Risk aversion generally dominates the global markets today. Following selloff in Asia, major European indexes open lower and are trading down around -2%. DOW future is also losing around -500pts. Swiss Franc and Yen are overwhelmingly the strongest ones for the day, as followed by Euro and Dollar. Commodity currencies are the worst performing, Focus will now turn to developments in US stocks and yields, on whether they could “bend up ” before closing.

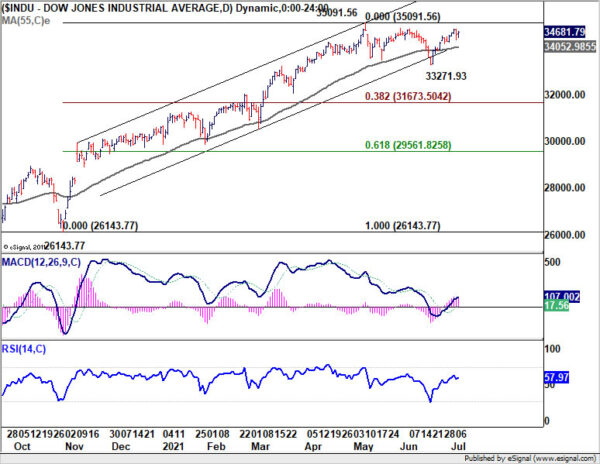

Technically, we’d believe that the key level to watch is 34k handle in DOW, which is slightly below 55 day EMA and medium term trend line support. Sustained break there would at least bring deeper fall back towards 33271.93 support. That might trigger even strong rally in Yen and Franc. However, defending 34k could, at least, help Yen crosses stabilize from the current level.

In Europe, at the time of writing, FTSE is down -1.93%. DAX is down -2.01%. CAC is down -2.29%. Germany 10-year yield is down -0.014 at -0.308. Earlier in Asia, Nikkei dropped -0.88%. Hong Kong HSI dropped -2.89%. China Shanghai SSE dropped -0.79%. Singapore Strait Times dropped -1.08%. Japan 10-year JGB yield closed flat at 0.028.

US initial jobless claims rose to 373k, above expectations

US initial jobless claims rose 2k to 373k in the week ending July 3, above expectation of 355k. Four-week moving average of initial claims dropped -250 to 394.5k, lowest since March 14, 2020.

Continuing claims dropped -145k to 3339k in the week ending June 26, lowest since March 21, 2020. Four-week moving average of continuing claims dropped -44.5k to 3441k, lowest since March 21, 2020.

ECB adopts symmetric 2% inflation target negative and positive deviations equally undesirable

ECB announced to adopts a symmetric 2% inflation target over medium term. Being symmetric meaning “negative and positive deviations of inflation from the target are equally undesirable”.

“When the economy is operating close to the lower bound on nominal interest rates, it requires especially forceful or persistent monetary policy action to avoid negative deviations from the inflation target becoming entrenched,” ECB said. “This may also imply a transitory period in which inflation is moderately above target.”

Also, HICP will remain the appropriate price measures, while the Governing Council recommends inclusion of owner-occupied housing over time.

President Christine Lagarde said, “The new strategy is a strong foundation that will guide us in the conduct of monetary policy in the years to come.”

RBA Lowe wants to see results, not forecast, for rate hikes

In a speech, RBA Governor Philip Lowe said, it is “not enough” for inflation to be “forecast” in the rate of 2-3% target for the central bank to lift interest rates. He emphasized, “We want to see results before we change interest rates”. Also, “the bond purchases will end prior to any increase in the cash rate”.

He added that for inflation be sustainably in target rate, it’s like that “wage growth will need to exceed 3 per cent”. It will take “until 2024” for inflation to be sustainably within the target range.

Lowe also emphasized that “the condition for an increase in the cash rate depends upon the data, not the date; it is based on inflation outcomes, not the calendar.” Also, the tapering to AUD 4B purchase in bonds a week “does not represent a withdrawal of support”.

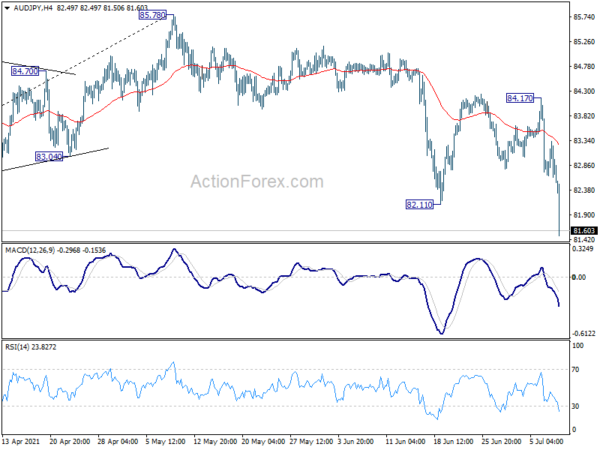

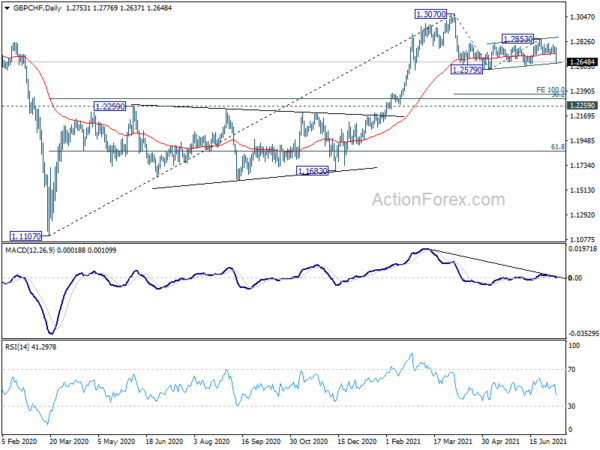

A look at falling AUD/JPY and GBP/CHF as risk aversion intensifies

Risk aversion comes back again today, as led by the -807pts, or -2.89%, free fall in Hong Kong HSI. In the currency markets, Yen and Swiss Franc are currently the strongest ones.

