- Risk linked currencies lose correlation to S&P 500

- Dollar outperforms all as Fed implied rate path rises

- BoC abandons tightening bias, but RBA and RBNZ stay hawkish

- China impacts aussie and kiwi, loonie linked to oil prices

Surrendering to the greenback’s dominance

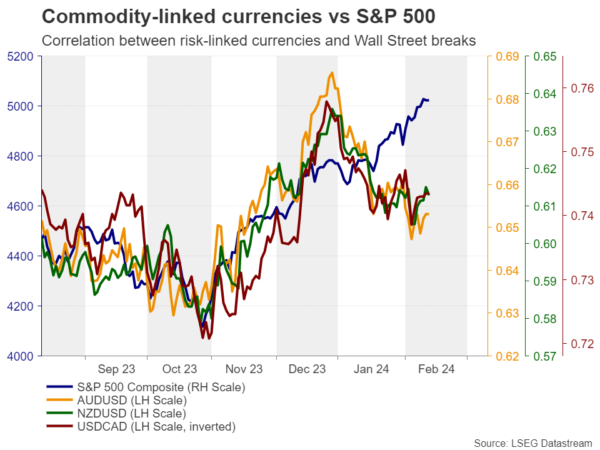

Just before the turn of the year, the risk-linked currencies – the Australian dollar, the New Zealand dollar, and the Canadian dollar – also known as the commodity-linked currencies, have come under selling pressure despite risk appetite remaining elevated and allowing Wall Street to conquer unchartered territories, with the correlations between these three currencies and the S&P 500 declining notably.

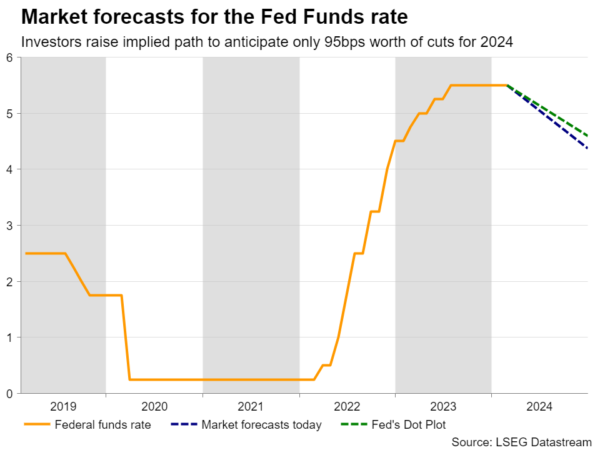

But what’s behind the break of an up-until-recently strong correlation? One reason is the greenback’s strength due to the market’s repricing regarding the Fed’s future course of action. At the start of the year, investors were fully convinced that Powell and his colleagues will lower interest rates by 25bps in March.

However, a less-dovish-than-expected Fed meeting in January, a streak of astounding US economic data, stickier than expected US inflation, and a chorus of policymakers that kept pushing back against an imminent rate reduction, forced market participants to lift their implied rate path, with the probability of a March cut dropping to a mere 4%. Even the June probability has dropped below 50% after the US CPI data for January.

At the same time, the impact of this repricing on Wall Street was minimal as investors remained willing to buy, perhaps on the logic that there are more AI-related future growth opportunities to be priced in. This allowed the greenback to stage a stellar recovery against all its major peers at a time when the S&P 500 was conquering uncharted territories.

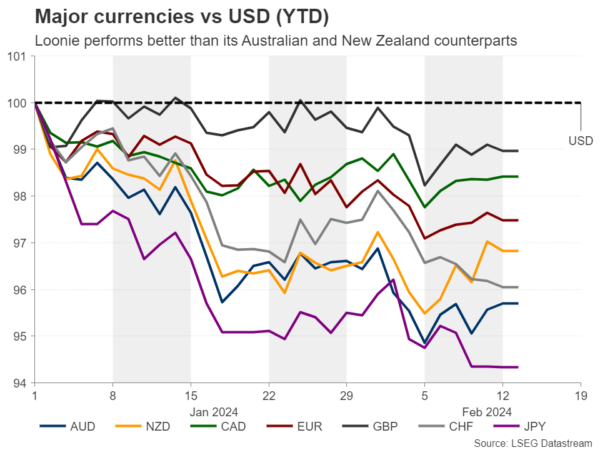

However, the aussie and the kiwi have been performing worse than the loonie, which is losing only against the dollar and the pound. Up until recently, and taking the bleeding yen out of the equation, the aussie and the kiwi were the worst performers.

This suggests that besides expectations surrounding the Fed, there are other forces to be considered; one that may be weighing on both the aussie and the kiwi, and one that is helping the loonie avoid being severely damaged, despite the Bank of Canada dropping its hiking bias at its latest gathering.

