Risk aversion eased mildly today as markets respond positive to US decision to delay the sanctions of Huawei for 90 days. After some initial hesitation, Yen sell-off is picking up momentum in early US session, because of rally in stocks and treasury yields. On the other hand, Sterling is recovering mildly, as traders takes profit on short positions. UK Prime Minister Theresa May is set to scheduled to announce her new Brexit deal at 1500GMT.

For now, we’d view the above moves as temporary. Firstly, the move by US Commerce Department was mainly for housekeeping purpose only. That is, it’s for preventing sudden disruptions on the internet, telecom on the US side. It’s by no means an end to US-China trade tension. More importantly, given the hard line rhetorics from both sides, we’re not seeing any chance of a deal in that 90 days window. Secondly, May has repeated history of delivering nothing special on Brexit. Pound could be back under pressure should May disappoint again.

The more sustainable underlying move is in Australian Dollar. RBA Governor Philip Lowe was clear in his speech that they’re going to considering cutting interest rate in June meeting. Even if RBA chooses to wait again in June, it looks inevitable that they’ll still deliver the rate cut in August. The uncertainty lies only in timing. Aussie will likely stay pressured ahead.

In the currency markets, Aussie is rightly below the weakest one for today so far. Yen follows as second weakest, then New Zealand dollar. Canadian Dollar is the strongest one, followed by Sterling, and then Dollar. Technically, 55 day EMA at 110.84 is a key level to watch in USD/JPY. As long as it holds, further decline is expected and Yen will likely resume recent broad based rise sooner or later. Though sustained break would probably pull other Yen crosses higher together.

In Europe, currently, FTSE is up 0.54%. DAX is up 1.07%. CAC is up 0.61%. German 10-year yield is up strongly by 0.0176 at -0.066. Earlier in Asia, Nikkei dropped -0.14%. Hong Kong HSI dropped -0.47%. China Shanghai SSE rose 1.23% to 2905.97. Singapore Strait Times dropped -0.69%. Japan 10-year JGB yield rose 0.0027 to -0.045.

UK CBI: Investment down, stockpiling up, threat of a no-deal ever present, viable Brexit deal desperately need

UK CBI trends total orders dropped to -10 in May, down from -5 and missed expectation of -5. 23% of manufacturers reported total orders books above normal. 32% said they were below normal. The -10 balance was the worst since October 2016, but stayed broadly in line with long-run average of -13.

Anna Leach, CBI Deputy Chief Economist, said: “With investment down, stockpiling up, and the threat of a no-deal ever present, we desperately need parliament to thrash out a viable deal in the national interest. Where the cross-party talks failed, Parliament must succeed, or continued economic paralysis will see us hurtle ever closer to disaster.”

ECB de Guindos: Slower growth momentum increases tail risks

ECB Vice President Luis de Guindos urged Eurozone banks to build extra capital buffers to mitigate the risk of unexpected shocks. He said “the slower growth momentum we are seeing increases the risk of tail events, in other words, shocks that are unlikely to occur, but would have a significant impact on the financial system and the economy if they did.”

“The continued build-up of buffers could therefore be justified, especially in those countries where the long upturn may have led to an underestimation of credit risk or where private indebtedness is particularly high or rising.”

BoJ Kuroda: Persisting US-China trade war has widespread impact of global and Japanese economies

BoJ Governor Haruhiko Kuroda warned of the impact of US-China trade war again in the parliament today. He said “if trade tensions persist, they would have a widespread impact on global and Japanese economies via business sentiment and market developments.” And, “we hope the United States and China engage in constructive discussions.”

Finance Minister Taro Aso also told the parliament that “we’re seeing some manufacturers delaying capital expenditure plans.” However, “corporate profits are high and the fundamentals supporting domestic demand remain solid.”

RBA to consider cutting interest rate at June meeting

In a speech delivered today, RBA Governor Philip Lowe said the central bank will consider the case for cutting interests in the upcoming meeting in two weeks’ time n June. After weak inflation reading and surge in unemployment rate in Q1, RBA might pull ahead the anticipated rate cut(s) for the second half.

Lowe said “accumulating evidence is that the Australian economy can support an unemployment rate of below 5 per cent without raising inflation concerns”. Such judgement is also “consistent with the experience overseas”. Meanwhile, recent flow of data suggests it’s “less likely” that “current policy settings are sufficient to deliver lower unemployment.”

There are few options ahead to lower unemployment rate. These include further monetary easing, additional fiscal support and structure policy changes. But he emphasized “relying on just one type of policy has limitations, so each of these is worth thinking about.”

Lowe concluded the speech noting: “A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target. Given this assessment, at our meeting in two weeks’ time, we will consider the case for lower interest rates.”

