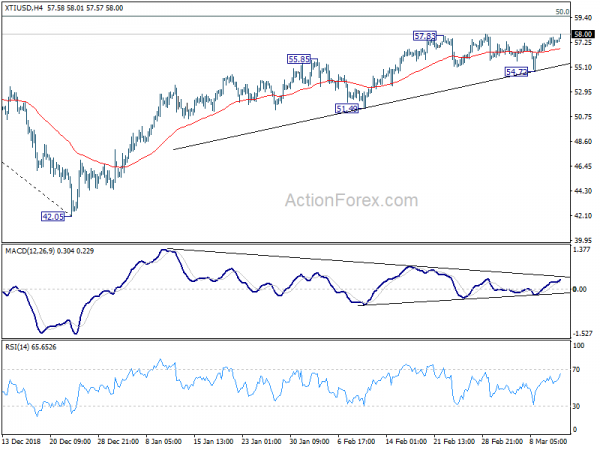

The financial markets are pretty directionless and traders await vote on no-deal Brexit in the UK parliament. Sterling remains the strongest one for now on recovery. But upside is limited below near term resistance against other major currencies. That is, the Pound is merely gyrating in recently established range. Canadian Dollar follows as the second strongest, as WTI crude oil jumps to as high as 58.01, resuming recent up trend. Nevertheless, other commodity currencies are left behind with New Zealand and Australian Dollar as the weakest ones.

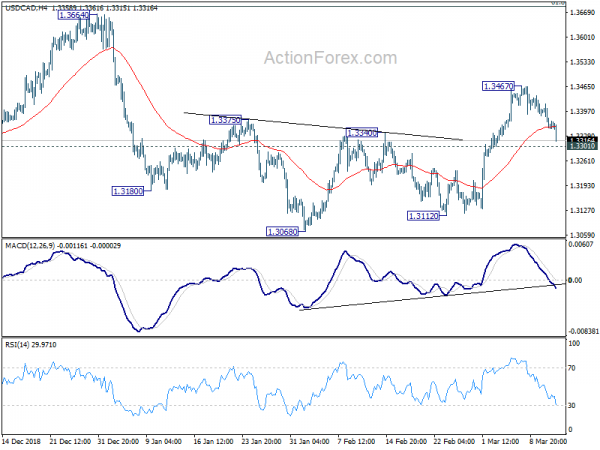

Technically, an immediate focus will be on 1.3301 in USD/CAD. Break there will dampen the original view of bullish reversal. Instead, that will signal that USD/CAD has completed recent rebound from 1.3068 and deeper fall could be seen back to 1.3112 support. GBP/USD, EUR/GBP and GBP/JPY staying in familiar range. We’re expecting sustained breakout today, unless UK votes for no-deal Brexit.

In other markets, FTSE is currently up 0.21%. DAX is up 0.02%. CAC is up 0.50%. German 10-year yield is up 0.015 at 0.068. Earlier in Asia, Nikkei dropped -0.99%. Hong Kong HSI dropped -0.39%. China Shanghai SSE dropped -1.09%. Singapore Strait Times dropped -0.52%. Japan 10-year JGB yield dropped -0.0151 to -0.045.

US PPI rose 0.1% mom, 1.9% yoy in February, versus expectation of 0.2% mom, 1.9% yoy. Core PPI rose 0.1% mom, 2.5% yoy, versus expectation of 0.2% mom 2.6% yoy. Durable goods orders rose 0.4% in January, above expectation of -0.5%. Ex-transport orders dropped -0.1%, below expectation of 0.1%.

EU Verhofstadt against even 24-hour Brexit extension

UK Parliament is set to vote on no-deal Brexit today at 1900GMT, which will likely be rejected. Then there will be another vote tomorrow for seeking Article 50 extensions. Responses from the EU so far are not very positive regarding an extension.

The European Parliament’s lead Brexit spokesman Guy Verhofstadt warned that he would oppose to even 24-hour extension. He said ” I am against every extension, whether an extension of one day, one week, even 24 hours, if it is not based on a clear opinion of the House of Commons for something, that we know what they want.” Verhofstadt also warned that “An extension, where we go beyond the European elections, and the European elections will be hijacked by the Brexiters, and by the whole Brexit issues. We will talk only about that, and not about the real problems, and the real reforms we need in the European Union.”

EU chief Brexit negotiator repeated his question that “extend this negotiation — what for?” And he reiterated that “if the UK still wants to leave the EU in an orderly manner, this treaty is — and will remain — the only treaty possible”. Barnier also told the European parliament that “We are at a critical point. The risk of no-deal has never been higher. That is the risk of an exit – even by accident – by the UK from the EU in a disorderly fashion. I urge you please not to under-estimate the risk or its consequences.”

Germany’s Economy Minister Peter Altmaier expressed said After divisive debates & votes, today can become a turning point.” “Rejecting No-deal-Brexit by a large cross-party majority will unite millions in the UK & in Europe.”

