Commodity currencies came back to live entering into US session, with help from broad based rally in European indexes and US futures. Canadian Dollar is also lifted as WTI oil price recaptures 70 handle. Dollar turned mixed for now as selling turns to Swiss Franc, Euro and Yen. With an empty economic calendar for the rest of the day, the currency markets would likely follow risk markets closely.

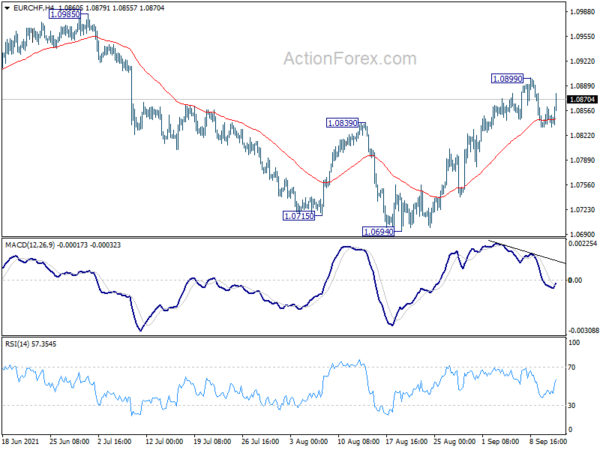

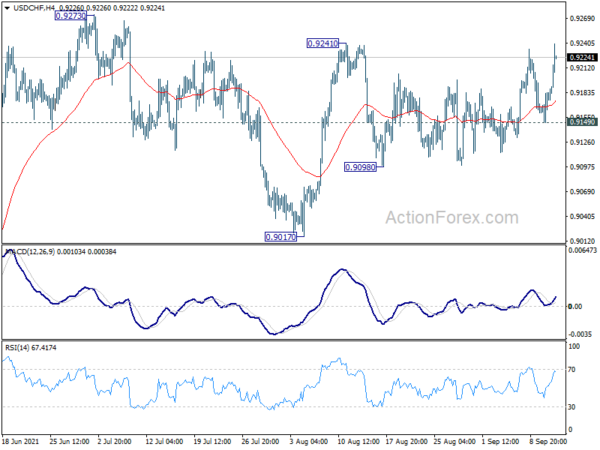

Technically, USD/CHF breaches 0.9241 and focus could be on 0.9273 resistance. Break there will resume rise from 0.8925. EUR/CHF also drew support from 4 hour 55 EMA and rebounds. Break of 1.0899 will resume whole rise from 1.0694 to 1.0985 resistance. Such development, if happens, could either fuel upside acceleration in USD/CHF, or help cushion EUR/USD’s decline somewhat.

In Europe, at the time of writing, FTSE is up 0.68%. DAX is up 0.96%. CAC is up 0.75%. Germany 10-year yield is down -0.0044 at -0.332. Earlier in Asia, Nikkei rose 0.22%. Hong Kong HSI dropped -1.50%. China Shanghai SSE rose 0.33%. Singapore Strait Times dropped -0.79%. Japan 10-year JGB yield rose 0.0008 to 0.046.

ECB Schnabel: Premature tightening would choke the recovery

In a speech, ECB Executive Board member Isabel Schnabel said inflation in Eurozone is “likely to ease noticeably next year”. She warned that “a premature monetary policy tightening in response to a temporary rise in inflation would choke the recovery and be most harmful to those who are already suffering from the current spike in inflation.”

Also she said, “there are good reasons to assume that the current constellation of fiscal and monetary policy in the euro area may finally chart the path out of the low interest rate environment.”

BoE Hauser: Balance sheet will be structurally larger even after QE unwind

BoE Executive Director Andrew Hauser said in a speech, the central bank balance sheets will be “structurally larger”, comparing to the start of the millennium, even after current QE program unwind. Central will need to meet at “bigger share of the structurally higher demand for liquidity; and contemplate possible Central Bank Digital Currencies.”.

Also, the balance sheets will be “more variable as lower global interest rates and a broader liquidity insurance toolkit mean balance sheets play a more active countercyclical role.”

Germany likely to have a noticeable jump in output in Q3

Germany’s Economy Ministry said in its monthly report that “there will likely be a noticeable increase in economic output in the current third quarter.” Nevertheless, there were also signs of normalization of growth in Q4. Also, the spread of new variants of COVID-19 could cloud the outlook.

GDP grew only 1.6% qoq in Q2, as constrained by shortage of semiconductor chips and other intermediate goods.

Japan corporate goods price ticked down to 5.5% yoy, wholesale inflation will remain under upward pressure

Japan’s corporate goods price index slowed slightly to 5.5% yoy in August. But it was close to July’s 5.6% yoy, which was the highest reading since September 2008. Also, at 105.8, the index marked the highest level since 1982.

Shigeru Shimizu, head of the BoJ’s price statistics division, said, “as the global economy continues to recover thanks to progress in vaccinations, domestic wholesale inflation will remain under upward pressure, though there’s uncertainty over the outlook due to a resurgence in infections.”

