Market sentiment sinks deeply after Russian President Valdimir Putin declared recognition of independence of the breakaway regions of eastern Ukraine, and ordered troops to enter the regions, which is seen as risk of imminent invasion. Coordinated sanctions on Russia are expected shortly from the US and allies, including the UK, France and Germany. It seems that further escalation is the only way to go.

Asian stocks are in deep red today, which US futures trading heavily lower. On the other hand, Gold and oil prices are both firming up. In the currency markets, Swiss Franc remains the strongest one for the week on risk aversion, while Yen is catching up. Euro is so far the worst performing one, together with Sterling. Others are mixed.

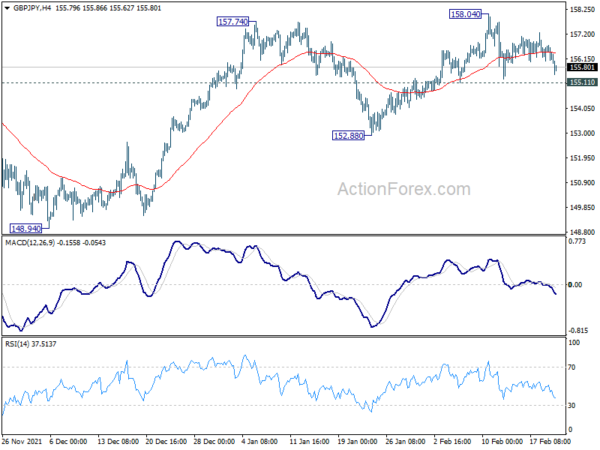

Technically, GBP/CHF’s break of 1.2465 support should confirm that rebound from 1.2276 has completed at 1.2598. and deeper fall would be seen back to 1.2776 as risk sentiment deteriorates. To follow up, we’d now look at 155.11 support in GBP/JPY. Firm break there will suggest that rise from 152.88 has finished at 158.04. Deeper selloff could then be seen back to 152.88 and possibly through to 148.94. Both pairs could be indicative of how desperate the safe haven flows are.

In Asia, at the time of writing, Nikkei is down -1.93%. Hong Kong HSI is down -2.95%. China Shanghai SSE is down -1.36%. Singapore Strait Times is down -0.83%. Japan 10-year JGB yield is down -0.0095 at 0.199.

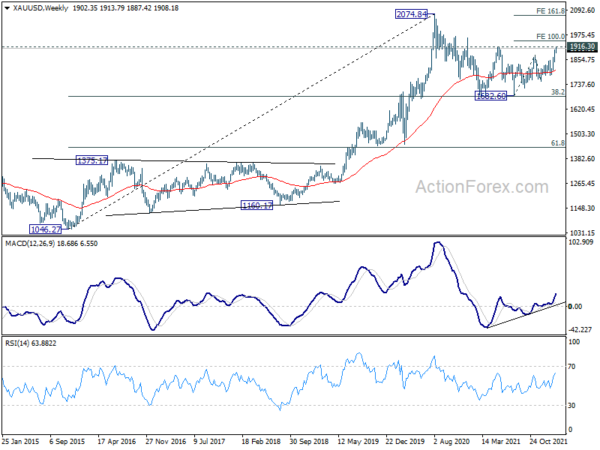

Gold breaks 1900, upside acceleration ahead?

Gold’s rally resumes today and hits as high as 1913.79 so far, breaking 1900 handle. It’s now eyeing 1916.30 resistance. Break there will extend current rise from 1682.60 to 100% projection of 1682.60 to 1877.05 from 1752.12 at 1946.57.

Also, it should be pointed out that, firstly, sustained break of 1916.30 should confirm that whole correction from 2074.84 (2020 high) has completed at 1682.60, after defending 38.2% retracement of 1046.27 to 2074.84. Secondly, sustained break of 1946.57 would likely bring upside acceleration.

In this case, Gold could be quickly shot up to 161.8% projection at 2066.74, which is close to 2074.84 high.

WTI oil rises on geo tension, ready for breakout to 100?

