The financial markets are trading with a risk-on mood today. Major European indexes are trading up while US futures also point to higher open. Commodity currencies are trading generally higher, as led by Aussie. Meanwhile, Dollar is leading Yen and Euro lower. Sterling and Swiss Franc are mixed for now, trading a bit on the soft side.

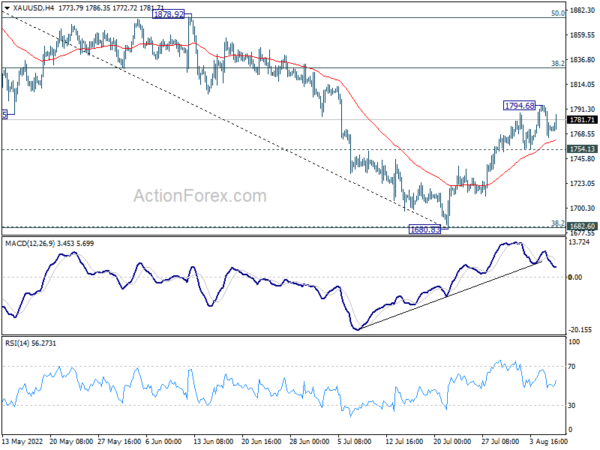

Technically, Gold’s retreat from 1794.68 is so far very shallow. Further rally is expected as long as 1754.14 support holds. Break of 1794.68 will target 38.2% retracement of 2070.06 to 1680.83 at 1829.51. When that happens, it might be accompanied by another selloff in Dollar.

In Europe, at the time of writing, FTSE is up 0.64%. DAX is up 0.95%. CAC is up 1.06%. Germany 10-year yield is down -0.0365 at 0.919. Earlier in Asia, Nikkei rose 0.26%. Hong Kong HSI dropped -0.77%. China Shanghai SSE rose 0.31%. Singapore Strait Times dropped -0.36%. Japan 10-year JGB yield rose 0.0152 to 0.178.

Eurozone Sentix improved to -25.2, but recession still very likely

Eurozone Sentix Investor Confidence improved slightly from -26.4 to -25.2 in August, better than expectation of -26.3. Current Situation index ticked up from -16.5 to -16.3. Expectations index also edged up from -35.8 to -33.8.

However, Germany Investor Confidence dropped from -24.2 to -24.4, lowest since May 2020. Current Situation index dropped from -13.0 to -14.8, lowest since February 2021. Expectations index, on the other hand, ticked up from -34.8 to -33.5.

Sentix said, the improvement in Eurozone “does not mean that the all-clear has been given”. And, “a recession in the Eurozone is still very likely.”

RBNZ 2-yr inflation expectation dropped to 3.07% in Q3

According to the latest RBNZ Survey of Expectations, the one-year-out inflation was relatively unchanged at 4.86% in Q3, down from Q2’s 4.88%. Expectations were still much higher than Q1’s 4.4% and Q4’s 3.7%.

However, two-year-out inflation expectation has fallen significantly to 3.07% in Q3, down from Q2’s 3.29%. That’s already below Q1’s 3.27% but still above Q4’s 2.96%.

Still, the most watched 2 year expectation sit above RBNZ’s target range. There is no change in market expectation that RBNZ would deliver another 50bps rate hike on August 17.

Ethereum breaks higher on risk-on sentiment, bitcoin lags

Both ethereum and bitcoin follow generally positive market sentiment and rise as another week starts. Nevertheless, bitcoin is clearly lagging behind.

Ethereum breaks through near term resistance at 1783.2 today, as rally from 878.5 low resumes. The sustained trading above 55 day EMA is a bullish signal, so is the bearish divergence condition in daily MACD. Current rise is seen as, at least, a correction to fall from 3577.70. Further rally is expected as long as 1578.96 support holds. Next target is 38.2% retracement of 3577.7 to 878.5 at 1909.5. Decisive break there will raise the chance of medium term reversal, and target 2157.05 support turned resistance next.

Bitcoin also rallies today but it’s stuck below near term resistance at 24949. It has yet gotten rid of 55 day EMA clearly. Nevertheless, there is still upside prospect as helped by the rally in ethereum. Break of 24949 will target 38.2% retracement of 48226 to 17575 at 29283.

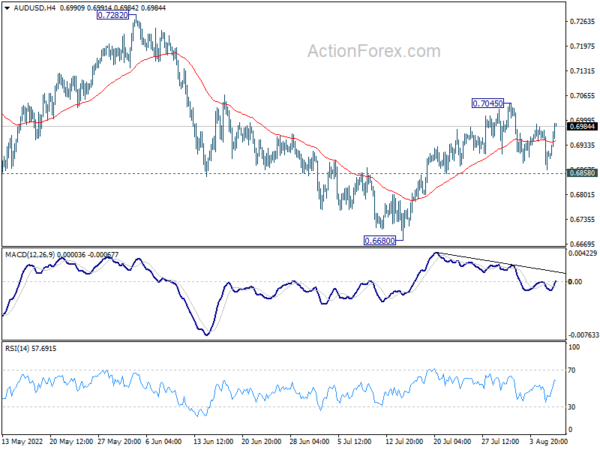

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6863; (P) 0.6919; (R1) 0.6968; More…

AUD/USD rebounds notably today but stays below 0.7045 resistance. Intraday bias remains neutral first. On the upside, break of 0.7045 will resume the rebound from 0.6680 to 0.7282 key resistance next. On the downside, however, break of 0.6858 minor support will argue that the rebound is over. Intraday bias will then be back on the downside for retesting 0.6680 low.

In the bigger picture, price actions from 0.8006 (2021 high) is seen more as a corrective pattern to rise from 0.5506 (2020 low). Or it could be a bearish impulsive move. In either case, outlook will remain bearish as long as 0.7282 resistance holds. Next target is 61.8% retracement of 0.5506 to 0.8006 at 0.6461.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jul | 1.80% | 1.40% | 1.30% | |

| 23:50 | JPY | Current Account (JPY) Jun | 0.84T | -0.03T | 0.01T | |

| 03:00 | NZD | RBNZ Inflation Expectations Q3 | 3.07% | 3.29% | ||

| 05:00 | JPY | Eco Watchers Survey: Current Jul | 43.8 | 53.6 | 52.9 | |

| 05:45 | CHF | Unemployment Rate Jul | 2.20% | 2.20% | 2.20% | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Aug | -25.2 | -26.3 | -26.4 |