European Union’s Economic Commissioner Pierre Moscovici said “we have done everything we could do.” And, “it is tome now for the British to say what they want, now that they said what they don’t want.”

UK announces modest liberalization of tariffs in case of no-deal Brexit

The UK government announces its temporary tariff regime for no-deal Brexit, designed to minimise costs to business and consumers while protecting vulnerable industries. The temporary regime would apply for up to 12 months as a full consultation and review on a permanent approach to tariffs is undertaken. Under the regime, 87% of imports to the UK by value would be eligible for tariff free access, up from current 80%. Tariffs would still apply to 13% of imports including some agricultural, dairy, auto and some other products.

Trade Policy Minister George Hollingbery said in the release that

- Our priority is securing a deal with the European Union as this will avoid disruption to our global trading relationships. However, we must prepare for all eventualities.

- If we leave without a deal, we will set the majority of our import tariffs to zero, whilst maintaining tariffs for the most sensitive industries.

- This balanced approach will help to support British jobs and avoid potential price spikes that would hit the poorest households the hardest.

- It represents a modest liberalisation of tariffs and we will be monitoring the economy closely, as well as consulting with businesses, to decide what our tariffs should be after this transitional period.

In addition, in case of no-deal Brexit, a temporary approach will be taken to “avoid new checks and controls on goods at the Northern Ireland land border”. The temporary tariffs will also not apply to goods crossing from Ireland to Northern Ireland.

The tariffs will also apply equally to all other trading partners expect those who were in free trade agreement with the UK. And around 70 developing countries will benefit from preferential access to the UK markets.

UK CBI: Extending Article 50 to close the door on no-deal is now urgent

In a rather short statement, UK CBI Direct-General Carolyn Fairbairn expressed the frustration on the parliament’s Brexit circus. She said:

“Enough is enough. This must be the last day of failed politics. A new approach is needed by all parties. Jobs and livelihoods depend on it. Extending Article 50 to close the door on a March no-deal is now urgent. It should be as short as realistically possible and backed by a clear plan. Conservatives must consign their red lines to history, while Labour must come to the table with a genuine commitment to solutions. It’s time for Parliament to stop this circus.”

Australia consumer sentiment dropped to 98.8, pessimists outnumbered again

Australia Westpac Consumer Sentiment dropped sharply by -4.9 to 98.8 in March, down from 103.8. That’s the lowest level since September 2017. Also, with sub-100 reading, pessimists outnumbered optimists again. The release of the national accounts update is seen as a piece of news that triggered the deterioration. Data collected before the March 6 release showed reading of 100.7. Those collected after showed combined reading of 92.7, down -8. Westpac continues to expect a total of -50bps rate cut by RBA by the end of 2019. And they expect the hikes to happen in August and then November.

Also released in Asian session, Japan machine orders dropped -5.4% mom in January, domestic CGPI rose 0.8% yoy.

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3332; (P) 1.3375; (R1) 1.3398; More…

USD/CAD drops sharply today but stays above 1.3301 minor support. Intraday bias remains neutral first. As long as 1.3301 holds, we’d still expect another rally. Break of 1.3467 will resume the rise from 1.3068 to retest 1.3664 high. However, decisive break of 1.3301 will suggest that such rebound from 1.3068 has completed with three waves up to 1.2467. That will carry larger bearish implications and should turn bias to the downside for 1.3068/3112 key support zone.

In the bigger picture, structure of the medium term rise from 1.2061 (2017 low) to 1.3664 is not clearly impulsive. Hence, we’d stay cautious on strong resistance from 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 and 1.3793 resistance to limit upside, and bring medium term topping. But in any case, medium term outlook will stay bullish as long as channel support (now at 1.3139) holds. Sustained break of 1.3793 will pave the way to retest 1.4689 (2015 high). Firm break of the channel support should confirm reversal target 1.2061 low again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Mar | -4.80% | 4.30% | ||

| 23:50 | JPY | Domestic CGPI Y/Y Feb | 0.80% | 0.70% | 0.60% | |

| 23:50 | JPY | Machine Orders M/M Jan | -5.40% | -1.50% | -0.10% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jan | 0.40% | -0.30% | -0.30% | -0.50% |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 1.40% | 1.00% | -0.90% | |

| 12:30 | USD | PPI M/M Feb | 0.10% | 0.20% | -0.10% | |

| 12:30 | USD | PPI Y/Y Feb | 1.90% | 1.90% | 2.00% | |

| 12:30 | USD | PPI Core M/M Feb | 0.10% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Feb | 2.50% | 2.60% | 2.60% | |

| 12:30 | USD | Durable Goods Orders Jan P | 0.40% | -0.50% | 1.20% | 1.30% |

| 12:30 | USD | Durables Ex Transportation Jan P | -0.10% | 0.10% | 0.10% | 0.30% |

| 14:00 | USD | Construction Spending M/M Jan | 1.30% | 0.40% | -0.60% | -0.80% |

| 14:30 | USD | Crude Oil Inventories | 2.7M | 7.1M |