China, oil prices, RBA and RBNZ monetary policy

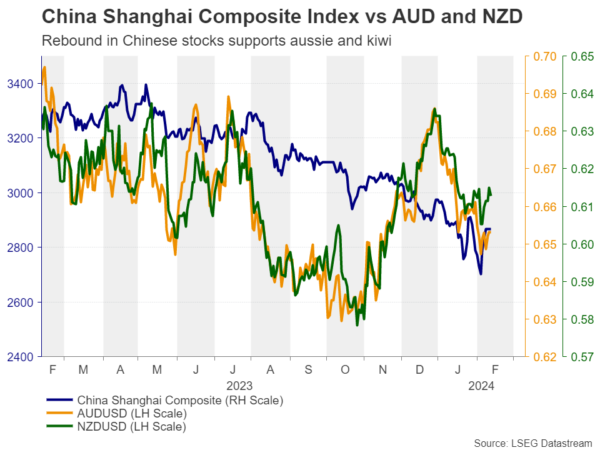

The force that added extra weight on the aussie and kiwi is called China. Mainly due to a battered property sector, the uncertainty surrounding the world’s second largest economy, and Australia’s and New Zealand’s main trading partner, prompted investors to abandon Chinese equities, with aussie and kiwi traders focusing more on that rather than the euphoria on Wall Street. As for the loonie, it may have received a helping hand recently by the recovery in oil prices, which is driven by the Middle East crisis.

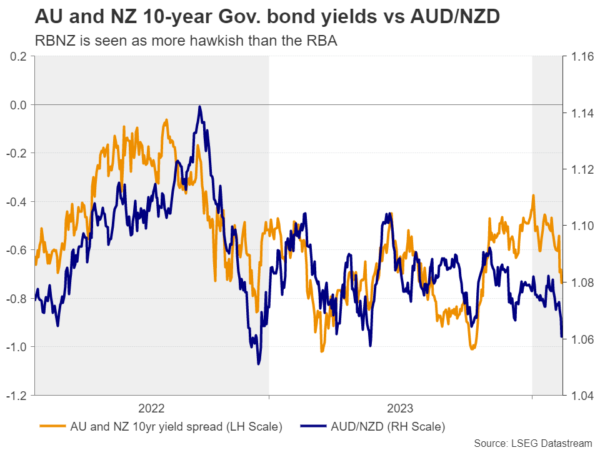

Having said all that, both the aussie and the kiwi paused their slides after the RBA maintained its tightening bias at its first policy decision for the year and after New Zealand’s employment report for Q4 came in better than anticipated. The kiwi received an extra boost last Friday, after the Australia and New Zealand Banking Group (ANZ) said it expects the RBNZ to lift its official cash rate by another 50bps to 6%. They clarified that they believe a 25bps hike will be delivered this month and another one in April.

What’s next?

Now the question is where those currencies are headed next, and which could perform better. Putting them all against the dollar, they are likely to come again under selling pressure if the market continues to upwardly adjust its Fed implied path.

However, against each other and amongst the three of them, the loonie may be the one to fall from first place to third. The BoC is the most dovish central bank among the three, while a resolution of the conflict in the Middle East may remove support from oil prices. But even if there is no ceasefire, as long as the situation does not escalate into something bigger, the market may stop paying attention at some point. After all, this is what happened with the war in Ukraine.

When aussie and kiwi enter the same ring

Now, putting the aussie against the kiwi, the latter has been outperforming and may continue to do so if the market remains convinced that the RBNZ is not done raising rates, and especially in the extreme case they hike in February and signal that another one could be looming as the ANZ projected.

However, considering both the RBA and RBNZ implied paths, the risk of the RBNZ disappointing the market is bigger than the RBA. Therefore, should the RBNZ appear less hawkish than the market anticipates at its upcoming gathering, the pair aussi/kiwi pair may be poised to rebound.

As for China, the latest rebound in Chinese stocks due to the decision by regulatory authorities to step up efforts to stabilize the market is a positive for both currencies, but it’s a zero-sum game when they enter the same ring. That said, this is what may allow both to outperform their Canadian counterpart.

Technically, aussie/kiwi rebounded the last couple of days, after hitting support slightly below 1.0600. The pair returned above the 1.0620 key barrier which has been acting as the lower end of the sideways range that’s been containing most of the price action since February 24, which keeps the long-term picture neutral for now.

Another dip and a decisive close below 1.0620 may confirm that this time, the bears are willing to take the driver’s seat again and may allow extensions towards the low of December 2022 at around 1.0470. On the upside, a recovery above 1.0700 may signal that traders want to keep the pair range bound for a while longer.