Dollar and Yen continue to be the strongest ones for today with help from risk aversion. Global stocks generally show weakness, from Asia to Europe to US futures. Major benchmark treasury yields also decline. The greenback is given another lift as US President Donald trump’s comments. On the other hand, Australian and New Zealand Dollars are the weakest, followed by Sterling.

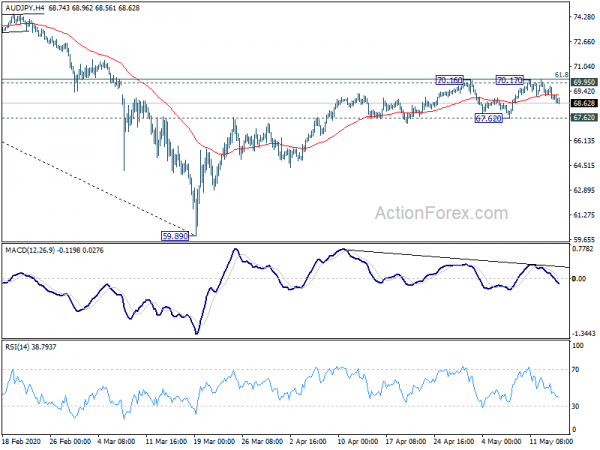

Technically, Dollar’s rebound now puts 1.0727 support in EUR/USD into focus. Break will pave the way for a test on 1.6035 low. 1.4173 resistance in USD/CAD would also be watched and break could finally confirm completion of correction pattern from 1.4667. Australian Dollar will be watched together with risk markets. Both AUD/USD and AUD/JPY could complete double tops should 0.6372 support and 67.62 support are taken out respectively.

In Europe, currently, FTSE is down -3.47%. DAX is down -3.07%. CAC is down -3.14%. German 10-year yield is down -0.0095 at -0.537. Earlier in Asia, Nikkei dropped -1.74%. Hong Kong HSI dropped -1.45%. China Shanghai SSE dropped -0.96%. Singapore Strait Times dropped -1.93%. Japan 10-year JGB yield dropped -0.0034 to -0.004.

Trump: Right now having a strong dollar is a great thing

US President Donald Trump said in a Fox Business Network interview today that it’s “a great time to have a strong dollar”. “Right now it’s good to have a strong dollar. Right now having a strong dollar is a great thing” he added. Dollar’s strength “could live both ways” as he noted. From a “trade standpoint, it’s tougher”. However, from a “country” and “inflation standpoint”, “you don’t have inflation, you don’t have problems.”

Regarding the trade deal phase one with China, Trump reiterated that “we’re not going to renegotiate”. And, “right now, I don’t want to speak to him (Chinese President Xi Jinping), I don’t want to speak to him”. He also cautioned that “we could cut off the whole relationship. If we did, what would happen? You’d save $500 billion.” (apparently referring to the trade between US and China).

US initial jobless claims dropped again to 2981k, continuing claims rose to 22.8m

US initial jobless claims dropped another week, by -195k to 2981k in the week ending May 9. Four-week moving average of initial claims dropped -564k to 3616.5k. Continuing claims rose 456k to 22833k in the week ending May 2. Four-week moving average of continuing claims rose 2730k to 19760k.

Also released, US import price index dropped -3.3% mom in April versus expectation of -3.0% mom. Canada manufacturing sales dropped -9.2% mom in March versus expectation of -5.7% mom.

BoE Bailey: Negative rate is not something we are contemplating

BoE Governor Andrew Bailey rejects negative interest at a webinar organized by the Financial times. He said, negative rate is “not something we are currently planning for or contemplating”. He added that cutting interest rate below zero would need “an extensive communications exercise” in the UK. It’s a “very big step” from “communications point of view, as well as “reaction” and expectations”.

He also warned that the economy would suffer longer-term damage from the current coronavirus crisis. Nevertheless, it’s unclear whether a 30% contraction in GDP is H1, as projected by BoE, would prove overly pessimistic or an under-estimate.

Released from Europe, UK RICS house price balance dropped to -21 in April, down from 9. Germany CPI was finalized at 0.4% mom, 0.8% yoy in April. Swiss PPI dropped -1.3% mom, -4.0% yoy in April. Italy trade surplus narrowed to EUR 5.69B in March.

Australia jobs dropped -594.3k, unemployment rate rose only to 6.2% as many people left work force

Australia employment dropped -594.3k to 12.4m in April, largest fall on record. That was slightly worse than expectation of -575.0k. Full-time jobs dropped -220.5k to 8.66m, Part times jobs dropped 373.8k to 3.76.

Unemployment rate rose 1.0% to 6.2%, highest since September 2015. That was much better than expectation of 8.3%, But it should be noted that firstly, participation rates dropped sharply by -2.4% to 63.5%. Secondly, monthly hours worked in all jobs dropped -163.9m hours to 1625.8m hours.

“The large drop in employment did not translate into a similar sized rise in the number of unemployed people because around 489,800 people left the labour force”, stated Bjorn Jarvis, head of labour statistics at the ABS. “This means there was a high number of people without a job who didn’t or couldn’t actively look for work or weren’t available for work”.

Also released from Asia pacific, Australia consumer inflation expectations dropped to 3.4% in May, down from 4.6%. Japan M2 rose 3.7% yoy in April versus expectation of 3.4% yoy. Japan machine tool orders dropped -48.3% yoy in April.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0788; (P) 1.0843; (R1) 1.0873; More…

EUR/USD drops mildly today but stays in familiar range. Intraday bias remains neutral first. Price actions from 1.0635 are seen as a corrective pattern. On the downside, break of 1.0727 support will raise the chance that the correction is completed. Intraday bias will be turned to the downside for retesting 1.0635 low. On the upside, above 1.0895 will turn bias to the upside for 1.1019 resistance to extend the pattern. But in that case, upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Apr | -21% | -25% | 11% | 9% |

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 3.70% | 3.40% | 3.30% | |

| 01:00 | AUD | Consumer Inflation Expectations May | 3.40% | 4.60% | ||

| 01:30 | AUD | Employment Change Apr | -594.3K | -575.0K | 5.9K | 0.7K |

| 01:30 | AUD | Unemployment Rate Apr | 6.20% | 8.30% | 5.20% | |

| 06:00 | EUR | Germany CPI M/M Apr | 0.40% | 0.30% | 0.30% | |

| 06:00 | EUR | Germany CPI Y/Y Apr | 0.80% | 0.80% | 0.80% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Apr P | -48.30% | -40.80% | ||

| 06:30 | CHF | Producer and Import Prices M/M Apr | -1.30% | -0.30% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Apr | -4.00% | -2.70% | ||

| 08:00 | EUR | Italy Trade Balance (EUR) Mar | 5.69B | 6.09B | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | CAD | Manufacturing Sales M/M Mar | -9.20% | -5.70% | 0.50% | |

| 12:30 | USD | Initial Jobless Claims (May 8) | 2981K | 3169K | 3176K | |

| 12:30 | USD | Import Price Index M/M Apr | -3.30% | -3.00% | -2.30% | |

| 14:30 | USD | Natural Gas Storage | 107B | 109B |