Overall market sentiment turned more positive after Fed officials jumped out to talk down the prospect of a 50bps hike in March. Australia Dollar is trading broadly higher, following risk-on sentiment, and shrugs off cautious comments from RBA Governor. Euro is following as the second strongest for now but has lost much momentum in crosses already. Dollar is recovering some ground but stays soft in general, together with Yen.

Technically, attention stays on some levels in Dollar pairs, including 1.1299 minor resistance in EUR/USD, 1.3523 minor resistance in GBP/USD and 114.46 minor support in USD/JPY. As long as these levels holds, there is still prospect for Dollar to resume recent rally sooner rather than later. Similarly, as long as 129.76 minor resistance in EUR/JPY and 155.38 minor resistance GBP/JPY hold, Yen crosses could have another dive.

In Asia, at the time of writing, Nikkei is up 1.73%. Japan 10-year JGB yield is down -0.0001 at 0.182. Hong Kong, China and Singapore are still on Lunar New Year holiday. Overnight, DOW rose 0.78%. S&P 500 rose 0.69%. NASDAQ rose 0.75%. 10-year yield rose 0.018 to 1.800.

Fed Bullard favors successive rate hike at upcoming meetings

St. Louis Fed President James Bullard said he’d favor successive rate hikes at the upcoming March, May and June meetings, rather than a 50bps hike in March. “The point of this is to get better positioned right now and in coming months, and then we will be able to assess, at that point, whether we need to do more or not,” he said.

“We are going to be have to be more nimble, faster, better at reacting to inflation data and other developments as we go through this year,” Bullard said. “It’s going to be a more data-dependent environment.”

Bullard added he’d like to start the balance sheet runoff in Q2, and “that the runoff can be faster than it was last time around.” “We are cognizant of the inflation issue, we’re moving on the policy rate, but we’re also going to move on the balance sheet so we’re not that far from reaching neutral if you are willing to consider both of those,” he said.

RBA Lowe: Ending bond purchase does not mean imminent rate hike

In a speech, RBA Governor Philip Lowe said ending the bond purchase program “does not mean that an increase in the cash rate is imminent”.

He noted that while inflation has picked up in Australia, it remains “substantially lower” than the 7% in the US, 5.4% in the UK and 5.9% in New Zealand. It has “not been accompanied by strong wages growth” as in the case in the US and UK. “Our lower rate of inflation and low wages growth are key reasons we don’t need to move in lock step with others,” he added.

Lowe also said it’s “too early to conclude” that inflation is sustainably the in the target range. And there is “a range of significant uncertainties” here that will “take time to resolve”. He reiterated that “the Board is prepared to be patient as it monitors the evolution of the various factors affecting inflation in Australia.”

New Zealand employment dropped to record low 3.2%

New Zealand employment rose 0.1% in Q4, below expectation of 0.4%. Unemployment rate ticked down from 3.3% to 3.2%, slightly better than expectation of 3.2%. Labor force participation rate dropped -0.1% to 71.1%.

“The labour market continued to show the tightness we saw in the September 2021 quarter, with both unemployment and underutilisation rates remaining low,” work and wellbeing statistics senior manager Becky Collett said. “This quarter’s unemployment rate is now the lowest rate recorded since the HLFS series began in 1986.”

Kuroda: BoJ easing not leading to regional banks’ deteriorating health

BoJ Governor Haruhiko Kuroda said, “Japan’s economy expanding moderately thanks in part to BoJ’s aggressive monetary easing.”

He admitted that the low interest rate environment has had an “impact on regional lenders through various channels.” Yet, he rejected that the easy monetary policy has led to regional banks’ deteriorating health.

Looking ahead

Eurozone CPI flash is the main feature in the European session. Later in the day, US will release ADP employment. Canada will release building permits.

USD/JPY Daily Outlook

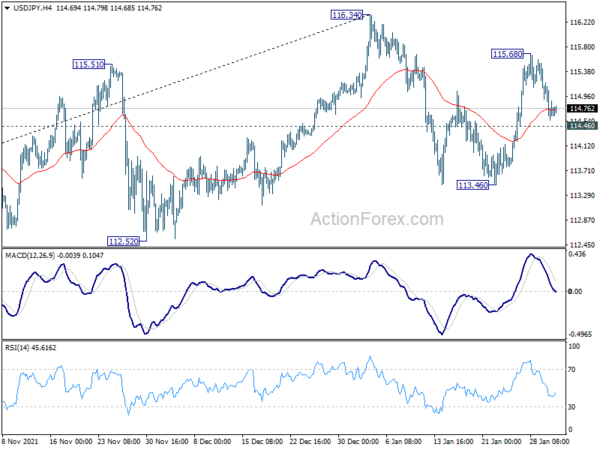

Daily Pivots: (S1) 114.45; (P) 114.82; (R1) 115.07; More…

Intraday bias in USD/JPY remains neutral for the moment. Further rise is still mildly in favor with 114.46 minor support intact. On the upside, break of 115.68 will target 116.34 high first. Decisive break there will resume larger up trend for 118.65 long term resistance next. On the downside, however, break of 114.46 will extend the corrective pattern from 116.34 with another falling leg through 113.46 support.

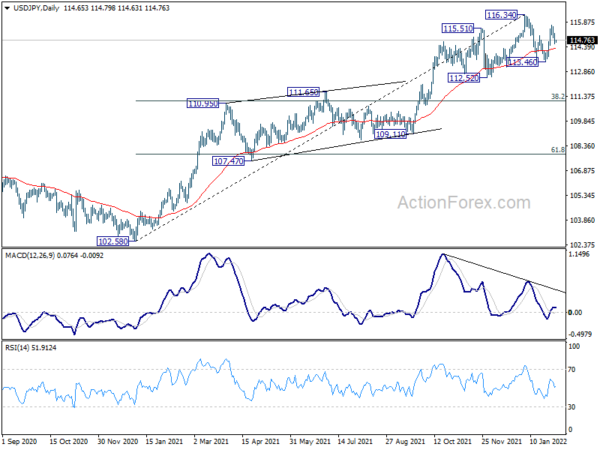

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high). Sustained break there will pave the way to 120.85 (2015 high) and raise the chance of long term up trend resumption. This will remain the favored case as long as 55 week EMA (now at 111.07) holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q4 | 0.10% | 0.40% | 2.00% | 1.90% |

| 21:45 | NZD | Unemployment Rate Q4 | 3.20% | 3.30% | 3.40% | 3.30% |

| 23:50 | JPY | Monetary Base Y/Y Jan | 8.40% | 8.50% | 8.30% | |

| 10:00 | EUR | Eurozone CPI Y/Y Jan P | 4.30% | 5.00% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan P | 1.90% | 2.60% | ||

| 13:15 | USD | ADP Employment Change Jan | 270K | 807K | ||

| 13:30 | CAD | Building Permits M/M Dec | -1.60% | 6.80% | ||

| 15:30 | USD | Crude Oil Inventories | 1.8M | 2.4M |