NZIER revised up inflation forecast, NZD to remain elevated for coming years

In NZIER’s September survey, consensus forecast for 2021/22 GDP was revised down from 5.0% to 4.5%. But 2022/23 GDP forecast for 2022/23 was revised up from 3.7% to 4.5%. The revision likely reflects the impact of the current COVID-19 outbreak. GDP is forecast to grow 2.3% in 2023/24 (revised down from 2.6%), then pick up to 2.7% in 2024/25.

Inflation forecasts were revised up sharply from 2.1% to 3.5% in 2021/22, up from 1.9% to 2.0% in 2022/23. It’s unchanged at 2.2% in 2023/24 and expected to be steady at 2.2% in 2024/25. NZIER said, “Capacity pressures continue to build up across the New Zealand economy, as acute labour shortages and COVID-related supply chain disruptions drive up cost pressures further. Solid demand has made it easier for businesses to pass these costs onto customers by raising prices.”

The NZD outlook is mixed with trade-weighted index revised lower in the near term. However, NZIER said, “expectations are for the currency to remain elevated over the coming years,” as RBNZ rate hike expectations improved yield attractiveness.

New Zealand ANZ business confidence rose to -6.8, showing resilience

In the preliminary September read, New Zealand ANZ Business confidence rose to -6.8, up from August’s -14.2. Own Activity outlook dropped to 18.2, down from 19.2. Looking at some more details, export intentions dropped from 7.4 to 5.7. Investment intentions dropped from 14.4 to 12.2. Employment intentions dropped from 17.0 to 14.7. Inflation expectations ticked lower from 3.05 to 2.97.

ANZ said the report showed “resilience” despite lockdown in Auckland, with most forward-looking activity indicators holding up well. ANZ said, “We examined a split between Auckland and the rest of the country but the differences were very small.”

“Overall, the preliminary ANZ Business Outlook results suggest that firms can see light at the end of the tunnel, even in Auckland. We can do this, it said”.

OPEC: Oil demand recovery delayed in to H1 2022

In the monthly oil market report, OPEC revised down Q4 oil demand forecasts to average 99.70m bpd, down 110k bpd from last months’ projections. For 2022, Overall, global oil demand would rise by 5.96m bpd in the whole of 2021. Demand growth forecasts for 2022 was revised from 3.28m bpd to 4.1m bpd.

It said the “increased risk of COVID-19 cases primarily fueled by the Delta variant is clouding oil demand prospects going into the final quarter of the year.” As a result, “second-half 2021 oil demand has been adjusted slightly lower, partially delaying the oil demand recovery into first-half 2022.”

“The pace of recovery in oil demand is now assumed to be stronger and mostly taking place in 2022,” OPEC said. “As vaccination rates rise, the COVID-19 pandemic is expected to be better managed and economic activities and mobility will firmly return to pre-COVID-19 levels.”

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9160; (P) 0.9172; (R1) 0.9195; More….

USD/CHF’s breach of 0.9017 suggests resumption of rise from 0.9017. Intraday bias is back on the upside for 0.9273 resistance first. Firm break there will solidify near term bluishness for 0.9471 resistance next. However, break of 0.9149 support will turn focus back to 0.908 support instead.

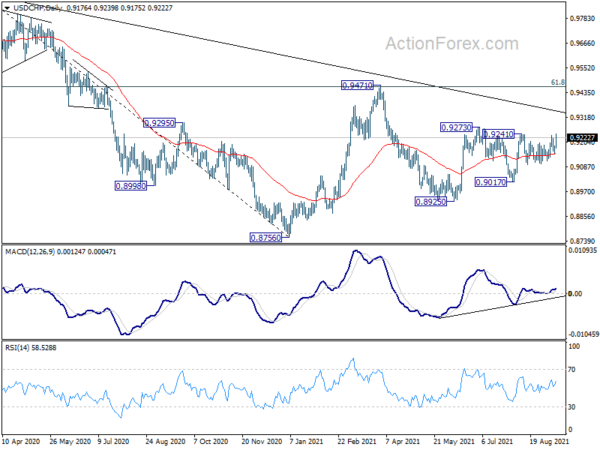

In the bigger picture, USD/CHF is still struggling around 55 week EMA (now at 0.9178) and outlook is mixed for now. Confirmed rejection by the 55 week EMA will retain medium term bearishness. That is, larger fall from 1.0342 would resume through 0.8756 low at a later stage. However, sustained trading above 55 week EMA will tilt favor to the case of bullish reversal. Focus would then be turned to 0.9471 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Aug | 5.50% | 5.60% | 5.60% | |

| 23:50 | JPY | BSI Large Manufacturing Conditions Index Q3 | 7 | -0.9 | -1.4 | |

| 18:00 | USD | Monthly Budget Statement (USD) Aug | -260.5B | -302.1B |