Asian markets are mixed today despite selloff in US overnight. Investors are generally non-committal, probably waiting for more concrete developments regarding US-China trade negotiations and Brexit. Though, the decline in US treasury yields is worth a note as 10-year yield closed back below 2.7 handle at 2.692. It remains to be seen if last week’s strong rise was a false dawn as more evidence of global slowdown surfaced. Non-farm payroll report, with wage growth, on Friday would probably firm up the tone in Dollar, yields and US stocks.

But for now, focus will turn to ECB meeting first. Euro is generally soft today as markets are expecting downgrade of economic outlook from the central bank. But Canadian Dollar is the worst performing one after BoC took rate hike off the table for now yesterday. Dollar is also soft for today on weakness in yields. On the other hand, Australian Dollar is regaining some ground after strong trade balance data.

Technically, yesterday’s strong rally solidifies USD/CAD near term bullish momentum for 1.3664 resistance. Dollar lost some momentum again against Euro and Swiss Franc. But with 1.1345 minor in EUR/USD and 0.9997 minor resistance in USD/CHF intact, more upside is mildly in favor in the greenback. Though, USD/JPY’s retreat from 112.13 looks basically corrective. Similarly, EUR/JPY and GBP/JPY are also engaging in corrective retreat. In other words, Yen will likely suffer renewed selloff after the corrective recovery completes. It’s just a matter of time.

In other markets, Nikkei is currently down -0.79%. Hong Kong HSI is down -0.46%. China Shanghai SSE is down -0.02%. Singapore Strait Times is up 0.26%. Japan 10-year JGB yield is down -0.0001 at -0.004. Overnight, DOW dropped -0.52%. S&P 500 dropped -0.65%. NASDAQ dropped -0.93%. 10-year yield dropped -0.030 to 2.692, back below 2.7 handle.

US-China trade talks going well, getting words down on contract

Ted McKinney, Undersecretary for Trade and Foreign Agriculture Services, said US-China trade talks are going well. And, “presently there’s a lot of discussions going on by digital video conference, also a very good and productive thing”. Meanwhile, there’s just a lot of work in getting words down … a contract or agreement, and that’s the current status”.

Trump said in the Oval Office that trade negotiations with China are “moving along well”, “very nicely”. But he added that “there would either be “a good deal or it’s not going to be a deal”.

Fed Beige Book: Government shutdown led to slower economic activity

In the Beige Book economic report, Fed noted that “economic activity continued to expand in late January and February”. 10 out of 12 districts reported “slight-to-moderate” growth, except Philadelphia and St. Louis, which were flat.

About half of districts said “government shutdown had led to slower economic activity in some sectors”, including retail, auto sales, tourism, real estate, restaurants, manufacturing, and staffing services.” Numerous manufacturing contacts expressed concerns on ” weakening global demand, higher costs due to tariffs, and ongoing trade policy uncertainty”.

Employment increased in most districts, with “modest-to-moderate” gains in a majority. Wages continued to increased, with a majority reported “moderately higher wages”. Price continued to increased at a “modest-to-moderate pace”. A few districts reported “upward price pressures from tariffs”. But several districts noted that steel prices had “stabilized or fallen recently”.

BoC turned cautious, rate hike off the table for now

Canadian Dollar dived sharply overnight after BoC kept interest rate unchanged at 1.75% and turned more cautious. A rate hike should be at least off the table temporarily. The most important change in the statement is in the last paragraph. BoC now said the outlook “continues to warrant a policy interest that is below its neutral range”. And, given the mixed data, “it will take time to gauge the persistence of below-potential growth and the implications for the inflation outlook”. Also, with “increased uncertainty” about timing of future hikes, BoC will closely watch developments in household spending, oil and trade.

More on BoC:

- CAD Drops as BOC Drops Hawkish Bias

- Bank of Canada Holds; We May Be Here a While

- Bank of Canada Strikes Cautious Tone; Keeps Rate Unchanged

- USD/CAD – CAD Weaker on BoC Dovish Stance

- (BOC) Bank of Canada maintains overnight rate target at 1 ¾ per cent

EU officials pessimistic on Brexit breakthrough this week

It’s less than a week from March 12 when another meaningful vote on Brexit deal could be held in the UK Parliament. But Bloomberg reported that positions on both sides are hardening rather than converging. Both the UK and EU are counting on the other to back down. EU officials are pessimistic about the chance of any breakthrough this week.

In particular, unnamed EU officials described the talks with UK Attorney General Geoffrey Cox earlier this week as some of the worst-tempered of the two-year process. Meanwhile, what Cox requested, independent arbitration of the contentious Irish backstop arrangement outside of European Court of Justice, was seen as unacceptable for the EU.

Australia recorded second largest trade surplus in Jan, but retail sales missed

Australia trade surplus widened to AUD 4.55B in January, up from AUD 3.77B and beat expectation of AUD 2.90B. That’s also the second largest surplus on record. Exports rose 5% to AUD 1.90B while imports rose 3% to AUD 1.12B.

However, retail sales was disappointing. Sales grew merely 0.1% mom in January, rebounding from -0.4% decline in prior month, but missed expectation of 0.3% mom.

Also from Australia, AiG Performance of Construction index rose 0.7 to 43.8 in February, indicating a slower rate of contraction.

