Sterling turned cautious as markets are now awaiting the result of UK Prime Minister Theresa May’s Cabinet meeting on Brexit. The withdrawal agreement text should have been agreed with the EU. Approval by the Cabinet will give the green-light to EU chief negotiator Michel Barnier to declare that “decisive progress” is made for a November EU summit. May would tell the House of Commons the results after the meeting. Meanwhile, Barnier will also make a statement. It could be rather volatile for the Sterling in the upcoming hours.

Though for now, the Pound is trading as the second weakest one, next to Swiss Franc. Yen is the third weakest, partly due to weak GDP data, and partly due to persistent fall in JGB yield. New Zealand Dollar is the strongest one for now, followed by Canadian Dollar. Some support is seen as WTI crude oil dipped to as low as 54.85 but recovers to 56.70 for now. But that support for the Loonie could be brief. Euro is indeed the third strongest at this point, despite weak Germany data and Italy budget jitters. Dollar reacts little to CPI release but will turn focus to Fed Chair Jerome Powell’s comments in the upcoming Asian session.

Technically, the forex markets are clearly in consolidation mode. For the Pound, break of 1.3741 resistance in GBP/USD and 149.70 in GBP/JPY are at least needed to prove its strength. Otherwise, we won’t believe the move. While Dollar trades lower since yesterday, there is limited selling. We’d look for Dollar buyers to come back, probably after UK May settles her Cabinet.

In other markets, major European indices are trading higher at this point. FTSE is up 0.56%, DAX is up 0.61% and CAC is up 0.45%. German 10 year yield drops -0.0053 to 0.408. Italy 10 year yield rises 0.398 to 3.487. That is, German-Italian spread remains above 300. Earlier in Asia, Nikkei closed up 0.16%. But Hong Kong HSI, China Shanghai SSE and Singapore Strait Times all closed down, by -0.54%, -0.85% and -0.34% respectively. Japan 10 year JGB yield drops -0.0077 to 0.108, below 0.11 now.

US CPI rose to 2.5%, but core CPI slowed to 2.1%

US headline CPI accelerated to 2.5% yoy in October, up from 2.3% yoy and matched expectations. However, core CPI slowed to 2.1% yoy, down from 2.2% yoy and missed expectation of 2.2% yoy.

BLS noted that gasoline was responsible for “over one-third” of the headline advances. On the other hand, food index “decline slightly”. For core CPI, ex-food and energy, medical care, household furnishing, motor insurance, tobacco all increased. But communications, new vehicles and recreation all declined.

UK CPI unchanged at 2.4%, core at 1.9%, Pound unmoved

UK Headline CPI was unchanged at 2.4% yoy in October, below expectation of 2.5% yoy. Core CPI was also unchanged at 1.9% yoy, below expectation of 2.0% yoy. RPI, too, was unchanged at 3.3% yoy, below expectation of 3.4% yoy.

ONS noted that the “large downward contributions to the change in the 12-month rate from food and non-alcoholic beverages, clothing and footwear, and some transport elements”. They were offset by “contributions from rising petrol, diesel and domestic gas prices.”

PPI input slowed to 10.0% yoy, down from 10.5% yoy, below expectation of 9.6% yoy. PPI output rose to 3.3% yoy, up from 3.1% yoy and beat expectation of 3.1% yoy. PPI output core was unchanged at 2.4% yoy, matched expectation.

Also from UK, house price index rose 3.5% yoy in September, accelerated from 3.1% yoy and beat expectation of 3.3% yoy.

German GDP contracted -0.2% qoq mainly due to foreign trade development

German GDP contracted -0.2% qoq in Q3, slightly better than expectation of -0.3% qoq. That’s also the first quarter-on-quarter decline since Q1 2015. But that’s a notable reversal from 0.5% qoq growth in Q2. The Federal Statistical Office noted that the slight decline in GDP was “mainly due to the development of foreign trade” as exports were down while imports were up in the quarter. “As regards domestic demand, there were mixed signals”.

Economy Ministry said in its monthly report that “the upturn was merely disrupted during the third quarter”. And, “once these special effects have dissipated, the German economy’s upturn will continue.”

Eurozone GDP rose 0.2% qoq in Q3, unrevised from preliminary reading. Industrial production dropped -0.3% mom in September versus expectation of -0.4% mom.