WTI crude oil edged higher today and it’s now pressing 95.98 resistance. Any deterioration in geopolitical situation could forcefully push WTI through this resistance to resume the medium term up trend. Next target will be 100 psychological level.

Rejection by 95.98 will extend the corrective pattern from 95.98 with another falling leg, possibly back to 89.23 support. But 88.66 support should provide the floor in this case, to set up the range for sideway trading.

Fed Bowman support rate hike in March, but size depends on data

Fed Governor Michelle Bowman said yesterday in a speech, ” I support raising the federal funds rate at our next meeting in March and, if the economy evolves as I expect, additional rate increases will be appropriate in the coming months.”

However, “I will be watching the data closely to judge the appropriate size of an increase at the March meeting,” she added.

“In the coming months, we need to take the next step, which is to begin reducing the Fed’s balance sheet by ceasing the reinvestment of maturing securities already held in the portfolio,” she added. “Returning the balance sheet to an appropriate and manageable level will be an important additional step toward addressing high inflation.”

Looking ahead

Germany Ifo business climate is the main focus in European session while UK will release public sector net borrowing. US consumer confidence will catch most attention later in the day, as house price index and PMIs will be published too.

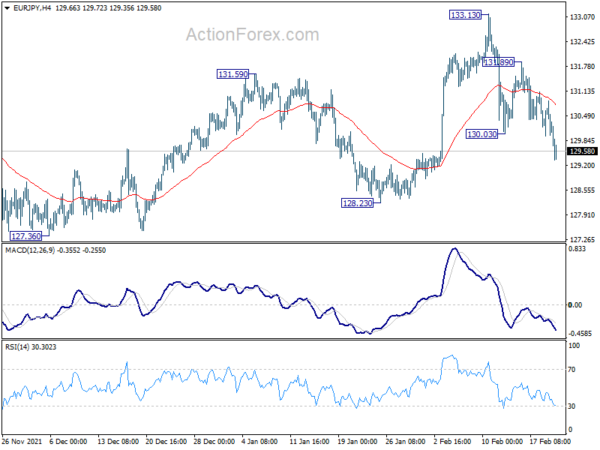

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.41; (P) 130.15; (R1) 130.55; More….

EUR/JPY’s fall from 133.13 resumed by breaking 130.03 temporary low and intraday bias is back on the downside. outlook is unchanged that corrective pattern from 134.11 is seen as extending with another falling leg. Deeper decline should be seen to 128.23 support first. Break there will target 127.36 support and possibly first to 126.58 medium term fibonacci level. For now, risk will stay on the downside as long as 131.89 minor resistance holds, in case of recovery.

In the bigger picture, price actions from 134.11 are currently seen as a consolidation pattern only. As long as 38.2% retracement of 114.42 (2020 low) to 134.11 at 126.58 holds, up trend from 114.42 is still in favor to continue. Break of 134.11 will target long term resistance at 137.49 (2018 high). However, sustained break of 126.58 will raise the chance of bearish reversal. In this case, deeper decline would be seen to 61.8% retracement at 121.94, and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Jan | 1.20% | 1.20% | 1.10% | |

| 07:00 | GBP | Public Sector Net Borrowing (GBP) Jan | -3.6B | 16.1B | ||

| 09:00 | EUR | Germany IFO Business Climate Feb | 96.5 | 95.7 | ||

| 09:00 | EUR | Germany IFO Current Assessment Feb | 96.6 | 96.1 | ||

| 09:00 | EUR | Germany IFO Expectations Feb | 96.5 | 95.2 | ||

| 14:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Dec | 18.00% | 18.30% | ||

| 14:00 | USD | Housing Price Index M/M Dec | 1.10% | 1.10% | ||

| 14:45 | USD | Manufacturing PMI Feb P | 56 | 55.5 | ||

| 14:45 | USD | Services PMI Feb P | 53 | 51.2 | ||

| 15:00 | USD | Consumer Confidence Feb | 110.2 | 113.8 |