Swiss Franc regains much ground today in mixed financial markets. Optimism over US corporate earnings had virtually no impact in Asian and European markets. Instead, European stocks turned mixed after German Ifo business confidence turned south again after brief recovery last month. German 10-year yield also suffers rather steep decline, and is threatening to turn negative again. Though, Sterling is displaying some resilience, mainly because there’s nothing to trade on.

On the handle hand, Australian Dollar remains the weakest one for today as much weaker than expected CPI raises the chance of an RBA rate cut in second half. New Zealand Dollar follows as second as RBNZ could cut even earlier in May. Euro is currently the third weakest as pull back in EUR/CHF extends. Canadian Dollar is turning cautious, awaiting BoC rate decision. BoC is widely expected to keep interest rate unchanged at 1.75%. It’s not totally sure if BoC would drop tightening bias today. If not, there is prospect of a rebound in the loonie.

Technically, 1.3467 resistance in USD/CAD will be a major focus in US session. Decisive break will resume whole rebound from 1.3068 towards 1.3664 high. Rejection will delay the bullish case and extend the consolidation from 1.3467 with another fall. EUR/USD might have another attempt towards 1.1176 key support again. Decisive break there will resume larger down trend from 1.2555. AUD/USD is also eyeing 0.7003 support after today’s free fall.

In Europe, currently, FTSE is down -0.60%. DAX is up 0.52%. CAC is down -0.35%. German 10-year yield is down -0.044 at 0.00. Earlier in Asia, Nikkei dropped -0.27%. Hong Kong HSI dropped -0.53%. China Shanghai SSE rose 0.09%. Singapore Strait Times rose 0.27%. Japan 10-year JGB yield dropped -0.0052 to -0.035.

Quick update: CAD dives after BoC drops tightening bias, slashes growth forecast. More here.

Quick update: CAD dives after BoC drops tightening bias, slashes growth forecast. More here.

German Ifo dropped to 99.2, March’s gentle optimism evaporated

German Ifo Business Climate Index dropped to 99.2 in April, down from 99.7 and missed expectation of 99.9. Expectation Index dropped to 95.2, down fro 95.6 and missed consensus of 96.0. Current Assessment Index also dropped to 103.3, down from 103.8 and missed expectation of 103.6.

Ifo President Clemens Fuest noted that “the mood among German managers became slightly gloomier this month… March’s gentle optimism regarding the coming months has evaporated. The German economy continues to lose steam.” Ifo economist Klaus Wohlrabe said the data points to 0.8% growth in Germany this year.

Looking at the details, business climate in manufacturing “has again worsened markedly”, down from 6.7 to 4.0. It’s the eighth straight month of decline. Services continued recovery from 26.1 to 26.3, comparing to cyclic low at 21.5 in February. Trade worsened again from 8.2 to 7.1. Construction improved slightly from 20.4 to 21.4.

Also released UK public sector borrowing rose GBP 0.8B in March, versus expectation of GBP -0.8B.

ECB: Impact of trade tensions escalation could heighten financial stress and lower confidence

In a paper released today, ECB noted that last year’s increased in trade tensions and the repercussions of the tariffs implemented pose only a “modest adverse risk” to the global and euro area outlooks. Also, impact of implemented tariffs and tariff announcements owing to uncertainty effects appears to have remained “confined to the targeted sectors” for the time being.

However, if trade tensions were to escalate once again, “the impact would be larger”. Model-based simulations indicate that the medium-term direct impact of an escalation could be “sizeable, compounded by heightened financial stress and a drop in confidence.” The longer-term effects would be “even more pronounced”.

ECB also warned that “although free trade is often seen as one of the factors behind rising inequality both within and across countries, winding back globalisation is the wrong way to address these negative effects.” “A retreat from openness will only fuel more inequality, depriving people of the undisputed economic advantages that trade and integration bring.”. The paper urged that “countries should seek to resolve any trade disputes in multilateral fora”.

Full paper “The economic implications of rising protectionism: a euro area and global perspective“.

Big downside surprise in Australia CPI adds to case for RBA cut

Australian Dollar is sold off sharply after much weaker than expected consumer inflation data.

- Headline CPI rose 0.0% qoq, 1.3% yoy in Q1, down from 0.5% qoq, 1.8% yoy, missed expectation of 0.2% qoq, 1.5% yoy. The 1.3% annual rate is also the slowest since September 2016.

- RBA trimmed mean CPI rose 0.3% qoq, 1.6% yoy, below expectation of 0.4% qoq, 1.7% yoy. Annual rate is slowest since December 2016.

- RBA weighted median CPI rose 0.1% qoq, 1.2% yoy, well below expectation of 0.4% qoq, 1.6% yoy.

