Overall, the markets are pretty quiet as focuses turns to Fed’s rate hike and guidance today. Dollar is consolidating in tight range, preparing for the next move. For now, Aussie and Loonie are the stronger ones for the week, but they only have a slim advantage over the greenback. Sterling is the worst, followed by Swiss Franc and Kiwi. Yen is mixed, also awaiting the next move in treasury yields.

Technically, main focuses will be on Dollar pairs today. In particular, break of 1.0470 support in EUR/USD, 1.2410 support in GBP/USD, 0.7029 support in AUD/USD, and 131.24 resistance in USD/JPY would confirm that Dollar buying is back. It would be a strong sign of underlying strength in Dollar if these levels are taken out simultaneously.

In Asia, at the time of writing, Hong Kong HSI is down -1.23%. Singapore Strait Times is down -0.05%. Japan and China are on holiday. Overnight, DOW rose 0.20%. S&P 500 rose 0.48%. NASDAQ rose 0.22%. 10-year yield dropped -0.036 to 2.960.

ECB Schnabel: Rate increase in July is possible

In an interview, ECB Executive Board member Isabel Schnabel “a rate increase in July is possible in my view.” But she added, “We of course have to wait and see how the data evolve up to the time of the decision. The first interest rate hike will in any case not take place until after the end of net asset purchases; we have committed to that.”

Schnabel also noted that energy is “not the only factor” for the current high inflation. Core inflation also “climbed strongly to 3.5%”. So, “we are seeing that inflationary pressures are becoming more broad-based.”

“There can be no doubt that we will see higher wage demands if inflation remains so high over a prolonged period. We need to prevent high inflation from becoming entrenched in expectations. Talking is no longer enough, we need to act,” she said.

NZ unemployment rate unchanged at 3.2%, high wage inflation

New Zealand employment rose 0.1% qoq in Q1, matched expectations. However, total actual weekly hours worked dropped slightly by -0.2%. Unemployment rate was unchanged at 3.2%, slightly above expectation of 3.1%. Participation rate dropped -0.1% to 70.9%.

Labor cost index rose 0.7% qoq, matched expectations. All sectors wage inflation rose 0.8% qoq. Annual rate jumped from 2.6% to 3.0%. “Wage inflation is at its highest level since the March 2009 quarter,” business prices delivery manager Bryan Downes said.

Australia retail sales rose 1.6% mom to new record in Mar

Australia retail sales rose 1.6% mom to new record AUD 33.6B in March, well above expectation of 0.5% mom. Over the 12-month period, sales rose 9.4% yoy.

Director of Quarterly Economy Wide Statistics, Ben James, said the result was up 0.8% on the previous record level set in November 2021. This follows a 1.8% rise in February 2022, a 1.6% rise in January 2022 and a fall of -4.1% in December 2021.

“Rising prices, combined with the continued easing of restrictions across the country has led to rises in turnover in all three months of the March quarter.

Fed to hike 50bps today, but what next?

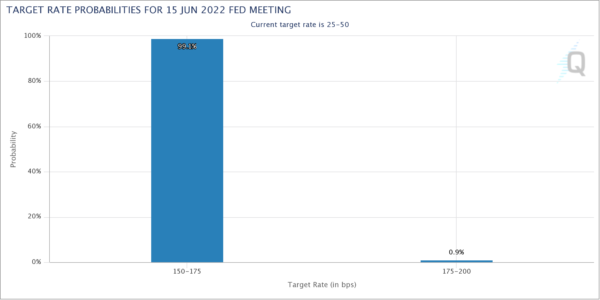

Fed is widely expected to raise federal funds rate by 50bps to 0.75-1.00% today. With markets pricing in 99.1% chance of that, there is no reason for Fed to rock the boat. Also, Fed is expected to announce the plan for runoff of its USD 9T balance sheeting, at a pace of roughly USD 95B per month (USD 60B in treasuries and USD 35B in MBS). That would be twice the speed of its quantitative tightening back in 2017.

Still, the main question is what next. Fed fund futures are currently pricing in 99.1% chance of another front-loading move in June to 1.50-1.75%. That is, a 75bps hike is near fully priced in for the next meeting. Markets would be eager to get some hints from Chair Jerome Powell on such expectations. But then, Powell is unlikely to give anything concrete.

Here are some previews on FOMC:

- Fed to Speed Up Rate Hikes, But How Far Will Powell Go?

- FOMC meeting preview – Hawkish, but will it be hawkish enough?

