, at a time when the Bank of Canada is trying to create some slack in the labor market to achieve its inflation target, it’s far from ideal. A summer rate cut is still expected but we’ll need to see more improvements in the data between now and then.

Next week doesn’t offer much, with tier-three data the only releases on the calendar.

Source – OANDA

USDCAD tested the 50% Fibonacci retracement level once again earlier this week and just like on the previous occasions, the level offered significant resistance.

This now makes the recent low on 31 January all the more interesting as it would represent the neckline of a double-top formation.