More on RBA:

- Westpac Moves Rate Profile Forward to June and August

- RBA Removes Rhetoric of “No Strong Case” for Near-Term Rate Cut

- RBA Minutes Signal Easing Bias

US grants housekeeping temporary exemptions on restrictions on Huawei

The US Commerce Department announced limited exemptions on products of Chinese telecom giant Huawei. The move is seen as for keeping the house in order, so as to prevent internet, computer and cell phone systems from crashing

Under the move, Huawei and its 68 non-US affiliates will be granted 90 days temporary general license to have limited engagement in transactions involving the export, reexport, and transfer of items.

With the arrangement, “this license will allow operations to continue for existing Huawei mobile phone users and rural broadband networks”. The Commerce Department said it will evaluate whether to extend the exemptions beyond 90 days.

OECD lowers global growth forecast on trade tension, but upgrades US

OECD lowered global growth forecast to 3.2% in 2019, down from March projection of 3.3%. Chief Economist Laurence Boone warned that “the fragile global economy is being destabilized by trade tensions.” And, growth is stabilizing but the economy is weak and there are very serious risks on the horizon. Governments need to work harder together to ensure a return to stronger and more sustainable growth.”

On US-China trade war, OECD warned that an intensification of trade restrictions would have significant costs. The new tariffs and measures announced this month could reduce GDP growth in US and China by 0.2-0.3% on average by 2021 and 2022. Under the scenarios of additional 25% tariffs on essentially all remaining bilateral trade between US and China, “the short term costs are considerably higher and broader”. Global trade could be reduced by 1% by 2021. US GDP could dropped by 0.6% while China GDP could drooped by 0.8%.

However, it should also be noted that GDP growth projection was revised up by 0.2% to 2.8% in 2019 and by 0.1% to 2.3% in 2020. OECD said “in the absence of further shocks, the economy is on track to continue its solid expansion and grow

somewhat faster than the rest of the OECD on average”.

Summary of new growth projections :

- 2019 global at 3.2%, down from 3.3% (March forecast)

- 2020 global at 3.4%, unchanged

- 2019 US at 2.8%, up from 2.6%

- 2020 US at 2.3% up from 2.2%.

- 2019 Eurozone at 1.2%, up from 1.0%

- 2020 Eurozone at 1.4% up from 1.2%

- 2019 Japan at 0.7%, down from 0.8%

- 2020 Japan at 0.6%, down from 0.7%

- 2019 UK at 1.2%, up fro 0.8%

- 2020 UK at 1.0%, up from 0.9%

- 2019 China at 6.2%, unchanged

- 2020 China at 6.2%, unchanged

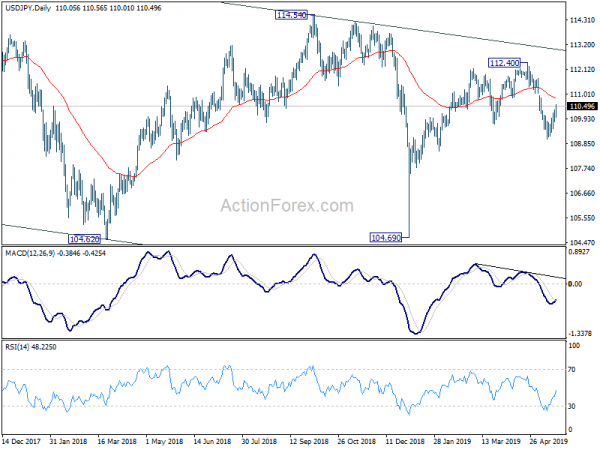

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.81; (P) 110.06; (R1) 110.32; More…

USD/JPY’s recovery form 109.02 extends higher today but outlook remains unchanged. Intraday bias stays neutral and upside should be limited by 55 day EMA (now at 110.83) to bring another fall. On the downside, below 109.81 minor support will turn bias back to the downside for 109.02. Break there will extend the decline from 112.40 to retest 104.69 low. However, sustained trading above 55 day EMA will indicate completion of the fall from 112.40 and bring retest of this high.

In the bigger picture, USD/JPY is staying inside falling channel from 118.65. Currently development suggests that rebound from 104.69 is only a corrective move. And fall from 118.65 is not completed yet. Decisive break of 104.69 will extend the down trend towards 98.97 support (2016 low). For now, we’d expect strong support above there to bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes May | ||||

| 10:00 | GBP | CBI Trends Total Orders May | -10 | -5 | -5 | |

| 14:00 | EUR | Eurozone Consumer Confidence May A | -7.7 | -7.9 | ||

| 14:00 | USD | Existing Home Sales Apr | 5.35M | 5.21M |