- US inflation and retail sales data to take the spotlight as dollar slips

- UK jobs and GDP numbers coming up too amid recession woes

- Will markets hold their nerve before the looming central bank storm?

Will CPI report cause a sticky problem for the Fed?

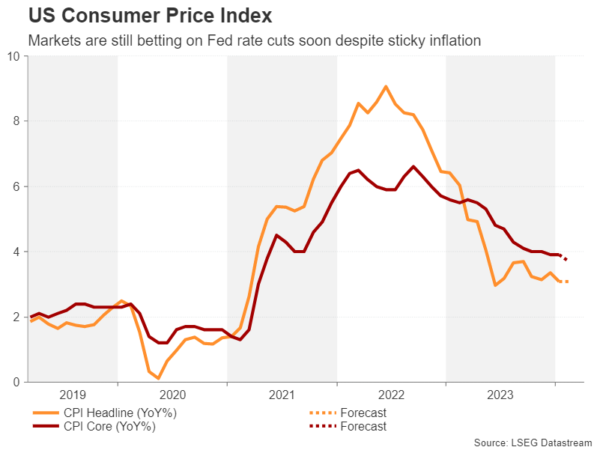

The US Federal Reserve doesn’t meet until March 20 for its next policy decision and with the jobs report out of the way, all eyes are now on the CPI numbers for February due Tuesday. There’s been good news and bad news on the inflation front in the US lately. The headline CPI rate has been stubbornly stuck above 3.0% with core CPI glued nearer the 4.0% level. There was some comfort from core PCE inflation, which fell to 2.8% y/y in January, although the six-month annualized measure of the same gauge edged up from 1.9% to 2.5% y/y.

Based on the forecasts, February’s readings of the consumer price index will probably be another mixed bag. The 12-month CPI rate is expected to have stayed unchanged at 3.1% on the back of a slight pick up in the month-on-month rate to 0.4%. However, there may be some relief from the core measure that excludes food and energy prices. It’s projected to have eased from 3.9% to 3.7% y/y.

The services component of CPI that excludes shelter costs will also be watched as it had ticked up to 3.6% in January, in a setback for the Fed, which wants to see this number come down. Thursday’s producer price index will be vital too before the March meeting.

Retail sales bounce eyed

Fed Chair Powell maintained caution over the inflation outlook when testifying before lawmakers in Capitol Hill this week. Whilst he signalled that rates will likely be cut later this year, his reluctance to be less vague about the possible timing suggests the Fed has some reservations about how fast inflation is falling.

That did not stop investors, though, from cheering at the prospect of a rate cut soon. The soft landing narrative whereby the US economy is slowing just enough for the Fed to ease policy but can still skirt a recession continues to underpin the risk-on sentiment in the markets.

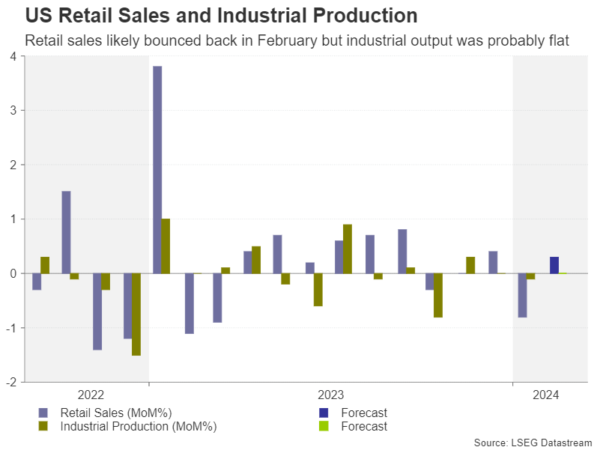

Growth went through a bit of a soft patch in January so some kind of a rebound in February is essential to sustaining this goldilocks scenario. And the latest retail sales figures are expected to do just that on Thursday. After plunging by 0.8% m/m in January, retail sales are forecast to have rebounded by 0.3% in February.

Dollar bulls hoping for hot CPI data

Other indicators on next week’s schedule include the Empire State manufacturing index, industrial production and the University of Michigan’s preliminary estimate of consumer sentiment in March, all due on Friday.

For the US dollar, the main risk is upside surprises in the CPI prints, which have the potential to cast doubt on a June rate hike that investors have pinned their hopes on. A hot CPI report would be damaging for risk assets but positive for the greenback, which badly needs a lift after being on the backfoot since mid-February. Aside from the data, a slew of bond auctions by the Treasury Department could also inject some volatility into bond, FX and equity markets.

