While Dollar is now the strongest one for the week, buying remains not too committed, except versus the weak Pound. The greenback is indeed mixed, awaiting more guidance from Fed Chair Jerome Powell’s speech. Yen is currently the strongest one for today,. Australian Dollar is trailing as the impact of RBA’s hawkish hike is fading quickly. Euro is following Sterling is the second weakest and both are pressured by selling against Swiss Franc.

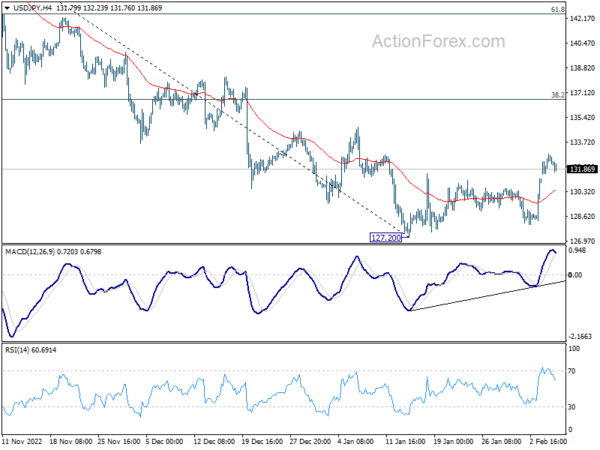

Technically, while USD/JPY retreats after hitting 132.89, further rally will remain in favor as long as 4 hour 55 EMA (now at 130.43). Current rise from 127.20 might just be a correction to the decline from 151.93 high. But even in such case, it should extend to 38.2% retracement of 151.93 to 127.20 at 136.64 before completion.

In Europe, at the time of writing, FTSE is up 0.34%. DAX is down -0.35%. CAC is down 0.16%. Germany 10-year yield is up 0.032 at 2.329. Earlier in Asia, Nikkei dropped -0.03%. Hong Kong HSI rose 0.36%. China Shanghai SSE rose 0.29%. Singapore Strait Times dropped -0.15%. Japan 10-year JGB yield dropped -0.0047 to 0.495.

US trade deficit widened to USD -67.4B in Dec

US international trade deficit widened from USD -61.0B to USD -67.4B in December, smaller than expectation of USD -68.5B. Goods deficit widened by USD 7.4B to USD -90.6B. Services surplus widened to USD 1.0B to USD 23.2B.

Exports of goods and services dropped -0.9% mom to USD 250.2B. Imports of goods and services rose 1.3% mom to USD 317.6B.

Fed Kashkari: I haven’t seen anything yet to lower my rate path

Minneapolis Fed President Neel Kashkari told CNBC, “We have a job to do. We know that raising rates can put a lid on inflation. We need to raise rates aggressively to put a ceiling on inflation, then let monetary policy work its way through the economy.”

Last week’s job data a “tells me that so far we’re not seeing much of an imprint of our tightening to date on the labor market. There’s some evidence that it’s having some effect, but it’s pretty muted so far,” Kashkari said.

“I haven’t seen anything yet to lower my rate path, but I’m obviously keeping my eyes open and we’ll see how the data comes in,” he added.

ECB Villeroy: No need to choose between fighting inflation and avoiding recession

ECB Governing Council member Francois Villeroy de Galhau said the improved economic situation in Eurozone makes it easy to fight inflation with monetary policy.

“I don’t think we have to choose between fighting inflation and avoiding a recession,” he added.

Also, he believed that Eurozone was not very far from the peak of inflation.

RBA hikes 25bps, further increases needed over the months ahead

RBA raises the cash rate target by 25bps to 3.35% as widely expected. The Board also expects that “further increases in interest rates will be needed over the months ahead”. To assess “how much” further hike is needed, close attention will be paid to “developments in the global economy, trends in household spending and the outlook for inflation and the labour market.”

The central noted that underlying inflation at 6.9% in December was “high than expected” with “strong domestic demand “adding to the inflationary pressures in a number of areas of the economy.” Inflation is expected to decline to 4.75% this year, then to around 3% by mid-2025. Medium-term inflation expectation remain” well anchored”.

GDP growth is expected to slow to 1.50% in 2023 and 2024. Unemployment rate is projected to rise form current 3.50% to 3.75% by the end of 2023, and then 4.50% by mid-2025.

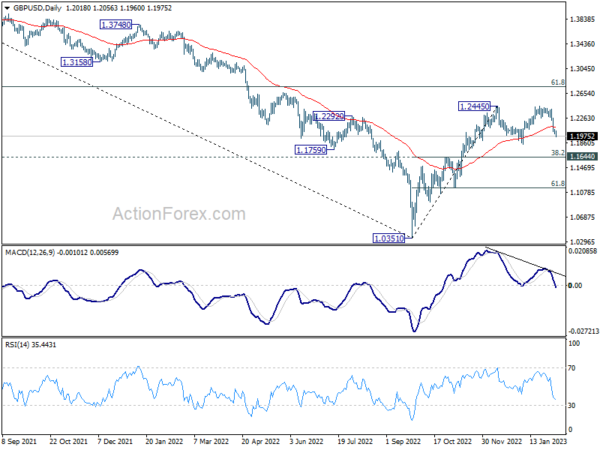

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1993; (P) 1.2035; (R1) 1.2064; More…

GBP/USD’s fall from 1.2446 extends further to 1.1960 so far today. Intraday bias stays on the downside for 1.1840 support and possibly below. Nevertheless, such decline is seen as the third leg of the corrective pattern from 1.2445. Downside should be contained by 38.2% retracement of 1.0351 to 1.2445 at 1.1645 to bring rebound. On the upside, above 1.2076 minor resistance will turn intraday bias neutral first.

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Dec | 4.80% | 2.50% | 0.50% | 1.90% |

| 23:30 | JPY | Household Spending Y/Y Dec | -1.30% | -0.20% | -1.20% | |

| 03:30 | AUD | RBA Rate Decision | 3.35% | 3.35% | 3.10% | |

| 00:30 | AUD | Trade Balance (AUD) Dec | 12.24B | 12.2B | 13.20B | 13.48B |

| 05:00 | JPY | Leading Economic Index Dec P | 97.2 | 97.2 | 97.4 | |

| 06:45 | CHF | Unemployment Rate Jan | 1.90% | 1.90% | 1.90% | |

| 07:00 | EUR | Germany Industrial Production M/M Dec | -3.10% | -0.60% | 0.20% | |

| 07:45 | EUR | France Trade Balance (EUR) Dec | -14.9B | -12.2B | -13.8B | -13.6B |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Jan | 784B | 784B | ||

| 13:30 | CAD | International Merchandise Trade (CAD) Dec | -0.2B | -0.6B | 0.0B | -0.2B |

| 13:30 | USD | Trade Balance (USD) Dec | -67.4B | -68.5B | -61.5B | -61.0B |