Yen remains the weakest one as another week starts with solid risk appetite. Sentiments towards US-China trade negotiation turned optimistic again after positive statements from both sides. Trump also hailed there were “big progress” during last week’s meetings in Beijing. More talks are scheduled this week in Washington to work out a memorandum of understand. It remains to be seen whether there will finally be something with substance, or it would turn out to be another cosmetic agreement. Risk appetite is lifted anyway.

In the currency market, Dollar follows Yen as the second weakest. However, Canadian Dollar and Australian Dollar receive no boost and are trading just next to Dollar. New Zealand Dollar, on the other hand, decouples from other commodity currencies as the strongest one for today so far. Euro follows as the second strongest and then Sterling.

Technically, Dollar is staying above near term support levels against other major currencies. Current retreat is seen as a corrective pull back only and more upside is in favor. The levels include 1.341 resistance in EUR/USD, 1.2958 resistance in GBP/USD, 0.9988 support in USD/CHF, 110.00 support in USD/JPY and 1.3196 support in USD/CAD.

In other markets, Nikkei close up 1.8%. Hong Kong HSI is up 1.73%. China Shanghai SSE is up 2.34%. Singapore Strait Times is up 0.81%. Japan 10-year JGB yield is up 0.003 at -0.018, staying negative.

WH adviser Pillsbury: Trump is giving China one last chance

Michael Pillsbury, a leading adviser to Trump on China issues, told Fox that Trump is “essentially giving the Chinese one last chance next week, and then perhaps … a short extension”, referring to the next round of trade negotiation in Washington this week. He pointed out, “notice how the president always refers to the tariffs as bringing in revenue, billions of dollars of revenue to us,” and “so he is not somebody who’s anti-tariff.”

Pillsbury also said “this coming week’s going to be awfully important, when the Chinese come here at the working level.” And, “We’re going to try to find out, I think, what will be in this memorandum of understanding,” he said, “whether it will “have enforcement and time limits and … be tough” or just “be a cosmetic agreement.”

Trump on the weekend tweeted “Important meetings and calls on China Trade Deal, and more, today with my staff. Big progress being made on soooo many different fronts! Our Country has such fantastic potential for future growth and greatness on an even higher level!”

Chinese delegation with travel to the US this week to work towards a memorandum of understanding, which should form the framework of a trade agreement, to be finalized through a Trump-Xi summit.

Auto tariff report submitted, 90 days for Trump to act

The US Commerce Department met the Sunday deadline and submitted its investigation report on imported cars and auto parts to the White House. The Section 232 is about national security threats from those auto imports. A Commerce Department spokesperson said it would not disclose any details of the report. Trump has 90 days to make a decision on whether to act up the recommendations, which could include some tariffs on fully assembled vehicles or on technologies and components related to electric, automated, connected and shared vehicles.

German Chancellor Angela Merkel said in the Munich Security Conference that “we are proud of our cars and so we should be.” She added that “if that is viewed as a security threat to the United States, then we are shocked”. German car lobby VDA said the countries car industry has created more than 113k jobs in the US in recent years, with around 300 factories. German car companies were the largest car exporters from the US. And VDA said “all this strengthens the USA and is not a security problem.”

Canada Freeland: Time to remove Section 232 tariffs with USMCA concluded

Canadian Foreign Minister Chrystia Freeland attended the Munich Security Conference over the weekend. There she also met US House Speaker Navy Pelosi and urged to remove the steel and aluminum tariffs. Freeland noted that Canada is now in the process of domestic ratification of the so called USMAC, US-Mexico-Canada agreement on trade. And Canada’s position remains strongly opposed to the section 232 steel tariffs. She also told reporters that “the Canada position is now that we have concluded (USMCA) that is all the more reason why the tariffs must be lifted.”

Separately at the conference, Freeland also urged to reinforce “rules-based international order”. And she proposed to bring together specific coalitions around specific issues.”

ECB de Galhau: The key question is if slowdown is temporary or more durable

ECB Governing Council member Francois Villeroy de Galhau said in a El Pais newspaper interview over the weekend that the central bank will scrutinize incoming data to decide whether to hike after this summer.

He said “the key question will be if the slowdown is temporary — with a bounce-back during this year — or more durable.” For now, there is resilient domestic demand in Germany, France and Spain. And that kept recession risk low even though outlook was clouded by protectionism and Brexit.

And de Galhau also noted that there was strong convergence of views within ECB about the sequencing of the next policy steps, as well as the flexibility about timing.

ECB Rehn: Have to wait and see how long slowdown lasts

Another ECB Governing Council member Olli Rehn told German newspaper Handelsblatt that “the most recent data point to a weakening of the economy.” And, the reasons for the slowdown mainly lie abroad, including US-China trade conflicts. Though, there were also uncertainties over Brexit, yellow vest protest in France, fiscal issues in Italy and slower industrial production in Germany.

But Rehn also noted that ECB’s monetary policy orientation is clear and unchanged. He added, “we have said that rates will be at their current level until we have sustainably reached our monetary policy goal.” For now, wage growth had not had much impact on core inflation yet even though “at the end of last year it looked as if there would be stronger momentum in inflation.”. And, “we have to wait and see how long the period of weaker growth will last.”

