Global markets are generally in risk-on mode today as recession fears eased mildly after improvement in Chinese manufacturing data. While sentiments remain generally positive in early US session, there is a slight bit of cautiousness after disappointment retail sales from he US. Headline sales dropped -0.2% mom in February, below expectation of 0.3% mom. Ex-auto sales dropped -0.4% mom versus expectation of 0.4% mom.

While China manufacture PMIs turned above 50, they’re hardly very encouraging readings. At the same time, there is no clear improvements in other major economies yet, including Eurozone, Japan ann even Swiss and Australia. UK PMI manufacturing posted strong upside price, but that’s primarily due to pre-Brexit stock building. It could indeed be a major headwind moving forward.

Also, the never-ending Brexit impasse still posts big risks ahead. the House Commons will hold a second session of indicative votes on Brexit today. Debate might center around options of customs union, single market or a combination. Also, there would be debates on confirmatory referendum. Prime Minister Theresa May could decide what she’d do next after having the results from the indicative votes.

In the currency markets, Sterling is surprisingly the strongest one for today so far, followed by Australian and New Zealand Dollar. Yen is the weakest naturally, followed by Canadian and than Dollar. In Europe, currently, FTSE is up 0.63%. DAX is up 1.02%. CAC is up 0.71%. German 10-year yield is up 0.0256 at -0.043, still negative. Earlier in Asia, Nikkei rose 1.43%. Hong Kong HSI rose 1.76%. China Shanghai SSE rose 2.58%. Singapore Strait Times rose 1.17%. Japan 10-year JGB yield rose 0.0113 to -0.079.

UK PMI manufacturing rose to 13-month high, stepping up Brexit preparations

UK PMI manufacturing rose to 55.1 in March, up from 52.1 and beat expectation of 51.2. It’s also the highest level in 13 months. Markit noted that stocks of inputs and finished goods rise at record rates. Also, trends in output, new orders and employment strengthen.

Rob Dobson, Director at IHS Markit, said: “Manufacturers reported a surge of business activity in March as companies stepped-up their preparations for potential Brexit-related disruptions… The stock-building boost introduces a major headwind for demand, output and jobs growth moving forward…. The survey is also picking up signs that EU companies are switching away from sourcing inputs from UK firms as Brexit approaches. It looks as if the impact of Brexit preparations, and any missed opportunities and investments during this sustained period of uncertainty, will reverberate through the manufacturing sector for some time to come.”

BDI: Disorderly Brexit could slash Germany GDP by 0.5% to just 0.7% in 2019

President Federation of German Industries (BDI), Dieter Kempf, warned that “in the case of the disorderly exit of the British from the EU in the current year threatens a relapse to only 0.7 percent increase in gross domestic product”. That would be 0.5% lower than current forecast of 1.2% growth for 2019.

Kempf also complained that “the extension of the time limit for the self-imposed departure of the British from the EU continues the exhausting uncertainty for our companies”. And, “there is a risk that British policymakers once again buy expensive time at the expense of the economy – without wanting to take responsibility for the bill.”

Eurozone unemployment rate unchanged at 7.8%, CPI slowed to 1.4%

Eurozone unemployment rate was unchanged at 7.8% in February, matched expectations. It’s the lowest level since October 2008. EU28 unemployment was was also unchanged at 6.5% . It’s the record low since the start of series in January 2000.

Among the member states, lowest unemployment rates in February 2019 were recorded in Czechia (1.9%), Germany (3.1%) and the Netherlands (3.4%). The highest unemployment rates were observed in Greece (18.0% in December 2018), Spain (13.9%) and Italy (10.7%).

Eurozone CPI closed to 1.4% yoy in March, down from 1.5% yoy and missed expectation of 1.5% yoy. CPI core dropped to 0.8% yoy, down from 1.0% yoy and missed expectation of 1.0% yoy.

Eurozone PMI manufacturing finalized at 47.5, lowest since 2013

Eurozone PMI manufacturing was finalized at 47.5 in March, revised down from 47.6, down from February’s 49.3. It’s also the lowest level since April 2013, and the second straight months of sub-50 reading. Markit noted there was the biggest monthly decline in new orders since late 2012. Also, confidence hits lowest level in over six years.

Among the countries, Germany PMI manufacturing was revised further lower to 44.1, an 80-month low. Italy PMI manufacturing was at 47.4, 70-month-low. France PMI manufacturing was revised down to 49.7, below 50, but it’s just a 3-month low. Australian PMI manufacturing was at 48-month low at 50.0. Netherlands PMI manufacturing was at 33-month low at 52.5. However, Greece PMI manufacturing was at 54.7, 12-month high.

Chris Williamson, Chief Business Economist at IHS Markit said: “The March PMI data indicate that the eurozone’s manufacturing sector is in its steepest downturn since the height of the region’s debt crisis in 2012…. January rebound from one-off factors late last year seen in the latest official data is likely to prove short lived… Looking at the forward-looking indicators, downside risks have intensified, and the trend could clearly deteriorate further in the second quarter.”

