Major US stock indices extended their losses from last Friday into today’s Asian session. Both S&P 500 and Nasdaq 100 E-mini futures dropped by 0.5% at the time of writing, weighed down by renewed tariff anxieties. US President Trump issued a surprise escalation, threatening the European Union with a 30% tariff—an increase from April’s proposed 20%, if no improved trade terms are reached before the 1 August deadline.

This move follows a series of aggressive tariff demand letters sent to US trading partners over the past week. Hopes for a preliminary US-EU trade deal were dashed after recent media reports hinted at progress, only for negotiations to hit fresh roadblocks. Germany’s DAX reflected this disappointment with a second straight loss of 0.8% last Friday.

Asia stocks resilient on strong China, Singapore data

Despite Trump’s latest tariff salvo, Asia Pacific stock markets remained broadly resilient, supported by upbeat economic data from China and Singapore.

Hong Kong’s Hang Seng Index posted a third consecutive gain, rising 0.4% intraday as it rebounded from its 20-day moving average, now acting as support near 24,050. Singapore’s Straits Times Index (STI), known for its defensive and dividend-yielding components, rallied 0.4%, approaching the psychological 4,100 level. It’s on track for a sixth consecutive record close. In contrast, Japan’s Nikkei 225 slipped 0.2%, while Australia’s ASX 200 remained flat.

China and Singapore surprise to the upside in key data

China’s June exports rose 5.8% year-on-year to US$325 billion, beating expectations (consensus: 5%). The growth was driven by manufacturers shifting focus to alternative markets amid the ongoing trade friction with the US. Notably, exports to 10 South Asian countries surged by 17% year-on-year.

Singapore also exceeded expectations. Its Q2 GDP grew by 1.4% quarter-on-quarter (seasonally adjusted), beating forecasts of 0.7%, and reversing Q1’s revised 0.5% contraction—helping the city-state avoid a technical recession.

Gold rebounds on safe-haven demand amid tariff tensions

Gold (XAU/USD) regained momentum last Friday, rallying 0.9% to a three-week high and moving back above its 20-day and 50-day moving averages. Safe-haven demand has resurfaced, particularly after gold’s recent underperformance relative to silver.

In today’s Asia session, the precious metal edged up another 0.1%, testing the key intermediate resistance at US$3,360. It briefly hit an intraday high of US$3,374. Technical signals remain constructive, and a daily close above US$3,360 could confirm a new bullish phase over the next several sessions.

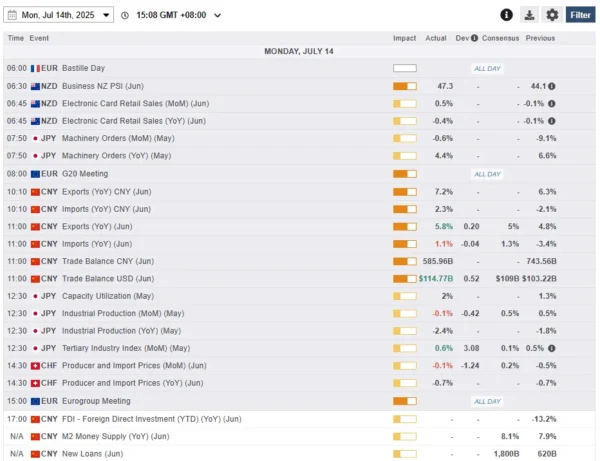

Economic data releases

Fig 1: Key data for today’s Asia mid-session (Source: MarketPulse)

Chart of the day – Gold (XAU/USD) looks set for a potential minor bullish breakout

Fig 2: Gold (XAU/USD) minor trend as of 14 July 2025 (Source: TradingView)

Recent price actions of Gold (XAU/USD) have managed to retest and stage a rebound from its medium-term ascending trendline in place since the 31 December 2024 low.

It has formed a minor “Double Bottom” bullish reversal configuration, taking into account the two swing lows of 30 June and 9 July. Right now, Gold (XAU/USD) is breaking above the US$3,360 intermediate neckline resistance of the minor “Double Bottom” configuration (see Fig 2)

In addition, the hourly RSI momentum indicator has continued to flash a bullish momentum condition. Watch the US$3,328 key short-term pivotal support (also the 50-day moving average) for the next intermediate resistances to come in at US$3,400 and US$3,450 in the first step.

On the other hand, a break below US$3,328 negates the bullish tone for another choppy minor corrective decline sequence to expose the next intermediate support at US$3,293/3,282.