Central bankers and growth outlook to dominate

In addition to US-China trade talks and Brexit, growth outlook and central bankers views will be the major focuses this week. Fed’s “patience” turn in January meeting was much of a surprise to the markets. However, despite of a downgrade, the median projection of federal funds rates by the end of 2019 was still at 2.9%, as seen in the projections. That is, there could be two more rate hikes. That’s apparently very different from recent comments from Fed officials, which indicate one hike at most, probably none at all. So, the minutes will be scrutinized for more hints on what the officials are actually thinking. A number of Fed officials will also speech this week, including John Williams, Richard Clarida and Randal Quarles. Durable goods orders and PMIs from US will also be watched for hints on growth outlook.

ECB will also release January monetary policy accounts. At the meeting, ECB turned more dovish and noted that “the risks surrounding the Euro area growth outlook have moved to the downside”. That’s the first time since April 2017 that the central bank admitted that risks are to the downside. And investors will be keen to know more about how much do the downside that is. ECB President Mario Draghi and Chief Economist Peter Praet will speak this week too. Eurozone will also release German ZEW and Ifo as well as PMIs, which will provide more hints on growth outlook ahead, and probably recession risks too.

RBA will also release February meeting minutes. The most important change in the monetary policy statement is that RBA noted that the chance for a hike or cut as next move is now roughly balanced. The minutes might provide more information on the chances. RBA Governor Philip Lowe would also face a lot of questions regarding the economy at the parliamentary testimony. Australian Dollar will also face important data including wage price, and employment.

Here are some highlights for the week:

- Monday: Japan machine orders, UK Rightmove house price

- Tuesday: RBA minutes; Swiss trade balance; Eurozone current account, German ZEW; UK employment; US NAHB housing index

- Wednesday: New Zealand PPI; Japan trade balance; Australia wage price; German PPI; FOMC minutes

- Thursday: Australia PMIs, employment; Japan PMI manufacturing, all industry index; German CPI final; Eurozone PMIs; UK public sector net borrowing; ECB accounts; Canada wholesale sales; US durable goods, Philly Fed survey, jobless claims, PMIs, leading index, existing home sales

- Friday: German GDP final, Ifo; Eurozone CPI final; Canada retail sales;

USD/JPY Daily Outlook

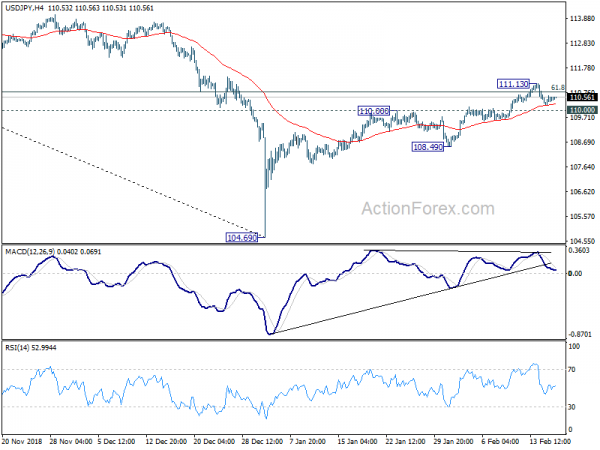

Daily Pivots: (S1) 110.26; (P) 110.46; (R1) 110.66; More…

Intraday bias in USD/JPY remains neutral at this point. On the downside, break of 110.00 resistance turned support will suggest rejection by 110.77 and the rebound from 104.69 has likely completed. Intraday bias will be turned back to the downside for 108.49 support for confirmation. Nevertheless, break of 111.13 should confirm resumption of rise from 104.69 for 114.54 resistance.

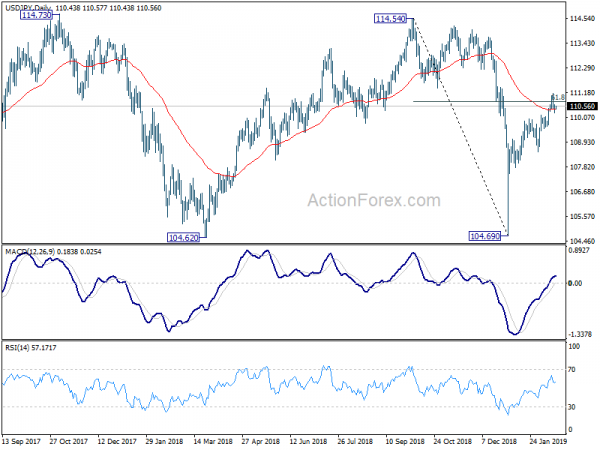

In the bigger picture, while the rebound from 104.69 was stronger than expected, it couldn’t sustain above 55 day EMA yet. Outlook is turned mixed first. On the downside, break of 108.49 support will revive that case that such rebound was a correction. And, larger down trend is still in progress for another low below 104.62. But sustained trading above 55 day EMA will turn focus to 114.54. Decisive break there will confirmation completion of the decline from 118.65 (2016 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machine Orders M/M Dec | -0.10% | -1.10% | 0.00% | |

| 00:01 | GBP | Rightmove House Prices M/M Feb | 0.70% | 0.40% |