Will UK GDP point to a rebound?

The pound will be in the limelight too over the coming week as labour market stats and the monthly GDP reading are on the UK agenda. Employment in the UK slumped last summer as the economy shrunk, but has been rising since October, with the jobless rate falling again to 3.8%. If Tuesday’s report points to a further improvement in the labour market in January, it would ease concerns about a sharp recession.

However, investors will probably not pay too much attention to the jobs numbers amid some reliability issues with the ONS surveys lately and the main focus will be on the wage growth figures. The Bank of England is unlikely to start cutting rates before it sees clear signs that wage pressures are cooling and although there’s been good progress – earnings growth excluding bonuses has declined from 7.9% to 6.2% y/y – there’s a long way to go still.

However, investors will probably not pay too much attention to the jobs numbers amid some reliability issues with the ONS surveys lately and the main focus will be on the wage growth figures. The Bank of England is unlikely to start cutting rates before it sees clear signs that wage pressures are cooling and although there’s been good progress – earnings growth excluding bonuses has declined from 7.9% to 6.2% y/y – there’s a long way to go still.

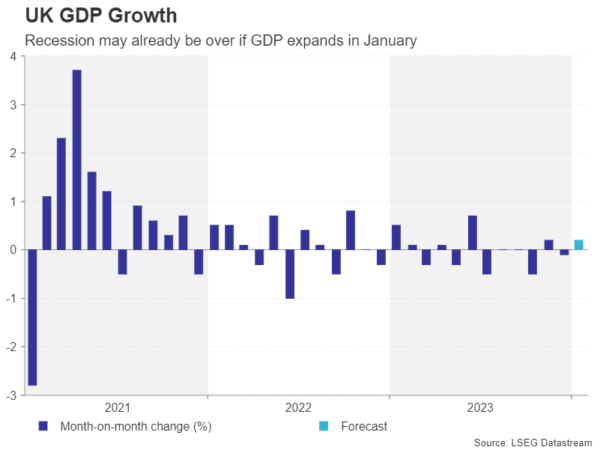

Sticky wage growth would make it difficult for policymakers to consider lowering rates even if the economy is struggling. The British economy is officially in a technical recession after GDP fell for two consecutive quarters in the second half of 2023. Output data for January are out on Wednesday and are expected to show GDP growing marginally by 0.2% m/m, potentially signalling the end of the recession. Industrial and manufacturing production figures will be released too.

The pound, which has been benefiting from the dollar’s pullback, could extend its recent advances should a stronger-than-expected set of data push up the market implied path for the BoE policy rate.

Drivers for the start of the week

Elsewhere, it will be an extremely quiet week ahead of the crucial central bank decisions from the Fed, Bank of Japan and Bank of England later in the month.

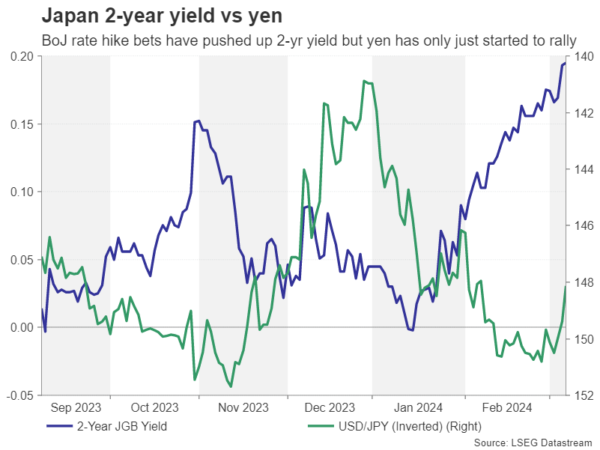

Speculation is mounting that the Bank of Japan could hike interest rates as soon as its March meeting so an upward revision to Japan’s Q4 GDP estimate on Monday could further bolster the yen against the dollar, having already rallied by almost 2% over the past week.

Meanwhile, Chinese price indicators released over the weekend could also boost sentiment at the start of the week. Consumer prices in China are expected to have risen by 0.4% y/y in February after plunging by 0.8% in January. However, producer prices are forecast to have remained in deflationary territory, amid a sluggish economic recovery.