Global stock markets continue with impressive rally today, with focuses on back-to-normal optimism. Germany’s DAX is even more impressive, with more than 3.7% against at the time of writing, after a three-day break. It’s supported by news that Chancellor Angela Merkel’s ruling coalition is working on another massive stimulus package. Risks like US-China tensions are ignored. It seems that no-one even talk about the risk of coronavirus resurgence in the US, due to ongoing protests.

In the currency markets, Dollar is in no doubt under heavy selling pressure. Yet, focus has shifted more to selling Yen and Swiss Franc. Australian Dollar remains the strongest one for today, followed by Sterling and then Canadian. Technically, USD/JPY’s break of 108.08 suggests resumption of rise form 105.98 and reaffirm the case that correction from 111.71 has completed. Further rise would be seen to 109.38 resistance. EUR/JPY is eyeing 121.14 and break will put 122.87 key medium term resistance in focus. GBP/JPY’s break of 135.74 resistance confirms resumption of whole rebound from 123.94. A focus would be whether rally in USD/JPY could help Dollar rebound from key support level against Euro, and Aussie.

In Europe, FTSE is currently up 1.00%. DAX is up 3.71%. CAC is up 1.99%. Germany 10-year yield is down -0.002 at -0.406. Earlier in Asia, Nikkei rose 1.19%. Hong Kong HSI rose 1.11%. China Shanghai SSE rose 0.20%. Singapore Strait Times rose 2.38%. Japan 10-year JGB yield dropped -0.0002 to 0.010.

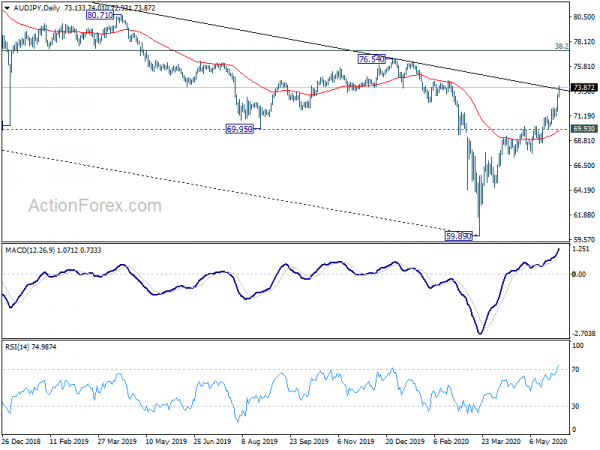

AUD/JPY breaks medium term trend line resistance

AUD/JPY surges sharply today as the top gainer so far, on the back of strong risk appetite in the market. Break of medium term falling trend line today as another signal of trend reversal. That is, firstly, whole fall from 90.29 should have completed at the 59.89 spike low. Outlook will stays bullish as long as 69.93 support holds. AUD/JPY should now target 38.2% retracement of 105.42 to 59.89 at 77.28 next. There is prospect of further rally to long term channel resistance at 80.80 in medium term.

Depth of downturn less than earlier expected, but RBA remains firmly on hold

RBA left monetary policy unchanged as widely expected. Cash rate is held at 0.25%. The target for 3-year government bond yield is also held at 0.25%. It maintained the pledge that, until progress is made towards full employment and inflation, “the Board will not increase the cash rate target”. Also, 3-year AGS yield target will “remain in place”.

The Bank had just purchased government bonds on one occasions since last meeting. Total purchase to date reached AUD 50B only too. Though, it remains ” to scale-up its bond purchases again and will do whatever is necessary to ensure bond markets remain functional and to achieve the yield target for 3-year AGS.”

On the economy, RBA said the depth of the downturn will be “less than earlier expected”. Rate of new coronavirus infections in Australia has “declined significantly” and some restrictions have been “eased earlier than was previously thought likely”. Also, hours worked could have stabilized in early May while there was pickup in some consumer spending.

Though, the “the outlook, including the nature and speed of the expected recovery, remains highly uncertain and the pandemic is likely to have long-lasting effects on the economy.

Australia current account surplus widened to AUD 8.4B, impact of coronavirus evident

Australia current account surplus widened notably to AUD 8.4B in Q1, up from AUD 1.7B and beat expectation of AUD 6.3B. The current account surplus was driven by a trade surplus of AUD 19.2B and a narrowing of net income deficit to AUD 10.6B. In seasonally adjusted chain volume terms, the balance on goods and services surplus should contribute 0.5% to Q1 GDP growth.

ABS Chief Economist Bruce Hockman said: “The impact of COVID-19 was evident across the Balance of Payments this quarter, with falls for imports and exports of both goods and services in volume terms”.