China Caixin PMI manufacturing rose to 50.8, employment expands again after five years

China Caixin PMI manufacturing rose to 50.8 in March, up from 49.9 and beat expectation of 50.0. The reading is back in expansionary region and is the highest since July 2018. Markit noted that production and total new work both increase at quicker rates. Also, employment expands for first time in over five years.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said the reading indicates “a notable improvement in the manufacturing industry.” “Overall, with a more relaxed financing environment, government efforts to bail out the private sector and positive progress in Sino-U.S. trade talks, the situation across the manufacturing sector recovered in March. The employment situation improved greatly.”

China official PMI manufacturing rose to 50.5, economy still in a critical period of stabilization

Released over the weekend, official China PMI manufacturing rose to 50.5 in March, up from 49.2 and beat expectation of 49.6. That’s firstly the largest monthly rise since 2012. Secondly, it’s also the highest level in six months. The improvement from February’s 3-yer low suggests stabilization in the slowdown in the sector. PMI non-manufacturing rose to 54.8, up from 54.3, and beat expectation of 54.5 too.

In the release, it’s noted the improvement stemmed from post Chinese New Year production recovery and effect of growth stabilization policies. However, overall recovery in market demand is still not apparent. Export orders rebounded while expectations also improved. The positive signals from Sino-US trade negotiations have begun to take effect.

But overall, the statement noted that the current economy is still in a “critical period of stabilization and recovery”. And, it is necessary to “further consolidate and enhance confidence recovery, and to restore market demand and stabilize economic growth.

Japan Tankan large manufacturing dropped to 12, lowest since 2017, large fall since 2012

Japan Tankan large manufacturing index dropped to 12 in Q1, down from 19 and even missed expectation of 13. That’s also the lowest level since March 2017. The quarterly decline was sharpest since 2012. Large non-manufacturing index dropped to 21, down from 24 and missed expectation of 22. It’s also the lowest level since March 2017.

Large manufacturing outlook also dropped to 8 down from 15 and missed expectation of 13. Large non-manufacturing outlook was unchanged at 20, matched expectations. All industry capex rose 1.2% in Q1, suggesting large firms expect to increase capital expenditure by a mere 1.2% in the year that begins in April. It’s sharply lower than prior 14.3% but beat expectation of 0.8%.

The overall set of numbers are weak, suggesting worsening outlook and deeper slowdown in the Japanese economy. Down the road, if the trend continues, BoJ might be force to re-evaluate its own monetary policy.

Japan PMI manufacturing finalized at 48.9, worst quarterly performance since 2016

Japan PMI manufacturing was finalized at 49.2 in March, up[ from February’s 48.9, signalling slowdown continues. Markets noted that demand remains sluggish, pulling output lower. Firms push resources to clearing backlogs due to lack of new work. And business confidence remains among lowest on record.

Joe Hayes, Economist at IHS Markit, said: “The final manufacturing PMI print of Q1 for Japan points to the worst quarterly performance in the sector since Q2 2016… The economic backdrop for the manufacturing sector in Japan remains fiercely challenging. Asian goods producers face headwinds from slowing growth in Europe and China, while global trade risks are yet to be mitigated by a breakthrough in US-Sino relations.”

Australia NAB business conditions improved, but confidence dropped

Australia NAB Business Conditions rose 3 pts to 7 in March, beat expectation of 2.On the positive side, employment index rose 2 pts to 7. It remains “well above average, suggesting that for now, survey indicators of labour demand remain favourable.” Trading and profitability also rebounded.

However, Business Confidence dropped -2 pts to 0, missed expectation of 4. It also “continued the below average run. “Other forward looking indicators – capacity utilisation and forward orders – showed some improvement but remain at or below average. Also, it’s noted that “overall survey measures of prices and inflation remain weak.”

AiG Performance of Manufacturing index dropped -3 pts to 51 in March, indicating slower pace of expansion. Some respondents attributed the down trend since mid-2018 to “general slowing in the economy”. Some said their customers are “delaying orders” until after Federal election. Also, downturn in housing construction also affect demand.

TD securities inflation accelerated to 0.4% mom in March.

