Yen is making a strong come back today and surges broadly. Investors are clearly unhappy with the lack of concrete progress with US-China trade negotiations. Sterling follows as the second strongest but it’s just recovering some of this week’s losses. Never-ending Brexit uncertainty is weighing on the Pound. Dollar regains much strong and is the third strongest for today. Australian Dollar and New Zealand Dollar are the weakest ones.

For the week, New Zealand Dollar is so far still the strongest one, rather resilient, as supported by RBNZ. Dollar takes up the second place from Aussie and the latter’s strengthen is fading quickly. Sterling remains the weakest one for the week, followed by Swiss Franc and then Yen. The is prospect for Franc and Yen to end higher should risk sentiments deteriorate further before weekly close.

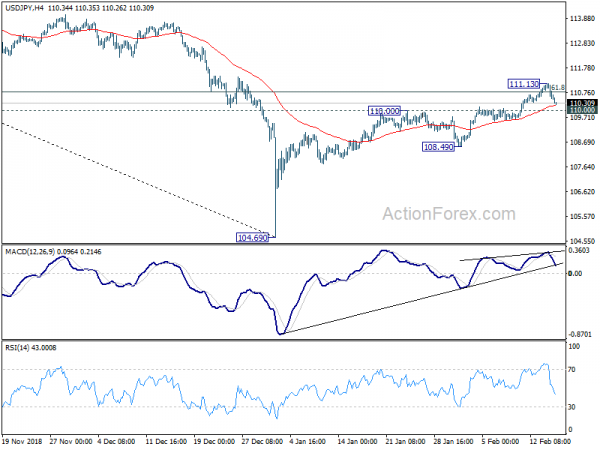

Technically, Yen crosses are worth a watch today. USD/JPY is heading back to 110.00 resistance turned support. Break will be a strong indication on near term bearish reversal. Meanwhile, EUR/JPY will eye 24.17 support. GBP/JPY is also heading back to 140.62 support. Break of these two levels could prompt more broad based buying in Yen.

In other markets, Nikkei closed down -1.13%. Hong Kong HSI dropped -2.03%. China Shanghai SSE dropped -1.37%. Singapore Strait Times is currently down -0.68%. Japan 10-year JGB yield is down -0.009 at -0.02, staying negative.

US-China trade talks set to conclude without substantial progress

US-China trade talks look set to conclude without substantial progress. US Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer didn’t comment on the discussions as the final day of close-door session starts today. But it’s reported that both sides are still far apart on the core issues, which would need a meeting between Trump and Xi to make the agreement.

Subsidies on State-Owned Enterprises that create unfair competition is one of the deadlocks as it’s considered fundamental policy of the Chinese government that couldn’t be touched. Reuters reported that China has pledged to adjust the industrial subsidy program to comply with WTO rules. But without any details, the US side, rightfully, is skeptical on enforcement of Chinese government’s promises.

White House economic adviser Larry Kudlow fold fox news that “the vibe in Beijing is good.” And, “negotiators in Beijing “are soldiering on”. Kudlow also said meeting with Chinese President Xi on Friday is “a very good sign” and the US delegation is “getting the job done”. Kudlow was “cautiously optimistic” on the outcome. Meanwhile, there is no decision on the trade truce by 60-days yet. But as we argued before, extending the period while keeping the current tariffs is just prolonging the damage to the economies.

Trump to declare national emergency and sign the shutdown averting bill

White House spokesperson Sarah Sanders confirmed that Trump will sign the bill that avert another government shut down. However, as the bill doesn’t include the full sum of the funding that Trump demands for the border wall, he’s going to declare national emergency.

Sanders said “President Trump will sign the government funding bill, and as he has stated before, he will also take other executive action – including a national emergency.”

Top Democrat in the Congress, House of Representatives Speaker Nancy Pelosi said she might file a legal challenge to Trump’s action and “that’s an option”. Senate Democrat leader Chuck Schumer also criticized Trump of a “gross abuse of the power of the presidency.”

Fed Brainard: Downside risks have definitely increased and gathering

Fed Governor Lael Brainard warned yesterday that “downside risks have definitely increased relative to that modal outlook for continued solid growth.” She added that back in December, she “had already noted that crosscurrents were increasing and that tailwinds were dying down, and I think that is even more true today because of those downside risks that are gathering.”

Brainard pointed to external risks including China’s economy, US-China trade conflicts and Brexit. And, “We are a very international economy… Our financial system in particular has shown itself to be very responsive to earnings abroad, to financial conditions and volatility abroad. So, yeah, I’m very attentive to the international outlook.”

Domestically, she believed that momentum has been “pretty solid”. But today’s retail sales numbers “caught my eye”. Though she “didn’t want to make too much” of one month’s numbers.

On monetary policy, she’s “comfortable waiting and learning” and the current policy is “in a good place”. And, she would weigh “what move, if any, later in the year”. Meanwhile, she added that the “balance sheet normalization process should probably come to an end later this year”.