ECB Previews: Growth and inflation projection downgrade expected, maybe forward guidance too

ECB rate decision and press conference will be the major focus today. No change in monetary policy is expected. The key interest rate should be held at 0.00%, with marginal lending facility rate at 0.25% and deposit facility rate at -0.40% respectively.

Since Q4 last year, economic outlook in Eurozone deteriorated and data released since January revealed little improvements. OECD downgraded Eurozone growth forecasts sharply lower from 1.8% in 2019 to just 1.0%. Most notably, Germany growth forecast was downgraded from 1.6% to just 0.7% in 2019. Italy is projected to contract -0.2% in 2019, revised down from 0.9% growth. There is a large chance for ECB to revised down both growth and inflation forecasts in the new staff projections to be published today.

On forward guidance, ECB adopted the stance that interest rates will remain at present level “at least through the summer of 2019”. There is a chance for ECB to extend the duration to at least “through the end of 2019” without losing flexibility nor precision. It’s good timing to do so with new economic projections. On new TLTROs, comments from ECB officials appear to suggests that they’re still in discussion. thus, it’s unlikely to have any formal announcement today.

More previews on ECB:

- ECB Preview – Downgrades in Forecasts, Changes in Forward Guidance and Hints on New Lending

- ECB Meeting: Acknowledging Weakness, Hinting at TLTROs?

- ECB Preview: The Loan Time Is Running Out (TLTRO)

- No Major Changes Likely to ECB’s Rate Guidance

On the data front

Swiss will release unemployment rate and foreign currency reserves. Eurozone will release Q4 GDP final and employment. Canada will release building permits. US will release jobless claims and non-farm productivity final.

EUR/USD Daily Outlook

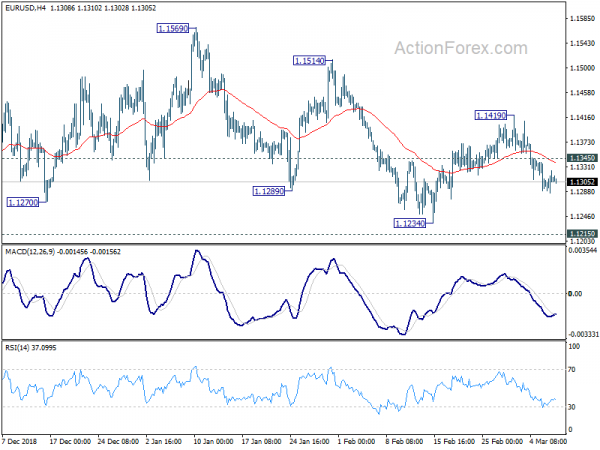

Daily Pivots: (S1) 1.1285; (P) 1.1307; (R1) 1.1327; More…..

EUR/USD is losing some downside momentum as seen in 4 hour MACD. But with 1.1345 minor resistance intact, further decline is still expected for 1.1215 low. Decisive break there will resume larger down trend from 1.2555. On the upside, above 1.1345 minor resistance will turn bias to the upside for 1.1419 resistance to extend the consolidation from 1.1215.

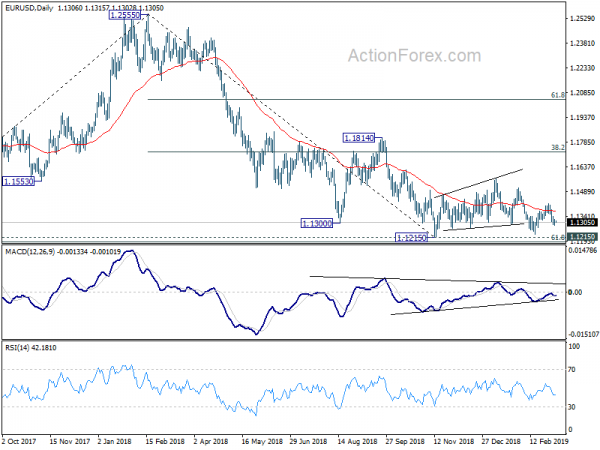

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Feb | 43.8 | 43.1 | ||

| 00:30 | AUD | Trade Balance (AUD) Jan | 4.55B | 2.90B | 3.68B | 3.77B |

| 00:30 | AUD | Retail Sales M/M Jan | 0.10% | 0.30% | -0.40% | |

| 05:00 | JPY | Leading Index CI Jan P | 96 | 97.5 | ||

| 06:45 | CHF | Unemployment Rate Feb | 2.40% | 2.40% | ||

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 741B | |||

| 10:00 | EUR | Eurozone Employment Q/Q Q4 F | 0.30% | 0.30% | ||

| 10:00 | EUR | Eurozone Employment Y/Y Q4 F | 1.20% | 1.20% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 F | 0.20% | 0.20% | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | 18.70% | |||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | Building Permits M/M Jan | -1.50% | 6.00% | ||

| 13:30 | USD | Initial Jobless Claims (MAR 02) | 225K | 225K | ||

| 13:30 | USD | Nonfarm Productivity Q4 F | 1.60% | 2.30% | ||

| 13:30 | USD | Unit Labor Costs Q4 F | 1.70% | 0.90% | ||

| 15:30 | USD | Natural Gas Storage | -166B |