USD/JPY Mid-Day Outlook

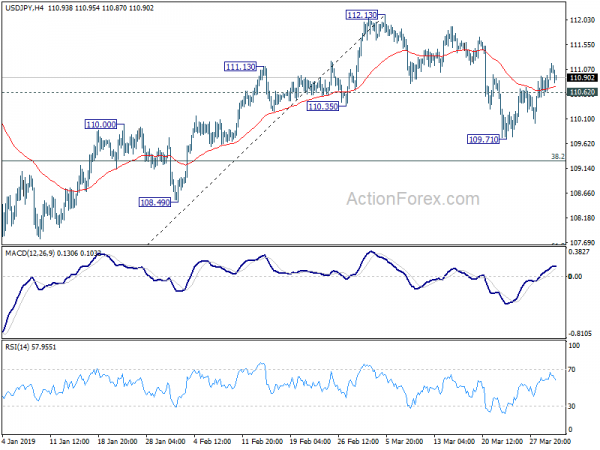

Daily Pivots: (S1) 110.58; (P) 110.78; (R1) 111.04; More…

USD/JPY retreats mildly after hitting 111.18. But with 110.62 minor support intact, intraday bias stays mildly on the upside. The pull back from 112.13 should have completed with three waves down to 109.71. Further rise would be seen to 112.13 resistance. Decisive break there will resume whole rise from 104.69 to 114.54 key resistance next. On the downside, below 110.53 minor support will turn bias back to the downside for 109.71 and possibly further to 38.2% retracement of 104.69 to 112.13 at 109.28.

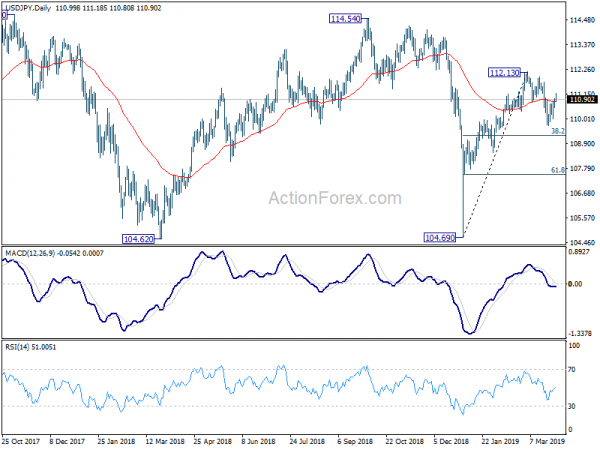

In the bigger picture, while the rebound from 104.69 was strong, USD/JPY failed to sustain above 55 week EMA (now at 110.80), and was kept well below 114.54 resistance. Medium term outlook is turned mixed and we’ll wait for the structure of the fall from 112.13 to unveil to make an assessment later. For now, more range trading is expected between 104.69 and 112.13 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Manufacturing Index Mar | 51 | 54 | ||

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 12 | 13 | 19 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q1 | 8 | 13 | 15 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q1 | 21 | 22 | 24 | |

| 23:50 | JPY | Tankan Non-Manufacturing Outlook Q1 | 20 | 20 | 20 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 1.20% | 0.80% | 14.30% | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q1 | 6 | 10 | 14 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q1 | -2 | 6 | 8 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q1 | 12 | 9 | 11 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q1 | 5 | 5 | 5 | |

| 00:00 | AUD | TD Securities Inflation M/M Mar | 0.40% | 0.10% | ||

| 00:30 | AUD | NAB Business Conditions Mar | 7 | 2 | 4 | |

| 00:30 | AUD | NAB Business Confidence Mar | 0 | 4 | 2 | |

| 00:30 | JPY | PMI Manufacturing Mar F | 49.2 | 48.9 | ||

| 01:45 | CNY | Caixin PMI Manufacturing Mar | 50.8 | 50 | 49.9 | |

| 06:30 | CHF | Retail Sales Real Y/Y Feb | -0.20% | -0.80% | -0.40% | -0.20% |

| 07:30 | CHF | PMI Manufacturing Mar | 50.3 | 53.5 | 55.4 | |

| 07:45 | EUR | Italy Manufacturing PMI Mar | 47.4 | 47.5 | 47.7 | |

| 07:50 | EUR | France Manufacturing PMI Mar F | 49.7 | 49.9 | 49.8 | |

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 44.1 | 44.7 | 44.7 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 47.5 | 47.7 | 47.6 | |

| 08:30 | GBP | PMI Manufacturing Mar | 55.1 | 51.2 | 52 | 52.1 |

| 09:00 | EUR | Eurozone Unemployment Rate Feb | 7.80% | 7.80% | 7.80% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Mar | 1.40% | 1.50% | 1.50% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar A | 0.80% | 1.00% | 1.00% | |

| 12:30 | USD | Retail Sales Advance M/M Feb | -0.20% | 0.30% | 0.20% | 0.70% |

| 12:30 | USD | Retail Sales Ex Auto M/M Feb | -0.40% | 0.40% | 0.90% | 1.40% |

| 13:30 | CAD | Manufacturing PMI Mar | 52.6 | |||

| 13:45 | USD | Manufacturing PMI Mar F | 52.5 | 52.5 | ||

| 14:00 | USD | ISM Manufacturing Mar | 54.3 | 54.2 | ||

| 14:00 | USD | ISM Prices Paid Mar | 49.4 | |||

| 14:00 | USD | ISM Employment Mar | 52.3 | |||

| 14:00 | USD | Construction Spending M/M Feb | -0.10% | 1.30% | ||

| 14:00 | USD | Business Inventories Jan | 0.40% | 0.60% |