Dollar is sold off notably in early US session after data showed record decline in core inflation reading. In the background, sentiments also improved mildly on WHO’s “potentially positive data” comments. Following Dollar, Canadian is the second weakest for the day, then Yen. On the other hand, New Zealand Dollar is the strongest one, followed by Australian Dollar. Aussie has somewhat left the news of China’s ban on four abattoirs behind.

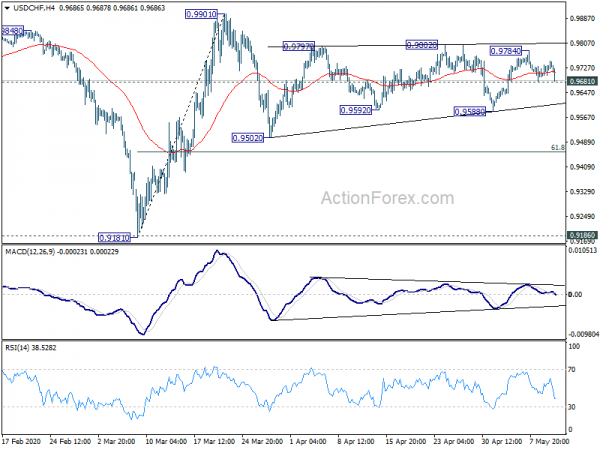

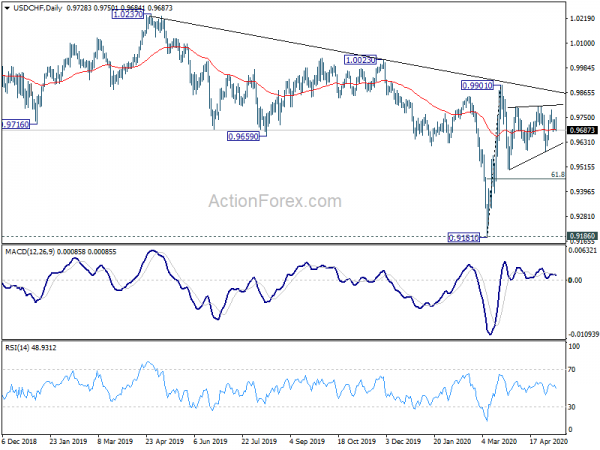

Technically, focus is back on 1.0895 minor resistance in EUR/USD with today’s recovery. Break will extend the corrective pattern from 1.0635 with another rising leg, possibly through 1.1019 resistance. Similarly USD/CHF is eyeing 0.9681 minor support and break will extend the corrective pattern from 0.9901 with another falling leg, possibly through 0.9588 support.

In Europe, currently, FTSE is up 1.10%. DAX is up 0.28%. CAC is down -0.28%. German 10-year yield is up 0.0205 at -0.487. Earlier in Asia, Nikkei dropped -0.12%. Hong Kong HSI dropped -1.45%. China Shanghai SSE dropped -0.11%. Singapore Strait Times dropped -0.90%. Japan 10-year JGB yield dropped -0.0154 to -0.005.

US CPI slowed to 0.3%, core CPI dropped to 1.4%

US CPI dropped -0.8% mom in April, versus expectation of -0.7% mom. That’s the largest monthly decline since December 2008. Core CPI dropped -0.4% mom versus expectation of -0.2%. That’s also the largest monthly decline since record started in 1957.

Annually, CPI slowed to 0.3% yoy, down from 1.5% yoy, missed expectation of 0.8% yoy. The year-over-year rate was smallest since October 2015. Core CPI slowed to 1.4% yoy, down from 2.1% yoy, missed expectation of 1.7% yoy. It’s the smallest increase since April 2011.

WHO sees potentially positive data regarding coronavirus treatment

The World Health Organization indicated today that there are some “potentially positive data” on coronavirus treatments. Spokesperson Margaret Harris said at a press briefing, “we do have some treatments that seem to be in very early studies limiting the severity or the length of the illness but we do not have anything that can kill or stop the virus.”

“We do have potentially positive data coming out but we need to see more data to be 100% confident that we can say this treatment over that one,” she added.

Meanwhile, she sounded cautious regarding expectations for a vaccine. She noted that coronaviruses are in general are “very tricky viruses” that are “difficult to produce vaccines against”.

