The markets are generally trading in risk-on mode today. New Zealand Dollar is leading commodity currencies higher, with additional boost from hawkish RBNZ rate hike. Australian Dollar is following closely, then Canadian Dollar. on the other hand, Yen and Dollar are under some selling pressure. Euro and Sterling are mixed despite hawkish comments from ECB and BoE officials.

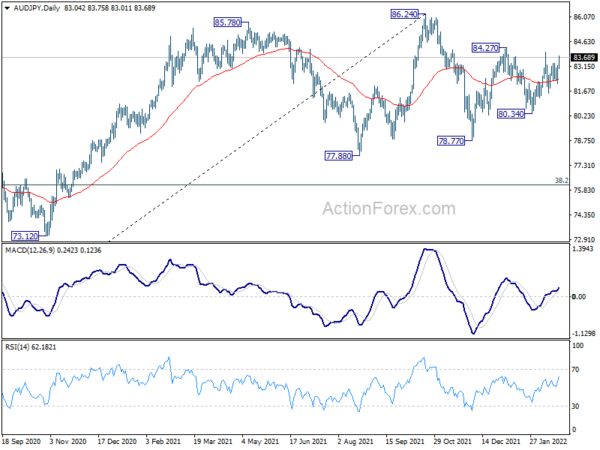

Technically, AUD/USD’s break of 0.7247 resistance reaffirmed near term bullishness and resume rise form 0.6966. Further break of 0.7313 will add to the case of bullish trend reversal. At the same time, EUR/AUD ‘s diving to 1.5559 support and bring will pave the way back to 1.5250 low. Break of 84.27 resistance in AUD/JPY will also resume the whole rise from 78.77 to retest 86.24. Attention will be paid to these levels to confirm underlying strength of Aussie.

In Europe, at the time of writing, FTSE is up 0.68%. DAX is up 1.07%. CAC is up 1.37%. Germany 10-year yield is down -0.001 at 0.244. Earlier in Asia, Hong Kong HSI rose 0.60%. China Shanghai SSE rose 0.93%. Singapore Strait Times dropped -0.06%. Japan was on holiday.

BoE Bailey sees very clear risk of high inflation coming through second-round effects

In the UK parliament’s Treasury Committee hearing, BoE Governor Andrew Bailey said, there was “very clearly an upside risk” inflation that “comes through from the second-round effects”.

“The second-round effects are a real concern. If we get the second-round effects… of course we would need to react to that with higher interest rates… ,” he warned. “And the consequence of that… is that it would of course slow activity in the economy and it would increase unemployment”

On off-loading the balance sheet, Bailey said, “what we said last August was that if and when Bank Rate reaches 1%, and the words are important here, we will begin to consider active sales. It’s not the same sort of quasi automatic process that we had with the ceasing reinvestment. So the 1% is a necessary but not sufficient thing. We would want to conduct QT at times when its impact on monetary policy was least.”

ECB de Guindos: We will readjust asset purchases if needed

ECB Vice President Luis de Guindos said asset purchases need to be completed before interest rates can rise. However, “we will look at the data, the projections and then we will readjust asset purchases if needed and will see when an interest rate hike can take place.”

Governing Council member Bostjan Vasle said the Eurofi Magazine, “The time seems right for our monetary policy to move out of crisis mode and start the process of gradual normalisation.”

“With the return of economic activity to the pre-crisis level, looming labour shortages and in part structural pressures on energy prices, our monetary policy needs to start rebuilding its space to be ready to respond to the next business cycle,” Vasle added.

ECB Holzmann favors first hike in summer, second by year end

ECB Governing Council member Robert Holzmann told Swiss newspaper NZZ, “When it comes to the interest rate outlook, the ECB has always signalled that an interest rate hike should not take place until shortly after the bond purchases have ended.”

“But it would also be possible to take a first interest rate step in the summer before the end of the purchases and a second at the end of the year. I would favour that.”

Also, Holzmann said and exit from negative interest rate would be an “important signal” to the society and markets. He would likely to see two rate hikes by the end of this year or early 2023. But, “some of my colleagues would perhaps be even more progressive here, while others would be more cautious,” he added.