RBA Kent: Markets expect next RBA move to be down than up

RBA Assistance Governor Christopher Kent delivered a speech on “Financial Conditions and the Australian Dollar – Recent Developments” today. There he acknowledged that developments in Australian financial markets have been similar to those offshore, with falling equity prices, rising credit spreads and increased volatility. Such development is “a story of risk premia increasing from low levels and were associated with rising concerns about downside risks, both internationally and domestically.”

The outlook for domestic economy has “also shifted” with downward revision in both growth and inflation forecasts. And market expectations for the next move in cash rate have “switched signs too”. Kent noted that “markets have assessed that the next move is more likely to be down than up.”. And that’s reflected in lower bond yields.

Fall in Australian bond yields is “likely to have contributed somewhat to the modest depreciation of the Australian Dollar of late”. On the other hand, “higher commodity prices appear to have worked to limit the extent of Australian dollar depreciation”.

On the data front

New Zealand BusinessNZ manufacturing PMI dropped to 53.1 in January, down from 54.8. China CPI slowed to 1.7% yoy in January, PPI slowed to just 0.1% yoy. Japan industrial production was finalized at -0.1% mom in December.

Looking ahead, UK retail sales will be the major focus in European session. Eurozone will release trade balance. Later in the day, Canada will release international securities transactions. US will release Empire State manufacturing, import price index, industrial production and U of Michigan consumer sentiment.

USD/JPY Daily Outlook

Daily Pivots: (S1) 110.26; (P) 110.69; (R1) 110.92; More…

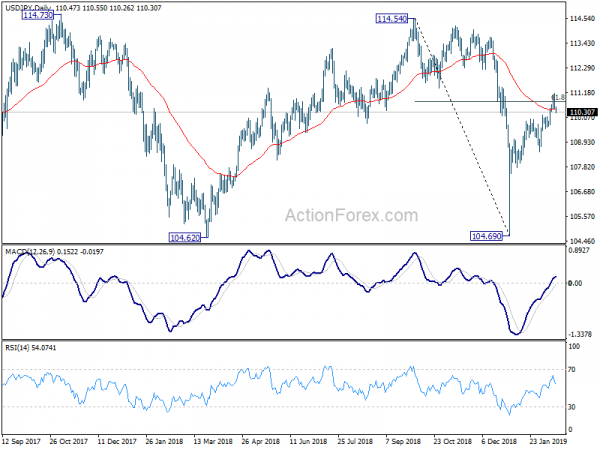

USD/JPY’s decline from 111.13 extends today but stays above 110.00 resistance turned support. Intraday bias remains neutral first. At this point, focus remains on whether USD/JPY could sustain above 61.8% retracement of 114.54 to 104.69 at 110.77. If yes, further rise could be seen back to 114.54 resistance. However, break of 110.00 will suggest that it’s actually rejected after the rebound from 104.69 was skewed slightly upwards. In that case, the original bearish view will be revived and further fall should be seen through 108.49 support.

In the bigger picture, the stronger than expected rebound from 104.69 mixed up outlook. We’d turn neutral for now first. On the upside, firm break of 110.77 resistance will suggest that fall from 114.54 has completed at 104.69 already. Such decline is seen as a leg in the corrective pattern from 118.65, which might be finished too. Decisive break of 114.54 will confirm this case and target 118.65 and above. On the downside, break of 108.49 support will turn focus back to 104.62/9 support zone instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing PMI Jan | 53.1 | 55.1 | 54.8 | |

| 1:30 | CNY | CPI Y/Y Jan | 1.70% | 1.90% | ||

| 1:30 | CNY | PPI Y/Y Jan | 0.10% | 0.90% | ||

| 4:30 | JPY | Industrial Production M/M Dec F | -0.10% | -0.10% | -0.10% | |

| 9:30 | GBP | Retail Sales Ex Auto Fuel M/M Jan | 0.20% | -1.30% | ||

| 9:30 | GBP | Retail Sales Ex Auto Fuel Y/Y Jan | 3.10% | 2.60% | ||

| 9:30 | GBP | Retail Sales Inc Auto Fuel M/M Jan | 0.20% | -0.90% | ||

| 9:30 | GBP | Retail Sales Inc Auto Fuel Y/Y Jan | 3.40% | 3.00% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | 16.4B | 15.1B | ||

| 13:30 | CAD | International Securities Transactions (CAD) Dec | 9.45B | |||

| 13:30 | USD | Empire State Manufacturing Feb | 7.6 | 3.9 | ||

| 13:30 | USD | Import Price Index M/M Jan | -0.10% | -1.00% | ||

| 14:15 | USD | Industrial Production M/M Jan | 0.10% | 0.30% | ||

| 14:15 | USD | Capacity Utilization Jan | 78.70% | 78.70% | ||

| 15:00 | USD | U. of Mich. Sentiment Feb P | 93.9 | 91.2 | ||

| 21:00 | USD | Net Long-term TIC Flows Dec | 37.6B |