BoE Broadbent: Quite possible that more monetary easing will be needed

BoE Deputy Governor Ben Broadbent said today that “the committee are certainly prepared to do what is necessary to meet our remit with risks still to the downside.” And, it’s “quite possible that more monetary easing will be needed over time”. But there are pros and cons of cutting interest rates further from the current 0.1% level. “These are the balanced questions the committee has to think about and … has been thinking about for the past decade,” Broadbent said.

Broadbent also rejected the idea that BoE is financing the government’s fiscal measures. “It is not surprising when you have a huge hit to the economy, as is the case now, as was the case in 2009, that you see easing on both fiscal and monetary fronts,” he said. “That is the connection — they are both responses to a weaker economy. It is not the case that one is a response to the other.”

BoJ Kuroda: Near term focus is to smoothen corporate financing and stabilize markets

In the semi-annual testimony to parliament, BoJ Governor Haruhiko Kuroda warned that “Japan’s economy is in an increasingly severe state”. Outlook will “remain severe for the time being.” He pledged to “do whatever we can as a central bank, working closely with the government.”

For the near term, focus of monetary policy is to “smoothen corporate financing and stabilize markets”. Though, there is no huge risk of sharp credit contraction as domestic financial institutions have sufficient capital buffers.

As for the steps to ease monetary further, he said, “we’re ready to take sufficient steps judged necessary at the time”. The measures could include expanding asset purchases, increasing market operations tools or cutting interest rates further.

China bans four Australian abattoirs as tensions rise

Trade tensions between China and Australia continued to escalate. Four Australian red meat abattoirs were banned from importing to China. It comes just days after China warned of the plan to impose 80% tariffs on Australian barley. Trade Minister Simon Birmingham tried to tone down the suspension as just some “technical issues”. He added, “there are many other meat processing facilities that will continue under their approved permits to send product to China as they do, indeed, around the rest of the world.”

But some analysts believed China’s moves are retaliations to Australian government’s push for independent inquiry on coronavirus pandemic that started in Wuhan. Chinese Ambassador to Australia Jingye Cheng warned last month that Chinese public may boycott Australia products for the push for coronavirus inquiry. In an Australian Financial Review in April, Cheng said, “maybe also the ordinary people will say why should we drink Australian wine or to eat Australian beef?”.

Australia NAB business conditions dropped to -34, broad-based deterioration across industries

Australia NAB Business Confidence rose to -46 in April, up from -65. But that remain well below the trough of 1990s recession. Business Conditions, however, dropped to -34, down from -22, below the level seen in the 08/09 financial crisis. Looking at some details, trading conditions dropped form -19 to -33. Profitability conditions dropped from -28 to -35. Employment conditions also dropped from -20 to -35. Forward orders dropped from -28 to -36, suggesting activity is likely to weaken further in the near term.

Alan Oster, NAB Group Chief Economist “confidence saw a rebound in the month after the sharp fall last month, but this provides little comfort given it remains around twice as weak as the 1990s recession. Business conditions declined further in the month, with a broad-based deterioration across industries”.

“We see a recovery in growth late this year, but even though it could be a solid bounce the level of output is not expected to be recovered to pre-COVID levels until early 2022. We expect unemployment to match this pattern, falling in 2021 but remaining above 7%. This all points to required ongoing policy support for some time” said Oster.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9704; (P) 0.9720; (R1) 0.9740; More…

Intraday bias in USD/CHF stays neutral with focus on 0.9681 minor support. Break will extend the corrective pattern with another falling leg. Intraday bias will be turned to the downside for 0.9588 support first. But downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, break of 0.9802 will target a test on 0.9901 high.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | NAB Business Confidence Apr | -46 | -66 | ||

| 01:30 | AUD | NAB Business Conditions Apr | -34 | -21 | ||

| 01:30 | CNY | CPI Y/Y Apr | 3.30% | 3.70% | 4.30% | |

| 01:30 | CNY | PPI Y/Y Apr | -3.10% | -2.60% | -1.50% | |

| 05:00 | JPY | Leading Economic Index Mar P | 83.8 | 84.3 | 91.7 | 91.9 |

| 10:00 | USD | NFIB Business Optimism Index Apr | 90.9 | 86.7 | 96.4 | |

| 12:30 | USD | CPI M/M Apr | -0.80% | -0.70% | -0.40% | |

| 12:30 | USD | CPI Y/Y Apr | 0.30% | 0.80% | 1.50% | |

| 12:30 | USD | CPI Core M/M Apr | -0.40% | -0.20% | -0.10% | |

| 12:30 | USD | CPI Core Y/Y Apr | 1.40% | 1.70% | 2.10% |