- FOMC Meeting Preview: 50bps a “Done Deal” but Balance Sheet Update Will be Key

- Fed Research – Preview: 50bp Rate Hike

In term of market reactions, the first two to note is whether EUR/USD would break through 1.0470 support to resume larger down trend. Second, attention is on whether 10-year yield would power through 3% handle.

Also, if Dollar is going to power up, Gold might re-accelerate downwards to 100% projection of 2070.06 to 1889.79 from 1998.23 at 1817.86, or even through it. Development in Gold would be used to confirm the underlying strength in Dollar.

Elsewhere

Germany trade balance, Eurozone PMI services final and retail sales, UK mortgage approvals and M4 will be featured in European session.

Later in the day, in addition to FOMC rate decision, US will release ADP employment, trade balance and ISM services. Canada will also release trade balance.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7045; (P) 0.7097; (R1) 0.7146; More…

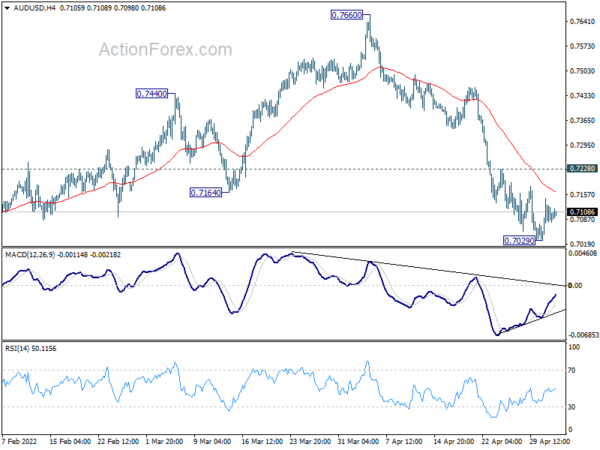

Intraday bias in AUD/USD remains neutral as consolidation from 0.7029 temporary low is extending. Further decline is still expected as long as 0.7228 minor resistance holds. As noted before, fall from 0.7660 is seen as the third leg of the larger correction from 0.8006. Below 0.7029 will target 0.6966 low first. Firm break there will confirm this bearish case and target 0.6756 medium term fibonacci level next. Nevertheless, considering bullish convergence condition in 4 hour MACD, break of 0.7228 should indicate short term bottoming, and turn bias back to the upside for stronger rebound.

In the bigger picture, price actions from 0.8006 are seen as a corrective pattern to rise from 0.5506 (2020 low). Fall from 0.7660 should be the third leg of this pattern. Break of 0.6966 will target 50% retracement of 0.5506 to 0.8006 at 0.6756. On the upside, break of 0.7660 will revive that case that the correction has already completed at 0.6966.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Apr | 55.9 | 56.5 | ||

| 22:45 | NZD | Employment Change Q1 | 0.10% | 0.10% | 0.10% | 0.00% |

| 22:45 | NZD | Unemployment Rate Q1 | 3.20% | 3.10% | 3.20% | |

| 22:45 | NZD | Labour Cost Index Q/Q Q1 | 0.70% | 0.70% | 0.70% | |

| 23:01 | GBP | BRC Shop Price Index Y/Y Mar | 2.70% | 2.10% | ||

| 01:30 | AUD | Retail Sales M/M Mar | 1.60% | 0.50% | 1.80% | |

| 06:00 | EUR | Germany Trade Balance (EUR) Mar | 12.3B | 11.5B | ||

| 07:45 | EUR | Italy Services PMI Apr | 53.9 | 52.1 | ||

| 07:50 | EUR | France Services PMI Apr F | 58.8 | 58.8 | ||

| 07:55 | EUR | Germany Services PMI Apr F | 57.9 | 57.9 | ||

| 08:00 | EUR | Eurozone Services PMI Apr F | 57.7 | 57.7 | ||

| 08:30 | GBP | M4 Money Supply M/M Mar | 0.80% | 1.00% | ||

| 08:30 | GBP | Mortgage Approvals Mar | 70K | 71K | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Mar | -0.20% | 0.30% | ||

| 12:15 | USD | ADP Employment Change Apr | 370K | 455K | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Mar | 4.0B | 2.7B | ||

| 12:30 | USD | Trade Balance (USD) Mar | -106.6B | -89.2B | ||

| 13:45 | USD | Services PMI Apr F | 54.7 | 54.7 | ||

| 14:00 | USD | ISM Services PMI Apr | 59 | 58.3 | ||

| 14:30 | USD | Crude Oil Inventories | -0.7M | 0.7M | ||

| 18:00 | USD | Fed Interest Rate Decision | 1.00% | 0.50% | ||

| 18:30 | USD | FOMC Press Conference |