Italy to cut debt to 129.2% of GDP in 2019 to address EU concern

According to the new draft budget plan (DBP) submitted by Italy to the European commission, growth forecasts are held unchanged at 1.5% in 2019, 1.6% in 2020 and 1.4% in 2021. These are widely seen as overly optimistic as European Commission forecasts only 1.2% growth in 2019. The IMF projects only 1.0% growth in Italy in the same year. The budget deficit target was also held at 2.4% of GDP in 2012. Among that, Italy planned to raise its structural deficit by 0.8% of GDP. This is clearly a violation of EU’s demand to cut by -0.6%.

However, the new draft showed fall debt as Italy planned to use funds equal to 1% of GDP from privatization. This is seen as an act to address EU’s major concern on ballooning debt. Public debt is now estimated to fall to 129.2% of GDP in 2019, then further to 127.3% in 2020, and then 126.0% in 2021. Italy’s debt stands at 130.9% this year.

The new DBP now risk triggering the Commission’s penalty process. But Italian Deputy Prime Minister Matteo Salvini warned that “they’ve got it wrong if they are even just thinking of imposing fines on the Italian people.” Economy Minister Giovanni Tria also insisted that fiscal expansion is necessary for the country.

ECB Knot: It’s pertinent that Italy complies with EU budget rules

ECB Governing Council member Klaas Knot said today that “it’s quite pertinent that Italy actually complies with the rules” of EU on budget. Or, he warned that “if it doesn’t, the result is that spread will go up.”

For now, Knot saw limited contagion from rising Italian yields. He added “we’re not seeing an overall deterioration in credit conditions, we’re not seeing an overall deterioration in financial conditions”. And, “those would have to be the kind of things that we would first have to see before could contemplate changing our course of action.”

Japan GDP contracted -0.3% qoq, exports contracted at fastest pace in over three years

Japan GDP contracted -0.3% qoq in Q3, matched expectation. Annualized rate showed -1.2% contraction, worse than expectation of -1.0%. GDP deflator dropped -0.3%, lowest than expectation of -0.2%. One detail to note is that exports contracted -1.8% qoq, fastest decline in over three years. It seems that the contraction in Q3 cannot be explained only by natural disasters. But the steep contraction in exports argued that US related trade tensions was also weighing on the economy of Japan. Though, it will take another quarter or two to really gauge the impact from protectionism.

Japan Economy Toshimitsu Motegi sounded confident and optimistic though. He said that “Japan’s economy is expected to recover driven mainly by domestic demand. Though he also warned that “we need to be vigilant to the impact of overseas uncertainties, financial market volatility and how trade problems affect the global economy.”

Also from Japan, tertiary industry index dropped -1.1% mom in September versus expectation of -0.4% mom. Industrial production dropped -0.4% mom versus expectation of -1.1% mom.

Latest set of data from China showed mixed picture

The latest set of macroeconomic data in China was mixed. Retail sales grew 8.6% yoy in October, weaker than consensus of, and September’s 9.2%. Growth in industrial production and urban fixed asset investment improved. For the former, growth picked up to 5.9% yoy, from 5.8% in September. For the latter, growth accelerated to 5.7% in the first 10 months of the year, compared with 5.4% in the first 9 months.

China’s economic policy has been torn between huge debt and slowing growth. The dilemma has been aggravated since Trump imposed the first trade tariff in July. The Chinese government has shifted its policy focus from deleveraging (credit tightening) to growth stimulation. We expect monetary and fiscal easing would be the key in China. With inflation eased, this should clear the hurdle for PBOC to loosen its monetary policy.

