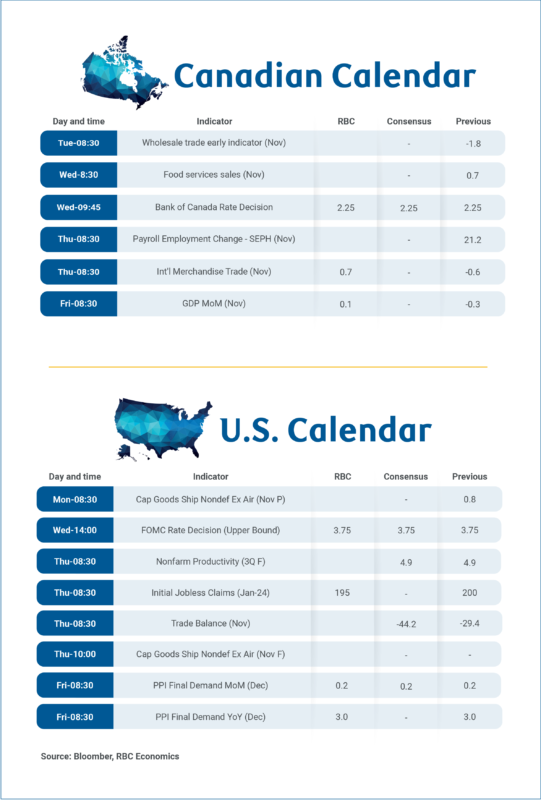

Canada’s economic calendar starts kicks off next week with the Bank of Canada’s first meeting of 2026 on Wednesday, where no change to the overnight rate is expected.

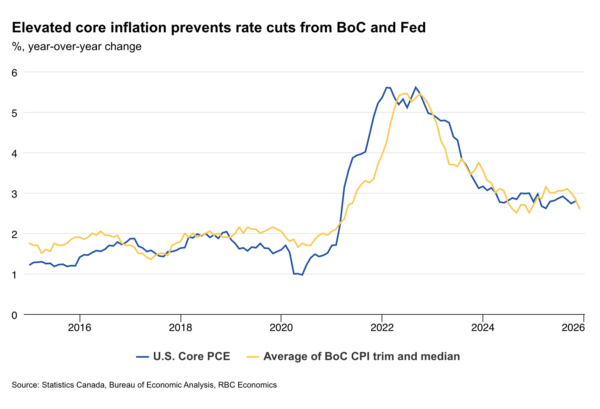

At December’s meeting, Governor Macklem reiterated the BoC’s holding bias, contingent on moderate growth and stabilizing inflation. Data since then have largely aligned with those expectations. December labour market conditions improved moderately from a quarter ago, and while core inflation decelerated in December, it remains above the 2% target.

The focus will be on the Monetary Policy Report and a new set of central projections. We don’t anticipate material revisions, and expect forecasts will continue to align well with our cautiously optimistic view for a gradual recovery in 2026. The BoC’s latest Business Outlook Survey showed a turnaround in business sentiment in late 2025, but a demand outlook still soft enough to constrain firms’ pricing ability.

Partial rebound in GDP after contraction

Canadian gross domestic product data for November on Friday is expected to be broadly consistent with that view. We expect a partial rebound of 0.1% growth (in line with Statistics Canada’s preliminary estimate) after October’s 0.3% contraction. The heavily trade exposed manufacturing sector remained under pressure. Added challenges include a global chip shortage that led to a plunge in auto manufacturing in November. Overall, manufacturing sales volume declined 2.3%.

On the plus side, education services likely bounced back in November following the end of the Alberta teachers’ strike. Postal disruptions that started in October extended into November, but a 32% drop in October postal services won’t likely be repeated. Finally, retail sales volume rose 1.1% in November.

U.S. Fed to keep rates steady despite pressure

The Federal Reserve is also widely expected to hold interest rates steady on Wednesday despite calls from the U.S. administration, and some FOMC members, for additional rate reductions. Signs of softening labour markets in the U.S. have prompted the Fed to cut at each of the last three meetings.

Going forward, the Fed will remain open to reducing interest rates further if necessary. But, GDP growth in the U.S. has been more resilient than expected, a tick lower in the unemployment rate in December reinforced the view that labour markets are cooling, not collapsing, and inflation is still running persistently above the central bank’s 2% objective.

Absent a sudden and substantial rise in the unemployment rate, we expect both the BoC and the Fed will remain on hold for the rest of this year.

Week ahead data watch:

- November’s international trade balance for Canada and the U.S. on Thursday will be closely watched for implications on Q4 2025 GDP growth, and for signs that U.S. effective tariff rates could be edging lower. Net trade is currently tracking a significant boost to GDP growth in both countries in Q4. U.S. customs duties collected fell consecutively in November and December, coinciding with an expanded list of products exempted from U.S. tariffs since mid-November. The impact on Canada will be marginal, as the new exemptions overlap with pre-existing CUSMA protections that already position Canada among the lowest tariff rates among major U.S. trading partners.