AUD/JPY breaks through 82.11 support to as low as 81.50 so far, resuming whole decline from 85.78. Rejection by 55 day EMA is a clear sign of near term bearishness. Such decline is seen as correcting the rise from 73.12 for the moment. Hence, we’d look for strong support from 38.2% retracement of 73.12 to 85.78 at 80.94 to contain downside and bring rebound. However, sustained break of 80.94 will argue that it’s indeed correcting whole up trend from 59.85 and target 73.12/78.44 support zone.

GBP/CHF’s sharp fall today now argues that consolidation from 1.2579 might have completed with three waves up to 1.2853. Immediate focus is now on 1.2579/2610 support zone. Decisive break there will confirm this bearish case and target 100% projection of 1.3070 to 1.2579 from 1.2853 at 1.2362. At this point, we’d expect strong support around 1.2259 resistance turned support to contain downside and bring rebound.

USD/CHF Mid-Day Outlook

USD/CHF Mid-Day Outlook

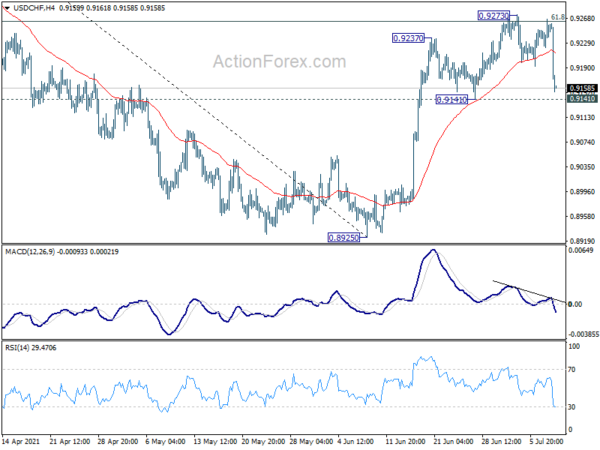

Daily Pivots: (S1) 0.9231; (P) 0.9249; (R1) 0.9276; More….

USD/CHF falls sharply today but stays above 0.9141 support. Intraday bias remains neutral at this point first. On the downside, firm break of 0.9141 will argue that whole rebound from 0.8925 has completed. Intraday bias will be turned to the downside for 55 day EMA (now at 0.9115). Sustained break there will pave the way back to retest 0.8925 low. On the upside, though, break of 0.9273 will resume the rally to 0.9471 key resistance instead.

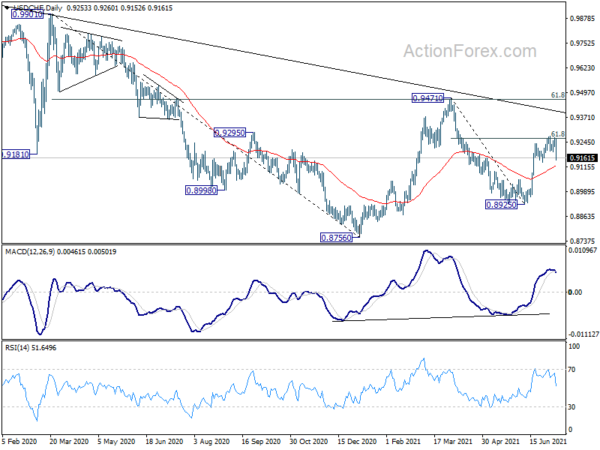

In the bigger picture, medium term outlook is currently neutral with focus on 0.9471 resistance. Sustained break there will indicate completion of whole decline from 1.0342 (2016 high). Medium term outlook will be turned bullish for a test on 1.0342 high. But, rejection by 0.9471 again will revive bearishness for another fall through 0.8756 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jun | 83% | 78% | 83% | 82% |

| 23:50 | JPY | Bank Lending Y/Y Jun | 1.40% | 3.00% | 2.90% | 2.80% |

| 23:50 | JPY | Current Account (JPY) May | 1.87T | 1.59T | 1.55T | |

| 05:00 | JPY | Eco Watchers Survey: Current Jun | 47.6 | 41.9 | 38.1 | |

| 05:45 | CHF | Unemployment Rate Jun | 3.10% | 3.00% | 3.00% | |

| 06:00 | EUR | Germany Trade Balance (EUR) May | 12.6B | 15.8B | 15.9B | |

| 12:30 | USD | Initial Jobless Claims (Jul 2) | 373K | 355K | 364K | 371K |

| 14:30 | USD | Natural Gas Storage | 29B | 76B | ||

| 15:00 | USD | Crude Oil Inventories | -4.0M | -6.7M |