Markets remain in risk-off mode today after Apple’s warning that China’s Wuhan coronavirus outbreak would hurt sales. Deep deterioration in German economic sentiment also reflect the impact on confidence. Investors will likely remain fragile until there is sign of full operation resumption in China. But that won’t happen soon. In the currency markets, commodity currencies remain the weakest ones for the day together with Euro. It remains to be seen which would end the day as worst performing. Yen, Sterling, and Dollar are currently the strongest ones.

Technically, fresh selling in EUR/USD in early US session sends it through 1.0804 projection level. Next target would be 1.0735. EUR/GBP is set to take on 0.8276 low and break will resume whole fall from 0.9324. AUD/USD is a focus as it might now take on 0.6662/70 key support level and break will confirm down trend resumption. USD/CAD recovers after being supported by near term channel. Focus is back on 1.3327/9 resistance zone for the rest of the week.

In Europe, FTSE is down -0.80%. DAX is down -0.61%. CAC is down -0.37%. German 10-year yield is down -0.012 at -0.412. Earlier in Asia, Nikkei dropped -1.40%. Hong Kong HSI dropped -1.54%. China Shanghai SSE rose 0.05%. Singapore Strait Times dropped -0.51%. 10-year JGB yield dropped -0.0.0122 to -0.050.

US Empire State manufacturing index rose to 12.9, new orders jumped

US Empire State manufacturing general business condition rose sharply to 12.9 in February, up from 4.8, beat expectation of 5.1. Looking at some details, new orders jumped from 6.6. to 22.1. However, number of employees dropped from 9.0 to 16.7. Prices paid dropped from 31.5 to 25.0. But prices received rose from 14.4 to 16.7. Six month expectations dropped from 23.6 to 22.9.

Canada manufacturing sales dropped -0.7%, down in 11 of 21 industries

Canada manufacturing sales dropped -0.7% mom in December, much worse than expectation of 0.8% mom. Sales were down in 11 of 21 industries, representing 42.6% of the manufacturing sector. The largest declines were in the motor vehicle assembly and aerospace product and parts industries. However, these decreases were partly offset by higher sales in the primary metal industry.

German ZEW dropped sharply to 8.7, fear of negative effects of China’s coronavirus

German ZEW Economic Sentiment dropped sharply to 8.7 in February, down from 26.7, missed expectation of 20.4. German Current Situation index dropped to -15.7, down from -9.5, missed expectation of -10.0. Eurozone ZEW Economic Sentiment dropped to 10.4, down form 25.6, missed expectation of 21.3. Eurozone Current Situation dropped -0.4 to -10.3.

ZEW President Achim Wambach said: “The feared negative effects of the Coronavirus epidemic in China on world trade have been causing a considerable decline of the ZEW Indicator of Economic Sentiment for Germany. Expectations regarding the development of the export-intensive sectors of the economy have dropped particularly sharply. Besides, the end of 2019 and the beginning of 2020 saw a worse-than-expected development of the German economy. Both the downward revision of the assessment of the economic situation and the downturn in expectations show clearly that economic development is rather fragile at the moment.”

UK unemployment rate unchanged at 3.8%, wage growth slowed

UK unemployment rate was unchanged at 3.8% in the three months to December, matched expectations, staying at a four-decade low. A estimated 1.29m people were unemployed. Employment rate was estimated at record high of 76.5%, up 0.4% from the previous quarter.

Average weekly earnings (including bonus) slowed to 2.9% 3moy, down from 3.2%, missed expectation of 3.1%. Average weekly earnings (excluding bonus) slowed to 3.2% 3moy, down from 3.4%, missed expectation of 3.3%.

China to exemption tariffs on 697 lines of US imports

China’s Customs Tariff Commission of the State Council. announced today tariffs exemptions on 697 lines of US imports, as fulfilment of the US-China trade deal phase one. The products include farm and energy, such as pork, beef, soybeans, liquefied natural gas and crude oil. Dozens of types of medical equipment are also included.

Importers can apply for tariffs exemptions starting from march 2. Such exemptions would only be effective for one year, subject to an approval process. China said that these exemptions are “to support enterprises to import goods from the US based upon their business considerations.”

Moody’s lower China’s 2020 growth forecast from 5.8% to 5.2%

Moody’s Investors Service warned today that outbreak of China’s Wuhan coronavirus would pressure growth in Asia Pacific as a whole. “This shock comes on the back of a marked slowdown in 2019 as decelerating global trade hit the region,” The impact would be felt mainly through trade and tourism. Some sectors could also be hurt due to supply chain disruptions.

For China, Moody’s cut 2020 growth forecasts sharply from 5.8% to 5.2%. The downgrade reflects “a severe but short-lived economic impact, with knock-on effects for economies across the region.” Lower import demand is the primary reason for slowing growth.

