Asian markets open the week generally lower as there is no sign of even a slowdown in coronavirus pandemic. The US has also given up hope for returning to normal by Easter. Yen strengthens generally, followed by Dollar. Meanwhile, Sterling and Euro are giving up some gains. Movements in the currency markets are so far limited. But more volatility is expected given an extremely busy week ahead.

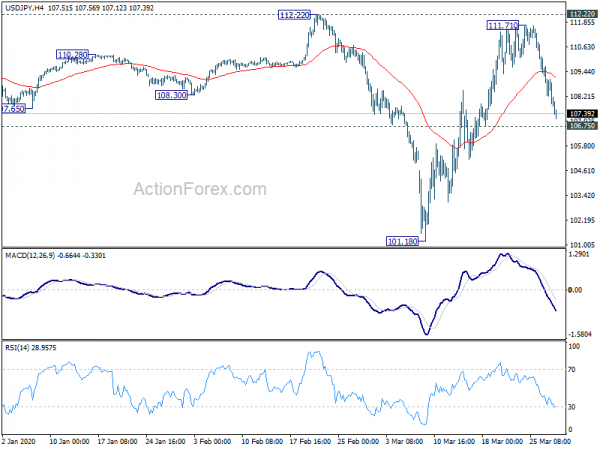

Technically, a major focus for the week is whether last week’s recovery in stocks have completed. For the currency markets, 106.75 support in USD/JPY would be watched. Firm break there could be a sign of come back of risk aversion. Also, in that case, it’s uncertain for now whether selloff in USD/JPY would translate into rally in Yen elsewhere, or decline in Dollar, or both. We’ll have to wait and see.

In Asia, currently, Nikkei is down -3.23%. Hong Kong HSI is down -1.45%. China Shanghai SSE is down -1.42%. Singapore Strait Times is down -3.86%. Japan 10-year JGB yield is down -0.0127 at -0.003.

Trump hopes to reach bottom of the hill by June

US President Donald Trump announced to extend the stay-at-home guidelines until the end of April, abandoning the target to have American return to normal life from coronavirus pandemic by Easter. He also warned, “the peak, the highest point of death rate, is likely to hit in two weeks.” He hoped the country would reach “the bottom of the hill” by June 1 — “could even be sooner, could be a little bit later.”

Separately, National Institute of Allergy and Infectious Diseases Director Anthony Fauci warned that coronavirus deaths in the US could reach 100,000 to 200,000. Nevertheless, “we feel the mitigation we are doing right now is having an effect,” Fauci said. “The decision to extend this mitigation process until the end of April is a wise and prudent decision.”

BOJ to relax requirements for some financial institutions

BoJ indicated in a statement today that it’s ready to relax some requirements for financial institutions to participate in its market operations. It firstly reiterated that institutions are subject to “capital buffer and liquidity cover ratio (LCR) requirements”.

However, “Even if a financial institution does not satisfy the requirements prescribed in the laws and regulations, in cases where the Bank judges that there is a high probability that the institution will steadily improve toward meeting these requirements, the institution remains eligible for the operations.”

BoJ is “confirming this application of eligible standards in view of the need for financial institutions to provide support for firms’ funding conditions due to the growing impact of the novel coronavirus (COVID-19).”

RBNZ to bank the banks to help businesses lower their funding costs

RBNZ said it is ramping support for businesses and banks by accepting corporate debt and other assets as security for loans to banks. The aim is to “pump more money into the economy through the banking system.”

Assistance Governor Christian Hawkesby said, “by banking the banks, we are ensuring large businesses can better manage their cash flows, and lower their funding costs.”

The RBNZ will have a weekly window for retail banks to access the money, with an offer to lend around $500 million each time for up to three months.