The weak inflation data heighten the prospect of RBA rate cut in May, together with RBNZ. But for now, it still seems a bit early for RBA to act given relative resilience in job data. May is more an ideal occasion for RBA to turn dovish with new economic projections and SoMP. If it happens, the case for a cut in August would be secured.

Also released in Asian session, Japan corporate service price index rose 1.1% yoy in March versus expectation of 1.0% yoy. All industry index dropped -0.2% mom in February, matched expectation. Leading indicator dropped to 97.1, missed expectation of 97.4.

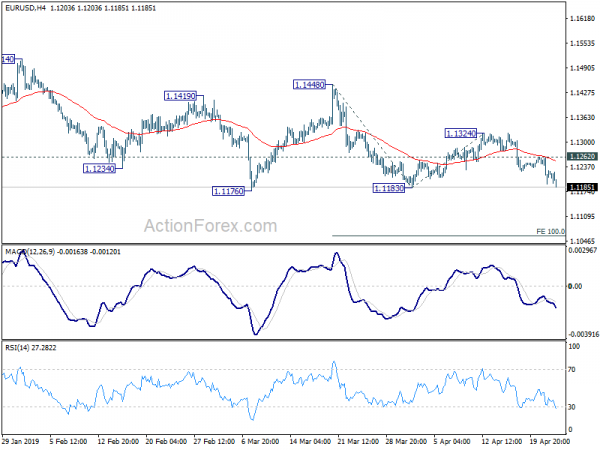

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1192; (P) 1.1227; (R1) 1.1261; More…..

EUR/USD drops further to as low as 1.1186 so far today. Intraday bias remains on the downside for 1.1176 key support. Decisive break there will resume whole down trend form 1.2555. Next near term target will be 100% projection of 1.1448 to 1.1183 from 1.1324 at 1.1059. On the upside, above 1.1262 minor resistance will delay the bearish case and bring rebound first.

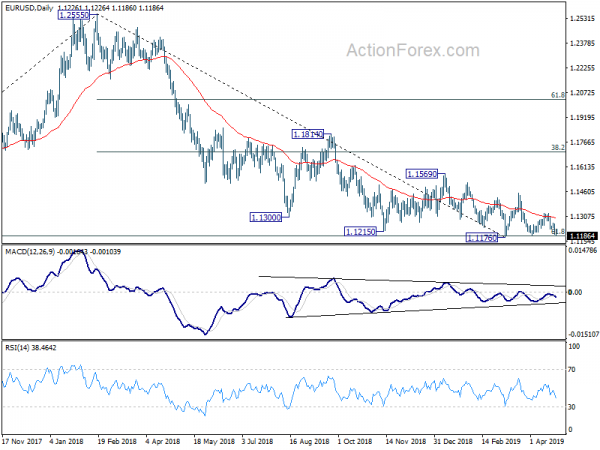

In the bigger picture, EUR/USD has been losing downside momentum around 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. But for now, there is no clear sign of medium term reversal yet. Down trend from 1.2555 is expected to resume sooner or later as long as 1.1569 structural resistance holds. Decisive break of 1.1186. could pave the way back to 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Mar | 1.10% | 1.00% | 1.10% | |

| 1:30 | AUD | CPI Q/Q Q1 | 0.00% | 0.20% | 0.50% | |

| 1:30 | AUD | CPI Y/Y Q1 | 1.30% | 1.50% | 1.80% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Q/Q Q1 | 0.30% | 0.40% | 0.40% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Y/Y Q1 | 1.60% | 1.70% | 1.80% | |

| 1:30 | AUD | CPI RBA Weighted Median Q/Q Q1 | 0.10% | 0.40% | 0.40% | |

| 1:30 | AUD | CPI RBA Weighted Median Y/Y Q1 | 1.20% | 1.60% | 1.70% | 1.60% |

| 4:30 | JPY | All Industry Activity Index M/M Feb | -0.20% | -0.20% | -0.20% | 0.00% |

| 5:00 | JPY | Leading Index CI Feb F | 97.1 | 97.4 | 97.4 | |

| 8:00 | EUR | German IFO Business Climate Apr | 99.2 | 99.9 | 99.6 | |

| 8:00 | EUR | German IFO Expectations Apr | 95.2 | 96 | 95.6 | |

| 8:00 | EUR | German IFO Current Assessment Apr | 103.3 | 103.6 | 103.8 | |

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 8:30 | GBP | Public Sector Net Borrowing (GBP) Mar | 0.8B | -0.8B | -0.7B | -0.5B |

| 14:00 | CAD | BoC Rate Decision | 1.75% | 1.75% | ||

| 14:30 | USD | Crude Oil Inventories | -1.4M |