RBA Minutes Reveal that Members Consider Cutting Rates Below 0.75%, Warn of Coronavirus Uncertainty

In contrast to February’s RBA meeting statement, which demonstrated a less dovish outlook, the minutes revealed that the members considered lowering the policy rate further. Yet, they decided to keep the powder dry on concerns over “risks associated with very low interest rates”.

The central bank was upbeat about the housing market. While there has been improvement in the employment situation, wage growth remains sluggish. Meanwhile, risk for growth is skewed to the downside as driven by huge bushfires. The minutes highlighted that the coronavirus outbreak is an important source of uncertainty. This is expected to negatively affect the economy of China, hence, that of Australia.

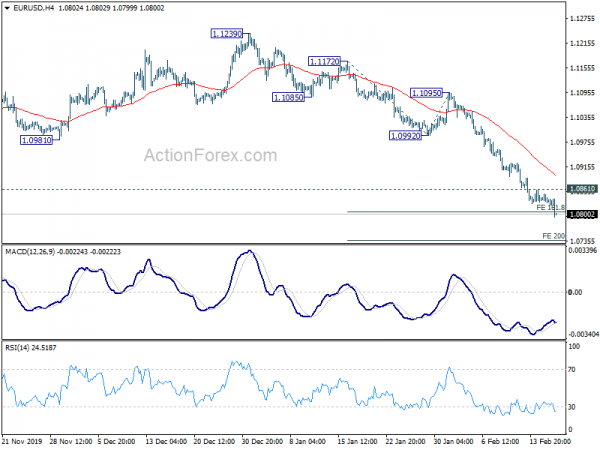

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0826; (P) 1.0839; (R1) 1.0848; More…

EUR/USD’s decline extends to as low as 1.0793 so far and broke 161.8% projection of 1.1172 to 1.0992 from 1.1095 at 1.0804. Intraday bias remains on the downside for 200% projection at 1.0735 next. On the upside, above 1.0861 minor resistance will turn intraday bias neutral and bring consolidations first. But recovery should be limited well below 1.0992 support turned resistance to bring fall resumption.

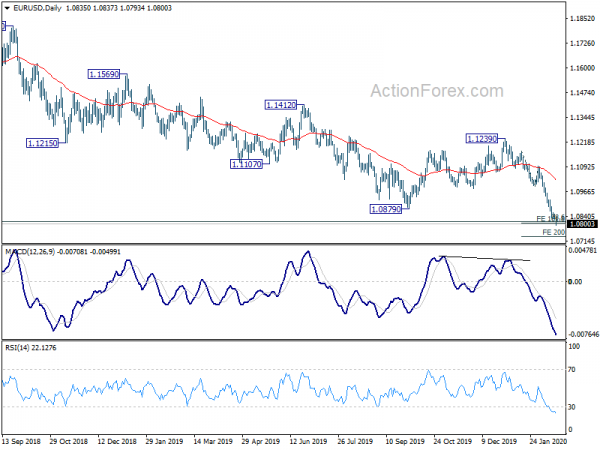

In the bigger picture, down trend from 1.2555 (2018 high) has just resumed and prior rejection by 55 week EMA affirms medium term bearishness. Sustained break of 78.6% retracement of 1.0339 (2017 low) to 1.2555 at 1.0813 will pave the way to retest 1.0339 low. For now, outlook will remain bearish as long as 1.1239 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 09:30 | GBP | Claimant Count Change Jan | 5.5K | 22.6K | 14.9K | 2.6K |

| 09:30 | GBP | Claimant Count Rate Jan | 3.40% | 3.50% | 3.40% | |

| 09:30 | GBP | ILO Unemployment Rate 3M Dec | 3.80% | 3.80% | 3.80% | |

| 09:30 | GBP | Average Earnings Excluding Bonus 3M/Y Dec | 3.20% | 3.30% | 3.40% | |

| 09:30 | GBP | Average Earnings Including Bonus 3M/Y Dec | 2.90% | 3.10% | 3.20% | |

| 10:00 | EUR | Germany ZEW Economic Sentiment Feb | 8.7 | 20.4 | 26.7 | |

| 10:00 | EUR | Germany ZEW Current Situation Feb | -15.7 | -10 | -9.5 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Feb | 10.4 | 21.3 | 25.6 | |

| 13:30 | USD | Empire State Manufacturing Index Feb | 12.9 | 5.1 | 4.8 | |

| 13:30 | CAD | Manufacturing Sales M/M Dec | -0.70% | 0.80% | -0.60% | -1.00% |

| 15:00 | USD | NAHB Housing Market Index Feb | 75 | 75 |