“I think that a key interest rate of very roughly 1.5% in 2024 could be realistic, although that may well shift forward or backward somewhat,” he said, adding that 1.5% would be a benchmark for neutral monetary policy.

Eurozone CPI finalized at 5.1% yoy in Jan, EU at 5.6% yoy

Eurozone CPI was finalized at 5.1% yoy in January, up from December’s 5.0% yoy. The highest contribution to the annual euro area inflation rate came from energy (+2.80%), followed by services (+0.98%), food, alcohol & tobacco (+0.77%) and non-energy industrial goods (+0.56%).

EU CPI was finalized at 5.6% yoy, up from December’s 5.3% yoy. The lowest annual rates were registered in France (3.3%), Portugal (3.4%) and Sweden (3.9%). The highest annual rates were recorded in Lithuania (12.3%), Estonia (11.0%) and Czechia (8.8%). Compared with December, annual inflation fell in eight Member States and rose in nineteen.

German Gfk consumer sentiment dropped to -8.1, expectations of easing inflation shattered

Germany Gfk consumer sentiment for March dropped from -6.7 to -8.1, below expectation of -6.2. In February, economic expectations rose from 22.8 to 24.1. Income expectations dropped from 16.9 to 3.9, lowest since January 2021. Propensity to buy dropped from 5.2 to 1.4.

“Above all, expectations of a significant easing in price trends at the beginning of the year have been shattered for the time being, as inflation rates continue to hover at a high level,” explains Rolf Bürkl, GfK consumer expert.

“Nevertheless, the outlook for the coming months is quite positive: Only recently it was decided to lift profound pandemic restrictions. This gives cause for hope that consumer spending will also return as a result. If this were to be supported by moderate price inflation, consumer sentiment could finally recover in the long term as well.”

RBNZ hikes rate to 1%, starts managed bond sales, raised OCR peak forecast

RBNZ raised OCR by 25bps to 1.00% as widely expected. Additionally, it will start to start reduction of the bond holdings under the Large Scale Asset Purchase program through “both bond maturities and managed sales.

The central bank also said “further removal of monetary policy stimulus is expected over time given the medium-term outlook for growth and employment, and the upside risks to inflation.”

In the minutes, it’s noted, “when deciding whether to move the OCR up by 25 or 50 basis points, many members saw this as a finely balanced decision.”

However, firstly, the active sales of bond holdings may “put some upward pressure on longer-term interest rates”. Also, the OCR is expected to “peak at a higher level than assumed” at the November MPC. The OCR peak was raised to around 3.4% in 2024, compared to 2.6% in November review.

Hence, the Committee came to a consensus of a 25bps hike, but “affirmed that it was willing to move the OCR in larger increments if required over coming quarters.”

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.7182; (P) 0.7208; (R1) 0.7243; More…

AUD/USD’s rise from 0.6966 resumes by breaking through 0.7247, and intraday bias is back on the upside for 0.7313 resistance. Decisive break there argue that correction from 0.8006 has completed at 0.6966, after hitting 0.6991 key support. Outlook will be turned bullish for 0.7555 resistance next. On the downside, break of 0.7163 minor support will mix up the outlook again and turn intraday bias neutral.

In the bigger picture, focus remains on 0.6991 key structural support. Sustained break there will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461. Meanwhile, strong rebound from 0.6991 will retain medium term bullishness. That is, whole up trend from 0.5506 is still in progress.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Wage Price Index Q/Q Q4 | 0.70% | 0.70% | 0.60% | |

| 00:30 | AUD | Construction Work Done Q4 | -0.40% | 2.10% | -0.30% | -1.20% |

| 01:00 | NZD | RBNZ Interest Rate Decision | 1.00% | 1.00% | 0.75% | |

| 02:00 | NZD | RBNZ Press Conference | ||||

| 07:00 | EUR | Germany Gfk Consumer Confidence Mar | -8.1 | -6.2 | -6.7 | |

| 09:00 | CHF | ZEW Expectations Feb | 9 | 9.5 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Jan F | 5.10% | 5.10% | 5.10% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Jan F | 2.30% | 2.30% | 2.30% |