More in China’s October Data Encourage More Easing From Government

GBP/USD Mid-Day Outlook

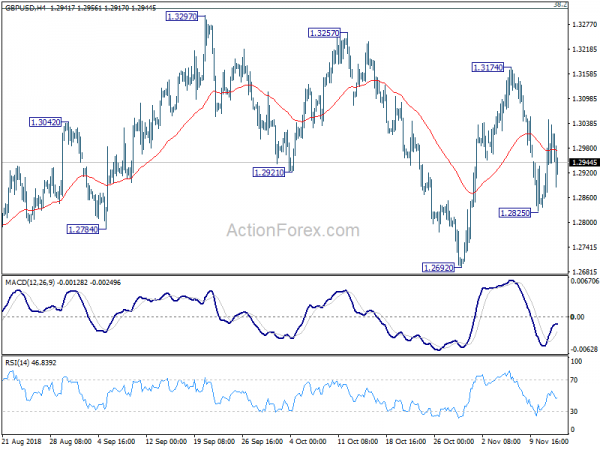

Daily Pivots: (S1) 1.2857; (P) 1.2952; (R1) 1.3063; More…

Intraday bias in GBP/USD remains neutral at this point. Overall outlook is unchanged that price actions from 1.2661 are viewed as a consolidation pattern. In case of stronger rise, strong resistance should be seen at 1.3316 fibonacci level to limit upside to bring down trend resumption eventually. On the downside, below 1.2825 will resume the fall from 1.3174 to 1.2661/92 key support zone. Decisive break there will resume larger down trend from 1.4376.

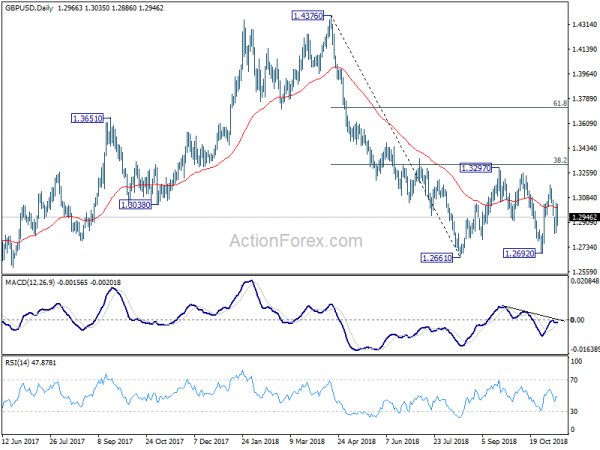

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | 2.80% | 1.00% | ||

| 23:50 | JPY | GDP Q/Q Q3 P | -0.30% | -0.30% | 0.70% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | -0.30% | -0.20% | 0.10% | 0.00% |

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 0.60% | 0.60% | 0.60% | 0.50% |

| 02:00 | CNY | Retail Sales Y/Y Oct | 8.60% | 9.20% | 9.20% | |

| 02:00 | CNY | Industrial Production Y/Y Oct | 5.90% | 5.80% | 5.80% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Oct | 5.70% | 5.50% | 5.40% | |

| 04:30 | JPY | Tertiary Industry Index M/M Sep | -1.10% | -0.40% | 0.50% | 0.40% |

| 04:30 | JPY | Industrial Production M/M Sep F | -0.40% | -1.10% | -1.10% | |

| 07:00 | EUR | German GDP Q/Q Q3 P | -0.20% | -0.30% | 0.50% | |

| 09:30 | GBP | CPI M/M Oct | 0.10% | 0.20% | 0.10% | |

| 09:30 | GBP | CPI Y/Y Oct | 2.40% | 2.50% | 2.40% | |

| 09:30 | GBP | Core CPI Y/Y Oct | 1.90% | 2.00% | 1.90% | |

| 09:30 | GBP | RPI M/M Oct | 0.10% | 0.20% | 0.00% | |

| 09:30 | GBP | RPI Y/Y Oct | 3.30% | 3.40% | 3.30% | |

| 09:30 | GBP | PPI Input M/M Oct | 0.60% | 0.60% | 1.30% | 1.40% |

| 09:30 | GBP | PPI Input Y/Y Oct | 10.00% | 9.60% | 10.30% | 10.50% |

| 09:30 | GBP | PPI Output M/M Oct | 0.30% | 0.20% | 0.40% | |

| 09:30 | GBP | PPI Output Y/Y Oct | 3.30% | 3.10% | 3.10% | |

| 09:30 | GBP | PPI Output Core M/M Oct | 0.30% | 0.20% | 0.10% | |

| 09:30 | GBP | PPI Output Core Y/Y Oct | 2.40% | 2.40% | 2.40% | |

| 09:30 | GBP | House Price Index Y/Y Sep | 3.50% | 3.30% | 3.20% | 3.10% |

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | -0.30% | -0.40% | 1.00% | 1.10% |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.20% | 0.20% | 0.20% | |

| 13:30 | USD | CPI M/M Oct | 0.30% | 0.20% | 0.10% | |

| 13:30 | USD | CPI Y/Y Oct | 2.50% | 2.50% | 2.30% | |

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | CPI Core Y/Y Oct | 2.10% | 2.20% | 2.20% |