Also released, sales of manufacturing goods and services rose 2.2% qoq in Q1. Whole sale trade rose 1.6% qoq. Inventories dropped -1.2% qoq. Company gross operating profits rose 1.1% qoq. wages and salaries were flat.

New Zealand terms of trade dropped -0.7% in Q1 as coronavirus hit

New Zealand terms of trade index dropped -0.7% qoq in Q1, worse than expectation of 1.3% rise. Export volume rose 1.8% qoq while import volumes fell -3.9% qoq. Export prices dropped -0.2% qoq while import prices rose 0.5% qoq. Overall export values for goods rose 3.6% qoq to NZD 15.1B while import values dropped -1.9% qoq to NZD 15.1B.

“The fall in export prices coincided with the COVID-19 outbreak, which was declared a global pandemic in March 2020,” business prices delivery manager Geoff Wong said. “The COVID-19 outbreak affected demand in export markets and disrupted supply chains, such as sea and air freight.”

Also released, building permits dropped -6.5% mom in April, comparing with March’s -21.7% mom decline.

USD/JPY Mid-Day Outlook

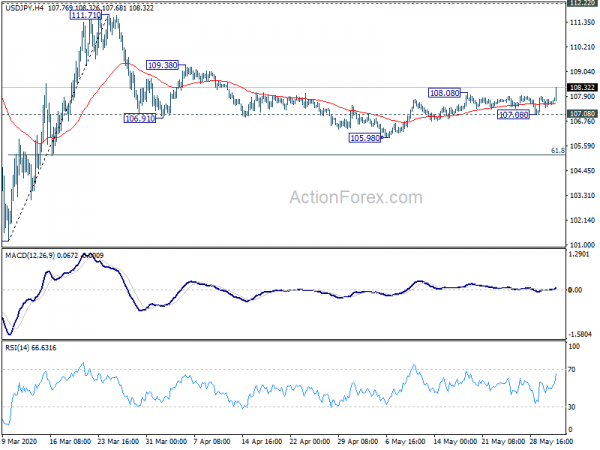

Daily Pivots: (S1) 107.35; (P) 107.61; (R1) 107.83; More..

USD/JPY’s rise from 105.98 resumed by breaking 108.08 resistance. Intraday bias is back on the upside for 109.38 resistance first. Corrective fall from 111.71 should have completed at 105.98 already. Break of 109.38 will target a test on 111.71 high. On the downside, break of 107.08 support will turn bias back to the downside for retesting 105.98 low instead.

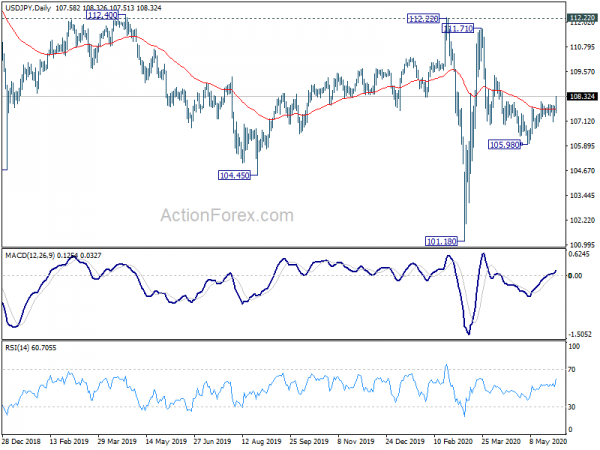

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Apr | -6.50% | -21.30% | -21.70% | |

| 22:45 | NZD | Terms of Trade Index Q1 | -0.70% | 1.30% | 2.60% | 2.80% |

| 23:50 | JPY | Monetary Base Y/Y May | 3.90% | 2.60% | 2.30% | |

| 1:30 | AUD | Current Account (AUD) Q1 | 8.4B | 6.3B | 1.0B | 1.7B |

| 1:30 | AUD | Company Gross Operating Profits Q/Q Q1 | 1.10% | 0.00% | -3.50% | |

| 4:30 | AUD | RBA Interest Rate Decision | 0.25% | 0.25% | 0.25% | |

| 6:30 | CHF | Real Retail Sales Y/Y Apr | -19.90% | -4.90% | -5.60% | -5.80% |

| 7:30 | CHF | SVME PMI May | 42.1 | 42.1 | 40.7 | |

| 8:30 | GBP | Mortgage Approvals Apr | 16K | 34K | 56K | |

| 8:30 | GBP | M4 Money Supply M/M Apr | 1.50% | 2.50% | 2.80% | 3.20% |