An extreme busy economic calendar ahead

It’s an extremely busy week in terms of data releases. More would be revealed about the damage of the coronavirus pandemic. US consumer confidence, ISM indices as well as non-farm payrolls will be the most important ones to watch. Eurozone confidence indicators are how different sectors are doing. Japan’s Tankan survey could reveal how deep the recession is going to be. Additionally, China, the origin of the pandemic, will release March PMIs, which might show ready are businesses to return to operations.

Here are some highlights for the week:

- Monday: Swiss KOF economic barometer; Germany CPI flash; UK M3 money supply, mortgage approvals; US pending homes sales.

- Tuesday: New Zealand building permits, ANZ business confidence; Australia private sector credit; Japan unemployment rate, industrial production , retail sales, housing starts; China PMIs; UK Q4 GDP final, current account; Swiss retail sales; Germany import price, unemployment; France consumer spending; Eurozone CPI flash; Canada GDP, IPPI and RMPI; US S&P Case-Shiller house price, Chicago PMI, consumer confidence.

- Wednesday: Australia AiG manufacturing, building approvals, RBA minutes; Japan Tankan survey, PMI manufacturing final; China Caixin PMI manufacturing; Germany retail sales, Eurozone PMI manufacturing final, unemployment rate; Swiss PMI manufacturing; UK PMI manufacturing final. Canada PMI manufacturing; US ADP-employment, ISM manufacturing, construction spending.

- Thursday: Japan monetary base; Swiss CPI; Eurozone PPI; Canada trade balance; US Challenger job cuts, jobless claims, trade balance, factory orders.

- Friday: Australia AiG construction, retail sales; China Caixin PMI services; Eurozone PMI services final, retail sale; UK PMI services final; US non-farm payrolls, ISM non-manufacturing.

USD/JPY Daily Outlook

Daily Pivots: (S1) 107.25; (P) 108.49; (R1) 109.21; More...

Focus remains on 106.75 support in USD/JPY as fall from 111.71 is extending. Decisive break there should confirm completion of rebound from 101.18, after failing 112.22 key resistance. Intraday bias will be turned back to the downside for retesting 101.18 low. On the upside, though, decisive break of 112.22 carry larger bullish implication and target 114.54 resistance next.

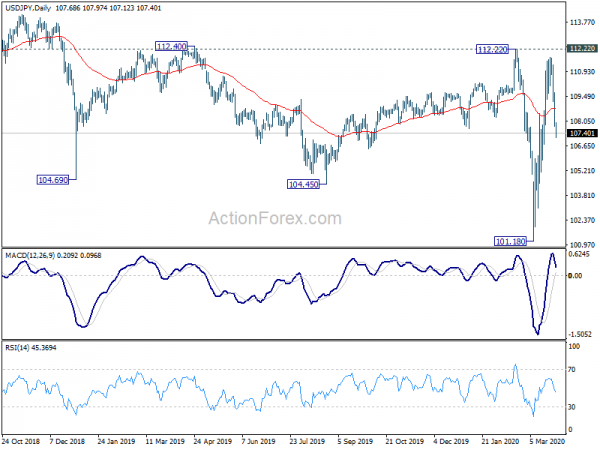

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | CHF | KOF Leading Indicator Mar | 81.1 | 100.9 | ||

| 08:30 | GBP | Mortgage Approvals Feb | 68K | 71K | ||

| 08:30 | GBP | M4 Money Supply M/M Feb | 0.40% | 0.60% | ||

| 09:00 | EUR | Eurozone Business Climate Mar | -0.05 | -0.04 | ||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Mar | 91.8 | 103.5 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Mar | -12.9 | -6.1 | ||

| 09:00 | EUR | Eurozone Services Sentiment Mar | -3.4 | 11.2 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Mar | -11.6 | -11.6 | ||

| 12:00 | EUR | Germany CPI M/M Mar P | 0.10% | 0.40% | ||

| 12:00 | EUR | Germany CPI Y/Y Mar P | 1.30% | 1.70% | ||

| 14:00 | USD | Pending Home Sales M/M Feb | -1.30% | 5.20% |